Automated Parcel Delivery Terminals Market Size

| Study Period | 2020 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 0.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Europe |

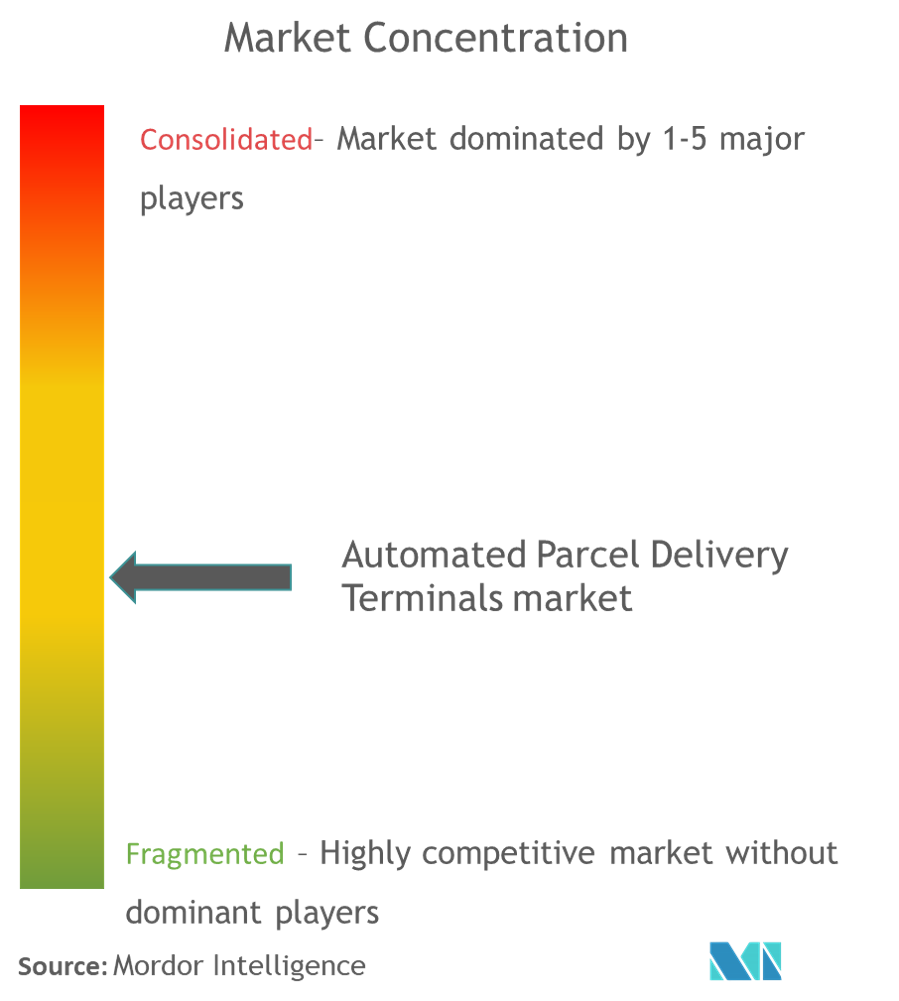

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Automated Parcel Delivery Terminals Market Analysis

The global automated parcel delivery terminals market is expected to grow at a CAGR of more than 12% during the forecast period (2019 - 2024).

- The last-mile delivery is the most challenging part of parcel delivery and it accounts for almost 50% of the total parcel delivery costs. Automated Parcel Delivery Terminals is one of the alternatives that is being explored by the companies.

- The swift growth of e-commerce has shifted the bargaining power towards the consumers, the demand for on-time parcel delivery is also growing. These automated parcel terminals improve the on-time delivery and also present an opportunity for the postal companies in some countries that are unprofitable to reduce the operational costs.

- The rapid penetration of e-commerce and the expenditures by governments to develop a logistics ecosystem are the key drivers for the growth of the market.

- The growth in Cross-border e-commerce is also fueling the parcel terminals market. The cross-border e-commerce market is anticipated to grow at a faster rate than the domestic e-commerce market.

- With the increasing adoption of these parcel terminals, the companies are sending the parcels directly to nearest parcel terminal instead of sending it to nearest post office/distribution center leading to faster delivery of parcels to consumers.

- With the growth in online sales of perishable items such as grocery items, the demand for refrigerated and freezer terminals is also growing.

- Apart from parcel deliveries, these terminals are also being used for postal and financial transactions. Also, the adoption of these parcel terminals results in a significant reduction in emissions.

Automated Parcel Delivery Terminals Market Trends

This section covers the major market trends shaping the Automated Parcel Delivery Terminals Market according to our research experts:

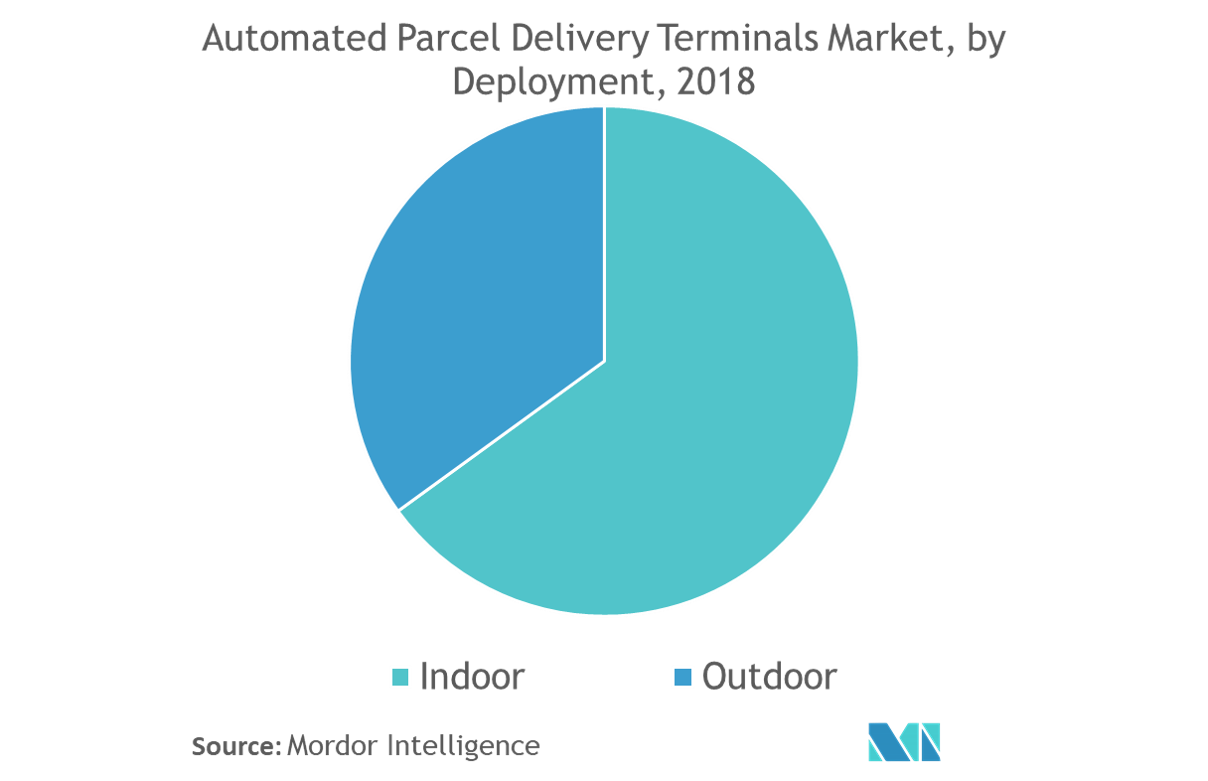

Indoor Parcel Terminals Dominate the market

The indoor parcel terminals account for major share of the market. These indoor terminals located in places such as shopping malls, convenience stores, grocery outlets, gas stations, etc. are being preferred as they are located in more secure environment and enable easy operation in adverse weather conditions. Additionally, the indoor terminals reduce the operational costs as they require lesser maintenance. In 2017, Amazon has partnered with Repsol, energy company based in Spain to install its parcel lockers at Repsol service stations across Spain and Portugal. The outdoor terminals are also becoming more popular as they offer greater convenience when compared to indoor terminals. The emerging economies across the globe present opportunities for the parcel terminal manufacturers.

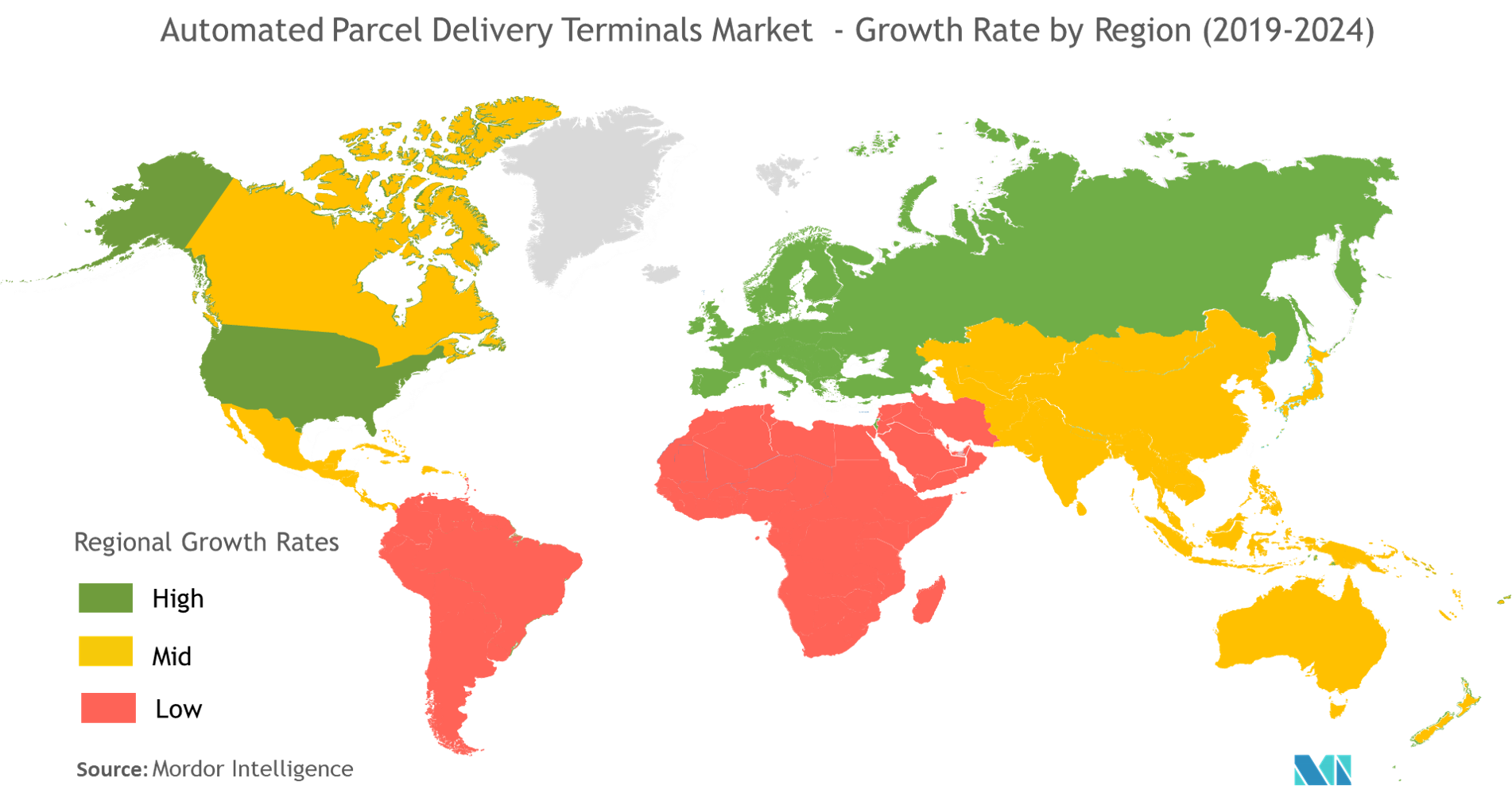

Europe is leading the Global Automated Parcel Delivery Terminals Market

Europe accounts for major share of the market in the world with major manufacturers of terminals located in the region while North America is expected to witness high growth through the forecast period with a matured e-commerce market. The penetration of these terminals is relatively low in Asia-Pacific; however, new players are emerging in the region and significant growth rate is expected.

The well-developed logistics infrastructure, with major logistics companies located in the region has boosted the adoption of the automated parcel delivery terminals in Europe. The automated parcel delivery terminals became functional in Europe more than a decade ago. Germany leads the European automated parcel delivery terminals market, and Germany, US, and China together account for more than one-third of the global market. Germany, UK, and France are the top three countries in the region with highest parcel volumes. The Northern/Western European region has a greater number of parcel terminals and is expected to grow faster than the Southern/Eastern.

With the increasing cross-border e-commerce sales, the companies are expanding the parcel terminal delivery to international purchases. In April 2019, Estonia based post and logistics company Omniva has announced that the company will deliver the international cargo to its parcel terminals.

Automated Parcel Delivery Terminals Industry Overview

The market for Automated Parcels Terminals is fairly fragmented with the presence of large number of players across the globe. Some established companies have a presence in multiple regions of the world. Prominent players in the market include Keba AG, Cleveron AS, Neopost group, Bell and Howell amongst others. The postal operators, retailers, and logistics companies that focus on parcel deliveries to consumers are focusing on building their own networks of parcel terminals. In 2015, Cleveron partnered with Bell and Howell to boost the parcel terminal delivery in North America. The partnerships between retailers and terminal companies is also expected to grow. For instance, in 2018, the smartphone retailer Xiaomi India as partnered with Smartbox, an automated parcel delivery company in India for delivering the online orders of customers. In June 2019, Cleveron partnered with Chile-based Falabella Retail, one of the largest companies in Latin America.

Automated Parcel Delivery Terminals Market Leaders

-

Cleveron AS

-

Keba AG

-

Neopost group

-

Bell and Howell LLC

-

Smartbox Ecommerce Solutions Pvt. Ltd.

*Disclaimer: Major Players sorted in no particular order

Automated Parcel Delivery Terminals Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Government Regulations and Initiatives

- 4.4 Technological Trends

- 4.5 Spotlight on growth of global e-commerce and cross-border e-commerce markets

- 4.6 Insights on Refrigerated Terminals

5. MARKET DYNAMICS

- 5.1 Drivers

- 5.2 Restraints

- 5.3 Opportunities

- 5.4 Industry Attractiveness - Porter's Five Force Analysis

6. MARKET SEGMENTATION

-

6.1 By Deployment

- 6.1.1 Indoor

- 6.1.2 Outdoor

-

6.2 By End-User

- 6.2.1 Retail/E-Commerce

- 6.2.2 Logistics Companies

- 6.2.3 Government

- 6.2.4 Others

-

6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 South America

- 6.3.2.1 Chile

- 6.3.2.2 Brazil

- 6.3.2.3 Rest of South America

- 6.3.3 Europe

- 6.3.3.1 Germany

- 6.3.3.2 United Kingdom

- 6.3.3.3 France

- 6.3.3.4 Netherlands

- 6.3.3.5 Spain

- 6.3.3.6 Estonia

- 6.3.3.7 Italy

- 6.3.3.8 Poland

- 6.3.3.9 Russia

- 6.3.3.10 Rest of Europe

- 6.3.4 Asia Pacific

- 6.3.4.1 China

- 6.3.4.2 Japan

- 6.3.4.3 Australia

- 6.3.4.4 India

- 6.3.4.5 New Zealand

- 6.3.4.6 South Korea

- 6.3.4.7 ASEAN

- 6.3.4.8 Rest of Asia Pacific

- 6.3.5 Middle East & Africa

- 6.3.5.1 South Africa

- 6.3.5.2 United Arab Emirates

- 6.3.5.3 Saudi Arabia

- 6.3.5.4 Rest of Middle East & Africa

7. COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration, Major Players)

-

7.2 Company Profiles

- 7.2.1 Cleveron AS

- 7.2.2 Keba AG

- 7.2.3 Neopost group

- 7.2.4 Bell and Howell LLC

- 7.2.5 Smartbox Ecommerce Solutions Pvt. Ltd.

- 7.2.6 Engy Group

- 7.2.7 InPost S.A.

- 7.2.8 Smartbox Ecommerce Solutions Pvt. Ltd.

- 7.2.9 ByBox Holdings Ltd.

- 7.2.10 TZ Ltd.

- 7.2.11 Winnsen Industry Co., Ltd.

- 7.2.12 LL OPTIC (Loginpost)

- *List Not Exhaustive

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

9. APPENDIX

- 9.1 Macroeconomic data for key countries (GDP, etc.)

- 9.2 E-Commerce related statistics foe key countries

- 9.3 Parcel Volumes for key countries

Automated Parcel Delivery Terminals Industry Segmentation

A complete background analysis of Automated Parcel Delivery Terminals market, market overview, market size estimation for key segments and emerging trends by segments, and market dynamics are covered in the report.

| By Deployment | Indoor | |

| Outdoor | ||

| By End-User | Retail/E-Commerce | |

| Logistics Companies | ||

| Government | ||

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Geography | South America | Chile |

| Brazil | ||

| Rest of South America | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Netherlands | ||

| Spain | ||

| Estonia | ||

| Italy | ||

| Poland | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| Australia | ||

| India | ||

| New Zealand | ||

| South Korea | ||

| ASEAN | ||

| Rest of Asia Pacific | ||

| Geography | Middle East & Africa | South Africa |

| United Arab Emirates | ||

| Saudi Arabia | ||

| Rest of Middle East & Africa |

Automated Parcel Delivery Terminals Market Research FAQs

What is the current Automated Parcel Delivery Terminals Market size?

The Automated Parcel Delivery Terminals Market is projected to register a CAGR of 0% during the forecast period (2024-2029)

Who are the key players in Automated Parcel Delivery Terminals Market?

Cleveron AS, Keba AG, Neopost group, Bell and Howell LLC and Smartbox Ecommerce Solutions Pvt. Ltd. are the major companies operating in the Automated Parcel Delivery Terminals Market.

Which is the fastest growing region in Automated Parcel Delivery Terminals Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Automated Parcel Delivery Terminals Market?

In 2024, the Europe accounts for the largest market share in Automated Parcel Delivery Terminals Market.

What years does this Automated Parcel Delivery Terminals Market cover?

The report covers the Automated Parcel Delivery Terminals Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Automated Parcel Delivery Terminals Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Automated Parcel Delivery Terminals Industry Report

Statistics for the 2024 Automated Parcel Delivery Terminals market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Automated Parcel Delivery Terminals analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.