APAC Probiotic Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 9.60 % |

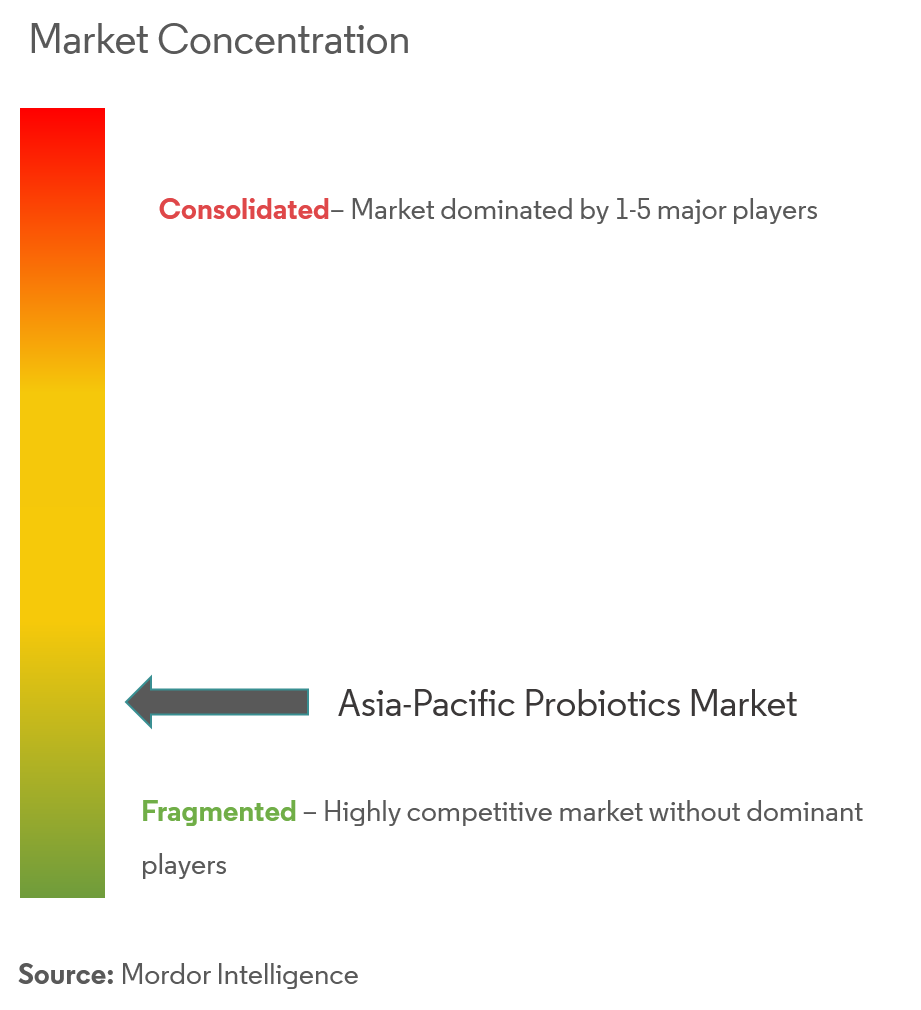

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

APAC Probiotic Market Analysis

The Asia-Pacific probiotics market is projected to witness a CAGR of 9.6% over the next five years.

The market is majorly driven by the robust demand for health-based products, like probiotics, among consumers, especially the younger generations. Probiotics are part of functional foods and beverages and are known for improving gut functionality, along with other benefits, including immunity boost. Various health benefits of probiotic foods are driving consumers in the region toward the consumption of such foods and beverages. Probiotics are made of good live bacteria and/or yeasts that naturally live in your body which help in digesting food, creating vitamins, and the breakdown and absorbing medications, among many others. Additionally, increasing acidity, stomach and gut issues, and indigestion problems among people in the region are increasing the demand for such probiotics-incorporated foods. For instance, according to GOQii, a large-scale survey conducted across India in 2021 resulted that about 30% of female respondents reported acidity and indigestion problems, whereas about 29% of male respondents had gut-related problems that year.

Moreover, a growing number of customers in the region are turning to beverages that do more than just satisfy their thirst, and this is creating a strong need for functional beverages to meet their demands, in addition to naturally sourced, balanced, and nutritious meals. This growing trend of healthier, enhanced drinks has created a new opportunity for brands or start-ups to develop products that nourish as well as refresh and hydrate. For instance, a new start-up in India called Ginger Rage offers probiotic products like Kombucha, which claims to be low in calories, a cocktail mixer, and is gut-friendly and an immunity booster. The company is also offering all of its products through its online retail store and other social media platforms. Such innovations and diversity in the products being offered in the region are expected to further boost the market's growth during the forecast period.

APAC Probiotic Market Trends

This section covers the major market trends shaping the APAC Probiotics Market according to our research experts:

Increasing Health Consciousness

Probiotics are a key ingredient in the thriving digestive health supplement market, and consumers of all ages are consuming more of them. Due to their increased awareness of health and wellness owing to multi-channel publicity campaigns, which significantly affect their consumption habits, the majority of consumption is seen among millennials. With the rising health concerns and early occurring gastric and gut-related problems, consumers in the region have become more conscious about their gut health and maintaining gut flora. Probiotics being the perfect solution to overcome or prevent such undesired issues, demand for such beverages and foods is highly increasing. For instance, according to the Ministry of Food and Drug Safety of South Korea, in 2021, probiotic products took up about 19% of the South Korean health functional food market, considerably up from around 15.8% in the previous year. Similarly, Hy Co. Ltd, formerly known as Korea Yakult, was the leading probiotics company in South Korea in 2021. It generated around KRW 275 billion in sales of probiotics products. Hence, rising consumption and demand for probiotic products in the region are expected to fill the market with innovative products, thus driving the market for probiotics in the near future.

Japan Holds a Prominent Share in the Market

In Japan, probiotic ingredients and finished products are developed based on scientific proof and supported by health requirements. Additionally, the probiotics market in Japan is primarily driven by Japanese customers, who have been particularly concerned about regularly replacing their gut flora and believe probiotic bacteria to be the best way to do so. In line with this, different new technologies being developed in the country to produce more effective and sustainable products are also supporting the market's growth by increasing the consumer base. For instance, in June 2021, after 20 years of research and development, SCIENCE OF PROBIOTICS by TCI JAPAN announced that it finally broke through the existing limitations and found new ways to create innovative probiotic beverages. TCI JAPAN's SCIENCE OF PROBIOTICS is the first in the industry to announce its development of a new patented process where high-efficiency fermentation technology is used to infuse into each tiny glass bottle of drink with 100 billion live probiotics, roughly equal to the total probiotic count in 10 bottles of common lactic acid bacteria drinks.

In addition, using such cutting-edge technologies, high counts of live bacteria can be maintained in the drinks, which is expected to attract consumers owing to the high-potency, quick-acting, and long-acting probiotic beverages in the country. Notably, the Japanese-based brand, Yakult, is so prevalent in the country with higher revenues and its products are served as part of school lunches and delivered to homes by its employees, thus augmenting its growth in the country. For instance, according to Yakult Honsha, in the fiscal year 2021, the company generated almost JPY 102 billion in net sales through its dairy product segment in Japan, continuing the upward trend of recent years.

APAC Probiotic Industry Overview

The Asia-Pacific probiotics market is fragmented, with the presence of various players in the market. Probiotic foods in the region are currently dominated by dairy products, such as fermented milk drinks, probiotic yogurts, and probiotic yogurt drinks. The major players in the market are Yakult, Danone, Morinaga, and Nestlé. These players have further consolidated their positions in recent years. The launch of new innovative products in the market is one of the major strategies adopted by the players in the market in order to expand their product portfolios and consumer bases.

APAC Probiotic Market Leaders

-

PepsiCo Inc.

-

Danone SA

-

Yakult Honsha Co. Ltd

-

Nestle SA

-

Bio-k Plus International

*Disclaimer: Major Players sorted in no particular order

APAC Probiotic Market News

- Sept 2022: Nestle Health Science's probiotics brand Garden of Life launched two new probiotic drinks targeted at kids' growth and immune health in China's offline retail market.

- Jan 2022: Mengniu's Youyi C launched two probiotic solid drinks and claimed they are specially designed for Chinese people. The company claimed that the drink 'Daily Health' was added with Chinese patented star bacteria of Bifidobacterium lactis V9, Lactobacillus plantarum Lp-6, and Lactobacillus paracasei PC-01.

- Mar 2021: COSTA, one of the leading international coffee brands, collaborating with NZMP, an ingredient and solution brand of the internationally renowned dairy giant Fonterra, announced the official launch of the peach probiotic latte (probiotic coffee) in all 200 stores in China.

APAC Probiotic Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Type

- 5.1.1 Probiotic Foods

- 5.1.1.1 Yogurt

- 5.1.1.2 Bakery/Breakfast Cereals

- 5.1.1.3 Baby Food and Infant Formula

- 5.1.1.4 Other Probiotic Foods

- 5.1.2 Probiotic Drinks

- 5.1.2.1 Fruit-based Probiotic Drinks

- 5.1.2.2 Dairy-based Probiotic Drinks

- 5.1.3 Dietary Supplements

-

5.2 Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Pharmacies and Drug Stores

- 5.2.4 Online Retail Stores

- 5.2.5 Other Distribution Channels

-

5.3 Geography

- 5.3.1 China

- 5.3.2 Japan

- 5.3.3 India

- 5.3.4 South Korea

- 5.3.5 Australia

- 5.3.6 Rest of Asia-Pacific

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Nestle SA

- 6.3.2 Groupe Danone

- 6.3.3 Danone SA

- 6.3.4 PepsiCo Inc.

- 6.3.5 Yakult Honsha Co. Ltd

- 6.3.6 Cell Biotech

- 6.3.7 Bio-K Plus International

- 6.3.8 Now Foods

- 6.3.9 Amway Corp.

- 6.3.10 Anand Milk Union Limited

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityAPAC Probiotic Industry Segmentation

Probiotics are a combination of beneficial bacteria and yeasts that help humans and animals maintain intestinal microbial balance.

The Asia-Pacific Probiotics Market is Segmented by Product Type (Probiotic Foods, Probiotic Drinks, and Dietary Supplements), Distribution Channel (Supermarkets/Hypermarkets, Pharmacies and Health Stores, Convenience Stores, Online Retail Stores, and Other Distribution Channels), and Geography (India, China, Japan, South Korea, Australia, Rest of Asia-Pacific). The report offers market size and values in (USD million) for the above-mentioned segments.

| Type | Probiotic Foods | Yogurt |

| Bakery/Breakfast Cereals | ||

| Baby Food and Infant Formula | ||

| Other Probiotic Foods | ||

| Type | Probiotic Drinks | Fruit-based Probiotic Drinks |

| Dairy-based Probiotic Drinks | ||

| Type | Dietary Supplements | |

| Distribution Channel | Supermarkets/Hypermarkets | |

| Convenience Stores | ||

| Pharmacies and Drug Stores | ||

| Online Retail Stores | ||

| Other Distribution Channels | ||

| Geography | China | |

| Japan | ||

| India | ||

| South Korea | ||

| Australia | ||

| Rest of Asia-Pacific |

APAC Probiotic Market Research FAQs

What is the current Asia-Pacific Probiotics Market size?

The Asia-Pacific Probiotics Market is projected to register a CAGR of 9.60% during the forecast period (2024-2029)

Who are the key players in Asia-Pacific Probiotics Market?

PepsiCo Inc., Danone SA, Yakult Honsha Co. Ltd, Nestle SA and Bio-k Plus International are the major companies operating in the Asia-Pacific Probiotics Market.

What years does this Asia-Pacific Probiotics Market cover?

The report covers the Asia-Pacific Probiotics Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Asia-Pacific Probiotics Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

APAC Probiotics Industry Report

Statistics for the 2024 APAC Probiotics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. APAC Probiotics analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.