Alternative Sweetener Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 4.30 % |

| Fastest Growing Market | Asia Pacific |

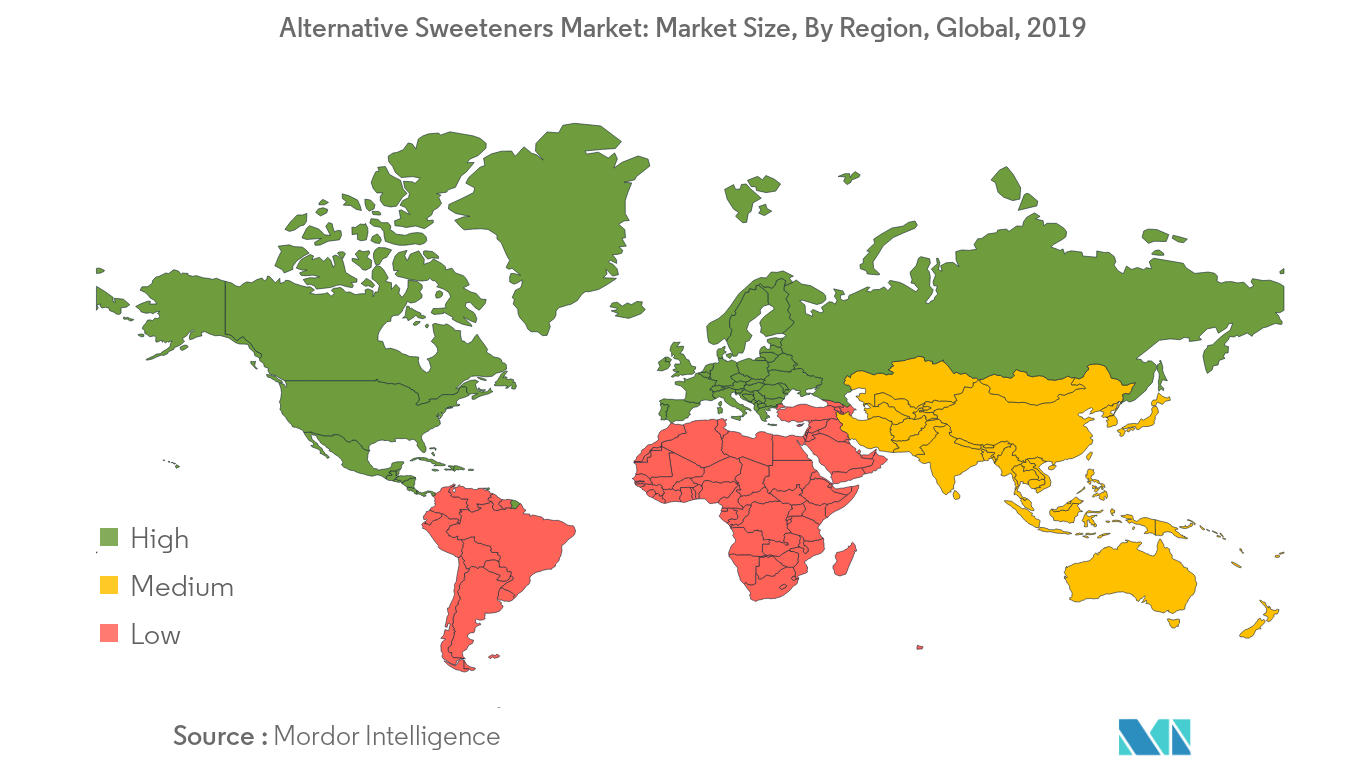

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Alternative Sweetener Market Analysis

Global Alternative Sweetener market is growing at a CAGR of 4.3 % during the forecast period (2020-2025).

- The market is expected to grow owing to the increase in patients suffering from lifestyle diseases such as diabetes, obesity and cardiovascular diseases. Also, the inclination towards living a healthy lifestyle and rise in demand for low-calorie food products are other critical factors driving the growth of the global alternative sweetener market throughout the forecast period.

- The growth of beverage market in both developed and developing countries is also promoting the demand for alternative sweeteners.

- On the other hand, high costs and side effects caused by the alternative sweetener may hinder the market growth.

Alternative Sweetener Market Trends

This section covers the major market trends shaping the Alternative Sweetener Market according to our research experts:

Rising Number of Consumers Affected by Diabetes and Obesity

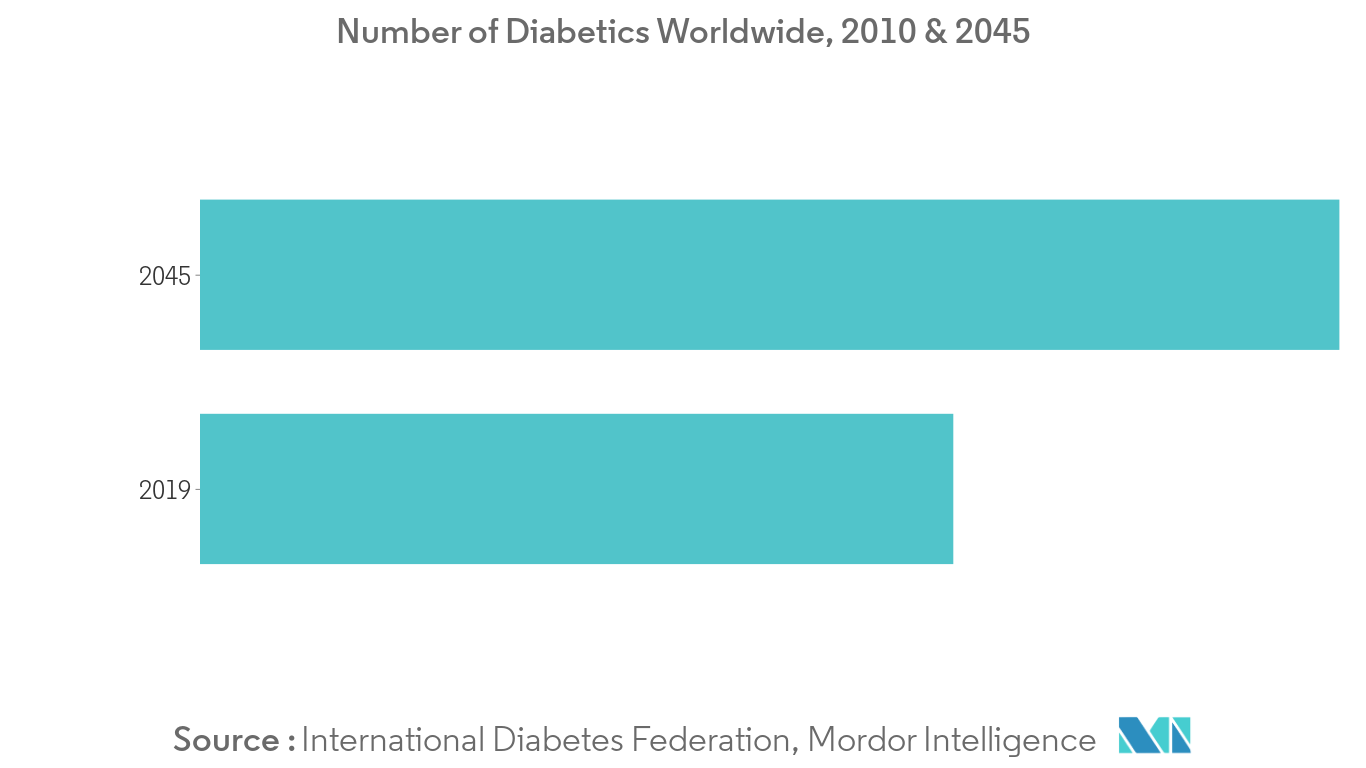

According to the International Diabetes Federation, the number of diabetics worldwide in 2019 is 463 million. This number is expected to reach 700 million by the year 2045. With an increased number of diabetics, the prevalence of diabetes is also projected to increase to just under 10 percent by 2045. Increase in obesity levels, along with concern regarding the risk of developing cardiovascular disease and diabetes are encouraging consumers to make more healthy choices. Consumers suffering from diabetes and obesity go for the low-calorie sweeteners as these products have less or no calories and therefore are helpful in controlling weight and maintaining blood sugar levels. Development of low sugar food for diabetic and diet-conscious consumers and high demand for diet beverages has projected to drive the market.

North America having the Largest Market Share

The demand for natural sweeteners in North America is mainly due to the trend of healthy food. The growing awareness about the harmful effects of excessive sugar consumption is the major driving factor for market growth. Thus, more opportunities for low-calorie sweeteners are created especially in bakery, beverage and dairy applications. The beverages industry is dominating, followed by bakery, confectionery, and dairy industry. According to US Census Bureau, the preferred brands of alternative sweeteners are Splenda, Sweet’N Low, Stevia in the Raw and Equal.

Alternative Sweetener Industry Overview

The global market for sugar substitutes is driven by a large number of active players. The most preferred growth strategies include new product development, mergers, acquisitions, expansion, and partnerships to boost the market growth. There are numerous prominent players in this industry, such as Cargill Inc., Heartland Food Products Group, DuPont de Nemours, Inc., and Ingredion Inc., among others.

Alternative Sweetener Market Leaders

-

Cargill, Incorporated

-

Archer Daniels Midland Company

-

Heartland Food Products Group

-

DuPont de Nemours, Inc.

-

Ajinomoto Co., Inc.

*Disclaimer: Major Players sorted in no particular order

Alternative Sweetener Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Product Type

- 5.1.1 High Fructose Syrup

- 5.1.2 High-Intensity Sweeteners

- 5.1.3 Low-Intensity Sweeteners

-

5.2 By Source

- 5.2.1 Natural

- 5.2.2 Synthetic

-

5.3 By Application

- 5.3.1 Food and Beverages

- 5.3.1.1 Bakery

- 5.3.1.2 Confectionery

- 5.3.1.3 Beverage

- 5.3.1.4 Dairy

- 5.3.1.5 Others

- 5.3.2 Pharmaceuticals

- 5.3.3 Others

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 Germany

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Cargill, Incorporated

- 6.4.2 Archer Daniels Midland Company

- 6.4.3 Heartland Food Products Group

- 6.4.4 DuPont de Nemours, Inc.

- 6.4.5 Ajinomoto Co., Inc

- 6.4.6 PureCircle Ltd.

- 6.4.7 Roquette Freres

- 6.4.8 Stevia First Corporation

- 6.4.9 Ingredion Inc.

- 6.4.10 Kawarlal & Co.Inc.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityAlternative Sweetener Industry Segmentation

The global alternative sweetener market has been segmented by product type which includes high fructose syrup, high intensity sweeteners, low intensity sweeteners. Based on source, the market is segmented into natural and synthetic. Based on application, the market is segmented into food and beverages, pharmaceuticals and others. The food and beverage sector are further divided into bakery, confectionery, beverage, dairy and others. The report further analyses the global scenario of the market, which includes detail analysis on North America, Europe, Asia-Pacific, South America, the Middle East, and Africa.

| By Product Type | High Fructose Syrup | |

| High-Intensity Sweeteners | ||

| Low-Intensity Sweeteners | ||

| By Source | Natural | |

| Synthetic | ||

| By Application | Food and Beverages | Bakery |

| Confectionery | ||

| Beverage | ||

| Dairy | ||

| Others | ||

| By Application | Pharmaceuticals | |

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Spain |

| United Kingdom | ||

| Germany | ||

| France | ||

| Italy | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East and Africa | South Africa |

| United Arab Emirates | ||

| Rest of Middle East and Africa |

Alternative Sweetener Market Research FAQs

What is the current Alternative Sweeteners Market size?

The Alternative Sweeteners Market is projected to register a CAGR of 4.30% during the forecast period (2024-2029)

Who are the key players in Alternative Sweeteners Market?

Cargill, Incorporated, Archer Daniels Midland Company, Heartland Food Products Group, DuPont de Nemours, Inc. and Ajinomoto Co., Inc. are the major companies operating in the Alternative Sweeteners Market.

Which is the fastest growing region in Alternative Sweeteners Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Alternative Sweeteners Market?

In 2024, the North America accounts for the largest market share in Alternative Sweeteners Market.

What years does this Alternative Sweeteners Market cover?

The report covers the Alternative Sweeteners Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Alternative Sweeteners Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Alternative Sweeteners Industry Report

Statistics for the 2024 Alternative Sweeteners market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Alternative Sweeteners analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.