Automatic Tea Bag Packaging Equipment Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 4.90 % |

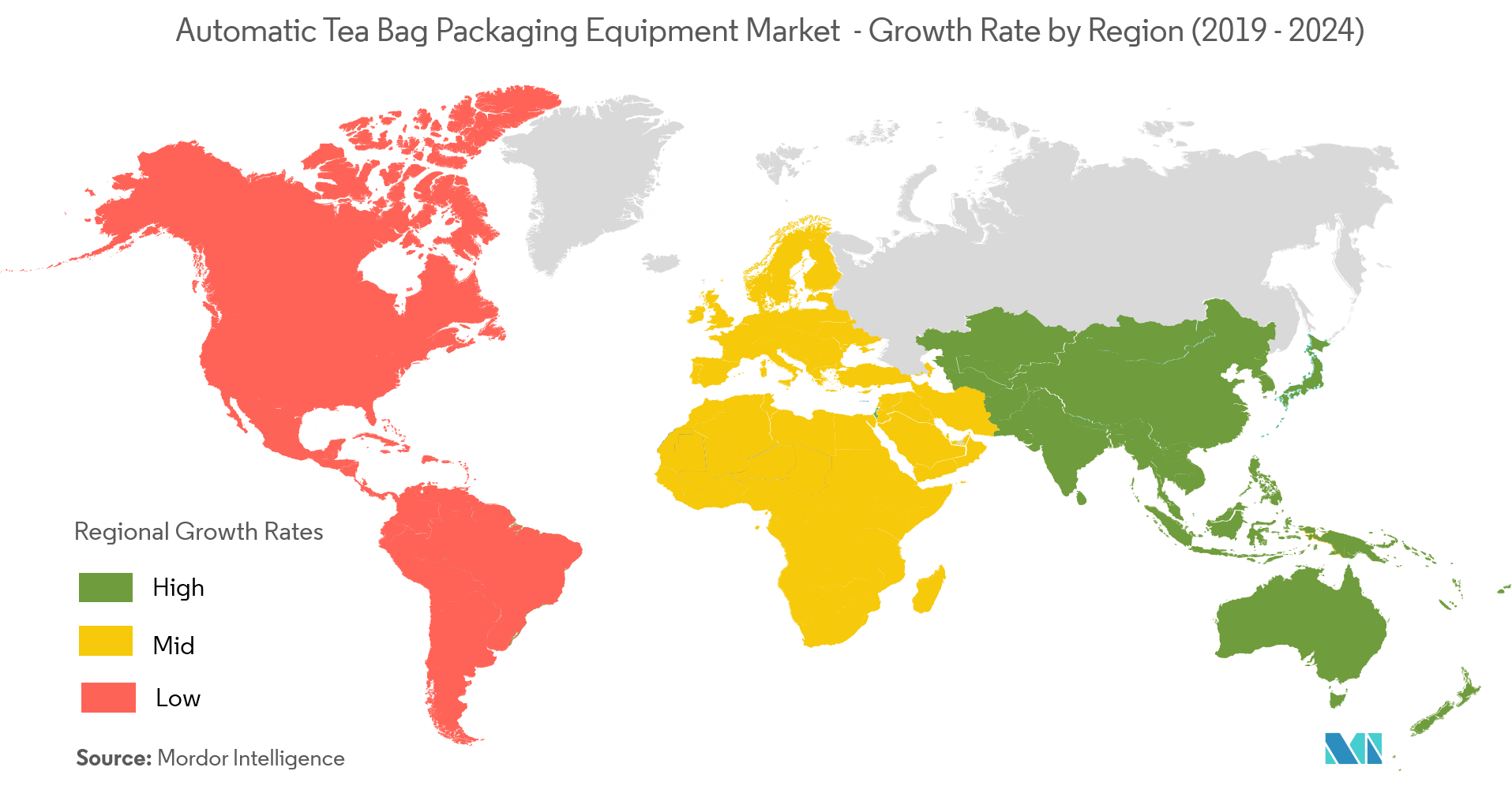

| Fastest Growing Market | Asia Pacific |

| Largest Market | Europe |

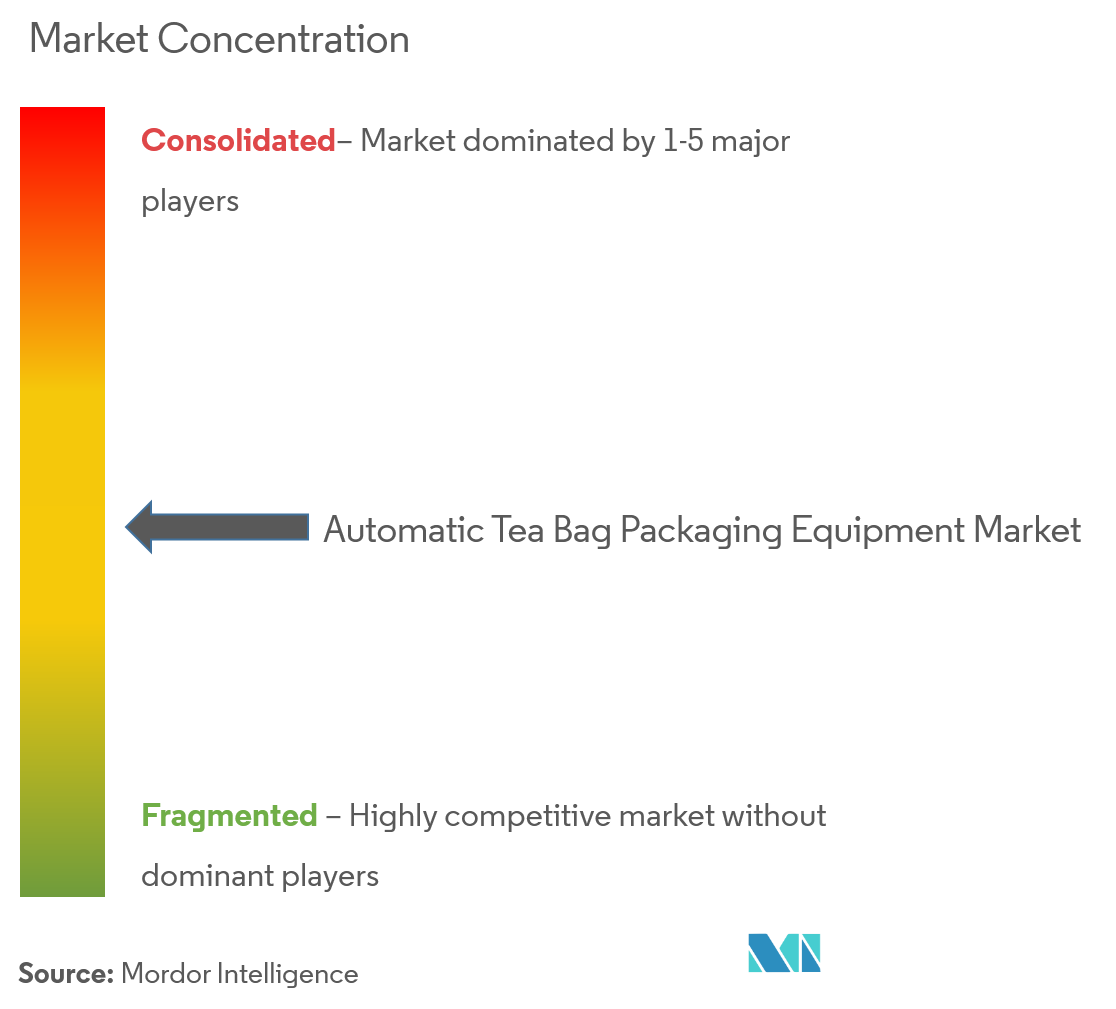

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Automatic Tea Bag Packaging Equipment Market Analysis

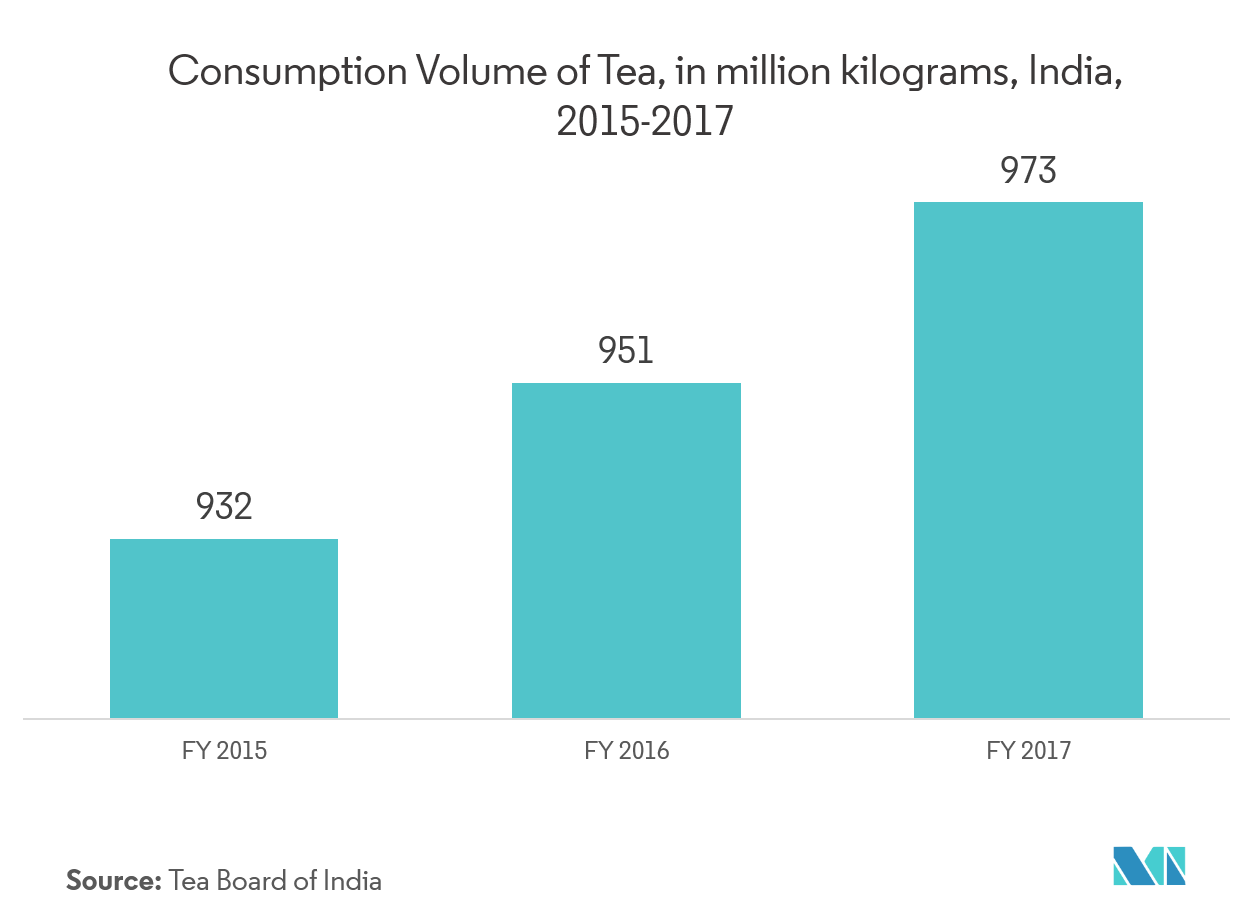

The automatic tea bag packaging equipment market is expected to register a CAGR of over 4.9% during the forecast period (2021 to 2026). According to FAO Intergovernmental Group (IGG), growing consumption of tea is driven by the increasing awareness of it's antioxidant, inflammatory, and weight loss effects.

- Global tea production and consumption are anticipated to keep rising over the next decade, driven by the robust demand from emerging economies of China and India among others, owing to higher incomes and efforts to diversify production to include specialty items, such as herbal teas, fruit fusions, and flavored gourmet teas.

- Sustainability is also one of the primary concerns in the tea bag packaging industry. As a result, packaging equipment manufacturers are increasingly adopting automation in their production line and adhering to Sustainable Trade Initiatives throughout the globe.

- The RTD (Ready-to-Dink) tea and instant tea market are burgeoning across the world, with Asia-Pacific, the United States, and Europe as the largest consumers of RTD products. These teas are convenient and offer a healthy alternative to other ready-to-drink beverages. The RTD market for tea has witnessed strong growth with several entrants looking to tap this opportunity. For instance, in 2018, 8th Wonder Tea, a US-based company launched ready-to-drink teas to meet the rising demand for high-quality teas on-the-go.

Automatic Tea Bag Packaging Equipment Market Trends

This section covers the major market trends shaping the Automatic Tea Bag Packaging Equipment Market according to our research experts:

Pyramid Tea Bag Packaging is Expected to Hold a Significant Share

- The pyramid-shaped tea bag is gaining popularity because of its tetrahedral shape that allows more significant pieces of broken leaf teas to be bundled into a single pocket. This shape allows the ingredients to expand properly, releasing maximum flavor into the cup. With the increasing consumption of tea in countries such as India as a refreshment beverage has further created opportunities for pyramid tea bags market globally. Companies in the country such as Teabox offers TeaPacs packaged in pyramid-shaped tea bags. The pyramid-shaped tea bag allows adequate space for the loose leaves to unfurl, thus, resulting in a cup of tea steeped with rich flavor.

- Increasing environmental concerns among consumers have further resulted in a growing demand for sustainable packaging solutions. Companies such as PG Tips, in 2018, launched a new tea bag made from 100% biodegradable plant-based materials.

- The demand for premium tea is on the rise, and the pyramid tea bag is moving into the mainstream with the larger brands, including Lipton and Twinings, rolling out new premium lines to tap into the trend. Fuso International, a Japanese Brand, provides automatic equipment for pyramid tea bag packaging, which is predominantly used in the Asia-Pacific. All these factors have driven the growth of the packaging market for tea, thus directly impacting the market studied.

Europe is Expected to Hold the Largest Share

- Europe is one among the largest importer of tea and can be characterized as a mature tea market. Within Europe, the United Kingdom has always been a country of tea-drinkers, despite the rising growth of coffee shops in every street and shopping street. As per the UK Tea & Infusions Association, 84% of the British population drink tea and herbal infusions every day. Although the use of loose-leaf is increasing, 96% percent of British tea is consumed from tea bags.

- The tea market in the region is facing competition from other beverages, particularly coffee. Coffee consumption in the United Kingdom continues to grow with about 70 million cups drunk daily, according to the UK Tea & Infusions Association. However, with the introduction of different varieties of quality and specialty teas, such as green, as well as herbal and fruit teas are gaining popularity in the different markets, especially in Europe, owing to their perceived health benefits. Thus, augmenting the market for the packaging of tea bags.

- The region represents a comparatively low share of tea bag manufacturing companies. However, the demand is expected to rise owing to the use of specialty papers to fabricate porous sachets for tea. Attributes of specialty paper, such as its ability to retain flavor, its sustainability, and its biodegradable feature are significant advantages contributing to the growth of the specialty paper market for tea bags in Europe.

Automatic Tea Bag Packaging Equipment Industry Overview

The automatic tea bag packaging equipment market consists of several players. These players are continuously striving to make their market presence by introducing new products, entering into partnerships, or by entering into strategic mergers and acquisitions.

January 2019 - Tetley parent company Tata Global Beverages installed fully automated and bespoke machine made by Sewtec, to accommodate the launch of its latest fruit tea product line to market. This machine can pack 2,000 tea bags per minute.

Automatic Tea Bag Packaging Equipment Market Leaders

-

I.M.A. Industria Macchine Automatiche SpA

-

Xiamen Sengong Packing Equipment Co. Ltd.

-

ACMA S.p.A. (Coesia S.p.A.)

-

Dongguan Sammi Packing machine Co.,Ltd

-

Teepack Spezialmaschinen GmbH & Company KG

*Disclaimer: Major Players sorted in no particular order

Automatic Tea Bag Packaging Equipment Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increasing Awareness Regarding Health Benefits Associated with the Consumption of Tea

- 4.3.2 Growing Requirement for Automation in Tea Packaging Industry

-

4.4 Market Restraints

- 4.4.1 High Initial Investment Cost

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Snapshot

5. MARKET SEGMENTATION

-

5.1 By Raw Material Packaging Type

- 5.1.1 Paper

- 5.1.2 Nylon

- 5.1.3 Silk

- 5.1.4 Other Types

-

5.2 By Packaging Bag Shape

- 5.2.1 Round

- 5.2.2 Pyramid

- 5.2.3 Other Packaging Shapes

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Teepack Spezialmaschinen GmbH & Company KG

- 6.1.2 Xiamen Sengong Packing Equipment Co. Ltd

- 6.1.3 I.M.A. Industria Macchine Automatiche SpA

- 6.1.4 Dongguan Sammi Packing machine Co.,Ltd

- 6.1.5 ACMA S.p.A. (Coesia S.p.A.)

- 6.1.6 FUSO International (Nasa Corporation)

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. INVESTMENT ANALYSIS

** Subject To AvailablityAutomatic Tea Bag Packaging Equipment Industry Segmentation

In the tea industry, the demand for varieties of black, green, herbal, and fruit infusions is getting stronger day-by-day. Packaging has a key role to play for the tea market as it not only preserves and protects the product within, but also communicates a brand’s message. It is viewed to be almost as critical as the selection of the product itself, and is the reason that tea packaging has become so creative and versatile.

| By Raw Material Packaging Type | Paper |

| Nylon | |

| Silk | |

| Other Types | |

| By Packaging Bag Shape | Round |

| Pyramid | |

| Other Packaging Shapes | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| Latin America | |

| Middle East and Africa |

Automatic Tea Bag Packaging Equipment Market Research FAQs

What is the current Automatic Tea Bag Packaging Equipment Market size?

The Automatic Tea Bag Packaging Equipment Market is projected to register a CAGR of 4.90% during the forecast period (2024-2029)

Who are the key players in Automatic Tea Bag Packaging Equipment Market?

I.M.A. Industria Macchine Automatiche SpA, Xiamen Sengong Packing Equipment Co. Ltd., ACMA S.p.A. (Coesia S.p.A.), Dongguan Sammi Packing machine Co.,Ltd and Teepack Spezialmaschinen GmbH & Company KG are the major companies operating in the Automatic Tea Bag Packaging Equipment Market.

Which is the fastest growing region in Automatic Tea Bag Packaging Equipment Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Automatic Tea Bag Packaging Equipment Market?

In 2024, the Europe accounts for the largest market share in Automatic Tea Bag Packaging Equipment Market.

What years does this Automatic Tea Bag Packaging Equipment Market cover?

The report covers the Automatic Tea Bag Packaging Equipment Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Automatic Tea Bag Packaging Equipment Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Automatic Tea Bag Packaging Equipment Industry Report

Statistics for the 2024 Automatic Tea Bag Packaging Equipment market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Automatic Tea Bag Packaging Equipment analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.