Financial Services Advanced Authentication Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 13.60 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

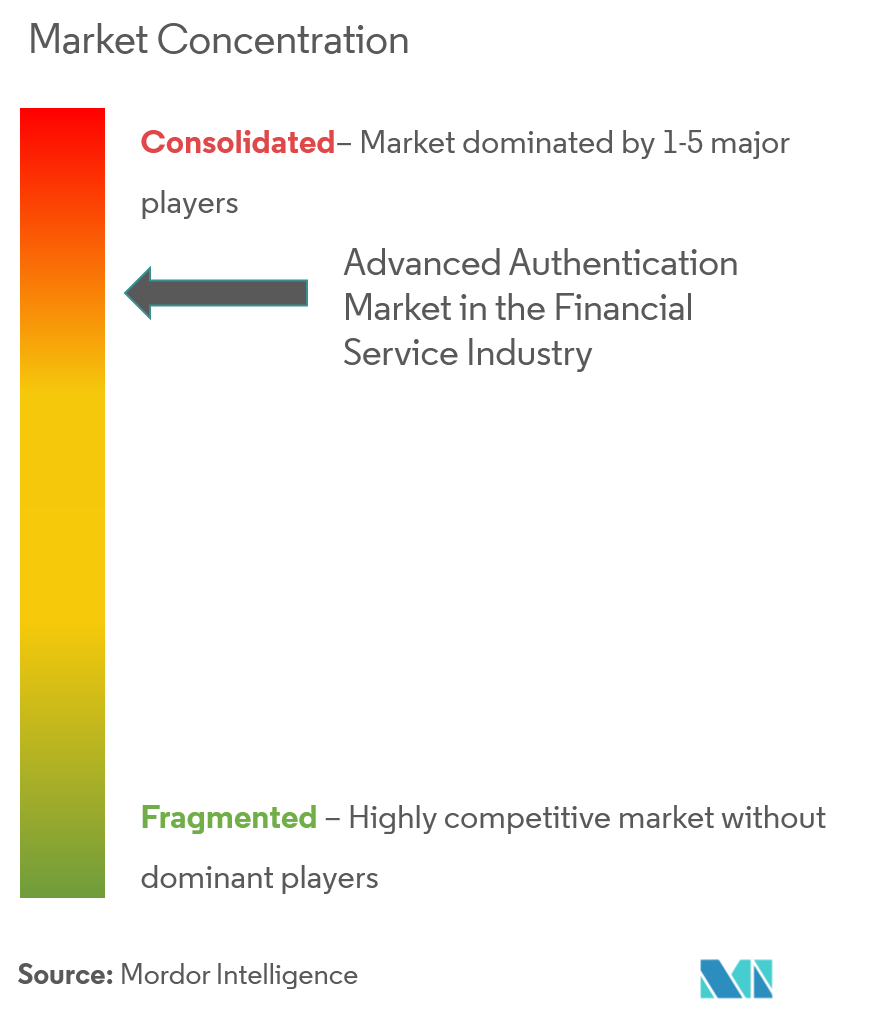

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Financial Services Advanced Authentication Market Analysis

The global advanced authentication market in the financial service industry was valued at USD 3.476 billion in 2020, and it is expected to register a CAGR of 13.6% over the forecast period 2021-2026. The financial services domain, to provide seamless services to its end users, needs to share sensitive and often regulated information across organizations and corporates. The need for sharing data has increased considerably over the last few years, majorly as a result of the advent of cloud-based services.

- Online frauds, changing consumer dynamics and increasing technology penetration are driving the adoption of online services among end users. The trend is also driving online transactions, resulting in a renewed emphasis on security and privacy.

- Major solution providers in the market today are focusing on providing a broad platform to support various existing entities in the environment, including Windows Credential Provider, OSX, iOS, Android, Windows Mobile, and Linux Pluggable Authentication.

- As the population and creativity of hackers grow, BFSI sector is compelled to deploy new authentication methods which will ensure protection of customer data. It is forcing the vendors for continuous innovation.

Financial Services Advanced Authentication Market Trends

This section covers the major market trends shaping the Financial Services Advanced Authentication Market according to our research experts:

Biometrics to Hold Major Share

- The anonymous nature of digital transactionsmeans that businesses and consumers must mutually find ways of establishing bilateral trust. To accomplish that today, consumers look forvisual signs of security when interacting with a business.

- This method of authentication has been widely adopted, owing to the key advantages it offers, namely its non-repudiation, non-transferable, and non-identifiable nature, thus providing a high level of protection against fraud.

- Iovation's 2018 reporttitled “Moving Beyond the Password: Consumers’ Views on Authentication”, revealed that 85 % of respondents want to replace passwords with advanced authentication methods.

- In March 2019,British bank NatWest startedtrialing the use of a new NFC payment card with a built-in fingerprint scanner. Itallowed its participants to make NFC payments (called “contactless” in the UK) without needing to input a PIN or offer a signature.

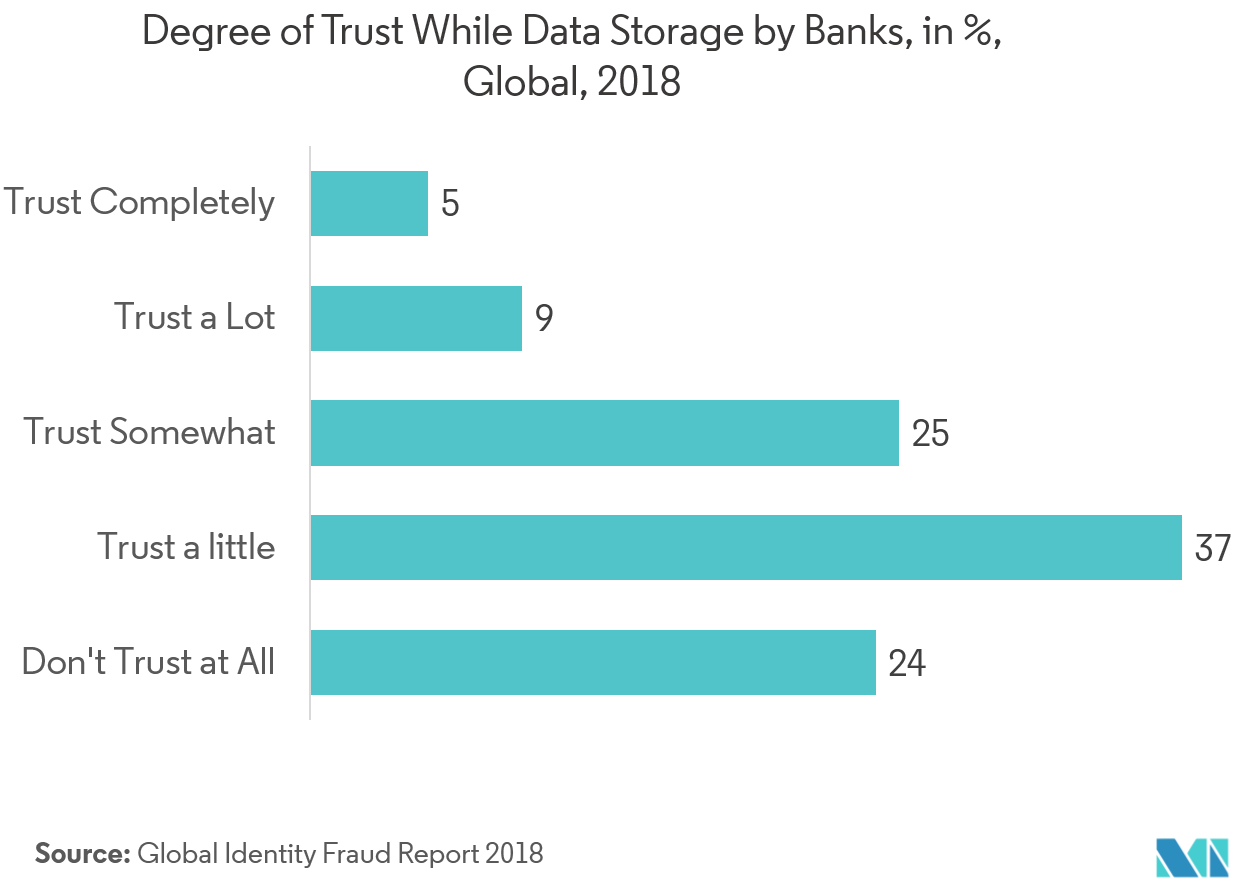

- In Global Identity Fraud Report 2019, it was mentioned that consumers still do not have"complete faith" on banks when it comes to personal data storage, Thus Biometric is poised for market expansion in the financial industry.

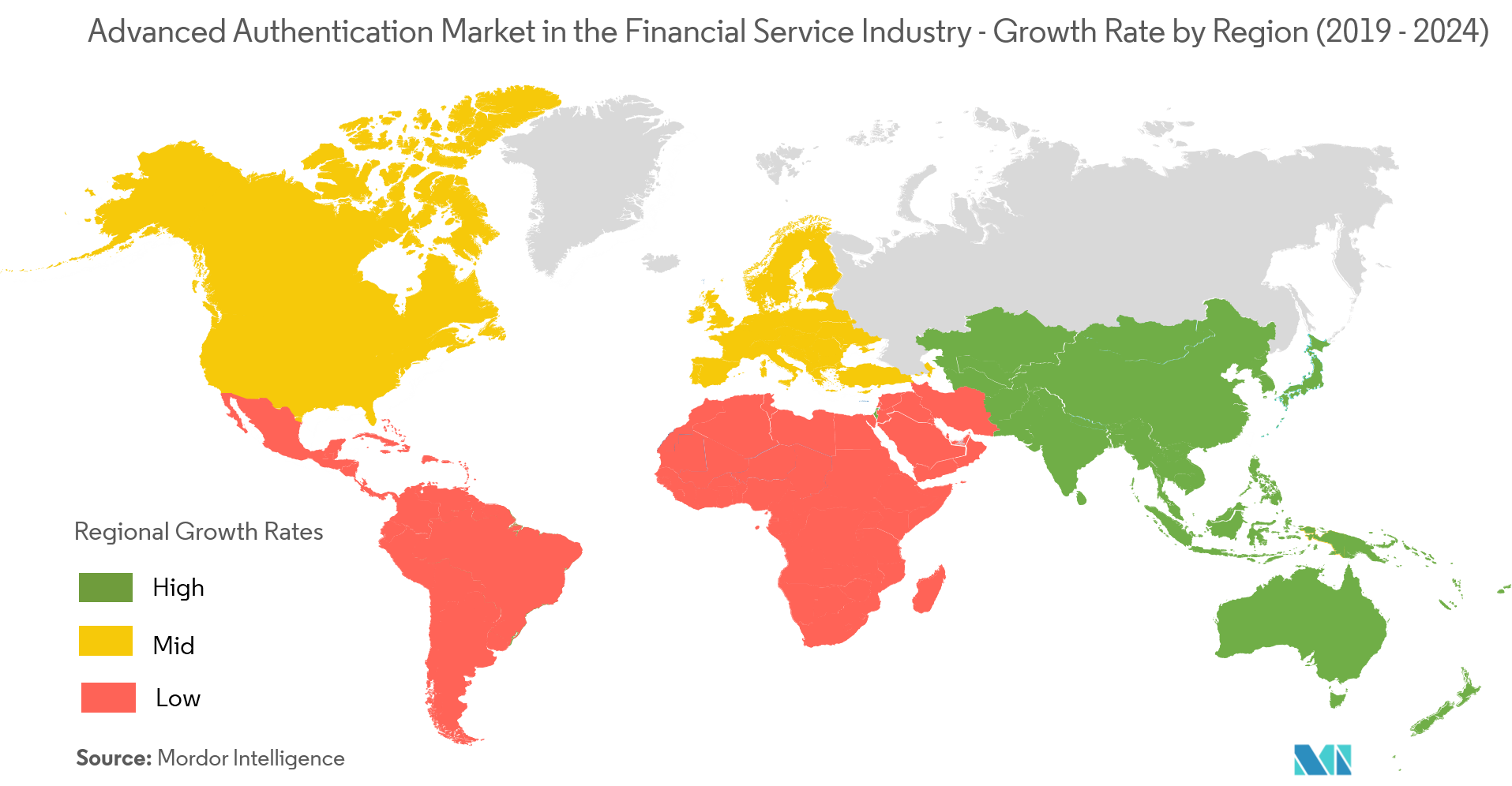

Asia-Pacific to Witness the Highest Growth

- Asia-Pacific holdsa unique place in the global financial and digital technology landscape.Adoption for digital banking and commerce is highest in the world among some countries in Asia-Pacific and growing rapidly in others.

- According to APAC Identity and Fraud Report, 90% of the respondents reported personal banking as one of their top online activities. This indicates a demand for advanced authentication methods.

- Many countries have passed regulation andcreated independent programs to create a “single source of truth” and provide banks and retailers with verified customer digital identities. Examples are, Malaysia’s MyKad, Singapore’s MyInfo and Thailand’s Digital ID, all designed to facilitate and speed up identity verification.

- A major bank in Japan is set to equip its ATMs with facial recognition technology by the end of 2019, allowing customers to open accounts. This will replace the need to submit a copy of an ID, such as a driver’s license.

Financial Services Advanced Authentication Industry Overview

The advance authentication market in the financial services industry is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent share in the market are focusing on expanding their customer base across foreign countries.

- January 2018 - Gemalto announced PURE white-label payment solution services to GhIPSS (Ghana Interbank Payment and Settlement Systems), a subsidiary of Ghana's central bank that manages the country's interbank payment processing system.

- January 2018 - HID Global announced that its HID Approve two-factor mobile authentication and verification platform supports Apple’s iPhone X Face ID facial recognition system.

Financial Services Advanced Authentication Market Leaders

-

Fujitsu Ltd.

-

Thales Group (Gemalto N.V)

-

NEC Corp.

-

Broadcom Inc.

-

Dell Technologies Inc.

*Disclaimer: Major Players sorted in no particular order

Financial Services Advanced Authentication Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increasing Number of Security Frauds and Technology Penetration is Driving the Market Growth

-

4.4 Market Restraints

- 4.4.1 Continuous Innovation is Required in Advanced Authentication Methods which Creates a Pressure on Vendors

-

4.5 Industry Attractiveness Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. TECHNOLOGY SNAPSHOT

6. MARKET SEGMENTATION

-

6.1 By Authentication Type

- 6.1.1 Smartcards

- 6.1.2 Biometrics

- 6.1.3 Mobile Smart Credentials

-

6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East & Africa

7. COMPETITIVE LANDSCAPE

-

7.1 Company Profiles

- 7.1.1 Fujitsu Ltd.

- 7.1.2 Thales Group (Gemalto N.V)

- 7.1.3 NEC Corp.

- 7.1.4 Broadcom Inc.

- 7.1.5 Safran Identity and Security SAS

- 7.1.6 Dell Technologies Inc.

- 7.1.7 Lumidigm Inc.

- 7.1.8 Validsoft Ltd.

- 7.1.9 Pistolstar Inc.

- 7.1.10 SecurEnvoy Ltd.

- *List Not Exhaustive

8. INVESTMENT ANALYSIS

9. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityFinancial Services Advanced Authentication Industry Segmentation

Advanced authentication provides a central place for all authentication policies to be managed. This is important because organizations are usually forced to operate and maintain multiple infrastructures. Advanced authentication, two-factor authentication, or multifactor authentication requires an additional separate factor or credential to complete the log-in or transaction process.

Financial Services Advanced Authentication Market Research FAQs

What is the current Advanced Authentication Market size?

The Advanced Authentication Market is projected to register a CAGR of 13.60% during the forecast period (2024-2029)

Who are the key players in Advanced Authentication Market?

Fujitsu Ltd., Thales Group (Gemalto N.V), NEC Corp., Broadcom Inc. and Dell Technologies Inc. are the major companies operating in the Advanced Authentication Market.

Which is the fastest growing region in Advanced Authentication Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Advanced Authentication Market?

In 2024, the North America accounts for the largest market share in Advanced Authentication Market.

What years does this Advanced Authentication Market cover?

The report covers the Advanced Authentication Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Advanced Authentication Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Advanced Authentication Industry Report

Statistics for the 2024 Advanced Authentication market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Advanced Authentication analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.