Defense Industry Advanced Authentication Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 14.17 % |

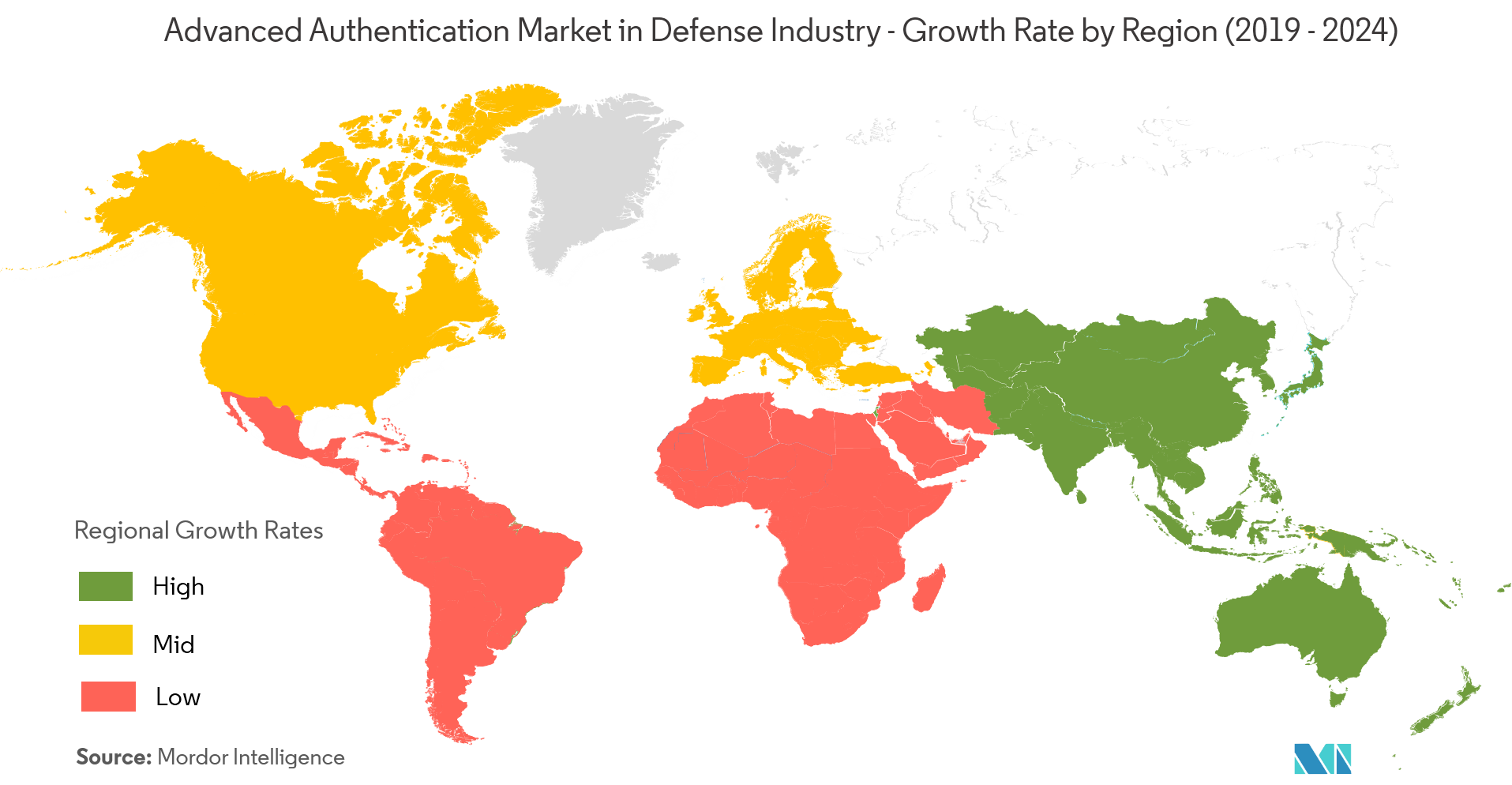

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

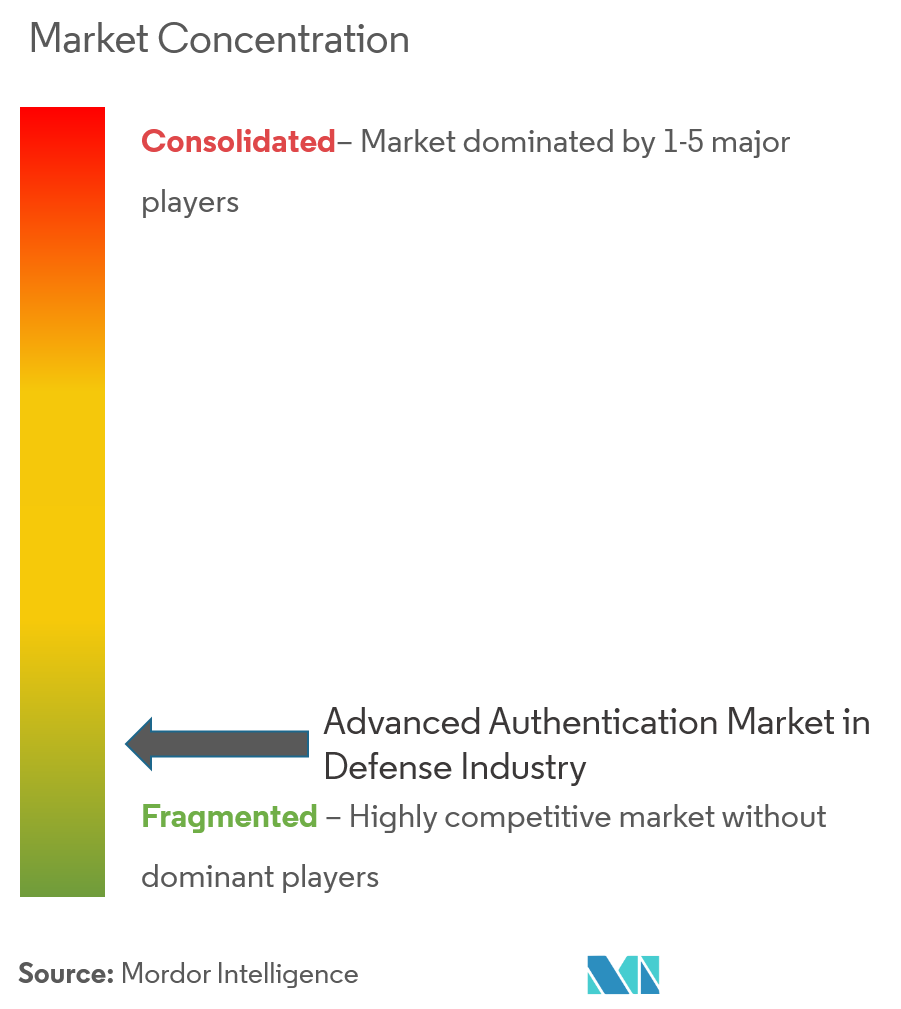

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Defense Industry Advanced Authentication Market Analysis

The Advanced Authentication Market in Defense was valued at USD 1.57 billion in 2020 and is expected to reach a value of USD 3.47 billion by 2026, at a CAGR of 14.17% over 2021-2026. As attack vectors increase with the burgeoning of the Internet of Things (IoT), the Defense sector is exposed to different risks that require increasingly advanced authentication techniques. Today's threat players are using more sophisticated social engineering tactics, credential-stuffing botnets, and account takeover tactics to pull off all sorts of attacks. According to the IBM Security's Future of Identity Report, identity fraudsters have stolen USD 112 billion over the past six years - that's approximately USD 35,600 every minute. Advanced authentication methods in Defense can help identify malicious actions while reducing unwanted speed bumps in the online experience.

- The increasing digitization of the defense industry is likely to create new avenues for cyber-criminal activities, and the risk is high as compared to any other sector. The defense industry is investing rigorously in software application and is expected to grow at a fast pace, owing to the increasing integration of digitization and connected devices. Hence, the increasing number of attacks with the rapid adoption of technologies, such as IoT, is driving the growth of the market. The defense industry contains information related to equipment and relevant data, which can be illegally utilized to vandalize a country. In addition, the companies involved in the transfer of enormous amounts of data associated with flight monitoring are the major adopters of advanced authentication.

- Companies are introducing advanced authentication, such as biometrics and iris scanners to overthrow cyber attackers. Furthermore, data about performance, technology, and service, is transferred over the internet by companies, which can be misused to steal ideas and outgrow the competitors. This is expected to drive the advanced authentication market over the forecast period. The aerospace and defense sector face persistent cyber threats from Advanced Persistent Threat (APT) groups working in association with nation-states. From stealing intellectual property to collecting intelligence that risks undermining nations' defense systems and capabilities, aerospace and defense organizations have a responsibility to ensure best practice cybersecurity is maintained.

- For example, the Associated Press (AP) reported that the Fancy Bear hacking group targeted at least 87 employees working for U.S. defense contractors via personal Gmail accounts and some corporate email accounts. If compromised, proprietary company data, such as advancements in drone and weapons research, and the U.S.'s defense could be at risk. To minimize the cyber threat it is essential that defense companies adopt the strongest form of advanced authentication for employees and suppliers by issuing and managing cryptographically protected digital identities across large numbers of employees and tier suppliers using public key infrastructure (PKI) for the most secure method of multi-factor authentication.

Defense Industry Advanced Authentication Market Trends

This section covers the major market trends shaping the Defense Industry Advanced Authentication Market according to our research experts:

Biometrics to Drive the Advanced Authentication Market in Defense Industry

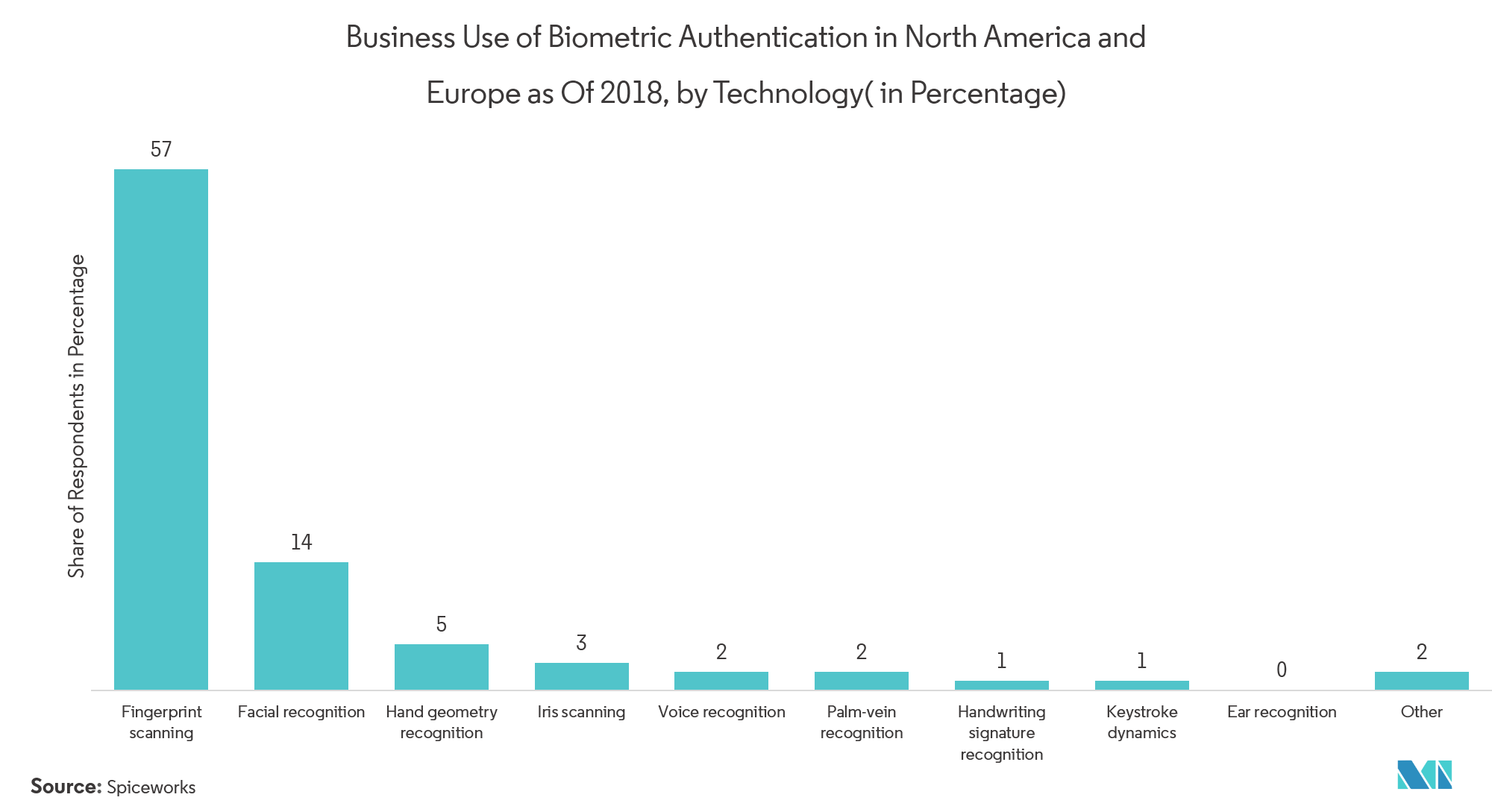

- Biometrics analyze and verify/authenticate individuals based on human physical characteristics such as fingerprints, retinas and irises, palm, speech, and voice, among others. This method of authentication has been extensively adopted, owing to the fundamental advantages it grants because of its non-transferable, non-repudiation, and not-identifiable nature, thus providing a great level of protection against deception and fraud. For instance, the US Department of Defense (DOD) said the Government Accountability Office (GAO) it intends to have its Identity Matching Engine for Security and Analysis (IMESA) system connected to its Automated Biometric Identification System (ABIS) for vetting individuals for access to all domestic DOD installations and facilities.

- The technology found successful implementation across various end-users, such as forensics and governments, among others. Moreover, the widespread availability of fingerprint sensors in affordable mobile devices and government national ID programs have been instrumental in increasing the awareness and adoption of this technology. Biometric identification services serve to protect, through its Office of Biometric Identity Management (OBIM), which supplies the technology for matching, storing, and sharing biometric data.

- Armies around the world now use biometrics as a way to intensify battlefield awareness and handle encounters with mala fide members which may be hidden in civilian populations. The U.S. military pioneered the usage of biometrics in Iraq and Afghanistan, where biometric indicators such as irises, fingerprints, and facial images were gathered from captured prisoners and other people in the field. Since then, the application of biometrics in military applications has extended significantly. Biometrics are now used to know pirates in the Indian Ocean, trace terrorist travel around the world, and map the relationships between criminal networks which pose military intimidation.

North America Holds a Dominant Share of Advanced Authentication Market in Defense Industry

- North America contains a significant share in the market, with the United States governing the advanced authentication market in defense, followed by Canada. The refinement level of professional identity thieves involved in organized crime in the country continues to progress, along with the counter methods firms used to develop. The US military supply chains well-documented obstacle is counterfeit electronics, with about 1800 estimated cases inside the military system. Counterfeits threaten national security and the stories of servicemen. These factors are spurring the need for advanced authentication solutions in this area. Also, growing ransomware attacks are supporting market growth.

- The North American advanced authentication segment is registering rapid growth, due to technological advancements and an established infrastructure. Key organizations in the region are adopting advanced authentication tools, to ensure data security. Identity theft is the fastest-growing threat in the region. According to CNBC, 53% of thefts of consumers’ identity data are “non-digital,” meaning they don’t involve - or at least, don’t start with - the thief exploiting some cyber vulnerability in 2018. Furthermore, North America has established and secure governments, which significantly rely on data security. Identity verification at online checkout systems is widespread in the region.

Defense Industry Advanced Authentication Industry Overview

The Advanced Authentication Market in Defense Industryis a highly fragmented market. In terms of market share, severalmajor players continue to hold a considerable share in the overall market, especially across developed economies in regions such as North America and Europe. The leaders constantly keep innovating for the new technology and investing in research and development.These companies are leveraging collaborative initiatives to increase their market share and increase their profitability.

- August 2019 -The Ministry Of Foreign Affairs (MOFA) of Thailand contract Gemalto to supply 15 million e-passports to its citizens over the next seven years. By bringing superior standards of technology and enhancing local technical expertise, the company aligns closely with the Government’s ‘Thailand 4.0’ initiative which aims to drive Thailand towards innovation and value-based economy.

- January 2018 - Gemalto launched its first biometric EMV card into the market. The company highlighted the features of on-card storage technology used to store sensitive biometric information with maximum security. The launch is expected to increase the company's presence in the contactless payments market.

Defense Industry Advanced Authentication Market Leaders

-

Fujitsu Ltd

-

Thales Group (Gemalto N.V.)

-

NEC Corporation

-

Broadcom Inc. (CA Technologies Inc.)

-

Dell Technologies Inc.

*Disclaimer: Major Players sorted in no particular order

Defense Industry Advanced Authentication Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Increased Number of Cloud Users and Datacenters

- 4.2.2 Increasing Number of Security Breaches and Related Costs

-

4.3 Market Restraints

- 4.3.1 Privacy Concerns towards the Authentication Vendor and High Costs of Token

- 4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Authentication Methods

- 5.1.1 Smartcards

- 5.1.2 Biometrics

- 5.1.3 Tokens

- 5.1.4 User-based Public Key Infrastructure

- 5.1.5 Other Methods

-

5.2 By Deployment Model

- 5.2.1 On-premise

- 5.2.2 Cloud

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

- 5.3.5

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Fujitsu Ltd.

- 6.1.2 Thales group (Gemalto NV)

- 6.1.3 NEC Corporation

- 6.1.4 Broadcom Inc. (CA Technologies Inc.)

- 6.1.5 Safran Identity and Security SAS.

- 6.1.6 Dell Technologies Inc. (RSA Security)

- 6.1.7 Lumidigm Inc (HID Global)

- 6.1.8 Validsoft

- 6.1.9 Pistolstar Inc.

- 6.1.10 Securenvoy(Shearwater Group)

- 6.1.11 NetMotion Wireless

- 6.1.12 CJIS Solutions

- 6.1.13 Authasas BV

- 6.1.14 WideBand Corporation

- 6.1.15 SecureAuth Corporation

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. INVESTMENT ANALYSIS

** Subject To AvailablityDefense Industry Advanced Authentication Industry Segmentation

An advanced authentication is an approach to authentication which requires the presentation of two or more of the three authentication factors: a knowledge factor - something the user knows, a possession factor - something the user has, and an inherence factor - something the user is. Advanced authentication gives a central place for all authentication systems to be managed. This is critical because companies are usually made to operate and maintain various infrastructures.

| By Authentication Methods | Smartcards |

| Biometrics | |

| Tokens | |

| User-based Public Key Infrastructure | |

| Other Methods | |

| By Deployment Model | On-premise |

| Cloud | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| Rest of the World | |

Defense Industry Advanced Authentication Market Research FAQs

What is the current Advanced Authentication Market in Defense Industry size?

The Advanced Authentication Market in Defense Industry is projected to register a CAGR of 14.17% during the forecast period (2024-2029)

Who are the key players in Advanced Authentication Market in Defense Industry?

Fujitsu Ltd, Thales Group (Gemalto N.V.), NEC Corporation, Broadcom Inc. (CA Technologies Inc.) and Dell Technologies Inc. are the major companies operating in the Advanced Authentication Market in Defense Industry.

Which is the fastest growing region in Advanced Authentication Market in Defense Industry?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Advanced Authentication Market in Defense Industry?

In 2024, the North America accounts for the largest market share in Advanced Authentication Market in Defense Industry.

What years does this Advanced Authentication Market in Defense Industry cover?

The report covers the Advanced Authentication Market in Defense Industry historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Advanced Authentication Market in Defense Industry size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Advanced Authentication in Defense Industry Industry Report

Statistics for the 2024 Advanced Authentication in Defense Industry market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Advanced Authentication in Defense Industry analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.