Algae Products Market Size

| Study Period | 2018 - 2029 |

| Market Size (2024) | USD 1.92 Billion |

| Market Size (2029) | USD 2.45 Billion |

| CAGR (2024 - 2029) | 4.99 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Algae Products Market Analysis

The Algae Products Market size is estimated at USD 1.92 billion in 2024, and is expected to reach USD 2.45 billion by 2029, growing at a CAGR of 4.99% during the forecast period (2024-2029).

The algae products market is driven by changing dietary preferences and the paradigm shift toward preventive health management practices amid rising healthcare costs and the increasing burden of lifestyle-related diseases. The growing geriatric population, coupled with the rising prevalence of chronic conditions, is anticipated to drive the growth of algae products worldwide. Moreover, consumer awareness about botanical variants and their functional properties has been a critical driver. As algae also support immunity development, the post-COVID-19 situation is predicted to witness steep sales of algae supplements

Algae have wide applications as functional ingredients in various food products as they are rich in essential oils such as omega-3 fatty acids and poly-unsaturated fatty acids (PUFA). Omega-3 fatty acids and PUFA are widely used in health food products and pharmaceuticals. Algae products are also being used in renewable raw materials for biofuels. According to the Department of Energy, algae can provide at least 30 times more energy than land-based crops currently utilized to make biofuels. Algae may also effectively recycle atmospheric carbon, making them an ideal environmentally beneficial energy source. Moreover, with the discovery of the potential of algal oil as a renewable fuel source, many petro-based companies, including Exxon, Shell, BP, Statoil, ENAP, and Chevron, are investing in biofuel R&D to produce methanol, ethanol, bio-butanol, biodiesel, and biocrude, as well as bio-based chemicals, thereby, augmenting the market growth.

North America holds the largest share of the algae products market due to a high level of consumer awareness about the nutritional benefits of the ingredient. By source, brown algae account for the largest market share.

Algae Products Market Trends

This section covers the major market trends shaping the Algae Products Market according to our research experts:

Health Benefits Associated With Algae Products' Consumption

Algae, including microalgae, are photosynthetic organisms for the production of dietary foods claimed to offer high protein content, along with other nutritional benefits, making it an ideal ingredient in the production of dietary supplements, cosmetics, functional food and beverage products, and animal feed, among other applications. Apart from being a source of protein, the presence of various bioactive components in algae and microalgae provides an added health benefit. Moreover, compared to various plant and floral species, microalgae contain higher amounts of pigments. Algae-derived proteins have completed essential amino acids (EAA) profiles, and their protein content is higher than conventional sources, such as meat, poultry, and dairy products. Numerous microalgae species are reported to be rich in proteins, carbohydrates, lipids, and other bio-active compounds. Antioxidative, antihypertensive, immunomodulatory, anticancerogenic, hepato-protective, and anticoagulant activities have been attributed to some microalgae-derived compounds, such as peptides. Furthermore, according to Becker et al., microalgae are excellent sources of vitamins, such as vitamins A, B1, B2, B6, B12, C, and E, and minerals, such as potassium, iron, magnesium, calcium, and iodine. They also contain potent probiotic compounds that enhance health by strengthening the immune system, helping cleanse the body of toxins, and boosting energy.

Asia-Pacific is the Fastest-growing Market

Asia-Pacific is anticipated to record the fastest growth in the market during the forecast period. Algae products used in food processing are mostly grown in the Philippines, Vietnam, and Indonesia. The region is anticipated to account for a large share of the carrageenan production industry due to the possibility of cultivating high-quality carrageenan. The algae-based superfoods like Spirulina and Chlorella provide nutritious, vegan supplements for human consumption. In the Asia-Pacific region, the rising consumption of nutraceuticals, mainly in China and Japan, is assisting the market's growth. Additionally, the Indian government-funded open-access research and policy stimulus is expected to help drive further innovation and entrepreneurship in food applications of algal protein. According to the Good Food Institute (GFI), in March 2021, the Indian government has already pledged around USD 87 million to develop an algae economy.

Algae Products Industry Overview

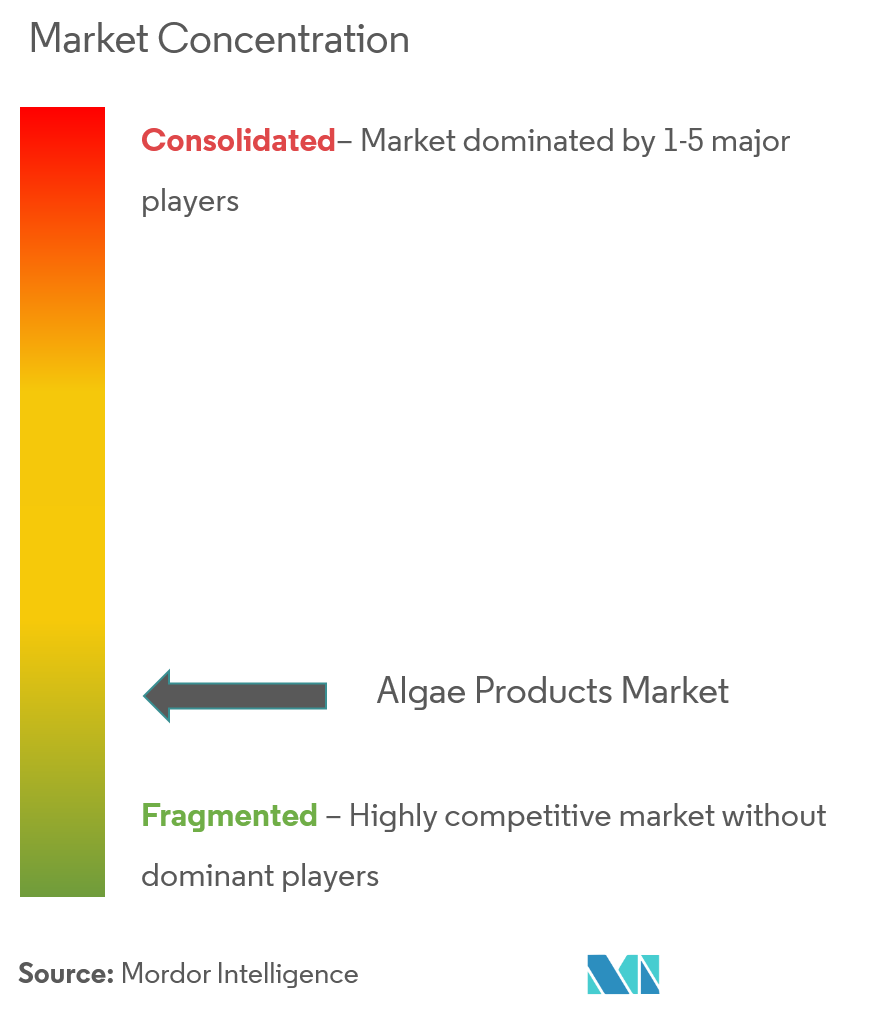

Major global players account for a significant market share, such as Kerry, Cargill, ADM, and ACCEL Carrageenan. Most manufacturers are focusing on expanding their current production capacities by increasing sales in various developing regions as the market in these regions is not consolidated by major players. The companies are also focusing on developing new techniques of storage and production in the market's dietary supplement segment. The key players are also planning to strengthen their distribution relationships with firms across various regions to leverage the customer base for future product launches. For instance, in October 2021, CP Kelco announced the expansion of its distribution relationship with Azelis in Europe and Middle East & Africa. The new distribution scope extension names Azelis as the exclusive distribution partner of CP Kelco across numerous countries and market segments.

Algae Products Market Leaders

-

Archer Daniels Midland Company

-

ACCEL Carrageenan Corporation

-

Cargill, Incorporated

-

BASF SE

-

Koninklijke DSM N.V.

*Disclaimer: Major Players sorted in no particular order

Algae Products Market News

- In September 2022, in the Netherlands, the Danish company Aliga Microalgae (Aliga) acquired a large chlorella algae facility. The company plans to use a modern production facility to commercialize its chlorella algae products.

- In April 2022, With two line extensions, Koninklijke DSM N.V. is expanding its 'life' range of algal-sourced omega-3 products. The company intended to offer an omega-3 alternative to fish oil while retaining quality and potency by increasing the product line, which includes life's OMEGA and life's DHA. DSM's most effective form of algal omega-3 is life's OMEGA O1030DS, which contains both EPA and DHA from a single, sustainable source.

- In September 2021, AAK announced a strategic partnership with Progress Biotech to supply the company's high-quality, algae-based DHA for infant formula.

Algae Products Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Source

- 5.1.1 Brown Algae

- 5.1.2 Red Algae

- 5.1.3 Green Algae

- 5.1.4 Blue-green Algae

-

5.2 Product Type

- 5.2.1 Algal Protein

- 5.2.2 Alginate

- 5.2.3 Carrageenan

- 5.2.4 Carotenoids

- 5.2.5 Lipids

- 5.2.6 Other Product Types

-

5.3 Application

- 5.3.1 Personal Care

- 5.3.2 Food and Beverage

- 5.3.3 Dietary Supplements

- 5.3.4 Pharmaceuticals

- 5.3.5 Animal Feed

- 5.3.6 Other Applications

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 Germany

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle-East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Archer Daniels Midland Company

- 6.3.2 ACCEL Carrageenan Corporation

- 6.3.3 Cargill Incorporated

- 6.3.4 BASF SE

- 6.3.5 Yemoja Ltd.

- 6.3.6 Source Omega LLC

- 6.3.7 DuPont de Nemours Inc.

- 6.3.8 Koninklijke DSM N.V.

- 6.3.9 Aliga Microalgae Company

- 6.3.10 Progress Biotech BV

- 6.3.11 Algenol Biotech LLC

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityAlgae Products Industry Segmentation

Algae products are single-celled, aquatic, plant-like substances with rich nutrition. They are used in dietary supplements, personal care, and pharmaceuticals. The algae products market is segmented by source, product type, application, and geography. Based on the source, the market is segmented into Brown Algae, Red Algae, Green Algae, and Blue-green Algae. Based on product type, the market is segmented into Algal Protein, Alginate, Carrageenan, Carotenoids, Lipids, and Other Product Types. Based on application, the market is segmented into Personal Care, Food and Beverage, Dietary Supplements, Pharmaceuticals, Animal Feed, and Other Applications. Based on geography, the market is segmented into North America, Europe, South America, Asia Pacific, and Middle-East & Africa). For each segment, the market sizing and forecasts have been done on the basis of value (in USD million).

| Source | Brown Algae | |

| Red Algae | ||

| Green Algae | ||

| Blue-green Algae | ||

| Product Type | Algal Protein | |

| Alginate | ||

| Carrageenan | ||

| Carotenoids | ||

| Lipids | ||

| Other Product Types | ||

| Application | Personal Care | |

| Food and Beverage | ||

| Dietary Supplements | ||

| Pharmaceuticals | ||

| Animal Feed | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Spain |

| United Kingdom | ||

| Germany | ||

| France | ||

| Italy | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle-East and Africa | South Africa |

| United Arab Emirates | ||

| Rest of Middle-East and Africa |

Algae Products Market Research FAQs

How big is the Algae Products Market?

The Algae Products Market size is expected to reach USD 1.92 billion in 2024 and grow at a CAGR of 4.99% to reach USD 2.45 billion by 2029.

What is the current Algae Products Market size?

In 2024, the Algae Products Market size is expected to reach USD 1.92 billion.

Who are the key players in Algae Products Market?

Archer Daniels Midland Company, ACCEL Carrageenan Corporation, Cargill, Incorporated, BASF SE and Koninklijke DSM N.V. are the major companies operating in the Algae Products Market.

Which is the fastest growing region in Algae Products Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Algae Products Market?

In 2024, the North America accounts for the largest market share in Algae Products Market.

What years does this Algae Products Market cover, and what was the market size in 2023?

In 2023, the Algae Products Market size was estimated at USD 1.83 billion. The report covers the Algae Products Market historical market size for years: 2018, 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Algae Products Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Algae Products Industry Report

The Microalgae-Based Products Market is segmented by source, product type, application, and geography. This market analysis provides insights into various sources such as brown algae, red algae, green algae, and blue-green algae. The market size and values are projected based on product types including algal protein, alginate, carrageenan, carotenoids, lipids, and other product types. Applications covered in this industry analysis include personal care, food and beverage, dietary supplements, pharmaceuticals, animal feed, and other applications.

The market research indicates significant market growth across different regions, including North America, Europe, South America, Asia Pacific, and the Middle-East and Africa. The market leaders in this industry are contributing to the market trends and market forecast, providing a comprehensive industry overview. This industry report also includes a detailed market segmentation and market value analysis.

The industry outlook highlights the growth rate and market predictions for the coming years. The industry statistics and market data are crucial for understanding the market overview and market review. This report example is available for download as a report PDF, offering valuable industry information for research companies interested in this sector.

Overall, the market forecast and industry research demonstrate the potential for continued market growth and expansion. The market outlook and industry reports provide a thorough understanding of the market dynamics, making it an essential resource for stakeholders looking to capitalize on the opportunities within the microalgae-based products market.