Alcoholic Beverage Packaging Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.13 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Alcoholic Beverage Packaging Market Analysis

The alcoholic beverage packaging market was valued at USD 63.43 billion in 2020 and is expected to reach USD 93.68 billion by 2026, at a CAGR of 5.13% over the forecast period 2021 - 2026. The packaging of alcoholic beverages plays a significant role in the brand promotion of alcohol. The alcoholic beverage industry highlights the innovations, including enhanced branding and unconventional packaging formats, such as paper wine bottles, whiskey pouches, etc.

- It was observed that the global consumption of alcoholic beverages has been increasing significantly, over the decades. According to the study conducted by Lancet, alcohol per-capita consumption increased from 59 liters in 1990 to 65 liters in 2017, globally. Furthermore, in the following 13 years, alcohol per-capita consumption is expected to grow by 17%, reaching 76 liters in 2030. The rising alcoholic beverage consumption is one of the key factors driving market growth.

- Additionally, owing to the awareness regarding the usage of 100% recyclable products, in order to minimize packaging waste, the focus on recycling packagings is growing. This is, thus, fuelling the demand for sustainable packaging products and supporting the growth of the alcoholic beverage packaging market.

- However, stringent government regulations on the use of hazardous and non-biodegradable products have limited the manufacturers to a few packaging materials. Furthermore, the increasing cost of production is also restricting the growth of the market studied.

Alcoholic Beverage Packaging Market Trends

This section covers the major market trends shaping the Alcoholic Beverage Packaging Market according to our research experts:

Glass Packaging Segment to Account for a Crucial Share

- Glass is 100% recyclable without the loss of quality and sturdiness. The majority of utilized glass bottles are used for the production of new glass bottles. The demand for glass containers may likely expand, owing to its increasing importance in wine packaging and robust demand in the market.

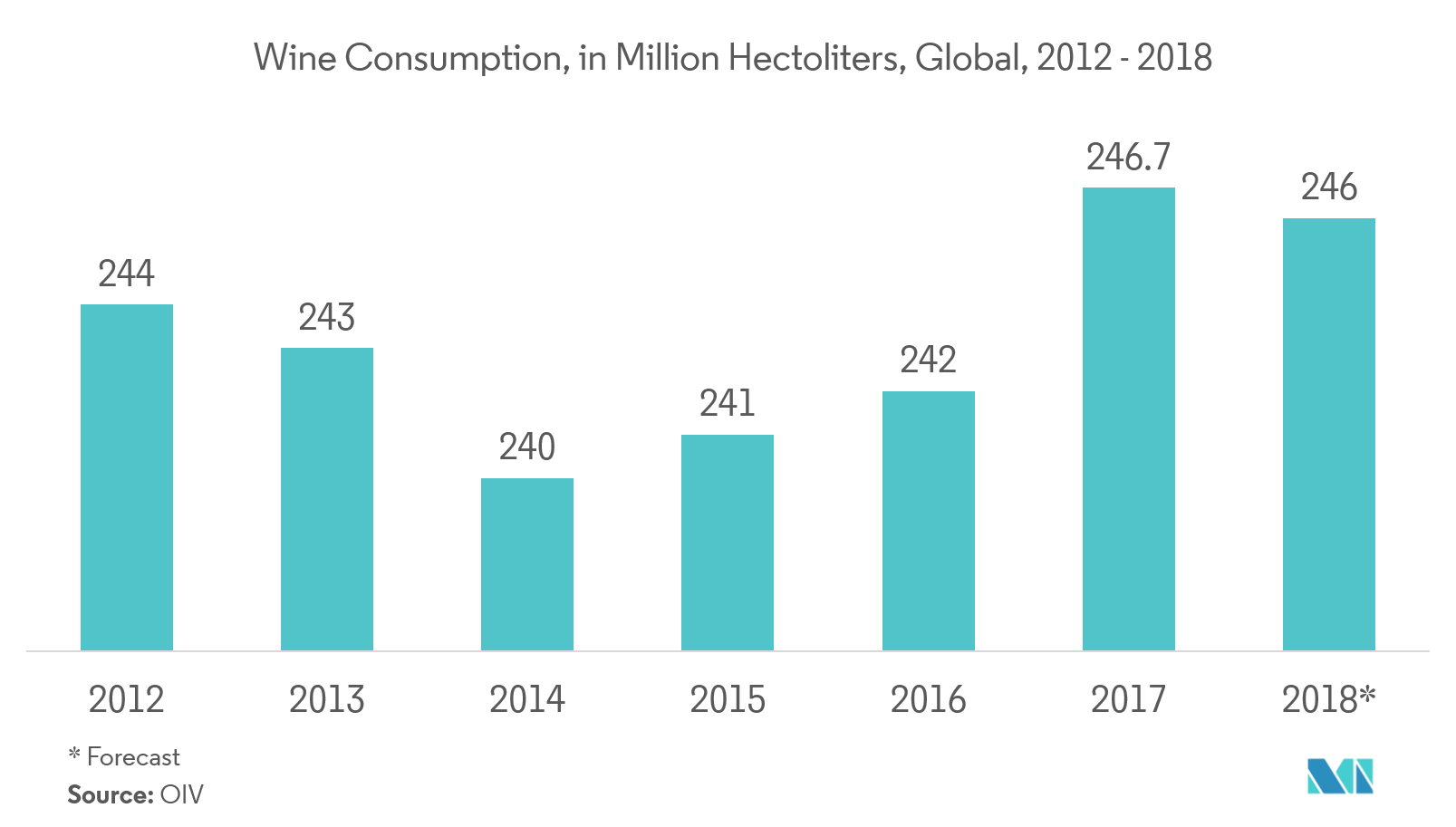

- More than 50% of the alcohol consumed globally is in the form of wine, and OIV has projected a 17% growth in the production of wine, globally.Though the customers have started accepting wine in alternative packagings, like Bags in a Box (BiB), it is limited to bulk purchasing.

- According to the report by the Wine Institute of America, released in April 2019, almost 1 billiongallons of wine wereproduced in the United States in 2017. The United States isthe highest consumerof wine,with a 15% global share. Thus, the glass packaging segment dominates the wine packaging application.

- Additionally, the beer industry has shown steady growth over the past years. Thegrowing beer industry may possibly show significant development in the glass packaging segment. For instance,in Europe, out of the overall recycling materials, glass captured 22% share in 2017, after paper.

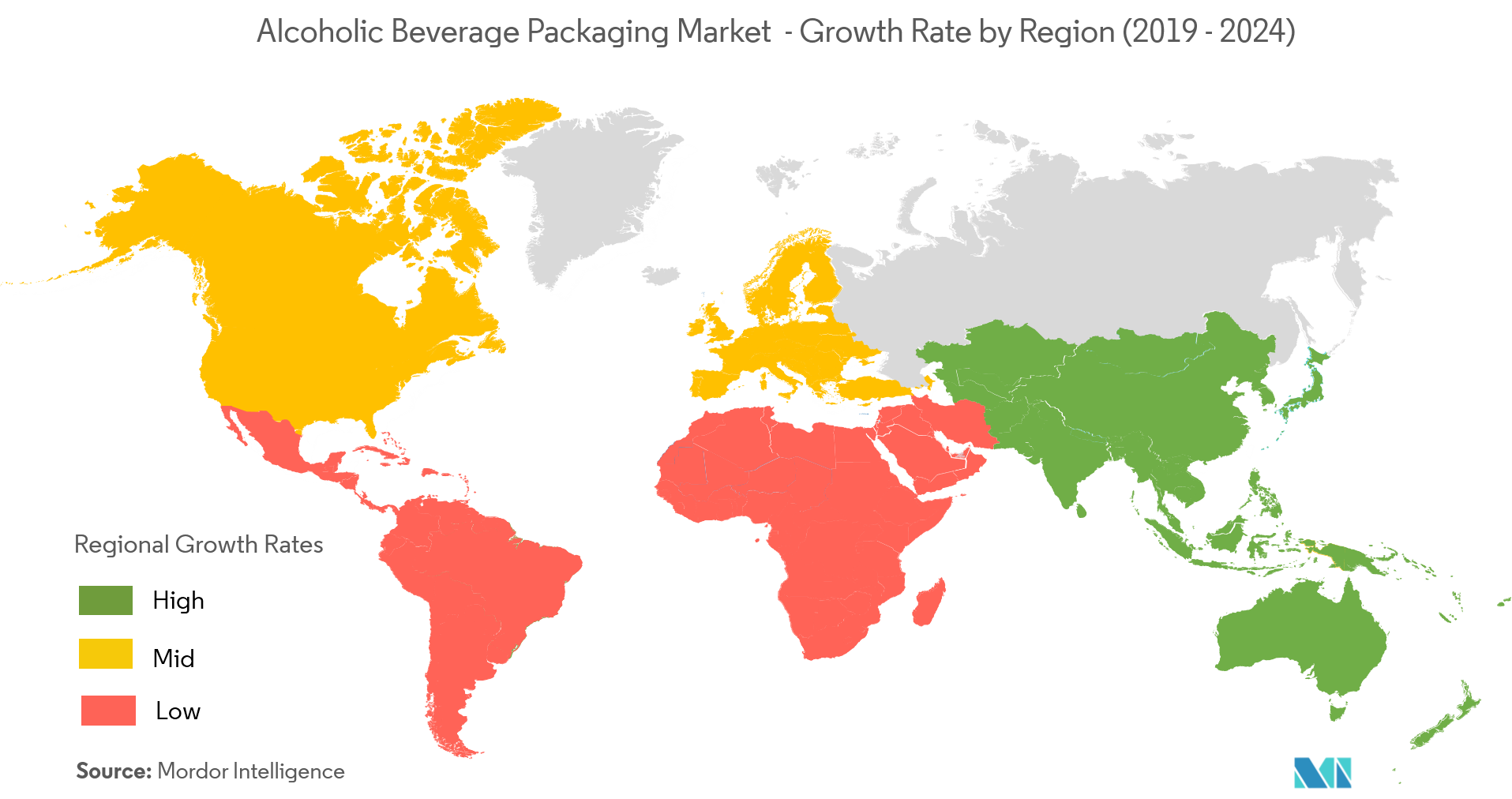

Asia-Pacific Region is Expected to Dominate the Market

- The increasing consumption of beer and spirit drinks in the region has been a significant factor for the growth of the market. WHO has stated that 92% of the alcohol consumers in India prefer spirits over beer and wine. As the players are moving toward sustainable packaging products, the adoption of glass packaging for alcoholic beverages is growing in the region.

- The huge consumer base in the region, reinforced by the presence of highly populated countries, like China and India, increasing disposable incomes, and the growing acceptance of alcohol consumption in developing nations are the major factors driving the growth of the market studied.

- The study by Lancet has stated that per capita alcohol consumption in Southeast Asia and West Pacific increased by 104% and 54%, respectively, from 1990 to 2017. The Asian population represents the median age of 30.7 years, which presents huge potential opportunities for the alcoholic beverages market, thus augmenting the demand for alcoholic beverage packaging.

Alcoholic Beverage Packaging Industry Overview

The availability of several players providingpackagingsolutions for alcoholic beverages has intensified the competition in the market. Therefore, the market is moderately fragmented, with many companies developing expansion strategies.

- Apr 2019 -Diageo PLCannounced that it will not be using plastic packaging, globally, for its beer brand, Guinness, with a focus on minimizing plastic waste. The company is planning to invest EUR 16 million for this move and for the introduction of 100% recyclable and biodegradable cardboard to replace plastic.

- Mar 2019 - Amcor Limited acquired its rival Bemis CompanyInc. By combining these two market leaders, Amcor aims tocreate a stronger value proposition for shareholders, customers, employees, and the environment.

Alcoholic Beverage Packaging Market Leaders

-

Amcor PLC

-

Ball Corporation

-

Krones AG

-

Mondi PLC

-

Crown Holdings Inc.

*Disclaimer: Major Players sorted in no particular order

Alcoholic Beverage Packaging Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Increasing Consumption of Alcoholic Beverages

- 4.2.2 Increased Focus on Recycling

- 4.2.3 Rising Demand for Long Shelf Life of the Product

-

4.3 Market Restraints

- 4.3.1 Implementation of Stringent Regulations on Packaging Materials

- 4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Material

- 5.1.1 Glass

- 5.1.2 Metal

- 5.1.3 Plastic

- 5.1.4 Other Materials

-

5.2 By Product

- 5.2.1 Cans

- 5.2.2 Bottles

- 5.2.3 Other Products

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 Unites States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Ball Corporation

- 6.1.3 Krones AG

- 6.1.4 Mondi PLC

- 6.1.5 Crown Holdings Inc.

- 6.1.6 Sidel SA

- 6.1.7 Oi SA

- 6.1.8 Ardagh Group SA

- 6.1.9 Berry Global Inc.

- 6.1.10 Nampak Limited

- 6.1.11 Stora Enso Oyj

- 6.1.12 Gerresheimer AG

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityAlcoholic Beverage Packaging Industry Segmentation

The scope of the alcoholic beverage packaging market study is limited to the packagings offered by the various vendors, made of different packaging materials. The trend of using non-conventional packaging for alcoholic beverages is increasing. Thus, the study also considers the global usage of different products, like paper wraps and plastic bags.

| By Material | Glass | |

| Metal | ||

| Plastic | ||

| Other Materials | ||

| By Product | Cans | |

| Bottles | ||

| Other Products | ||

| Geography | North America | Unites States |

| Canada | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | Latin America |

| Middle East & Africa |

Alcoholic Beverage Packaging Market Research FAQs

What is the current Alcoholic Beverage Packaging Market size?

The Alcoholic Beverage Packaging Market is projected to register a CAGR of 5.13% during the forecast period (2024-2029)

Who are the key players in Alcoholic Beverage Packaging Market?

Amcor PLC, Ball Corporation, Krones AG, Mondi PLC and Crown Holdings Inc. are the major companies operating in the Alcoholic Beverage Packaging Market.

Which is the fastest growing region in Alcoholic Beverage Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Alcoholic Beverage Packaging Market?

In 2024, the Asia Pacific accounts for the largest market share in Alcoholic Beverage Packaging Market.

What years does this Alcoholic Beverage Packaging Market cover?

The report covers the Alcoholic Beverage Packaging Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Alcoholic Beverage Packaging Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Alcoholic Beverage Packaging Industry Report

Statistics for the 2024 Alcoholic Beverage Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Alcoholic Beverage Packaging analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.