Austria Snack Bar Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 2.66 % |

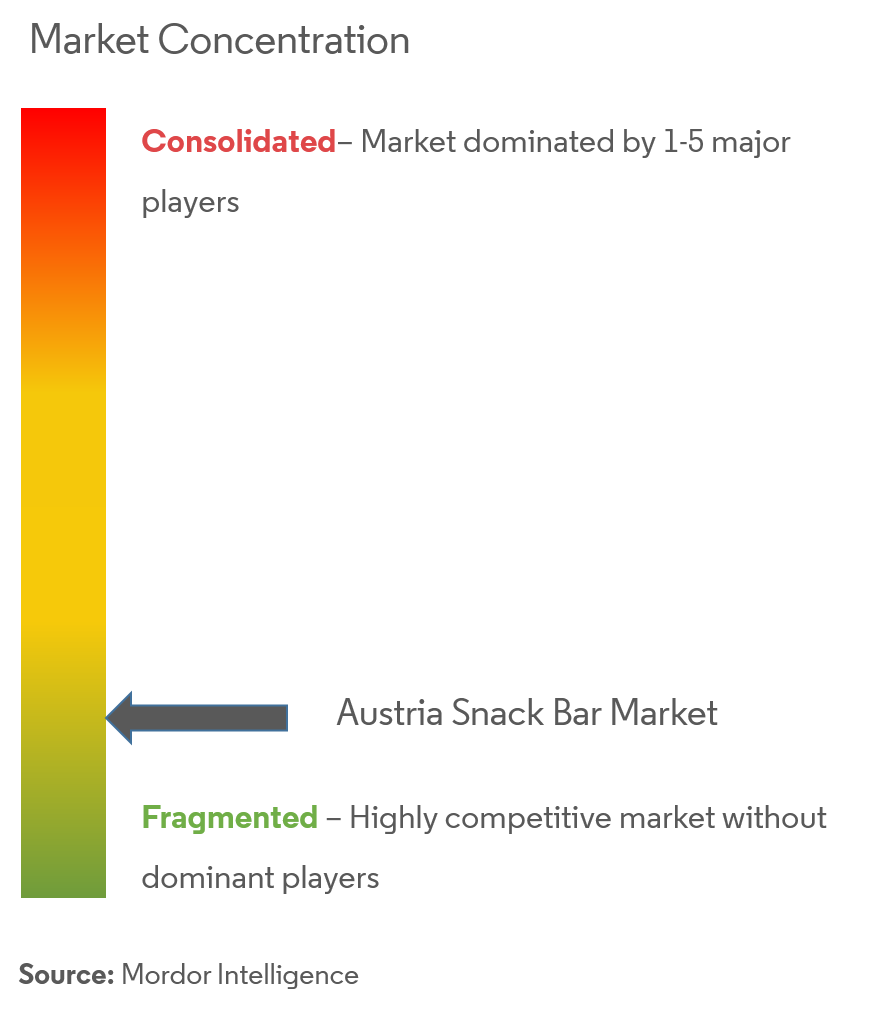

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Austria Snack Bar Market Analysis

The Austria Snack Bar market is projected to grow at a CAGR of 2.66% during the forecast period (2020- 2025).

- Consumers are shifting towards healthier snacking options, and snack barsserve as a healthier alternative to chocolate or confectionery products.

- A healthy diet has become a trend amongst Austrians, who are increasingly becoming nutrition savvy and are paying attention to labels, along with their diets. This is not only to keep in shape but also to keep diseases at bay, especially from very serious illnesses, such as obesity and diabetes.

- The competition for procuring more raw materials and stringent regulations are the majorrestrainingfactors that impede the growth of theAustrian snack bar market.

Austria Snack Bar Market Trends

This section covers the major market trends shaping the Austria Snack Bar Market according to our research experts:

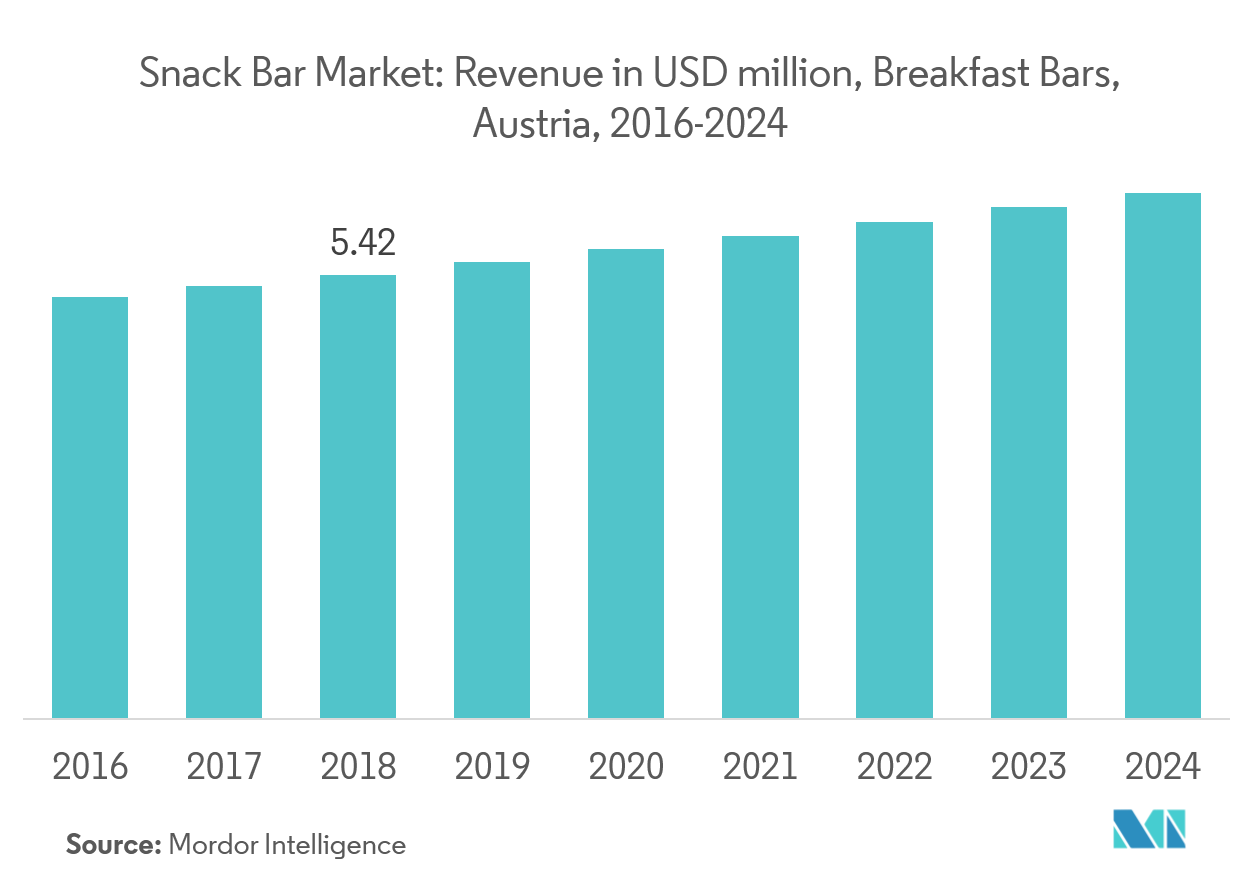

Breakfast Bars likely to Register Highest Growth Rate

Breakfast bars are marketed as healthier snack alternatives to several products, like confectionery, biscuits, and cakes. Moreover, they serve as a replacement to general muesli or cereals, particularly among the office goers, because of the convenient ‘on the go’ trend. Consumers are replacing meals with breakfast bars for nutrition. Bars high in protein and fiber content and low in carbohydrates, are influencing the preferences of consumers in the snack bar market. Some of the most popular trends in the breakfast bar segment include label claims, such as “gluten-free” and “high in fiber or added fiber”. The snacking trend has even come up with the term “second breakfast”, which refers to mid-morning munch for people at their office desk.

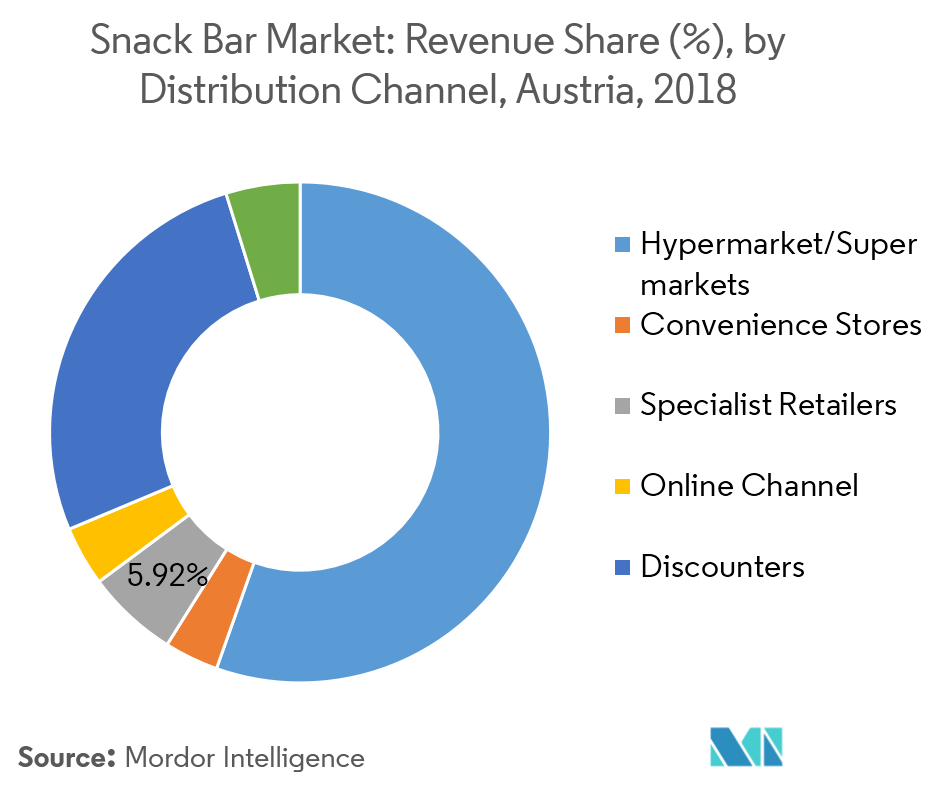

Hypermarket/Supermarket Segment Accounted For Largest Share

Several Austrian firms have their distribution channels across the neighboring markets of Central and Eastern Europe at wholesale as well as retail levels. By distribution channel, the Austrian snack bar market was led by hypermarkets/supermarkets with a highest share, followed by discounters. Also, the discounters are expected to register the highest growth rate during the forecast period, owing to their pricing strategy, promotional activities, and availability of variety of products. Snack bars are sold primarily through supermarkets/hypermarkets in most regions. As these cutlets are abundantly available in most of the areas in the region, people prefer to buy daily groceries including, snack bars. There has been an increase in the sale of snack bars through the supermarket/hypermarket chains, due to the availability of new styles and flavors of snack bars across the shelves.

Austria Snack Bar Industry Overview

The Austria snack bar market is highly competitive with key international players, such as General Mills, Nestle, Mars Inc., and CLIFF bar. Companies are coming up with several marketing strategies for strong positioning of their snack bars, such as clean label campaigns and product launches, with several developments, like the raw label, meat-based bars, plant-based protein bars, and others. Various food processing companies have merged with larger national or foreign companies, so as to secure their position in the larger, matured European market. For instance, all leading retailers in Austria are part of a large German retailer group with one exception, i.e., Spar (International Spar Centrale BV). Other major retailer groups in the country include Rewe Group and Aldi Group.

Austria Snack Bar Market Leaders

-

Clif Bar (LUNA BAR)

-

General Mills

-

Nestle

-

Hero Group

-

Nature Balance Foods

*Disclaimer: Major Players sorted in no particular order

Austria Snack Bar Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porters Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Degree of Competition

5. MARKET SEGMENTATION

-

5.1 By Product Type

- 5.1.1 Breakfast Bars

- 5.1.2 Granola/Muesli Bars

- 5.1.3 Energy & Nutrition Bars

- 5.1.4 Fruit Bars

- 5.1.5 Others

-

5.2 By Distribution Channel

- 5.2.1 Hypermarket/Supermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Online Channel

- 5.2.4 Specialist Retailers

- 5.2.5 Discounters

- 5.2.6 Others

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Clif Bar(LUNA BAR)

- 6.1.2 General Mills

- 6.1.3 Hero Group

- 6.1.4 MARS, Incorporated

- 6.1.5 Post Holding

- 6.1.6 Nature Balance Foods

- 6.1.7 Olimp Sports Nutrition

- 6.1.8 Isostar

- 6.1.9 Nestle

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityAustria Snack Bar Industry Segmentation

The Austria snack bar market can be divided by type which includes breakfast bars, granola/muesli bars, energy and nutrition bars, fruit bars, and others. The market is also segmented based on distribution channel including hypermarkets/supermarkets, convenience stores, online channel, specialist stores, discounters and others.

| By Product Type | Breakfast Bars |

| Granola/Muesli Bars | |

| Energy & Nutrition Bars | |

| Fruit Bars | |

| Others | |

| By Distribution Channel | Hypermarket/Supermarkets |

| Convenience Stores | |

| Online Channel | |

| Specialist Retailers | |

| Discounters | |

| Others |

Austria Snack Bar Market Research FAQs

What is the current Austria Snack Bar Market size?

The Austria Snack Bar Market is projected to register a CAGR of 2.66% during the forecast period (2024-2029)

Who are the key players in Austria Snack Bar Market?

Clif Bar (LUNA BAR), General Mills, Nestle, Hero Group and Nature Balance Foods are the major companies operating in the Austria Snack Bar Market.

What years does this Austria Snack Bar Market cover?

The report covers the Austria Snack Bar Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Austria Snack Bar Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Austria Snack Bar Industry Report

Statistics for the 2024 Austria Snack Bar market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Austria Snack Bar analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.