Alternator Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.00 % |

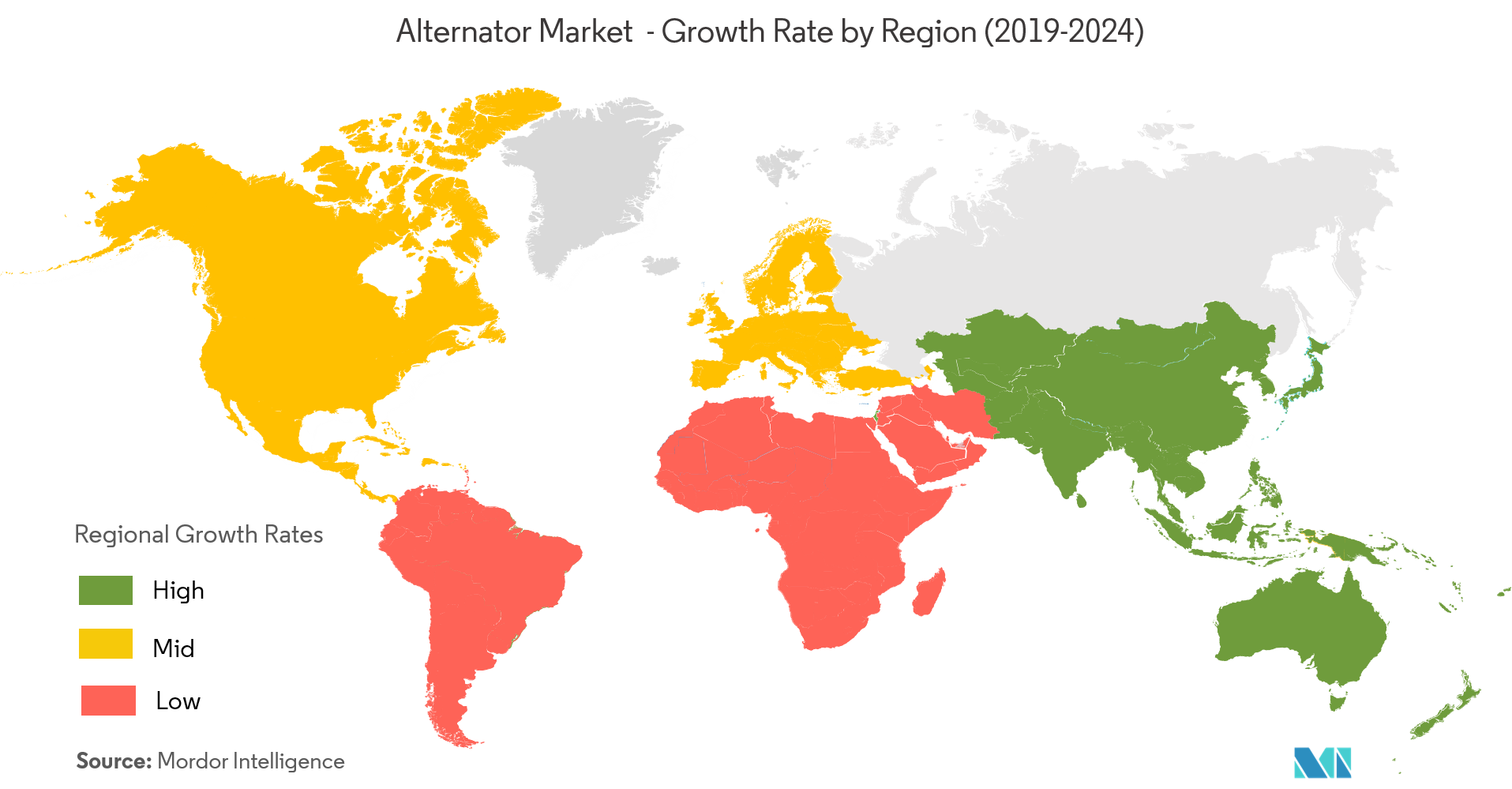

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Alternator Market Analysis

The alternator market is expected to register a CAGR of over 5% over the forecast period (2021 - 2026). The demand for the alternator is increasing owing to the growing consumption of alternating current in different sectors, such as oil & gas, industrial manufacturing, and power, among others.

- Growing investment in grid infrastructure across emerging markets is boosting the market's growth positively. For instance, China announced to spend at least 2 trillion yuan (USD 315 billion) to enhance its power grid infrastructure over the 2015-2020 period.

- Moreover, rising demand for turbines and engine and increasing investment in the construction industry are also expected to augment the growth of the market. According to the Construction Industry Federation report, USD 26 billion was invested in building and construction during the year 2018, up 20% on the previous year.

- Furthermore, growing demand for power, from both conventional and non-conventional sources, has been fueling the application of alternators in the power generation sector.

Alternator Market Trends

This section covers the major market trends shaping the Alternator Market according to our research experts:

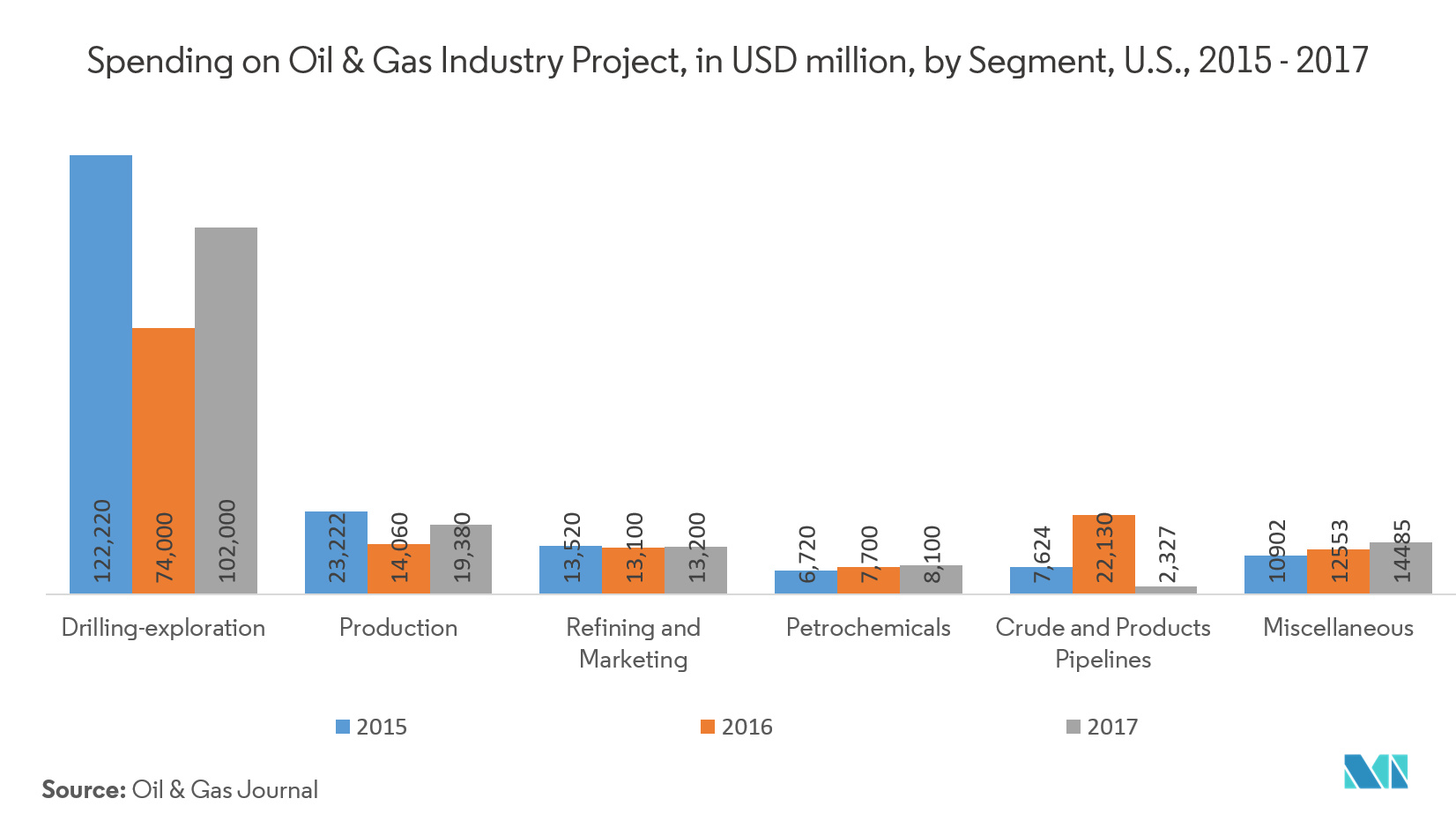

Application in Oil & Gas is Expected to Hold a Significant Share

- Oil and gas projects typically require alternators in the 500kW-25MW range. In Offshore, alternators are used in drilling rigs support vessels providing prime power, drilling operation, and platform propulsion when used on the floating rigs.

- The search for oil often leads to extreme conditions, either on the sea or on land, where dusty desert conditions or offshore platforms can affect an alternator's performance. Thereby, vendors are providing total environmental protection, delivering the reliability and durability demanded by the customers and designed to suit oil & gas project.

- For instance, a continuous power requirement in Colombia’s oil sector is being met by Stamford P80 alternators., provided by Cummins Generator Technologies. Specialist generator set manufacturer IGSA from Mexico specified the premium alternators from Cummins Generator Technologies. These were coupled with Cummins engines to make a 2.5MW generator set design that meets the highest quality standards in a demanding application. The alternators specified were low voltage variants of the Stamford P80 range.

- According to the Colombian Petroleum Association, Oil companies Operating in Colombia invested USD 4.35 billion in 2018, most of which went into production and some USD 800 million into exploration.

- Increasing offshore and onshore oil and gas projects in the United States owing to the National OCS leasing program, are expected to increase the demand for alternators over the forecast period.

Asia-Pacific is Expected to Provide Lucrative Growth Opportunities and Witness Highest Growth Rate

- Economic growth, urbanization, and the need for electrification have boosted the growth of alternator in the Asia-Pacific region. Countries such as India, China, and Japan are witnessing an increase in demand for alternator from power generation, cogeneration, and industrial sectors.

- Moreover, the Chinese government launched 'New-Type Urbanization Plan', focusing primarily on new-type, smart, and humanities city construction from 2014 – 2020. Additionally, Japan is attracting diverse companies to invest in data centers. In February 2018, Google announced to launch a second cloud platform data center in Japan. For instance, In February 2018, Google announced to launch a second cloud platform data center in Japan.

- The growth of the automotive industry in Asia-Pacific countries such as India, Japan, and South Korea among others is boosting the adoption of the alternator. The manufacturing sector has been one of ASEAN’s key economic growth drivers. The economies in the region have low operating costs which attract businesses from larger manufacturing bases.

- A company such as DENSO announced that it has developed a high-efficiency diode for alternators for gasoline and diesel engine vehicles with the semiconductor supplier, Hitachi Power Semiconductor Device, Ltd. The jointly developed diode significantly reduces the power conversion loss by increasing the efficiency of the function.

Alternator Industry Overview

The alternator market is fragmented with several regional as well as international players facing intense competition to maintain their position in the market. Vendors are adopting strategies such as mergers, and acquisition, strategies alliances to expand their sales and distribution network.

- January 2019- Leroy-Somerannouncedthe expansion of its LSA 44.3 and TAL 044 product lines, reaching 200 kVA in power with enhanced performance. The LSA 44.3 VL13 and VL14 alternators benefit from 93.4% and 93% efficiency at 0.8 PF respectively, which represents a significant advancement over the LSA 46.3 S2 (91.9%) and S3 (92.5%).These products are suitable for all types of power generation applications and provide high performance, delivering new opportunities for generator sets manufacturers.

- July 2018 - ABB announced that it has completed its acquisition of GE Industrial Solutions (GEIS), GE’s global electrification solutions business.GEIS will be integrated into ABB’s Electrification Products division,

Alternator Market Leaders

-

ABB Ltd.

-

Siemens AG

-

Cummins Inc.

-

Leroy Somer (Nidec Motor Corporation)

-

Mecc Alte Spa

*Disclaimer: Major Players sorted in no particular order

Alternator Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Investment in Grid Infrastructure across Emerging Markets

- 4.3.2 Growing Demand for Engines and Turbines

-

4.4 Market Restraints

- 4.4.1 Volatile Economy

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Gas Engine

- 5.1.2 Diesel Engine

- 5.1.3 Gas Turbine

- 5.1.4 Steam Turbine

-

5.2 By Power Range

- 5.2.1 1MW-5MW

- 5.2.2 5MW-20MW

- 5.2.3 20MW-40MW

- 5.2.4 300kW-1MW

- 5.2.5 60kW-300kW

- 5.2.6 1kW-60kW

-

5.3 By Application

- 5.3.1 Oil & Gas

- 5.3.2 Prime Power

- 5.3.3 Data Centres

- 5.3.4 Residential

- 5.3.5 Industrial and Commercial

- 5.3.6 Other Applications

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 South Korea

- 5.4.3.4 India

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.5 Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Leroy Somer (Nidec Motor Corporation)

- 6.1.2 Cummins Inc.

- 6.1.3 ABB Ltd.

- 6.1.4 Mecc Alte Spa

- 6.1.5 HHI Group

- 6.1.6 Marathon Generators (Regal Beloit Corporation)

- 6.1.7 Magneti Marelli S.p.A. (CK Holdings Co. Ltd. )

- 6.1.8 GE Power Conversion (General Electric)

- 6.1.9 Generac Power Systems Inc.

- 6.1.10 WEG Industries

- 6.1.11 Jeumont Electric

- 6.1.12 Indar (Ingeteam Corporation, S.A)

- 6.1.13 Denyo Co.Ltd.

- 6.1.14 T D Power Systems Limited

- 6.1.15 Siemens AG

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityAlternator Industry Segmentation

An alternator is an electrical generator which converts mechanical energy to electrical energy in the form of alternating current (AC). The electromagnetic induction produces electricity in alternators. They are now replacing the DC generators owing to its improved efficiency. Alternators find applications in industrial & commercial, automotive, marine, oil & gas industries, and power plants among others.

| By Type | Gas Engine | |

| Diesel Engine | ||

| Gas Turbine | ||

| Steam Turbine | ||

| By Power Range | 1MW-5MW | |

| 5MW-20MW | ||

| 20MW-40MW | ||

| 300kW-1MW | ||

| 60kW-300kW | ||

| 1kW-60kW | ||

| By Application | Oil & Gas | |

| Prime Power | ||

| Data Centres | ||

| Residential | ||

| Industrial and Commercial | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | Germany |

| France | ||

| United Kingdom | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| South Korea | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Mexico |

| Brazil | ||

| Geography | Middle-East & Africa |

Alternator Market Research FAQs

What is the current Alternator Market size?

The Alternator Market is projected to register a CAGR of 5% during the forecast period (2024-2029)

Who are the key players in Alternator Market?

ABB Ltd., Siemens AG, Cummins Inc., Leroy Somer (Nidec Motor Corporation) and Mecc Alte Spa are the major companies operating in the Alternator Market.

Which is the fastest growing region in Alternator Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Alternator Market?

In 2024, the North America accounts for the largest market share in Alternator Market.

What years does this Alternator Market cover?

The report covers the Alternator Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Alternator Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Alternator Industry Report

Statistics for the 2024 Alternator market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Alternator analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.