Asia-Pacific Arachidonic Acid Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 7.40 % |

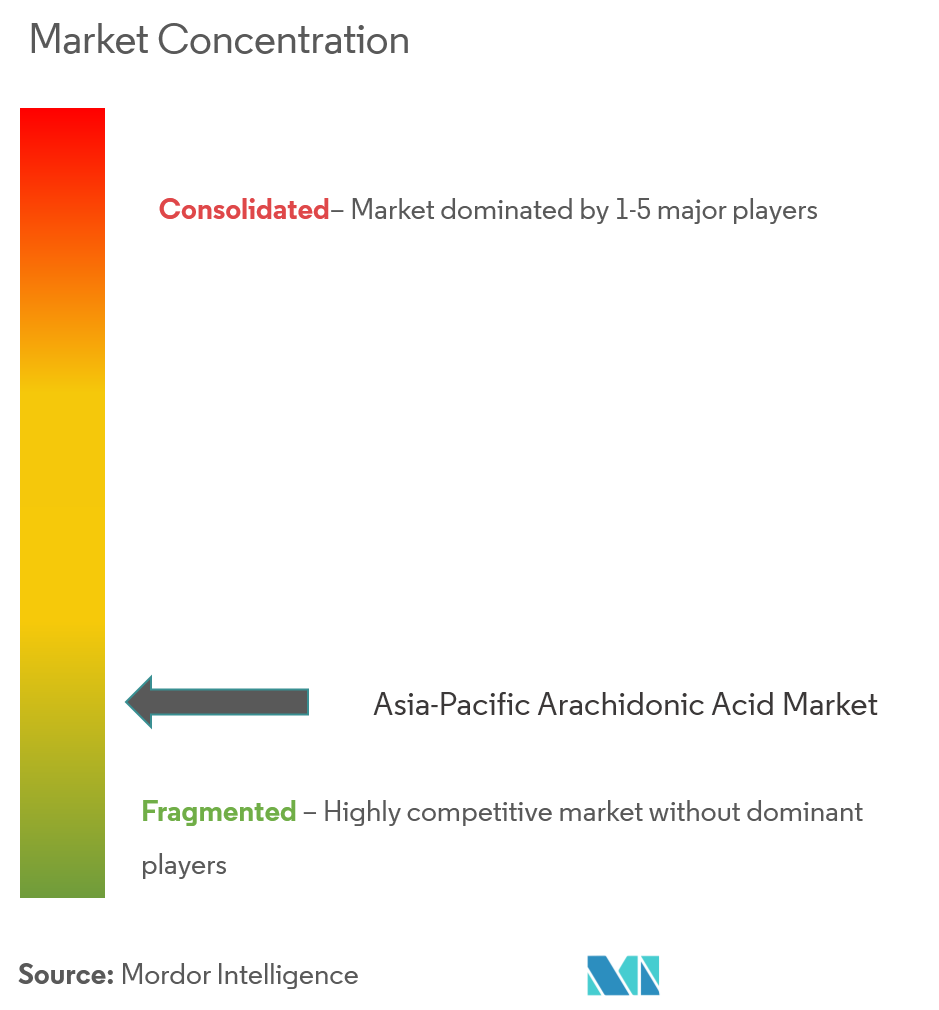

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Asia-Pacific Arachidonic Acid Market Analysis

Asia-Pacific Arachidonic acid market is projected to grow at a CAGR of 7.4% during the forecast period (2020- 2025).

- The major driver for the arachidonic acidmarket, is the high birth rate in countries, like India and China, which has increased its application in infant formula products, sports nutrition, and dietary supplement products, and increased in fortification of products to meet the nutritional gap.

- Also, the increase in the number of road accidents and the growing number of cases of muscle damage are expected to boost the demand. The increasing levels of childcare awareness, baby care products, and use of ARA as sports supplements serve as the primary growth drivers for ARA market.

Asia-Pacific Arachidonic Acid Market Trends

This section covers the major market trends shaping the APAC Arachidonic Acid Market according to our research experts:

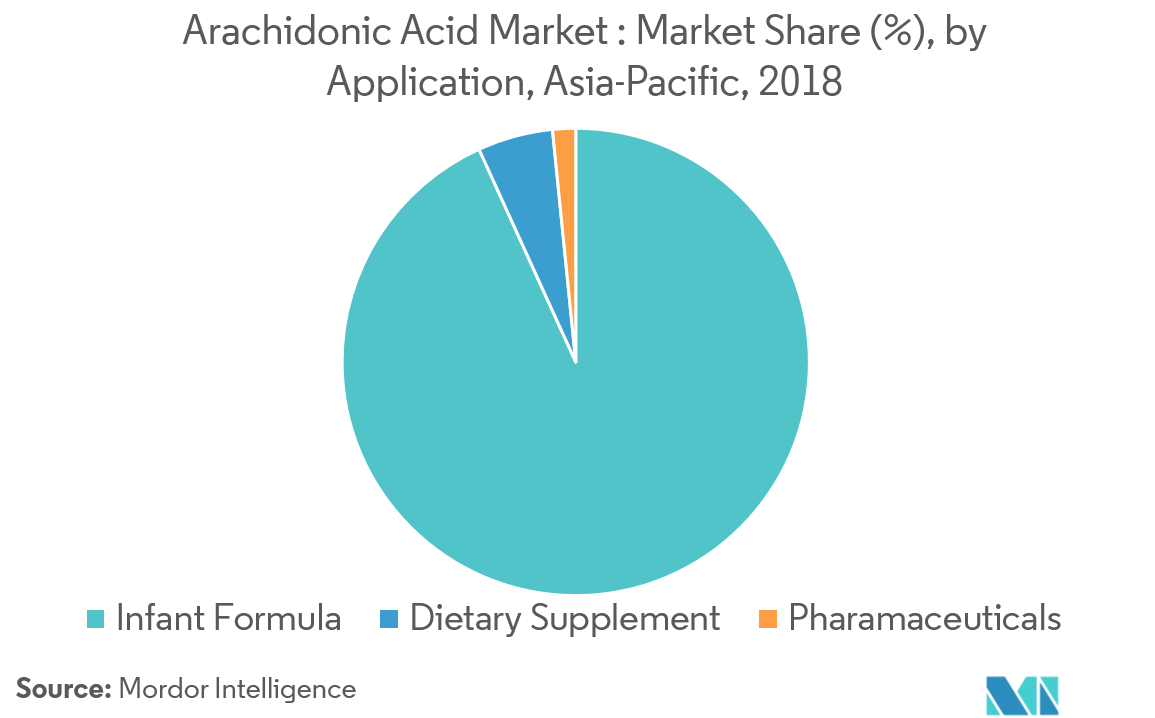

ARA In Infant Formula Products Driving The Market

The Infant Formula segment of the Asia-Pacific ARA market growing at a CAGR of 6.8%, during the forecast period. In the food application, infant nutrition covers the major share in the market. ARA, as a dietary supplement, is mainly used for sports nutrition products. The nutritional requirement among infants for neurological developments during the first two years means the demand for ARA remains constant. This fact is driving the infant formula segment of the ARA market.

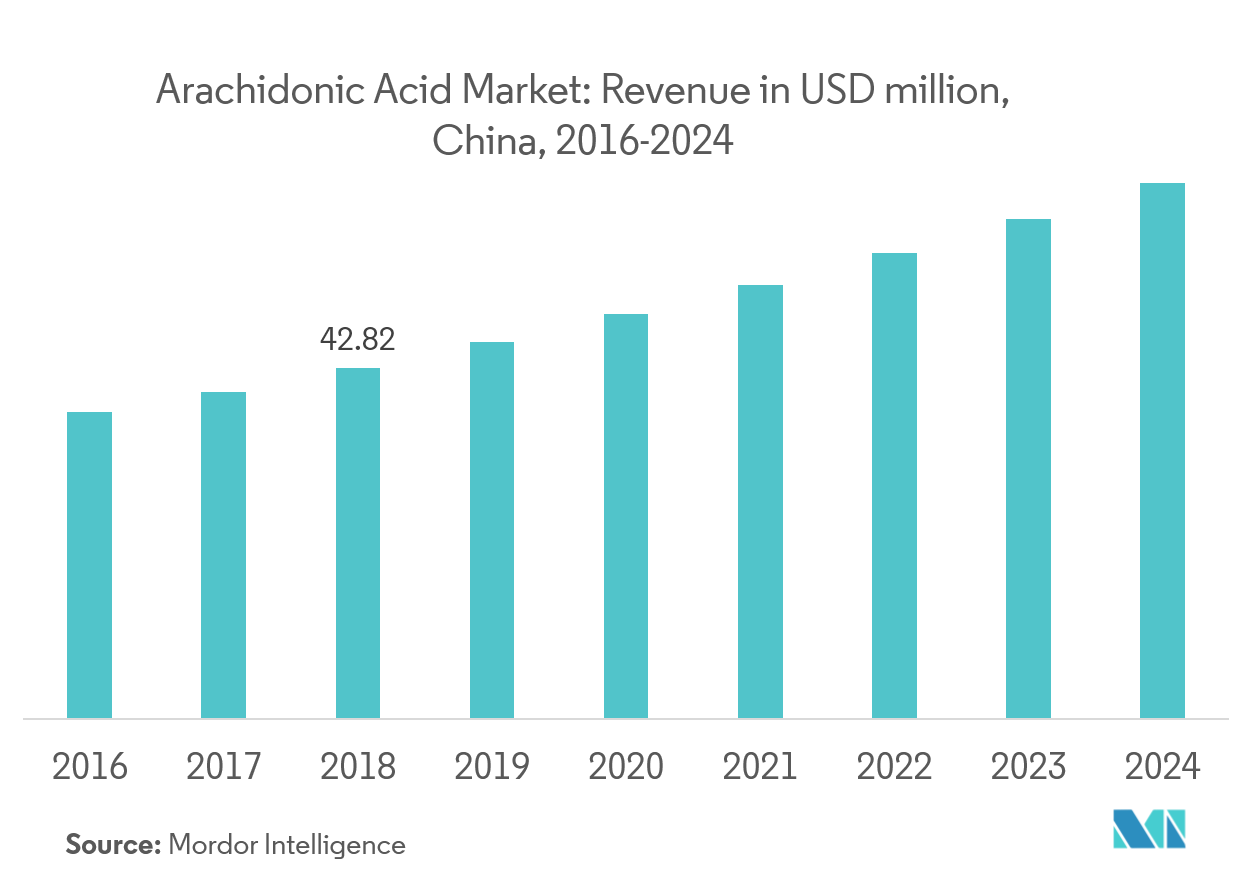

China Is Major Producer Of Arachidonic Acid

China accounts for the largest share of the regional market, followed by India, Australia, and rest of Asia-Pacific. China is the world’s largest infant formula product market, which is the major factor for its large ARA consumption. China contributes to around 65% of the global infant formula market. Due to high quality, there is a growing demand for imported infant formula in the country. The Japanese market is open to international players and has advanced regulatory principles, thereby driving the growth of the arachidonic acid market. Singapore, Malaysia, and Thailand have fairly developed economies, where consumers are aware of the availability of arachidonic acid products for improving their diets.

Asia-Pacific Arachidonic Acid Industry Overview

Asia-Pacific Arachidonic Acid Market is fragmented and prominent players are DSM, Cargill, Cabio Bioengineering, Guangdong Runke, Cayman Chemicals, among others. Advancement in biotechnology has given a good opportunity for the market. The major competitors prefer investment in new product development and marketing strategy, due to volatility in commodity costs to maintain their position.

Asia-Pacific Arachidonic Acid Market Leaders

-

Cargill Inc.

-

CABIO Biotech Wuhan Co Ltd

-

Cayman Chemical

-

Guangdong Runke Bioengineering Co., Ltd.

-

Royal DSM

*Disclaimer: Major Players sorted in no particular order

Asia-Pacific Arachidonic Acid Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Technology

- 5.1.1 Solvent Extraction

- 5.1.2 Solid-Phase Extraction

-

5.2 By Application

- 5.2.1 Food and Beverage

- 5.2.1.1 Infant Formula

- 5.2.1.2 Dietary Supplements

- 5.2.2 Pharmaceuticals

-

5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 India

- 5.3.1.2 China

- 5.3.1.3 Australia

- 5.3.1.4 Japan

- 5.3.1.5 Rest of Asia-Pacific

6. COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

-

6.2 Company Profiles

- 6.2.1 Cargill. Inc

- 6.2.2 Cabio Biotech (Wuhan)Co., Ltd

- 6.2.3 Cayman Chemicals

- 6.2.4 Guangdong Runke

- 6.2.5 Royal DSM

- 6.2.6 A & Z Food Additives Co., Ltd

- 6.2.7 Zhejiang Weiss (Wecan)

- 6.2.8 BASF

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityAsia-Pacific Arachidonic Acid Industry Segmentation

The arachidonic acid market is segmented by technology used which includes solvent extraction and solid-phase extraction. In the application type, the arachidonic acid market is segmented into food and beverage and pharmaceutical. The food and beverage segment is further divided into infant formula and dietary supplements. The study also involves the analysis of regions such as India, China, Australia, Japan and rest of Asia-Pacific.

| By Technology | Solvent Extraction | |

| Solid-Phase Extraction | ||

| By Application | Food and Beverage | Infant Formula |

| Dietary Supplements | ||

| By Application | Pharmaceuticals | |

| Geography | Asia-Pacific | India |

| China | ||

| Australia | ||

| Japan | ||

| Rest of Asia-Pacific |

Asia-Pacific Arachidonic Acid Market Research FAQs

What is the current Asia-Pacific Arachidonic Acid Market size?

The Asia-Pacific Arachidonic Acid Market is projected to register a CAGR of 7.40% during the forecast period (2024-2029)

Who are the key players in Asia-Pacific Arachidonic Acid Market?

Cargill Inc., CABIO Biotech Wuhan Co Ltd, Cayman Chemical, Guangdong Runke Bioengineering Co., Ltd. and Royal DSM are the major companies operating in the Asia-Pacific Arachidonic Acid Market.

What years does this Asia-Pacific Arachidonic Acid Market cover?

The report covers the Asia-Pacific Arachidonic Acid Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Asia-Pacific Arachidonic Acid Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

APAC Arachidonic Acid Industry Report

Statistics for the 2024 APAC Arachidonic Acid market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. APAC Arachidonic Acid analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.