Agricultural Biologicals Testing Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 9.70 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Europe |

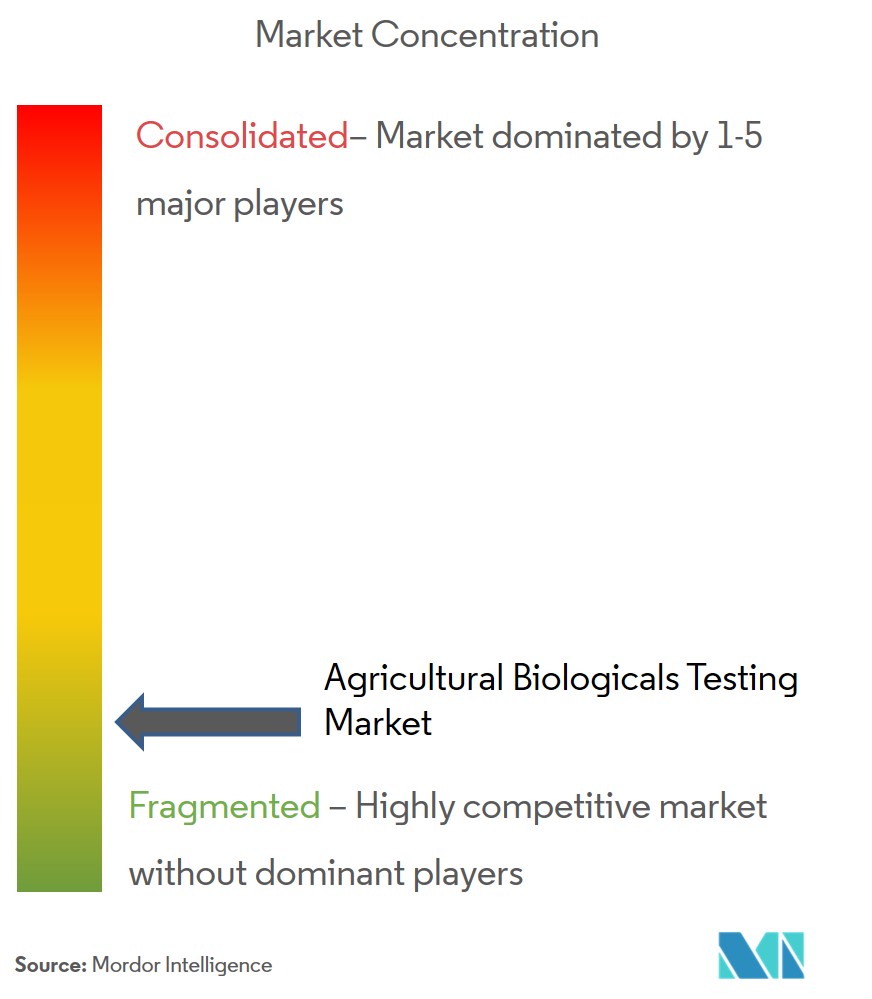

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Agricultural Biologicals Testing Market Analysis

The agricultural biologicals testing market is forecasted to witness a CAGR of 9.7% in the forecast period 2020-2025. The market is driven by several factors like the increasing adoption of bio-based pesticides, fertilizers, and biostimulant products across the world due to stringent regulations on chemical usage in several countries, a large investment in product development by agricultural companies, and an increased organic agricultural production across several regions.

Europeis the largest market for biological testing services. Several environmental agencies that promote sustainable agricultural practices are also favoring the use of biopesticides which is further enhancing the testing market for these products. The market is fragmented and companies are investing heavily in developing new products and are collaborating and acquiring other companies, which is expected to increase their market shares and strengthen the R&D activities.

Agricultural Biologicals Testing Market Trends

This section covers the major market trends shaping the Agricultural Biologicals Testing Market according to our research experts:

Government Regulations Favoring Agricultural Biologicals are Driving the Market

Given that biopesticides tend to pose fewer environmental risks compared to chemical pesticides, the United States Environmental Protection Agency (USEPA) generally requires less stringent data to register a biopesticide than to register a chemical pesticide. As a result, new biopesticides are often registered in less than a year, compared to an average of more than three years for chemical pesticides.

Biopesticides are regulated in the European Union in the same manner as chemical pesticides. The Organization for Economic Co-operation and Development (OECD), a 34-country group headquartered in Paris, France, assists EU governments in a quick and thorough assessment of biopesticide for eliminating risks to humans and the environment.

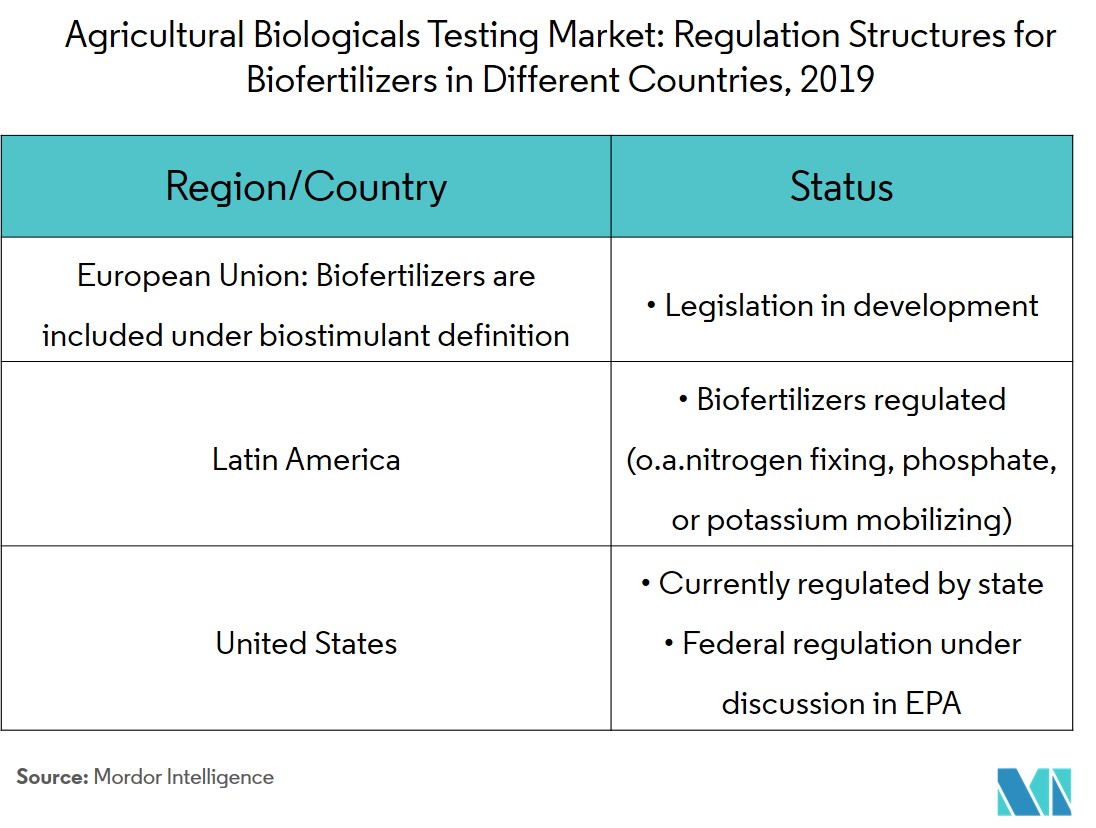

In the United States, the registration process for biofertilizers is done at the state level and they are registered under soil amendments, as they contain organic components. In Canada, the Canadian Food Inspection Agency (CFIA) has well-defined processes accepted by the industry, for the registration of biofertilizers. This practice allows biofertilizer companies to operate in a safe environment and attract new investors for the biofertilizer industry. Thus the favorable regulatory structure related to the use of biopesticides is giving a boost to the agricultural biologicals market in general and the biopesticide market.

Europe is the Largest Market as of 2019

The European agricultural biologicals testing market is driven by the increasing usage of biological agricultural products such as biostimulants and biofertilizers in the region. The stringent regulations imposed on chemical agrochemicals in various countries of this region have encouraged consumers to shift from the traditional pesticides to less toxic biological products. The agro biologicals market is also gaining momentum with the entry of major players like Bayer Cropscience and Marrone Bio Innovations Inc. into the market.

Italy, Germany, and the United Kingdom are some leading countries in the European market. The developments in the agricultural biologicals market are further stimulating the growth of the testing market for these products in Europe who are promoting their products and services including field trials, product analysis, and regulatory compliance. Owing to the above-stated factors, the agricultural biologicals market in Europe is also projected to witness significant growth over the coming years.

Agricultural Biologicals Testing Industry Overview

The Agricultural Biologicals Testing Market is fairly fragmented with a number of regional and international players occupying a significant share of the market. The companies in the segment are not only investing in expansion to different regions but also focussing on mergers and acquisitions to enhance their prominence across the world. For instance, in 2017, SGS SA had acquired BioVision Seed Research Limited (BioVision), in Canada which has testing laboratories serving the agricultural markets in Western Canada and beyond. In 2018, the company has also acquired OLEOTEST NV in Belgium.

Agricultural Biologicals Testing Market Leaders

-

SGS SA

-

Eurofins Scientific SE

-

Syntech Research

-

Staphyt S.A.

-

Anadiag Group

*Disclaimer: Major Players sorted in no particular order

Agricultural Biologicals Testing Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

-

4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Powers of Buyers

- 4.4.2 Bargaining Powers of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat from Substitute Products and Services

- 4.4.5 Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Product Type

- 5.1.1 Biopesticides

- 5.1.2 Biofertilizers

- 5.1.3 Biostimulants

- 5.1.4 Others

-

5.2 By Application

- 5.2.1 Field Support

- 5.2.2 Regulatory

- 5.2.3 Analytical

- 5.2.4 Others

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest Of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Italy

- 5.3.2.4 Spain

- 5.3.2.5 Germany

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Adopted Strategies

-

6.3 Company Profiles

- 6.3.1 Anadiag Group

- 6.3.2 Apal Agricultural Laboratory

- 6.3.3 Bionema Limited

- 6.3.4 Biotecnologie B.T. Srl

- 6.3.5 Eurofins Scientific SE

- 6.3.6 i2LResearch

- 6.3.7 Laus GmbH

- 6.3.8 RJ Hill Laboratories Ltd

- 6.3.9 SGS SA

- 6.3.10 Staphyt S.A.

- 6.3.11 Syntech Research

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityAgricultural Biologicals Testing Industry Segmentation

Agricultural biologicals testing refers to various types of tests such as efficacy, toxicity, stability, and microbiological analyses that are conducted on agricultural biologicals like biofertilizers, biopesticides, and biostimulants. Agricultural biologicals comprise natural products developed particularly for the purpose of crop production. The market for agricultural biologicals testing includes field support, analytical tests, and tests for regulatory compliance.

| By Product Type | Biopesticides | |

| Biofertilizers | ||

| Biostimulants | ||

| Others | ||

| By Application | Field Support | |

| Regulatory | ||

| Analytical | ||

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest Of North America | ||

| Geography | Europe | United Kingdom |

| France | ||

| Italy | ||

| Spain | ||

| Germany | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| India | ||

| Japan | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Africa | South Africa |

| Rest of Africa |

Agricultural Biologicals Testing Market Research FAQs

What is the current Agricultural Biologicals Testing Market size?

The Agricultural Biologicals Testing Market is projected to register a CAGR of 9.70% during the forecast period (2024-2029)

Who are the key players in Agricultural Biologicals Testing Market?

SGS SA, Eurofins Scientific SE, Syntech Research, Staphyt S.A. and Anadiag Group are the major companies operating in the Agricultural Biologicals Testing Market.

Which is the fastest growing region in Agricultural Biologicals Testing Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Agricultural Biologicals Testing Market?

In 2024, the Europe accounts for the largest market share in Agricultural Biologicals Testing Market.

What years does this Agricultural Biologicals Testing Market cover?

The report covers the Agricultural Biologicals Testing Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Agricultural Biologicals Testing Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Agricultural Biologicals Testing Industry Report

Statistics for the 2024 Agricultural Biologicals Testing market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Agricultural Biologicals Testing analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.