Automotive Inertial Systems Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 4.01 % |

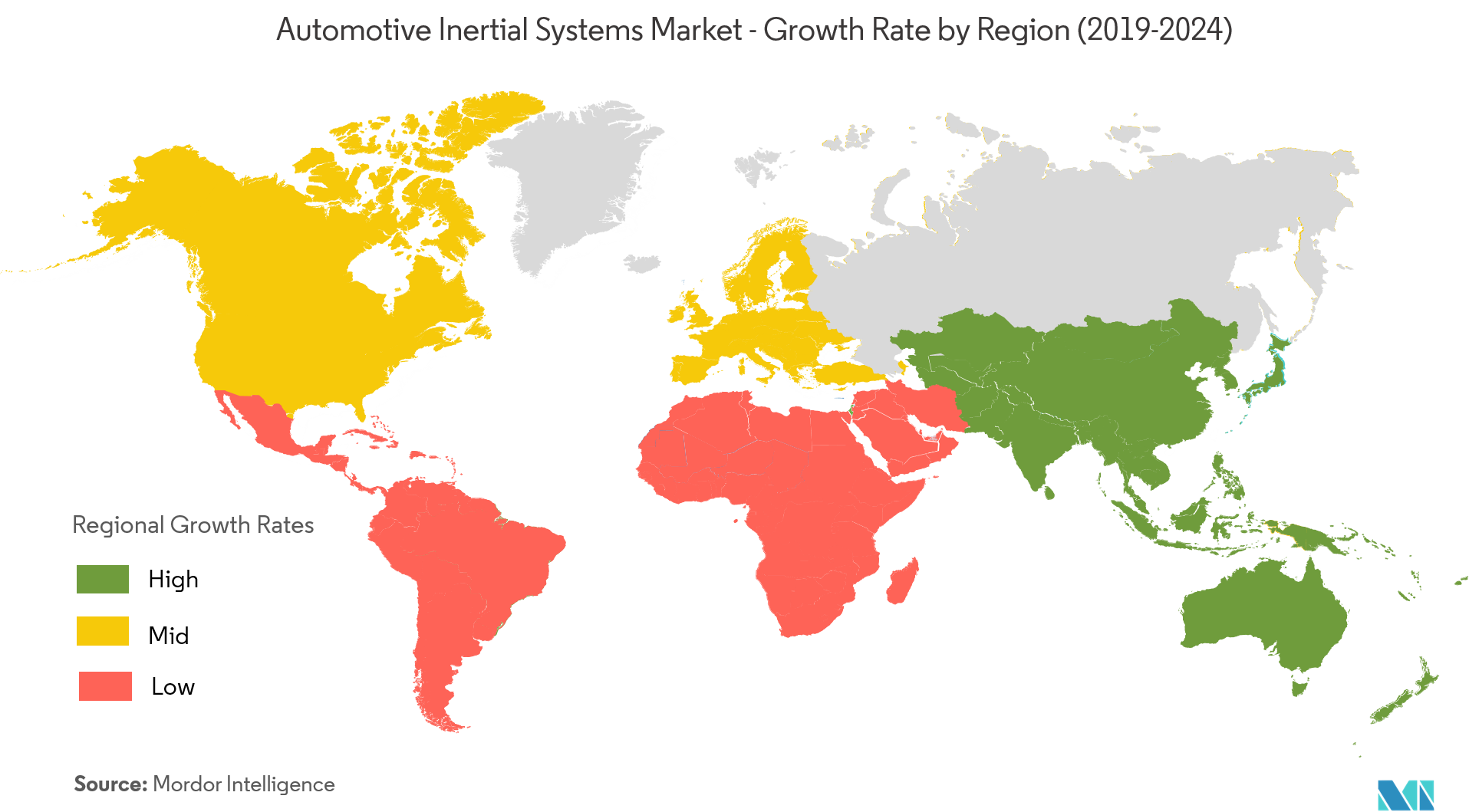

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

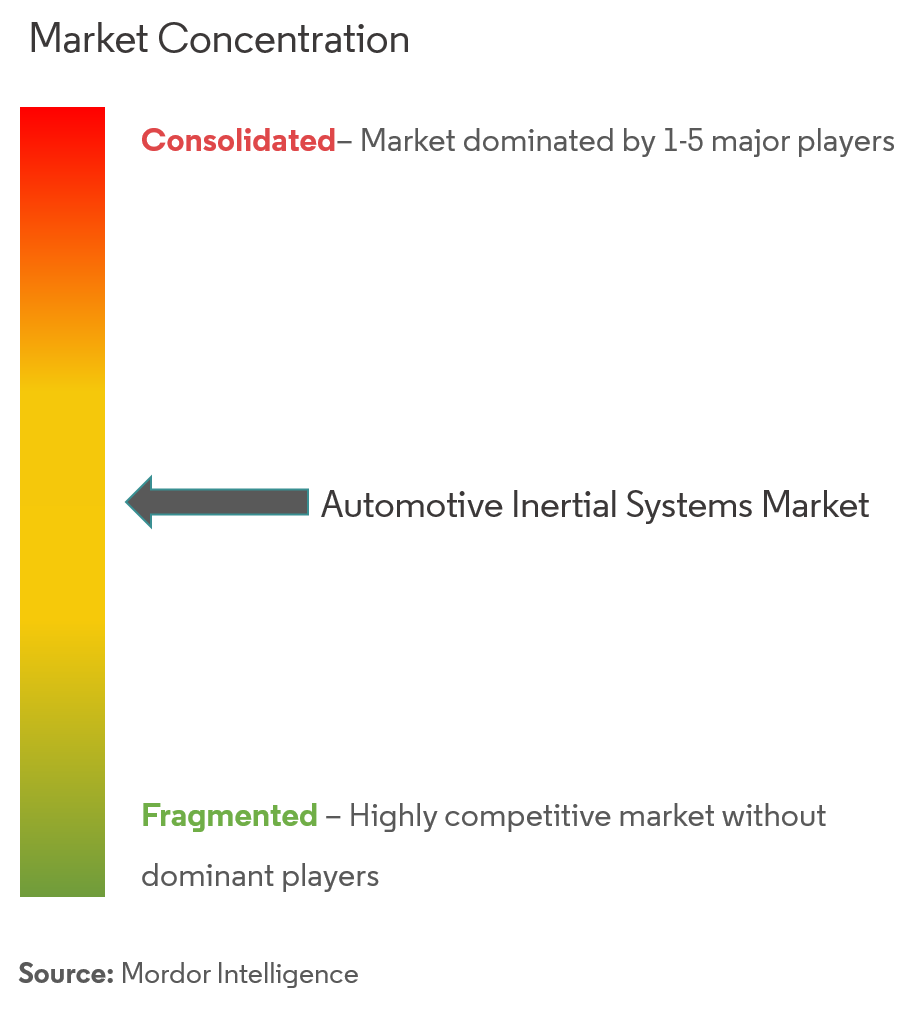

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Automotive Inertial Systems Market Analysis

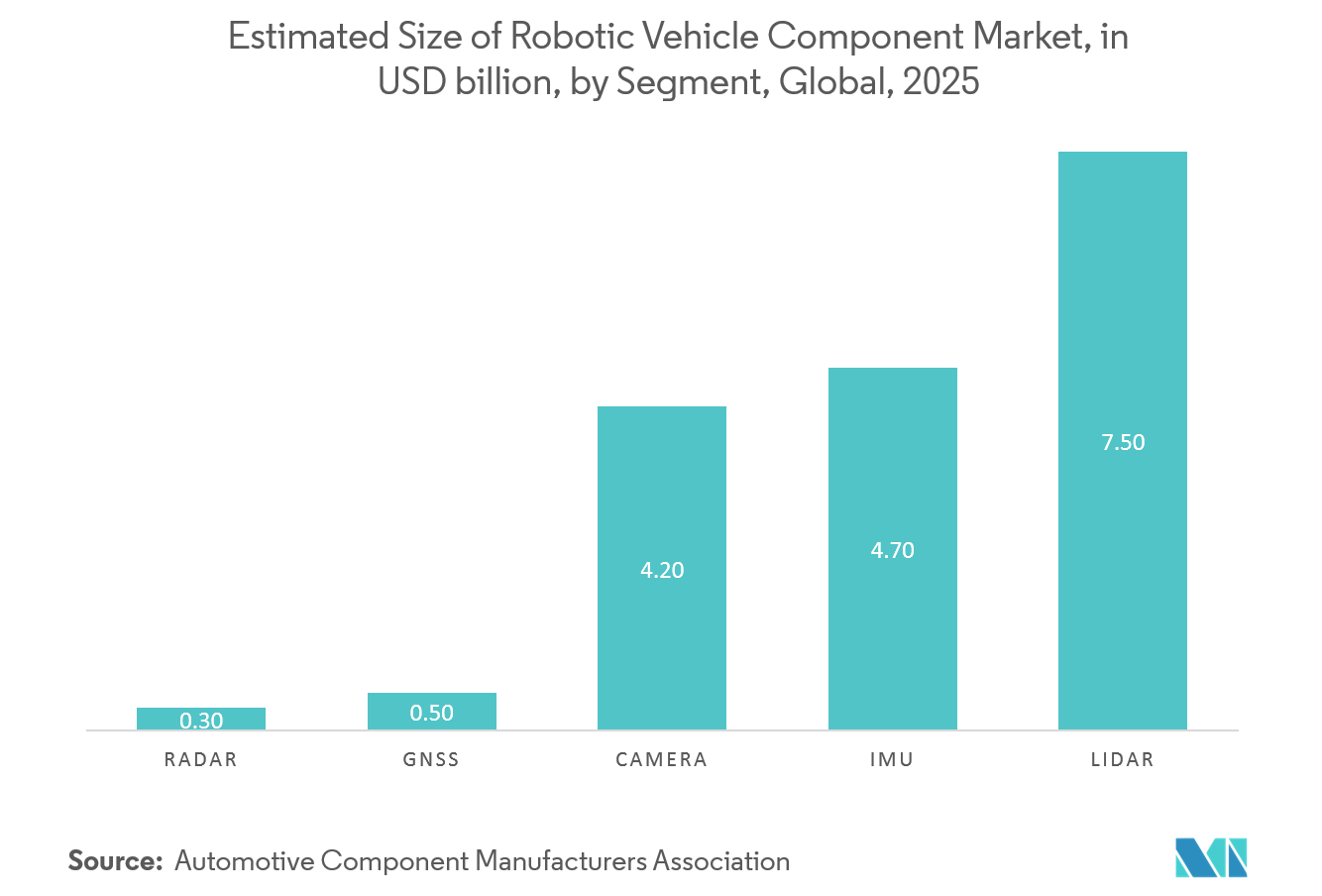

The Automotive Inertial Systems Market was valued at USD 1871.1 million in 2020 and expected to reach USD 2361.31 million by 2026 and grow at a CAGR of 4.01% over the forecast period (2021 - 2026). Inertial systems comprise IMUs in combination with high-performance sensors (gyroscopes, magnetometers, and accelerometers), to provide high-accuracy information about the surrounding environment, through relative movement. The powerful combination of IMUs with other onboard sensors produces critical data increasing the reliability of the vehicles and leading to new automation breakthroughs in automotive applications.

- The emergence of micro-electromechanical systems (MEMS) technology resulted in the miniaturization of mechanical and electro-mechanical elements in the field of sensors and semiconductors, with the help of micro-fabrication and micro-machining techniques. Hence, MEMS has now become an important part of several automation components in Level 1, 2, and 3 autonomous cars, boosting demand for inertial systems from the automotive sector significantly.

- The growing demand for safety in automobiles is boosting the market's growth positively. According to the World Health Organization, globally, approximately 1.35 million people are killed in road accidents every year. Moreover, between 20 and 50 million more people suffer non-fatal injuries, with many incurring a disability as the result of their injury. MEMS accelerometers play an important role in improving the safety features of vehicles.

- The current generation of automobiles highly relies on the collection of data from various sensors used in the vehicle. Gyroscopes and accelerometers provide essential measurements for improving the control and stability of the vehicle. Both these sensors are liable to make significant noise at low frequency, resulting in low accuracy of the measurements, especially under the low-dynamic conditions, thereby accelerating the market demand during the forecast period.

Automotive Inertial Systems Market Trends

This section covers the major market trends shaping the Automotive Inertial Systems Market according to our research experts:

Inertial Measurement Unit is Gaining Traction Due to Emergence of Automotive Inertial Systems

- Inertial Measurement Unit (IMU) allows the measurement of transitional as well as rotational accelerations by combining several inertial sensors including, accelerometer, gyroscope, and sometimes magnetometer to enable reading of six dimensions (yaw, roll and pitch rate as well as lateral, longitudinal and vertical accelerations) around the three axes while driving.

- The IMUs are used at a multitude of automotive applications as well as for the latest ADAS functioning for autonomous driving. It helps to fill the gap in GPS while the vehicle moving towards the blind spot and when LiDAR functionality struggles in a snowstorm.

- Owing to the high resonance frequency of over 25 kHz in IMU along with closed driving and evaluation unit, it provides high barrier to mechanical interference. The inertial measuring unit (IMU) has gained popularity for the application on contributing to active and passive safety systems such as ESP (Electronic Stability Control Program), airbag control unit, and driver assistance systems like the adaptive cruise control. This enhances the offset performance with an integrated microcontroller.

Asia-Pacific to Register a Significant Growth During the Forecast Period

- Asia-Pacific is a significant market for automotive inertial systems in the current market scenario. Huge volume production in countries such as China, Japan, and India keeps a constant demand for automotive inertial systems in the region. However, in recent times, sales of the new vehicle in certain parts of the region have been sluggish. The witnessed a decrease in car sales across various economies. For instance, according to the Japan Automotive Dealers Association and Japan Light Motor Vehicle and Motorcycle Association, 2,895,454 cars were sold in Japan in 2018 which decreased by 1.6% compared to 2017.

- Further, Electric vehicles (EVs) are projected to gain popularity with Chinese car owners this year, as new designs with improved performance offset a government cut in price subsidies. According to the International Energy Agency forecasts, In 2017, China had the largest EV market, where EVs accounted for 2.2% of new cars sold in the country. The Chinese government sees EVs as an opportunity for China to compete and become a major car manufacturer.

- Furthermore, the electric vehicle market is gaining momentum in India owing to the ambitious plans and initiatives of the government. Public authorities in India have made a number of electric vehicle-related policy announcements over the past few years showing strong commitment, concrete action, and significant ambition for the deployment of electric vehicles in the country.

Automotive Inertial Systems Industry Overview

The automotive inertial systems market is moderately competitive and consists of a few major players. In terms of market share, some of theplayers currently dominate the market. However, with the advancement in sensor technology across the inertial systems, new players are increasing their market presence thereby expanding their business footprint across the emerging economies.

- October2019 -Honeywell launched the HGuide i300, which is a high-performance MEMS-based Inertial Measurement Unit (IMU) designed to meet the needs of applications across various markets, including agriculture, AUVs, industrial equipment, robotics, survey/mapping, stabilized platforms, transportation, UAVs, and UGVs. With industry-standard communication interfaces and a wide-input voltage range, the HGuide i300 can be easily integrated into a variety of architectures. The extremely small size, lightweight, and low power make the HGuide i300 ideal for many applications.

- June 2019 -Emcore announced a new addition to the Emcore-Orion series of Micro Inertial Navigation (MINAV) systems. It was launched at the at the Paris Air Show. The EN-2000 is a closed-loop, solid-state design that will deliver higher performance at lower cost than traditional RLG (Ring Laser Gyroscope) navigation systems.

Automotive Inertial Systems Market Leaders

-

Honeywell International Inc.

-

Robert Bosch GmbH

-

MEMSIC Inc.

-

TE Connectivity Ltd

-

EMCORE Corporation

*Disclaimer: Major Players sorted in no particular order

Automotive Inertial Systems Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Component

- 5.1.1 Accelerometer

- 5.1.2 Gyroscope

- 5.1.3 Inertial Measurement Systems (IMU)

- 5.1.4 Inertial Navigation Systems (INS)

- 5.1.5 Other Components

-

5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Honeywell International Inc.

- 6.1.2 Robert Bosch GmbH

- 6.1.3 MEMSIC Inc.

- 6.1.4 EMCORE Corporation

- 6.1.5 TE Connectivity Ltd

- 6.1.6 Lord Corporation (Microstrain Inc.)

- 6.1.7 Xsens Inc.

- 6.1.8 Vectornav Technologies

- 6.1.9 SBG Systems

- 6.1.10 Aceinna Inc.

- 6.1.11 Continental AG

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityAutomotive Inertial Systems Industry Segmentation

| By Component | Accelerometer |

| Gyroscope | |

| Inertial Measurement Systems (IMU) | |

| Inertial Navigation Systems (INS) | |

| Other Components | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Automotive Inertial Systems Market Research FAQs

What is the current Automotive Inertial Systems Market size?

The Automotive Inertial Systems Market is projected to register a CAGR of 4.01% during the forecast period (2024-2029)

Who are the key players in Automotive Inertial Systems Market?

Honeywell International Inc., Robert Bosch GmbH, MEMSIC Inc., TE Connectivity Ltd and EMCORE Corporation are the major companies operating in the Automotive Inertial Systems Market.

Which is the fastest growing region in Automotive Inertial Systems Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Automotive Inertial Systems Market?

In 2024, the North America accounts for the largest market share in Automotive Inertial Systems Market.

What years does this Automotive Inertial Systems Market cover?

The report covers the Automotive Inertial Systems Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Automotive Inertial Systems Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Automotive Inertial Systems Industry Report

Statistics for the 2023 Automotive Inertial Systems market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Automotive Inertial Systems analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.