Audio Equipment Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 15.23 Billion |

| Market Size (2029) | USD 21.42 Billion |

| CAGR (2024 - 2029) | 7.06 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Audio Equipment Market Analysis

The Audio Equipment Market size is estimated at USD 15.23 billion in 2024, and is expected to reach USD 21.42 billion by 2029, growing at a CAGR of 7.06% during the forecast period (2024-2029).

- The advancement of technologies in the music industry has led to the widespread use of digital audio workstations (DAW) by artists to create, capture, blend, and perfect music. The growing trend of higher spending on worldwide celebrations and musical performances is anticipated to drive the need for professional sound gear. The rising number of trade shows, film productions, exhibitions, concerts, and sporting events is anticipated to drive the demand for different types of innovative audio amplifiers.

- The growth of car audio systems is fueling the industry. A limited number of amplifiers and sound processors can substitute the factory amp in a premium system while maintaining all of the vehicle's features and functionality. With a rise in automobile production, demand will increase efficiently.

- For instance, in March 2024, Novosense launched new Op Amps with better performance for automotive applications. They meet the AEC-Q100 Grade 1 standard and feature enhancements in offset, drift, and power supply rejection ratio.

- Improvements in technology and quick internet connections enable smooth streaming of high-quality audio, even in high-definition. This has led to consumers becoming more aware of and placing a higher value on top-notch sound quality.

- Creating high-performance audio equipment faces difficulties due to the intricate design and complexity of integrating interfaces in mixing circuits for audio mixers and amplifiers, limiting market expansion.

- The high cost of professional audio equipment and the limited availability of technological infrastructure needed to support high-quality audio systems, especially in developing regions and countries, could restrain the growth of the market studied during the forecast period.

Audio Equipment Market Trends

Microphone Segment Expected to Register the Fastest Growth

- As most activities shift to home settings, including TV productions, education, health and wellness, and daily work, vendors are assessing the demand for better audio in these environments by introducing new products to the market.

- The rising digital revolution in the education industry will drive the need for microphones in the coming years. Digitization in the education industry provides advantages for educators, students, and other individuals involved in the learning experience. These modifications will enhance accessibility and engagement by offering intriguing and flexible learning opportunities. Consequently, online education is becoming more available, extensive, and diverse.

- Some of the possibilities brought about by the digital advancement of higher education are short educational modules, engaging videos or quizzes, gaming options, and artificial intelligence-based learning methods. Each option allows a student to participate more actively in the relevant components or tasks.

- The arrival of VR and AR headsets, along with the launch of True Wireless Sound earbuds featuring voice calling, noise cancellation, spatial audio, and transparency mode, has raised consumer demands for microphone tech and audio quality. Such developments are contributing to the market's expansion.

- Additionally, the demand for audio accessories is also being met in the expanding market. Microphones and related items are highlighted for high-quality sound reproduction in various settings like installation, broadcast, film, and fieldwork. Countries are investing money into expanding their imports in response to increased demand.

- According to the Thai Ministry of Commerce, in 2023, Thailand saw a rise in imports of microphones, speakers, and earphones worth around USD 0.65 billion, showing growth from the year before.

- Players are investing in broadening their technologies in order to cover higher demand. For instance, in February 2024, Sony unveiled the new ECM-S1 wireless/streaming microphone, expanding its microphone lineup. This advanced microphone marries top-notch sound recording with a lightweight construction. Sony's ECM-S1 enables video content creators to capture high-quality audio in a variety of shooting situations. The ECM-S1 microphone is the perfect tool for professional videographers and video content creators who need high-quality audio for shoots, livestreams, and podcasts.

Asia-Pacific to Witness Significant Market Growth

- Due to rising technological innovations, the presence of key audio equipment providers like Yamaha Corporation and Alpine Electronics is projected to grow notably in the Asia-Pacific audio equipment market.

- The Asia-Pacific market’s growth is credited to the unparalleled expansion of consumer electronics production in China, which has positioned the country as the top smartphone producer worldwide. According to the National Bureau of Statistics of China, the production of cell phones amounted to 1.4 billion in November 2023. China has been among the top countries worldwide for producing cell phones and is expected to keep growing steadily in the coming years.

- Developments in digital audio technology and shifts in consumer preferences from traditional to contemporary audio systems are anticipated to propel the market's growth across the region. Moreover, the increasing need for portable home audio devices that can support USB drives and access high-quality audio content from the internet is also expected to positively impact the market's growth.

- In January 2024, Singapore-based company CODA Audio unveiled the LINUS6.4-iD installation amplifier at ISE 2024. The LINUS6.4-iD powers most of CODA's loudspeakers except for line arrays and sensor-controlled subwoofers, and it can be managed using LINUS Control, which provides complete network control and monitoring through Ethernet.

Audio Equipment Industry Overview

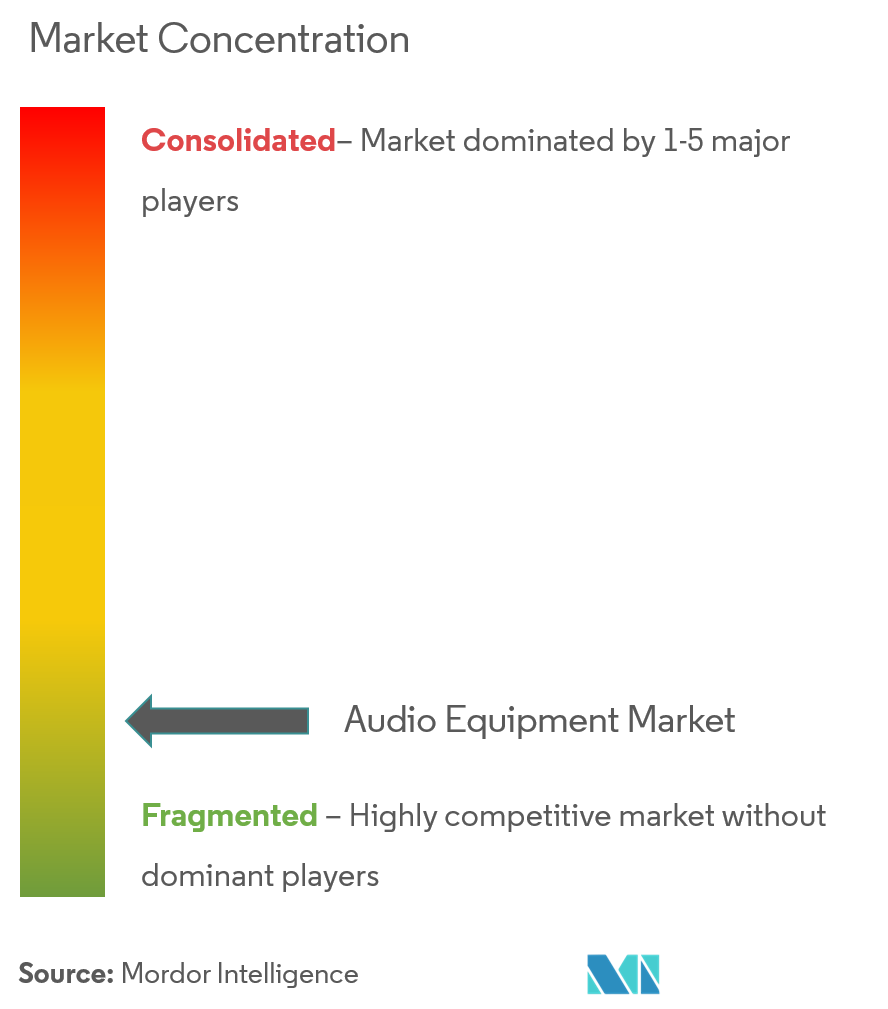

The audio equipment market is fragmented, featuring prominent players like Yamaha Corporation, Alpine Electronics, Kenwood Corporation, Behringer, and Allen & Heath. Changing consumer demands are driving companies to innovate in the space to attract more consumers. These key players in the market are actively pursuing various strategies, including partnerships and acquisitions, to enhance their product portfolios and establish a sustainable competitive advantage.

- July 2024: Allen & Heath and Harrison Audio introduced Harrison LiveTrax, a new software for multitrack recording and virtual soundcheck. It has been designed to work smoothly with Allen & Heath’s mixers, capturing scene changes as markers on the timeline for easy virtual soundcheck and timecode automation.

- April 2024: Sony Electronics Inc. launched a fresh series of home audio products called BRAVIA Theater, aiming to transform BRAVIA into a brand centered on movie-watching for an enhanced home cinema experience. By consolidating TVs, soundbars, and other audio technologies under the BRAVIA brand, Sony envisions a streamlined home theater setup for customers to indulge in a cinematic experience with top-notch picture and sound quality.

Audio Equipment Market Leaders

-

Yamaha Corporation

-

Alpine Electronics

-

Allen & Heath

-

Kenwood Corporation

-

Behringer

*Disclaimer: Major Players sorted in no particular order

Audio Equipment Market News

- April 2024: Goodix Technology released a new smart amplifier for mobile audio designs. The TFA9865's new device utilizes an exclusive, completely digital design and sophisticated production methods to enhance audio quality. Aimed at setting new standards in the audio industry, the TFA9865 audio amplifier boasts compact dimensions of only 2.2x2.2mm², delivering improved power efficiency, increased sound volume, and reduced noise levels.

- May 2024: Sony Electronics Inc. announced that it is the official consumer headphones and wireless speakers partner for the Sueños Music Festival, following the release of its ULT POWER SOUND series, a range of speakers and headphones aimed at delivering strong bass and an immersive music experience. The series includes three Bluetooth speakers, ULT TOWER 10, ULT FIELD 7, ULT FIELD 1, and the wireless noise-canceling headphone ULT WEAR, all designed to provide deep bass and superior sound quality.

Audio Equipment Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

-

4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5. MARKET DYNAMICS

-

5.1 Market Drivers

- 5.1.1 Rising Tendency of Increased Expenditure on Global Festivals and Music Concerts

- 5.1.2 Rise of Audio Equipment in Automobiles

- 5.1.3 Increasing Demand for HD and Ultra HD Sound Quality

-

5.2 Market Restraint

- 5.2.1 Design and Complexity Challenges for the Development of High-efficiency Audio Equipment

6. MARKET SEGMENTATION

-

6.1 By Product Type

- 6.1.1 Mixers

- 6.1.2 Amplifiers

- 6.1.3 Microphones

- 6.1.4 Audio Monitors

- 6.1.5 Other Product Types

-

6.2 By End User

- 6.2.1 Commercial

- 6.2.2 Automotive

- 6.2.3 Home Entertainment

- 6.2.4 Other End Users

-

6.3 By Geography***

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7. COMPETITIVE LANDSCAPE

-

7.1 Company Profiles*

- 7.1.1 Yamaha Corporation

- 7.1.2 Alpine Electronics

- 7.1.3 Allen & Heath

- 7.1.4 Kenwood Corporation

- 7.1.5 Behringer

- 7.1.6 AKG Acoustics (Harman International)

- 7.1.7 Peavey Electronics

- 7.1.8 Krell Industries

- 7.1.9 NXP Semiconductors

- 7.1.10 Bryston Ltd

- 7.1.11 Sony Electronics Inc.

8. INVESTMENT ANALYSIS

9. FUTURE OF THE MARKET

** Subject To AvailablityAudio Equipment Industry Segmentation

The audio equipment market refers to devices that reproduce, record, or process sound. This includes establishments producing electronic audio for home entertainment, musical instrument amplification, automobiles, etc. Audio gear includes tools that replicate, capture, or manipulate sound. This consists of microphones, radios, AV receivers, CD players, tape recorders, amps, mixers, effects units, headphones, and speakers.

The audio equipment market is segmented by product type (mixers, amplifiers, microphones, audio monitors, and other product types), end user (commercial, automotive, home entertainment, and other end users), and geography (North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa). The report offers the market sizes and forecasts for all the above segments in value (USD).

| By Product Type | Mixers |

| Amplifiers | |

| Microphones | |

| Audio Monitors | |

| Other Product Types | |

| By End User | Commercial |

| Automotive | |

| Home Entertainment | |

| Other End Users | |

| By Geography*** | North America |

| Europe | |

| Asia | |

| Australia and New Zealand | |

| Latin America | |

| Middle East and Africa |

Audio Equipment Market Research FAQs

How big is the Audio Equipment Market?

The Audio Equipment Market size is expected to reach USD 15.23 billion in 2024 and grow at a CAGR of 7.06% to reach USD 21.42 billion by 2029.

What is the current Audio Equipment Market size?

In 2024, the Audio Equipment Market size is expected to reach USD 15.23 billion.

Who are the key players in Audio Equipment Market?

Yamaha Corporation, Alpine Electronics, Allen & Heath, Kenwood Corporation and Behringer are the major companies operating in the Audio Equipment Market.

Which is the fastest growing region in Audio Equipment Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Audio Equipment Market?

In 2024, the Asia Pacific accounts for the largest market share in Audio Equipment Market.

What years does this Audio Equipment Market cover, and what was the market size in 2023?

In 2023, the Audio Equipment Market size was estimated at USD 14.15 billion. The report covers the Audio Equipment Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Audio Equipment Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

What trends are shaping the future of the Audio Equipment Market?

Key trends in the Audio Equipment Market include: a) Growing popularity of wireless earbuds b) Integration of Artificial Intelligence and voice control features c) Increasing demand for high-resolution audio products

What are the major challenges facing the Audio Equipment Market?

Major challenges in the Audio Equipment Market include: a) Intense competition b) Rapid technological changes c) Need for continuous innovation to meet consumer expectations

What trends are shaping the future of the Audio Equipment Market?

Key trends in the Audio Equipment Market include: a) Growing popularity of wireless earbuds b) Integration of Artificial Intelligence and voice control features c) Increasing demand for high-resolution audio products

Audio Equipment Industry Report

The audio equipment market is experiencing significant growth, driven by consumer demand for high-performance home theater systems and innovative technological features. The integration of Artificial Intelligence (AI) and Internet of Things (IoT) in smart devices is a key factor contributing to this growth. Industry trends indicate that innovations such as hi-fi wireless sound bars and home theaters with surround sound are becoming increasingly popular.

Market research shows that the market size is expanding due to increased disposable incomes and a trend towards portable products. Additionally, government support for domestic manufacturing is playing a crucial role in the market's development. The global market is seeing a rise in wireless technology and online sales channels, with the Asia Pacific region leading in market share.

Industry data highlights that despite challenges like global supply chain disruptions and inflation, continuous innovation in energy-efficient and high-quality audio products promises a bright future for the industry. The industry forecast suggests that the market will continue to grow, driven by advancements in technology and consumer preferences.

The industry information provided in the report offers a comprehensive industry overview and market analysis. It includes details on market growth, market report insights, and market segmentation. The industry report also covers market statistics, market share, and market value, providing a thorough understanding of the market dynamics.

The report example available in a free PDF download from Mordor Intelligence™ gives an in-depth look into the industry analysis and industry outlook. It includes industry reports, industry research, industry sales, and industry size, offering valuable insights for research companies and market leaders.

Market data and market forecast are essential for understanding the market outlook and market predictions. The market review and market overview sections provide a detailed examination of the market segmentation and market value. The report pdf is a valuable resource for anyone looking to gain a comprehensive understanding of the audio equipment market.

In conclusion, the audio equipment market is poised for continued growth, supported by technological advancements and favorable market conditions. The industry statistics and industry trends indicate a positive trajectory, making it an attractive market for investors and stakeholders.