Apoptosis Assay Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| CAGR | 9.30 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Apoptosis Assay Market Analysis

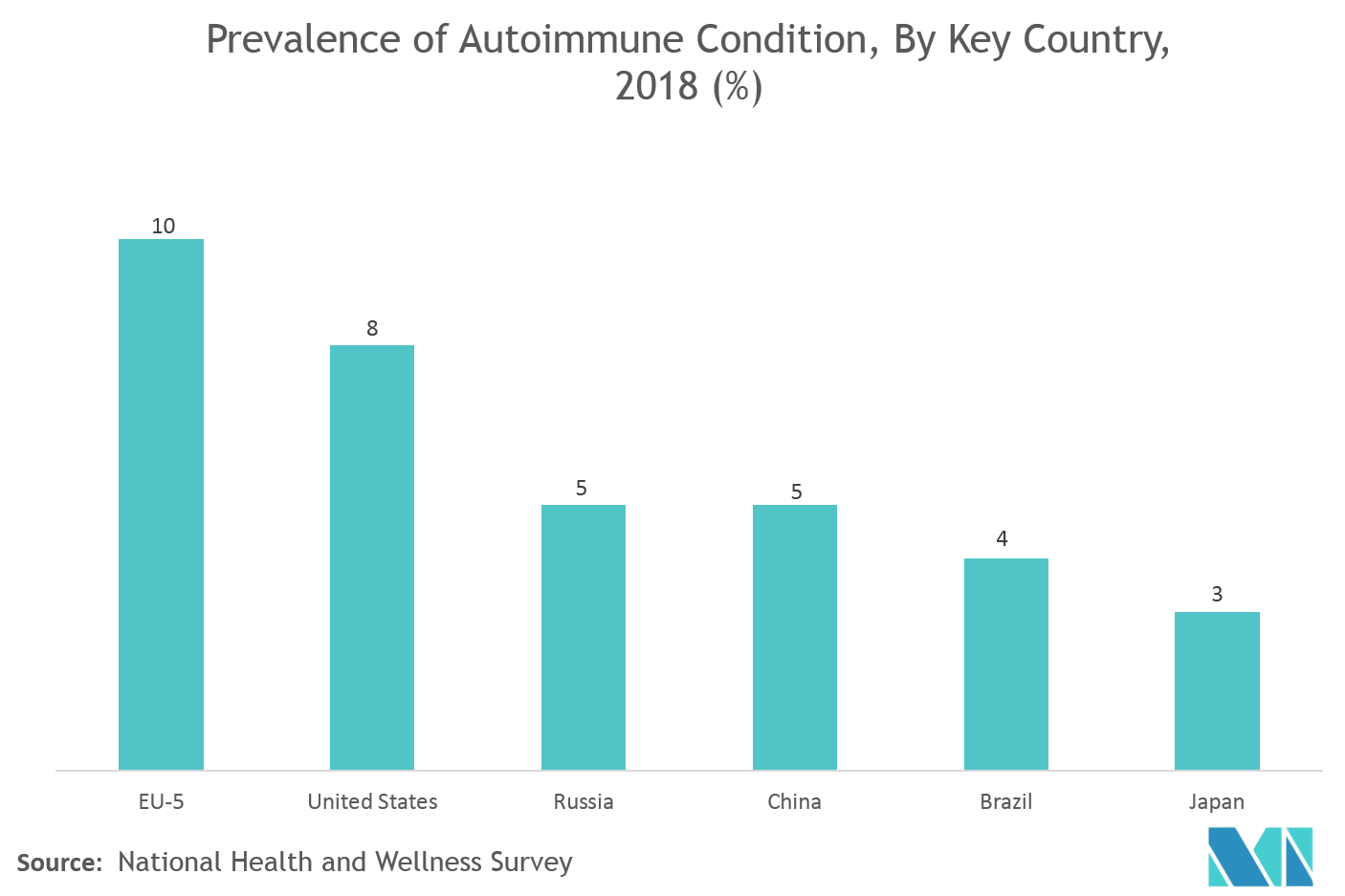

The major factors attributing to the growth of the apoptosis assay market are the rising incidence of infectious and chronic diseases such as autoimmune diseases, cancer, and others. Rise in population suffering from chronic and autoimmune diseases are propelling the demand for market growth. In 2018, as per the AARDA (AMERICAN AUTOIMMUNE RELATED DISEASE ASSOCIATION) statistics, around 50 million Americans have an autoimmune disease, and this number is expected to rise in the future. And there are few more factors which are playing crucial roles in taking the apoptosis assay market to the next level, among them one is on-going developments related to apoptosis-modulating drugs which are expected to further propel the growth of the global apoptosis assays market. However, Increasing demand for high-content diagnosis and clinical research for cancer, in particular, is indeed bolstering market growth during the forecasted period.

Apoptosis Assay Market Trends

This section covers the major market trends shaping the Apoptosis Assay Market according to our research experts:

Assay Kits Segment is Expected to Hold the Largest Market Share in the Apoptosis Assay Market

- Assay kits identify and quantify cell events related to programmed cell death, involving caspase initiation, phosphatidylserine (PS) cell surface exposure and DNA fragmentation.

- The number of repetitive consumption of assay in numerous other apoptosis processes can propel the demand of the assay kits during the forecast period.

- The rising incidence of infectious and chronic diseases such as autoimmune diseases, cancer, and others is also boosting the market growth. As per the statistics from GLOBOCAN 2018, worldwide 18,078,957 individuals have cancer. Asia remains the leading contributor in the rising incidence of cancer with a reported share of 48.4% followed by Europe, North and Latin America, Africa, and Oceania with a share of 23.4%, 13.2% and 7.8%, 5.8%, and 1.4% respectively.

North America Dominates the Market and Expected to do Same in the Forecast Period

North America is expected to dominate the overall apoptosis assay market, throughout the forecast period. This is owing to the factors such as the rising incidence of chronic diseases such as cancer and the availability of advanced healthcare infrastructure among the major factors. In North America region, the United States holds the largest market share owing to the factors such as increasing number of population suffering from autoimmune diseases and chronic disease, along with the rising geriatric population and developments related to apoptosis-modulating drugs in the country, is anticipated to stimulate the demand in this region.

Apoptosis Assay Industry Overview

The apoptosis assay market is moderately competitive and consists of several major players. In terms of market share, few of the major players are currently dominating the market. Ans some prominent players are vigorously making acquisitions and new product launches with the other companies to consolidate their market positions across the globe. Some of the companies which are currently dominating the market are Thermo Fisher Scientific, Bio-Rad Laboratories, Merck KGaA, GE Healthcare, and Becton, Dickinson and Company.

Apoptosis Assay Market Leaders

-

Thermo Fisher Scientific

-

Merck KGaA

-

Bio-Rad Laboratories

-

GE Healthcare

-

Becton, Dickinson and Company

*Disclaimer: Major Players sorted in no particular order

Apoptosis Assay Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Rising Incidence of Chronic and Autoimmune Diseases

- 4.2.2 Developments Related to Apoptosis-Modulating Drugs

-

4.3 Market Restraints

- 4.3.1 Stringent Regulatory Reforms

- 4.3.2 Expensive Detection Technology and High Capital Investment

-

4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Product

- 5.1.1 Assay Kits

- 5.1.1.1 Annexin V

- 5.1.1.2 Caspase Assay

- 5.1.1.3 Others

- 5.1.2 Reagents

- 5.1.3 Instruments

- 5.1.4 Microplates

-

5.2 By Detection Technology

- 5.2.1 Spectrophotometry

- 5.2.2 Flow Cytometry

- 5.2.3 Cell Imaging and Analysis Systems

- 5.2.4 Other Technology

-

5.3 By Application

- 5.3.1 Stem Cell Research

- 5.3.2 Clinical and Diagnostics Application

- 5.3.3 Drug Discover and Development

- 5.3.4 Others

-

5.4 By End User

- 5.4.1 Pharmaceutical and Biotechnology Companies

- 5.4.2 Hospitla and Laboratories

- 5.4.3 Academic and Research Institutes

-

5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle-East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle-East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Thermo Fisher Scientific

- 6.1.2 Merck KGaA

- 6.1.3 Bio-Rad Laboratories

- 6.1.4 GE Healthcare

- 6.1.5 Becton, Dickinson and Company

- 6.1.6 Sartorius AG

- 6.1.7 GeneCopoeia, Inc.

- 6.1.8 BioTek Instruments

- 6.1.9 Bio-Techne Corporation

- 6.1.10 PerkinElmer Inc.

- 6.1.11 Promega Corporation

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityApoptosis Assay Industry Segmentation

Apoptosis is a form of programmed cell death that occurs in multicellular organisms. Apoptosis Assay aims to detect if a cell has apoptosis or not. It identifies and quantifies cell events related to programmed cell death, involving caspase initiation, phosphatidylserine (PS) cell surface exposure and DNA fragmentation.

| By Product | Assay Kits | Annexin V |

| Caspase Assay | ||

| Others | ||

| By Product | Reagents | |

| Instruments | ||

| Microplates | ||

| By Detection Technology | Spectrophotometry | |

| Flow Cytometry | ||

| Cell Imaging and Analysis Systems | ||

| Other Technology | ||

| By Application | Stem Cell Research | |

| Clinical and Diagnostics Application | ||

| Drug Discover and Development | ||

| Others | ||

| By End User | Pharmaceutical and Biotechnology Companies | |

| Hospitla and Laboratories | ||

| Academic and Research Institutes | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Italy | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Middle-East and Africa | GCC |

| South Africa | ||

| Rest of Middle-East and Africa | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America |

Apoptosis Assay Market Research FAQs

What is the current Apoptosis Assay Market size?

The Apoptosis Assay Market is projected to register a CAGR of 9.30% during the forecast period (2024-2029)

Who are the key players in Apoptosis Assay Market?

Thermo Fisher Scientific, Merck KGaA, Bio-Rad Laboratories, GE Healthcare and Becton, Dickinson and Company are the major companies operating in the Apoptosis Assay Market.

Which is the fastest growing region in Apoptosis Assay Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Apoptosis Assay Market?

In 2024, the North America accounts for the largest market share in Apoptosis Assay Market.

What years does this Apoptosis Assay Market cover?

The report covers the Apoptosis Assay Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Apoptosis Assay Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Apoptosis Assay Industry Report

Statistics for the 2024 Apoptosis Assay market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Apoptosis Assay analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.