Automotive Camera Industry Overview

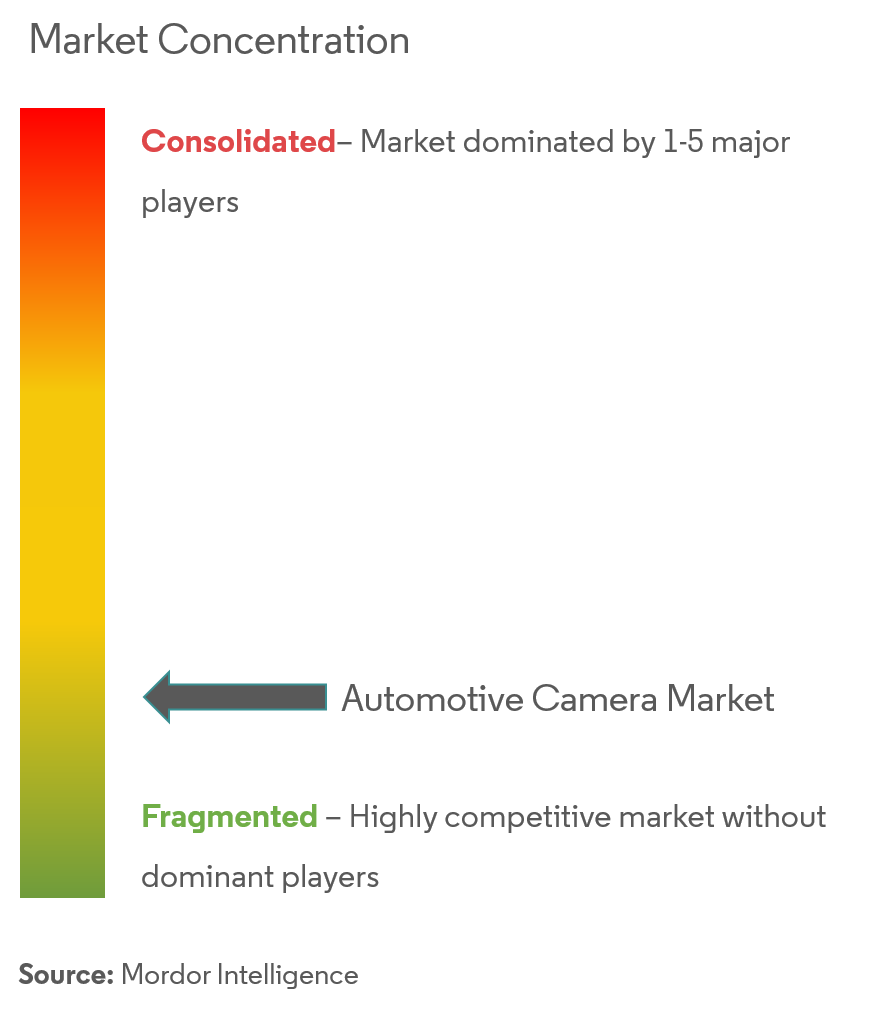

The automotive camera market is highly fragmented due to the presence of many regional players. However, some major players, like Garmin Ltd, Panasonic Corporation, Continental AG, Autoliv Inc., Bosch Mobility Solutions, and Magna International, captured significant shares in the market. These companies are focusing on strategic collaborative initiatives to expand their market shares and profitability. For instance,

- In September 2020, OMNIVISION Technologies, Inc. and GEO Semiconductor Inc. announced a joint solution optimized to provide the industry's highest quality images for rear-view cameras (RVCs) and surround-view systems (SVS) and e-mirrors. This solution includes OmniVision's OXO3C10, the world's only automotive image sensor that combines a large 3.0-micron pixel, high dynamic range of 140 dB for minimized motion artifacts, and the highest LED flicker mitigation (LFM) performance.

- In July 2020, ZF, the world's leading supplier of automotive cameras, announced that it had launched its S-Cam4.8 with enhanced vision technology from Mobileye, an Intel Company, on the new Nissan Rogue in the U.S. For light passenger vehicles in the near term, ZF is focusing on Level 2/2+ systems that utilize advanced camera technologies like the S-Cam4.8 and Tri-Cam4 for leading global automakers and plans to its coAssist Level2+ system, the most affordable Level2+ system available at well under USD 1,000, with a major Asian automaker by the end of 2022.

- In September 2019, Bosch developed an MPC3 mono video camera for applications such as advanced driver assistance systems (ADAS) and autonomous driving. The new camera utilizes a multi-path approach and artificial intelligence (AI) for more efficient recognition.

- In August 2019, Continental unveiled new system solutions for safer automated driving. It developed a combined camera system comprising an inward-looking infra-red camera and an outward-looking camera. The system can simultaneously monitor the driver and the surrounding vehicles.

Automotive Camera Market Leaders

-

Garmin Ltd

-

Continental AG

-

Panasonic Corporation

-

Magna International Inc.

-

Bosch Mobility Solutions

- *Disclaimer: Major Players sorted in no particular order