Almond Protein Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 7.40 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

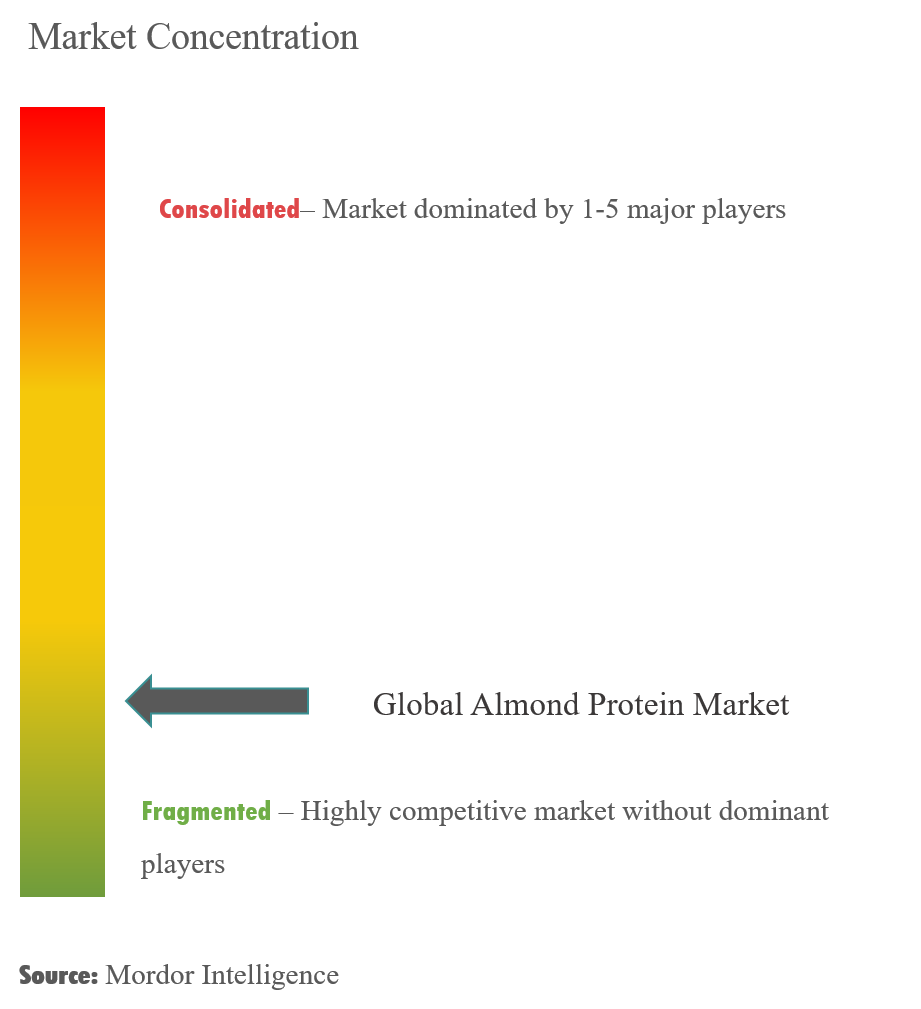

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Almond Protein Market Analysis

The global almond protein market is projected to grow at a CAGR of 7.4% during the forecast period.

- The almond protein market is driven by consumerinclination towards a plant-based protein diet.The high functional property of almond protein and its natural health benefits are boosting its market growth. There is an increase in the adoption of almond protein across several end-user industries, owing to its high sustainability.

- By application, dietary supplements hold a significant share of the market studied.Increasing health awareness among consumers and high protein demand for athletes have boosted the market for almond protein supplements in sports drinks and nutrition products.

Almond Protein Market Trends

This section covers the major market trends shaping the Almond Protein Market according to our research experts:

Nutritional Segment Holds Major Share of the Market

The protein supplement market for sports drinks is quite prominent in North America, where there is healthy competition among other protein beverages and increased demand for almond protein beverages. Manufacturers are launching innovative and healthy approached products consisting of almond protein and expanding their business, globally. These products are gaining praises of vegan and highly health-conscious consumers. For instance, the launch of Almond Pro™ protein powder containing 65% less fat and 60% more protein was a real hit in the market.

North America Capture the Largest Market Share

The market for plant-proteins is growing at a faster pace, owing to change in lifestyle, lack of balanced dietary intake, and improved R&D, in order to develop new kinds of almond-protein enriched products. The United States continues to capture the largest market share for almond protein, followed by Canada and Mexico, in the region. Moreover, California is the only state that produces almonds commercially. The driving factors for the US market are changes in consumption patterns, food requirements, and an inclination toward vegetarian products for protein sources. The demand for processed and low cholesterol foods has paved the way for the almond protein market, in the region.

Almond Protein Industry Overview

A large number of players drive the global plant protein market. At present, there are numerous active players in this industry, such as Austrade, Inc. Food Ingredients, All Organic Treasures GmbH, Blue Diamond Global, and Noosh Brands. The leading companies focus on the expansion of their almond protein business, in the local and international markets. Certain players have been expanding their geographical presence by acquiring or merging with the manufacturers in the international markets.

Almond Protein Market Leaders

-

Austrade, Inc. Food Ingredients

-

BLUE DIAMOND GLOBAL INGREDIENTS DIVISION.

-

All Organic Treasures GmbH

-

Noosh Brands

*Disclaimer: Major Players sorted in no particular order

Almond Protein Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Application

- 5.1.1 Bakery

- 5.1.2 Nutritional Supplements

- 5.1.3 Beverages

- 5.1.4 Confectionery

- 5.1.5 Other Applications

-

5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Spain

- 5.2.2.2 United Kingdom

- 5.2.2.3 Germany

- 5.2.2.4 France

- 5.2.2.5 Italy

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Austrade, Inc. Food Ingredients

- 6.3.2 Blue Diamond Global Ingredients Division

- 6.3.3 All Organic Treasures GmbH

- 6.3.4 Noosh Brands

- 6.3.5 Z-Company BV

- 6.3.6 Sabinsa Corporation

- 6.3.7 Herblink Biotech Corporation

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityAlmond Protein Industry Segmentation

The Global Almond Protein Market is segmented by application into Bakery, Nutritional Supplements, Beverages, Confectionery, and other Applications. Additionally by geography, the market is segemented by regions including North America, Europe, Asia-Pacific, South America and Middle East & Africa.

| By Application | Bakery | |

| Nutritional Supplements | ||

| Beverages | ||

| Confectionery | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Spain |

| United Kingdom | ||

| Germany | ||

| France | ||

| Italy | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East and Africa | South Africa |

| Rest of Middle East and Africa |

Almond Protein Market Research FAQs

What is the current Almond Protein Market size?

The Almond Protein Market is projected to register a CAGR of 7.40% during the forecast period (2024-2029)

Who are the key players in Almond Protein Market?

Austrade, Inc. Food Ingredients, BLUE DIAMOND GLOBAL INGREDIENTS DIVISION., All Organic Treasures GmbH and Noosh Brands are the major companies operating in the Almond Protein Market.

Which is the fastest growing region in Almond Protein Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Almond Protein Market?

In 2024, the North America accounts for the largest market share in Almond Protein Market.

What years does this Almond Protein Market cover?

The report covers the Almond Protein Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Almond Protein Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Almond Protein Industry Report

Statistics for the 2024 Almond Protein market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Almond Protein analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.