Market Trends of Advanced Authentication Industry

This section covers the major market trends shaping the Financial Services Advanced Authentication Market according to our research experts:

Biometrics to Hold Major Share

- The anonymous nature of digital transactionsmeans that businesses and consumers must mutually find ways of establishing bilateral trust. To accomplish that today, consumers look forvisual signs of security when interacting with a business.

- This method of authentication has been widely adopted, owing to the key advantages it offers, namely its non-repudiation, non-transferable, and non-identifiable nature, thus providing a high level of protection against fraud.

- Iovation's 2018 reporttitled “Moving Beyond the Password: Consumers’ Views on Authentication”, revealed that 85 % of respondents want to replace passwords with advanced authentication methods.

- In March 2019,British bank NatWest startedtrialing the use of a new NFC payment card with a built-in fingerprint scanner. Itallowed its participants to make NFC payments (called “contactless” in the UK) without needing to input a PIN or offer a signature.

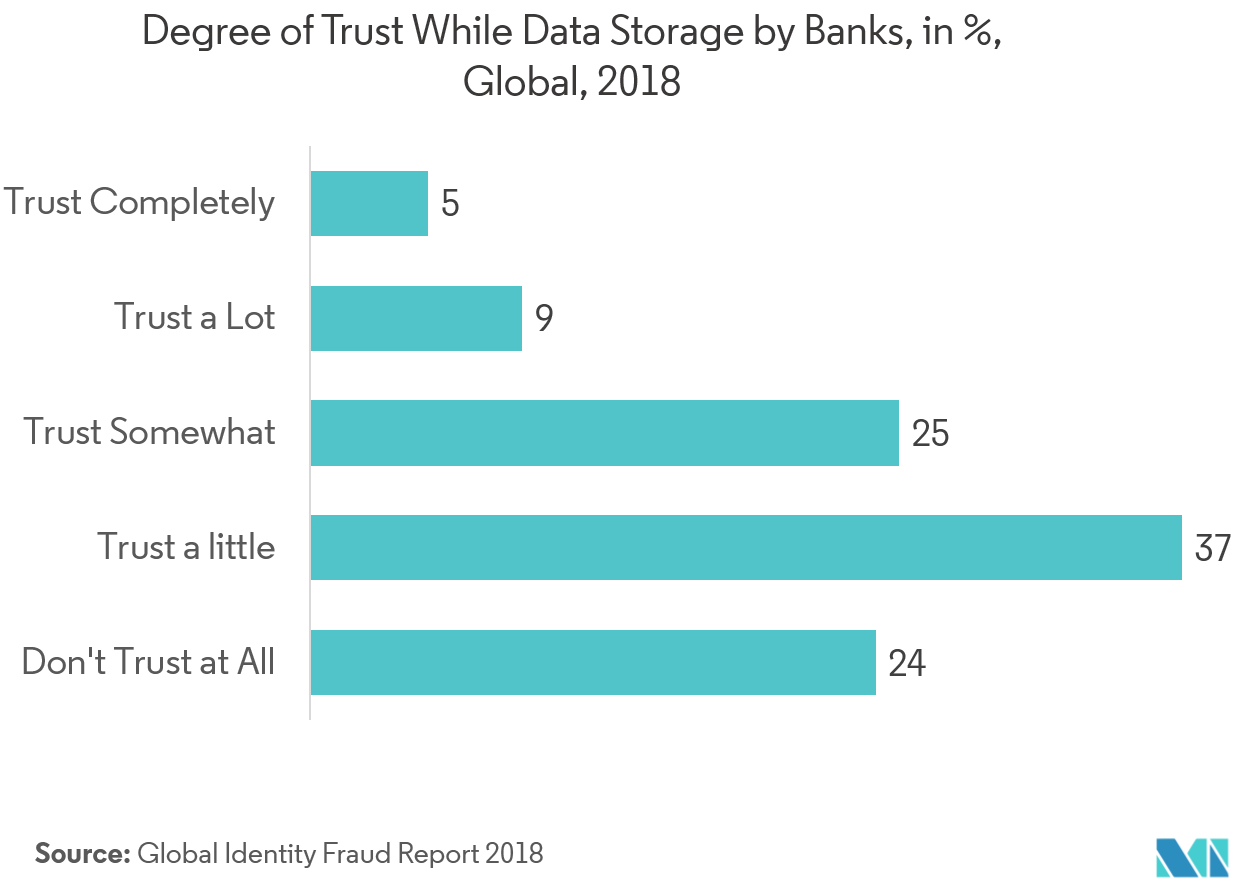

- In Global Identity Fraud Report 2019, it was mentioned that consumers still do not have"complete faith" on banks when it comes to personal data storage, Thus Biometric is poised for market expansion in the financial industry.

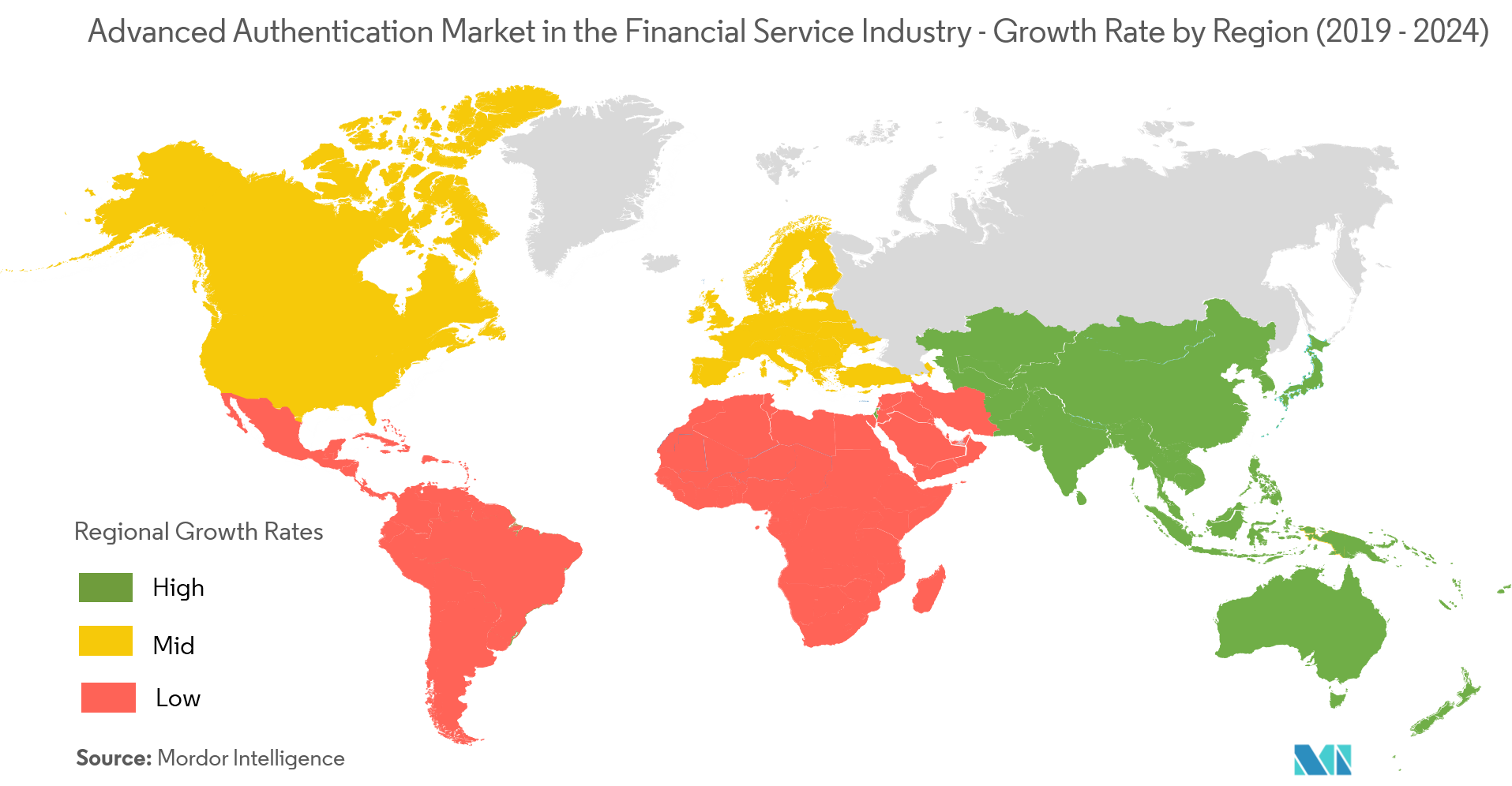

Asia-Pacific to Witness the Highest Growth

- Asia-Pacific holdsa unique place in the global financial and digital technology landscape.Adoption for digital banking and commerce is highest in the world among some countries in Asia-Pacific and growing rapidly in others.

- According to APAC Identity and Fraud Report, 90% of the respondents reported personal banking as one of their top online activities. This indicates a demand for advanced authentication methods.

- Many countries have passed regulation andcreated independent programs to create a “single source of truth” and provide banks and retailers with verified customer digital identities. Examples are, Malaysia’s MyKad, Singapore’s MyInfo and Thailand’s Digital ID, all designed to facilitate and speed up identity verification.

- A major bank in Japan is set to equip its ATMs with facial recognition technology by the end of 2019, allowing customers to open accounts. This will replace the need to submit a copy of an ID, such as a driver’s license.