ASEAN Freight Forwarding Market Size

| Study Period | 2020 - 2029 |

| Base Year For Estimation | 2023 |

| Market Size (2024) | USD 27.48 Billion |

| Market Size (2029) | USD 46.32 Billion |

| CAGR (2024 - 2029) | 11.00 % |

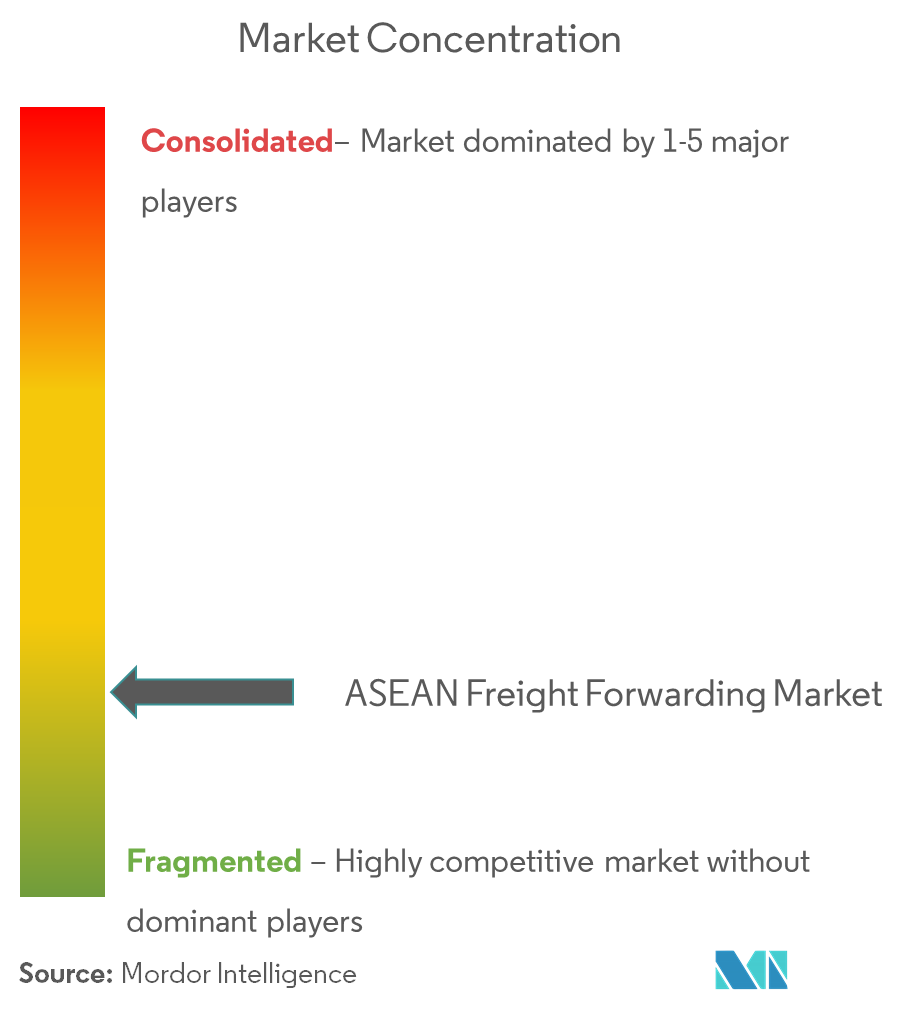

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

ASEAN Freight Forwarding Market Analysis

The Asean Freight Forwarding Market size is estimated at USD 27.48 billion in 2024, and is expected to reach USD 46.32 billion by 2029, growing at a CAGR of 11% during the forecast period (2024-2029).

- The region is home to more than 640 million people and generates GDP of around USD 2.9 trillion. Transportation and logistics are the key areas of focus for governments across the region.

- With the rising consumption and steady growth of e-commerce in the region, the trend of developing and modernizing the industrial inventories is expected to accelerate.

- Singapore has one of the established freight forwarding markets, and Indonesia remains an interesting market with high population. Thailand and Malaysia are also significant and are expected to witness steady growth during the forecast period.

- Despite the rapid growth, the logistics efficiency in the region is comparatively lower. Customs clearance is one of the critical processes in the freight forwarding market that largely affects efficiency. The governments of the region are taking necessary steps for improving the efficiency of the customs clearance process.

- In the wake of rising trade volume, a lot of freight aggregation platforms are also being started in the region. These platforms consolidate the freight from small- and medium-sized firms and send the combined cargo to freight forwarders. This reduces the processing time and complexities involved in forwarding low volumes of cargo.

- As agriculture being one of the key economic activities across the region, the cold chain logistics is a rapidly growing business across the region. In this context, the reefer shipping and air transport of perishable goods are also increasing.

ASEAN Freight Forwarding Market Trends

This section covers the major market trends shaping the ASEAN Freight Forwarding Market according to our research experts:

Sea Freight Forwarding to Achieve Significant Growth over the Forecast Period

The geographical profile of the region indicates that the maritime trade is vital to achieve an effective supply chain network, and it brings significant opportunities for the growth of the region. Shipping is a vital factor in the region’s transportation system, especially in Indonesia and Philippines.

The ports in Singapore and Malaysia are capable of handling large vessels with comparatively better infrastructure. The port quality in Thailand is also good, while the port quality in Indonesia, Philippines, and Vietnam is relatively lower.

The region is an important hub for cargo flow; for example, the Strait of Malacca accounts for more than one-fourth of the global trade. Given the prominent location of the region and the ongoing major upgrades of port infrastructure, the sea freight forwarding market is expected to witness steady growth over the forecast period.

The emerging new technologies, such as port automation, artificial intelligence, Internet of Things, and blockchain, are expected to boost the sea freight forwarding market in future.

Growing Trade in the Region is Expected to Drive the Freight Forwarding Market

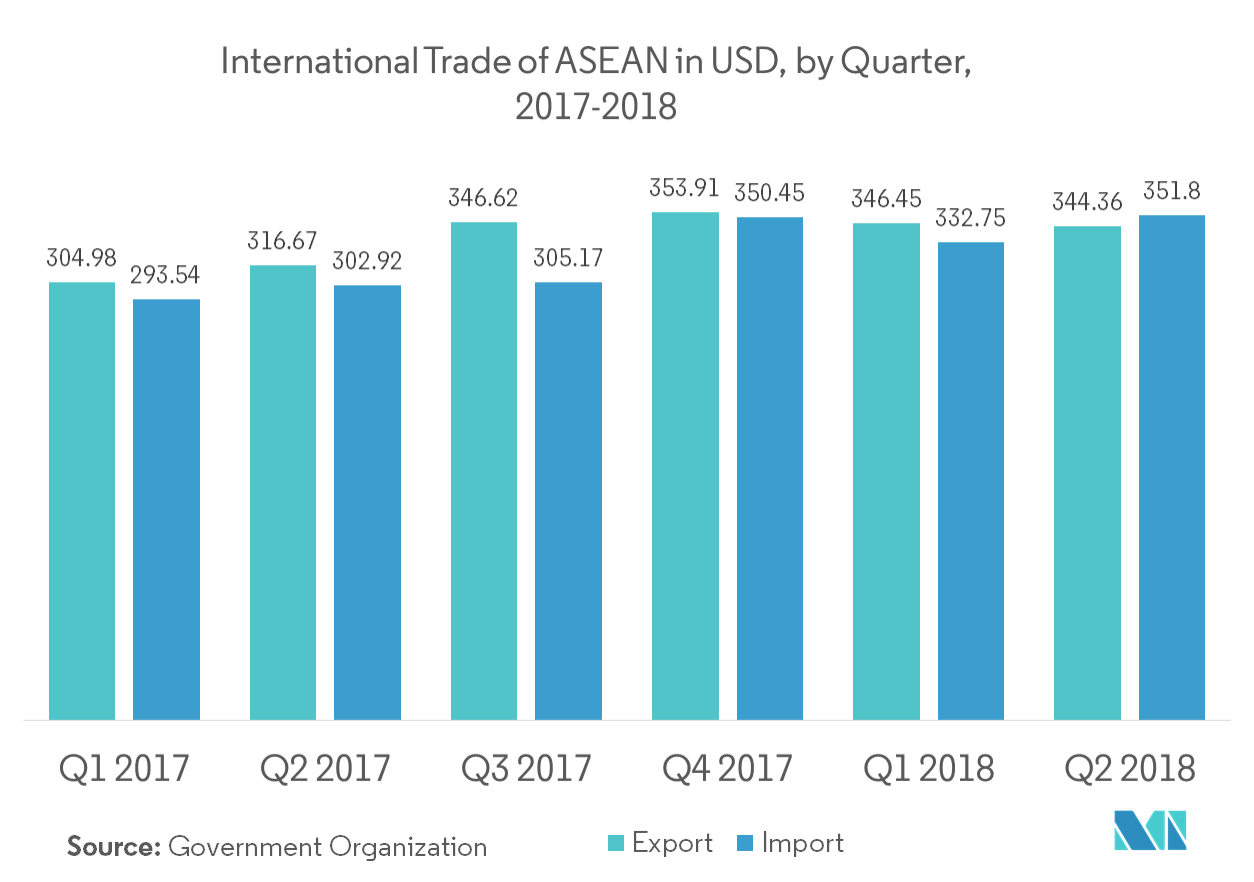

The international trade of the region is growing rapidly, driven by the increasing manufacturing activity. The manufacturing sector is the key sector in the emerging economies of ASEAN, and the governments of the region are continuously promoting the manufacturing activities through various initiatives, such as, Eastern Economic Corridor (EEC) in Thailand.

With the rising manufacturing costs in China, the country is moving away from labor-intensive industries. Additionally, moving up the value chain is leading the businesses to relocate their manufacturing facilities to Southeast Asia. Moreover, the Free Trade Agreements (FTAs) and Special Economic Zones (SEZs) fuel the growth of trade and manufacturing activities in the region.

A lot of economies in the region are majorly export driven. Additionally, the freight forwarding market is detrimental to the rising trade and supports the economic growth of the region.

ASEAN Freight Forwarding Industry Overview

The freight forwarding market in the region is fragmented with a large number of players. The region has the presence of large international freight forwarders, such as DHL, DB Schenker, Ceva Logistics, Sinotrans, Nippon Express, and other companies. Apart from these international players, a lot of domestic companies that are small- and medium-sized firms are also engaged in the freight forwarding business. Having a presence in land transport in the region presents an advantage to the companies involved in freight forwarding business.

With a high growth potential, the region is witnessing entry of new players in the logistics sector. For instance, in May 2019, Mahindra Logistics announced that the company is looking for an acquisition in the ASEAN region to strengthen the freight forwarding business of the company.

ASEAN Freight Forwarding Market Leaders

-

Deutsche Post DHL Group (DHL Global Forwarding)

-

Kuehne + Nagel International AG

-

DB Schenker

-

Nippon Express Co. Ltd

-

Kintetsu World Express Inc.

*Disclaimer: Major Players sorted in no particular order

ASEAN Freight Forwarding Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

-

4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.2 Restraints

- 4.2.3 Opportunities

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Government Regulations and Initiatives

- 4.6 Technological Trends

- 4.7 Insights on the E-commerce Industry in the Region (Domestic and Cross-border)

- 4.8 Spotlight - Freight Transportation Costs/Freight Rates

- 4.9 Brief on Freight Transport Corridors

- 4.10 Insights on Key Special Economic Zones (SEZs) and Manufacturing Hubs

- 4.11 Details on Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and its Effect on Freight Forwarding

- 4.12 Insights on Land Freight Forwarding (Road and Rail)

5. MARKET SEGMENTATION

-

5.1 Mode of Transport

- 5.1.1 Air Freight Forwarding

- 5.1.2 Sea Freight Forwarding

-

5.2 Service

- 5.2.1 Freight Transport

- 5.2.2 Warehousing

- 5.2.3 Value-added Services (Customs Clearance, Packaging, etc.)

-

5.3 Country

- 5.3.1 Singapore

- 5.3.2 Thailand

- 5.3.3 Malaysia

- 5.3.4 Indonesia

- 5.3.5 Vietnam

- 5.3.6 Philippines

- 5.3.7 Rest of ASEAN (Myanmar, Laos, Cambodia, and Brunei)

-

5.4 End User

- 5.4.1 Manufacturing and Automotive

- 5.4.2 Oil and Gas, Mining, and Quarrying

- 5.4.3 Agriculture, Fishing, and Forestry

- 5.4.4 Construction

- 5.4.5 Distributive Trade (Wholesale and Retail Segments - FMCG included)

- 5.4.6 Other End Users (Telecommunications, Pharmaceutical, etc.)

6. COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

-

6.2 Company Profiles (including Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements)

- 6.2.1 Deutsche Post DHL Group (DHL Global Forwarding)

- 6.2.2 Kuehne + Nagel International AG

- 6.2.3 DB Schenker

- 6.2.4 Sinotrans Limited

- 6.2.5 DSV A/S

- 6.2.6 Nippon Express Co. Ltd

- 6.2.7 CEVA Logistics

- 6.2.8 Kintetsu World Express Inc.

- 6.2.9 Kerry Logistics Network Limited

- 6.2.10 Nippon Yusen Kabushiki Kaisha (Yusen Logistics Co. Ltd)

- 6.2.11 Gemadept Corporation/Gemadept Logistics

- 6.2.12 TransOcean Holdings Bhd

- 6.2.13 Freight Management Holdings Bhd

- 6.2.14 Complete Logistic Services Bhd

- 6.2.15 PT Samudera

-

6.3 Other Companies (Key Information/Overview)

- 6.3.1 C.H. Robinson, Expeditors International, United Parcel Service Inc., Geodis, Bollor Logistics, Hellmann Worldwide Logistics GmbH & Co. KG, Agility Logistics Pvt Ltd, Advantage Logistics Co. Ltd, and PT Cahaya Pundimas Indonusa*

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. APPENDIX

- 8.1 GDP Distribution, by Activity and Region

- 8.2 Insights on Capital Flows

- 8.3 External Trade Statistics - Export and Import, by Product

- 8.4 Insights on Key Export Destinations of ASEAN

- 8.5 Insights on Key Import Origins of ASEAN

ASEAN Freight Forwarding Industry Segmentation

A complete background analysis of the ASEAN freight forwarding market, which includes market overview, market size estimation for key segments, emerging trends (by segments), and market dynamics.

| Mode of Transport | Air Freight Forwarding |

| Sea Freight Forwarding | |

| Service | Freight Transport |

| Warehousing | |

| Value-added Services (Customs Clearance, Packaging, etc.) | |

| Country | Singapore |

| Thailand | |

| Malaysia | |

| Indonesia | |

| Vietnam | |

| Philippines | |

| Rest of ASEAN (Myanmar, Laos, Cambodia, and Brunei) | |

| End User | Manufacturing and Automotive |

| Oil and Gas, Mining, and Quarrying | |

| Agriculture, Fishing, and Forestry | |

| Construction | |

| Distributive Trade (Wholesale and Retail Segments - FMCG included) | |

| Other End Users (Telecommunications, Pharmaceutical, etc.) |

ASEAN Freight Forwarding Market Research FAQs

How big is the Asean Freight Forwarding Market?

The Asean Freight Forwarding Market size is expected to reach USD 27.48 billion in 2024 and grow at a CAGR of 11% to reach USD 46.32 billion by 2029.

What is the current Asean Freight Forwarding Market size?

In 2024, the Asean Freight Forwarding Market size is expected to reach USD 27.48 billion.

Who are the key players in Asean Freight Forwarding Market?

Deutsche Post DHL Group (DHL Global Forwarding), Kuehne + Nagel International AG, DB Schenker, Nippon Express Co. Ltd and Kintetsu World Express Inc. are the major companies operating in the Asean Freight Forwarding Market.

What years does this Asean Freight Forwarding Market cover, and what was the market size in 2023?

In 2023, the Asean Freight Forwarding Market size was estimated at USD 24.76 billion. The report covers the Asean Freight Forwarding Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Asean Freight Forwarding Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

ASEAN Freight Forwarding Industry Report

Statistics for the 2024 ASEAN Freight Forwarding market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. ASEAN Freight Forwarding analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.