Alcoholic Drinks Packaging Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.06 % |

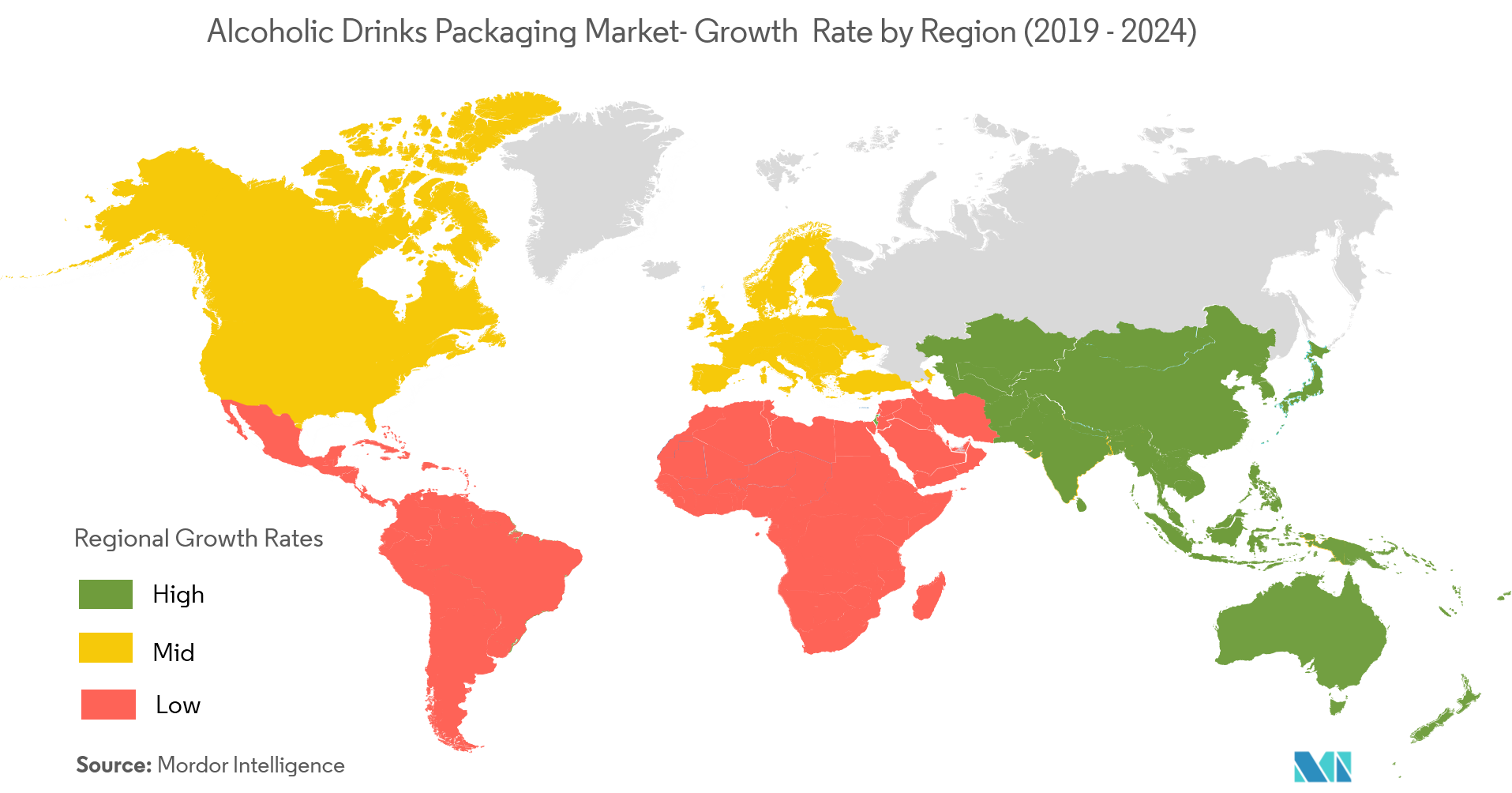

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Alcoholic Drinks Packaging Market Analysis

The alcoholic drinks packaging market was valued at USD 29.84 billion in 2020, and it is expected to reach a market value of USD 38.87 billion by 2026, registering a CAGR of 5.06% during the forecast period (2021-2026). Globally, growth in disposable income, coupled with increased spending on recreational activities, is a major influencing factor that collectively lead to a growth of the alcohol consumption, which fuels the growth of the alcoholic drinks packaging market over the forecast period.

- Major manufacturing companies in the alcohol industry follow attractive packaging formats, which include ceramic glass bottles, whiskey pouches, bag-in-box, bag-in-tube, etc. Changing consumer preferences are also affecting the market studied significantly.

- Over the years, growing awareness among the brand manufacturers about differentiating their alcoholic products based on the packaging is also expected to contribute to the growth of the alcoholic drinks packaging market.

- Conventionally, European and American manufacturers are often referred to as the leading producers of alcohol beverages. However, with the rise in demand for Chinese beer and Japanese whiskey, Asia-Pacific is increasingly becoming a major market for alcoholic beverage production, creating a massive demand for alcoholic drinks packaging solutions.

- Owing to various benefits offered by metal packaging, such as better hermetic sealing and high mechanical strength, there is a growing preference for metal packaging from the companies present in the alcoholic drinks packaging market.

- However, fluctuating raw material prices and implementation of stringent regulations on packaging materials used for alcoholic beverages may hinder the growth of the market studied.

Alcoholic Drinks Packaging Market Trends

This section covers the major market trends shaping the Alcoholic Drinks Packaging Market according to our research experts:

Glass Packing Accounts for the Largest Share in the Market

- In this industry, glass is mostly preferred, as it does not react with the alcohol, keeping the chemical composition of the contents intact. This factor is given much importance in the alcoholic beverage industry, which operates on little product differentiation and is heavily dependent on the integrity of chemical composition to ensure that the stored liquid maintains its strength, aroma, and flavor.

- In addition to this, packaging innovation in wines and spirits, especially toward the premium products, is expected to show continuous growth during the forecast period, resulting in the growth of the overall glass bottles and containers market.

- Colored glass bottles are used for alcohol packaging, as it protects the packed liquid from alteration caused by light. It is very important in the case of beer, which undergoes chemical changes in the presence of light and loses its quality.

- Amber colored bottles are most efficient in protection from light, and therefore, they are in highest circulation. Few manufacturers also use green bottles, owing to its perceived association with quality.

.png)

China Accounts for a Significant Share

- Globally, China is one of the most significant consumer of alcoholic drinks. Though the sale of the Chinese rice liquor ‘Baijiu’ is still very prevalent, the demand from the local customers for wine, imported beer, and spirits has been increasing over the past decade.

- Drinking alcohol has been traditionally accepted in the country during social events, such as the spring festival and wedding ceremonies. Furthermore, alcoholic beverages are now commonly consumed to relieve stress, facilitate social interaction, and foster good relations between supervisors and employees.

- According to the International Organization of Vine and Wine, the wine consumption volume in China increased by 64.2% during 2009-2017. With this growing demand for alcoholic beverages in the country, the demand for alcoholic drinks packaging is expected to grow rapidly over the forecast period.

Alcoholic Drinks Packaging Industry Overview

The market studied is fragmented, due to the presence of several players, like Mondi Group, Amcor, and Terta Packing. Some key recent developments in the market studied include:

- November 2018 - Kronesrevised its modufill HE, which is used to fill beer. For example, numerous new technological features and design enhancements ensure that the filling system offers several features, in terms of safety, operator-friendliness, space savings, and hygiene.

- February 2018 - Amcor Flexibles Kreuzlingen AGfiled a patent application for flexible multilayer packaging film with ultra-high barrier properties. The approval of the product may expand the product portfolio, especially for the food and beverage sector.

Alcoholic Drinks Packaging Market Leaders

-

Amcor Plc

-

Mondi Group

-

Saint Gobain SA

-

Tetra Pak International SA

-

Ball Corporation

*Disclaimer: Major Players sorted in no particular order

Alcoholic Drinks Packaging Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increasing Prosperity and Urbanization

- 4.3.2 Rising Innovations in the Packaging Industry

-

4.4 Market Restraints

- 4.4.1 Fluctuating Raw Material Prices

- 4.5 Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paper

- 5.1.3 Metal

- 5.1.4 Glass

- 5.1.5 Other Materials

-

5.2 By Package Type

- 5.2.1 Bottles

- 5.2.2 Metal Cans

- 5.2.3 Cartons

- 5.2.4 Jars

- 5.2.5 Pouches

- 5.2.6 Other Package Types

-

5.3 By Product

- 5.3.1 Beer

- 5.3.2 Spirit

- 5.3.3 Wine

- 5.3.4 Other Products

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Mexico

- 5.4.4.4 Rest of Latin America

- 5.4.5 Middle East & Africa

- 5.4.5.1 UAE

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Amcor Plc

- 6.1.2 Mondi Group

- 6.1.3 Ball Corporation (Rexam PLC)

- 6.1.4 Saint Gobain SA

- 6.1.5 Tetra Laval(tetra Pack)

- 6.1.6 Crown Holdings Incorporated

- 6.1.7 Krones AG

- 6.1.8 Sidel Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityAlcoholic Drinks Packaging Industry Segmentation

Alcoholic beverage packaging plays a prominent role in brand promotion, leading to increased brand visibility. At present, the alcohol beverages manufacturers are ardent on providing top packaging standards for their products, to influence the consumers to purchase their brand over another.

| By Material | Plastic | |

| Paper | ||

| Metal | ||

| Glass | ||

| Other Materials | ||

| By Package Type | Bottles | |

| Metal Cans | ||

| Cartons | ||

| Jars | ||

| Pouches | ||

| Other Package Types | ||

| By Product | Beer | |

| Spirit | ||

| Wine | ||

| Other Products | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Brazil |

| Argentina | ||

| Mexico | ||

| Rest of Latin America | ||

| Geography | Middle East & Africa | UAE |

| South Africa | ||

| Rest of Middle East & Africa |

Alcoholic Drinks Packaging Market Research FAQs

What is the current Alcoholic Drinks Packaging Market size?

The Alcoholic Drinks Packaging Market is projected to register a CAGR of 5.06% during the forecast period (2024-2029)

Who are the key players in Alcoholic Drinks Packaging Market?

Amcor Plc, Mondi Group, Saint Gobain SA, Tetra Pak International SA and Ball Corporation are the major companies operating in the Alcoholic Drinks Packaging Market.

Which is the fastest growing region in Alcoholic Drinks Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Alcoholic Drinks Packaging Market?

In 2024, the North America accounts for the largest market share in Alcoholic Drinks Packaging Market.

What years does this Alcoholic Drinks Packaging Market cover?

The report covers the Alcoholic Drinks Packaging Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Alcoholic Drinks Packaging Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Alcoholic Drinks Packaging Industry Report

Statistics for the 2024 Alcoholic Drinks Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Alcoholic Drinks Packaging analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.