Automotive Power Module Packaging Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 7.50 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

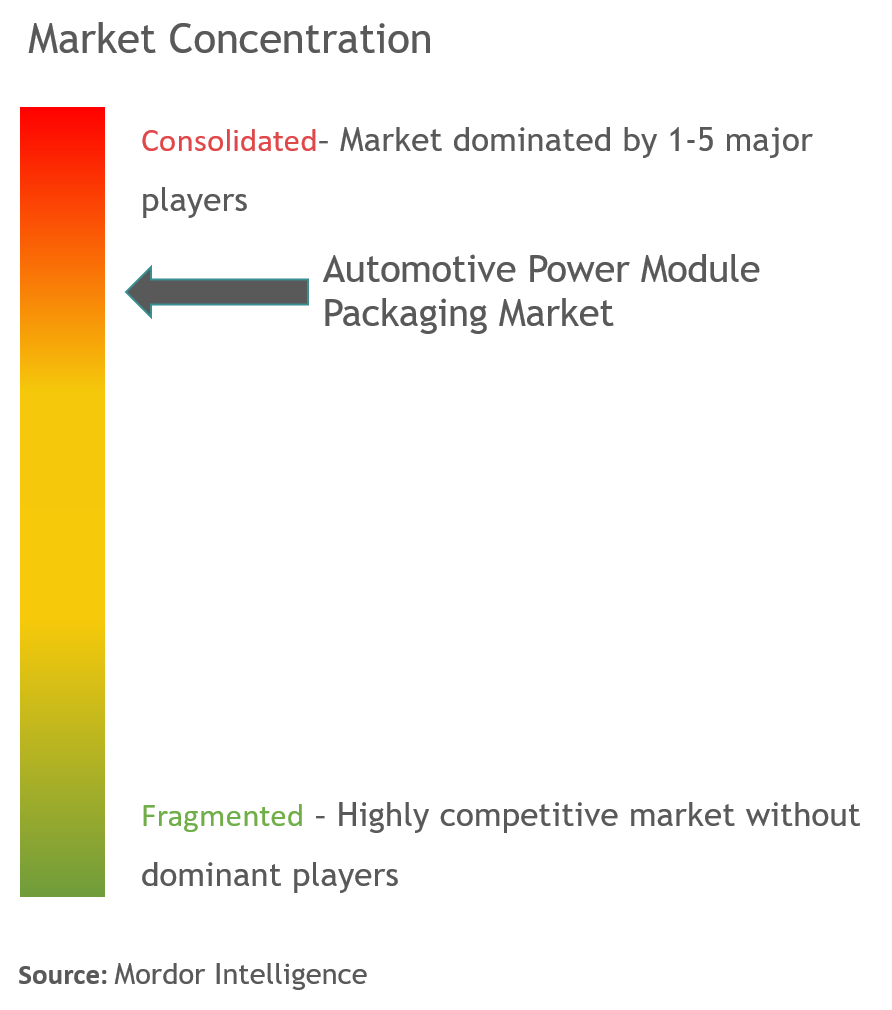

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Automotive Power Module Packaging Market Analysis

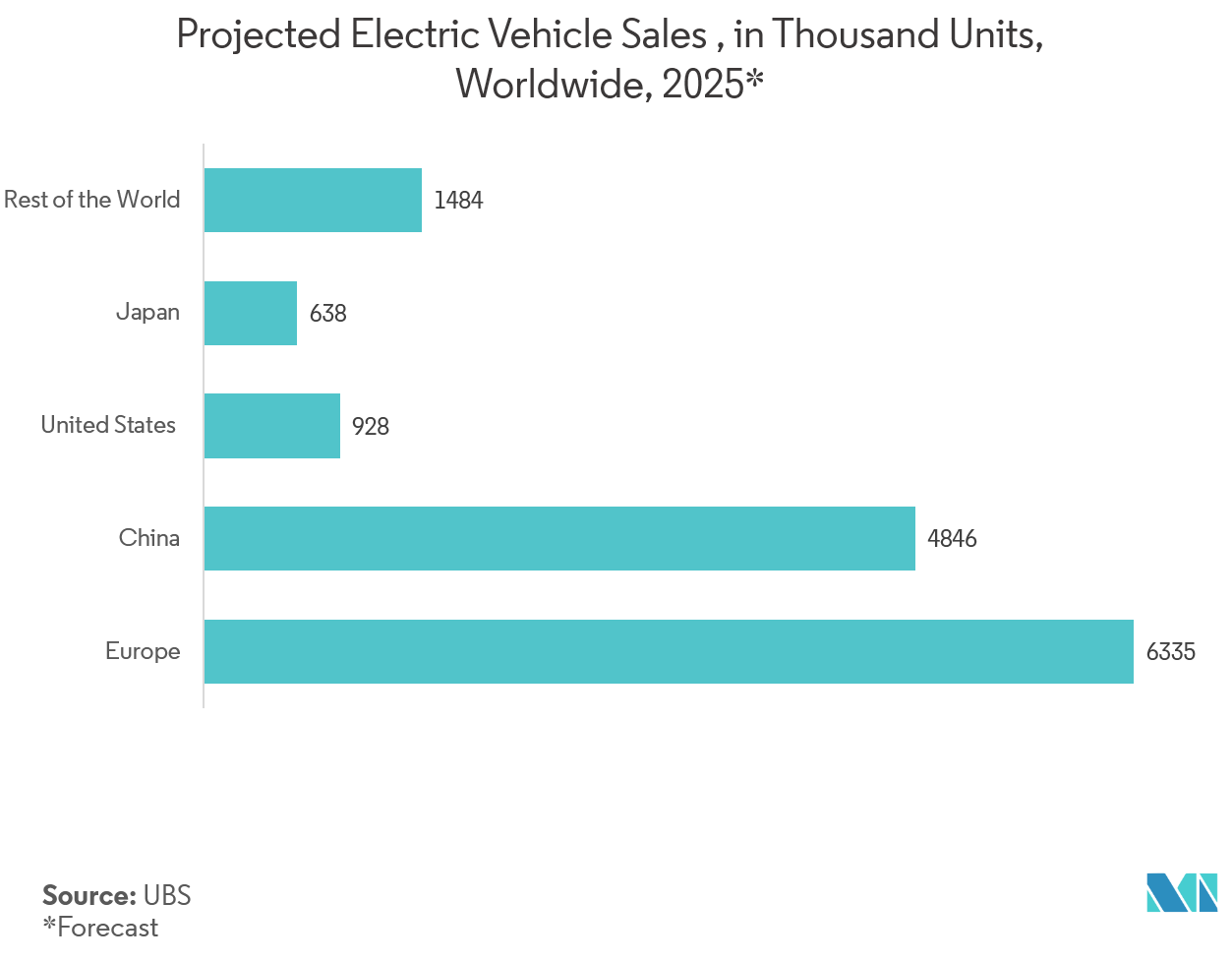

The automotive power module packaging market is expected to grow with a CAGR of 7.5%, over the forecast period (2021 - 2026). The demand for sustainable energy is increasing with people exploiting sustainable and clean energy to mitigate the global crisis of fossil energy. The automotive module has seen a steep growth with efforts to popularize hybrid electric vehicle (HEV) and electric vehicle (EV), thus driving the automotive power module packaging market.

- A number of environmental, economic and social factors are influencing future vehicle designs and powertrain choices. Power semiconductors are the key components in the powertrain systems of electric vehicles (EVs), hybrid electric vehicles (HEVs) and plug-in hybrid vehicles (PHEVs). As the number of electric and electrified vehicles (HEV and PHEV) increases, demand for sophisticated power electronics solutions reducing electrical losses, system weight and total cost of ownership will increase.

- For instance, in January 2018, Mitsubishi Electric Corporation announced that it has developed a 6.5 kV full silicon carbide (SiC) power semiconductor module that is believed to offer the highest power density among other power semiconductors modules rated from 1.7 kV to 6.5 kV. It is expected that the module to lead to smaller and more energy-efficient power equipment for high-voltage railcars and electric power systems.

- Moreover, growing focus by consumers and OEMs on minimizing power losses, increasing power density, and maximizing power savings are driving the growth of this market.

- A lack of standard protocols for the development of power modules and the rising complexity in the design and packaging results in the rise of the overall cost of the vehicle, which is considered as the key restraining factor for the growth of this market.

Automotive Power Module Packaging Market Trends

This section covers the major market trends shaping the Automotive Power Module Packaging Market according to our research experts:

Electric Vehicle and Hybrid Electric Vehicle to Drive the Automotive Power Module Packaging

- Over the past decade, electric vehicle technologies have gained significant progress due to the added advancement in electric motor drives, power converters, on-board batteries and systems integration.

- Advanced electric drive vehicles such as hybrid-electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), range-extended electric vehicle (REEV) and pure electric vehicles (EVs) employed advanced power electronics devices to control the flow of electrical energy from the on-board battery to the traction motors and other accessories.

- In advanced power electronics systems, apart from control topology and components, packaging plays an important role to improve the overall efficiency and reliability.

- Initially, the automotive power module packaging followed the standard of industrial drive module packaging, using the well-established wire bond technology. Such a basic packaging structure has gone through significant improvements in the pursuit of better electrical and thermal performance, reliability and cost-effectiveness.

- Need for improving the present practice of packaging in power electronics modules is amplified due to the stringent requirements of electric vehicles. The pursuit for higher current density is expected to be continued, and it brings along with it a need for continued improvement of cooling. Advancement in power electronic packaging is essential to support these needs.

- As the demand for Electric Vehicle will increase, the requirement of power module packaging will also increase to support the high power density and mechatronics integration.

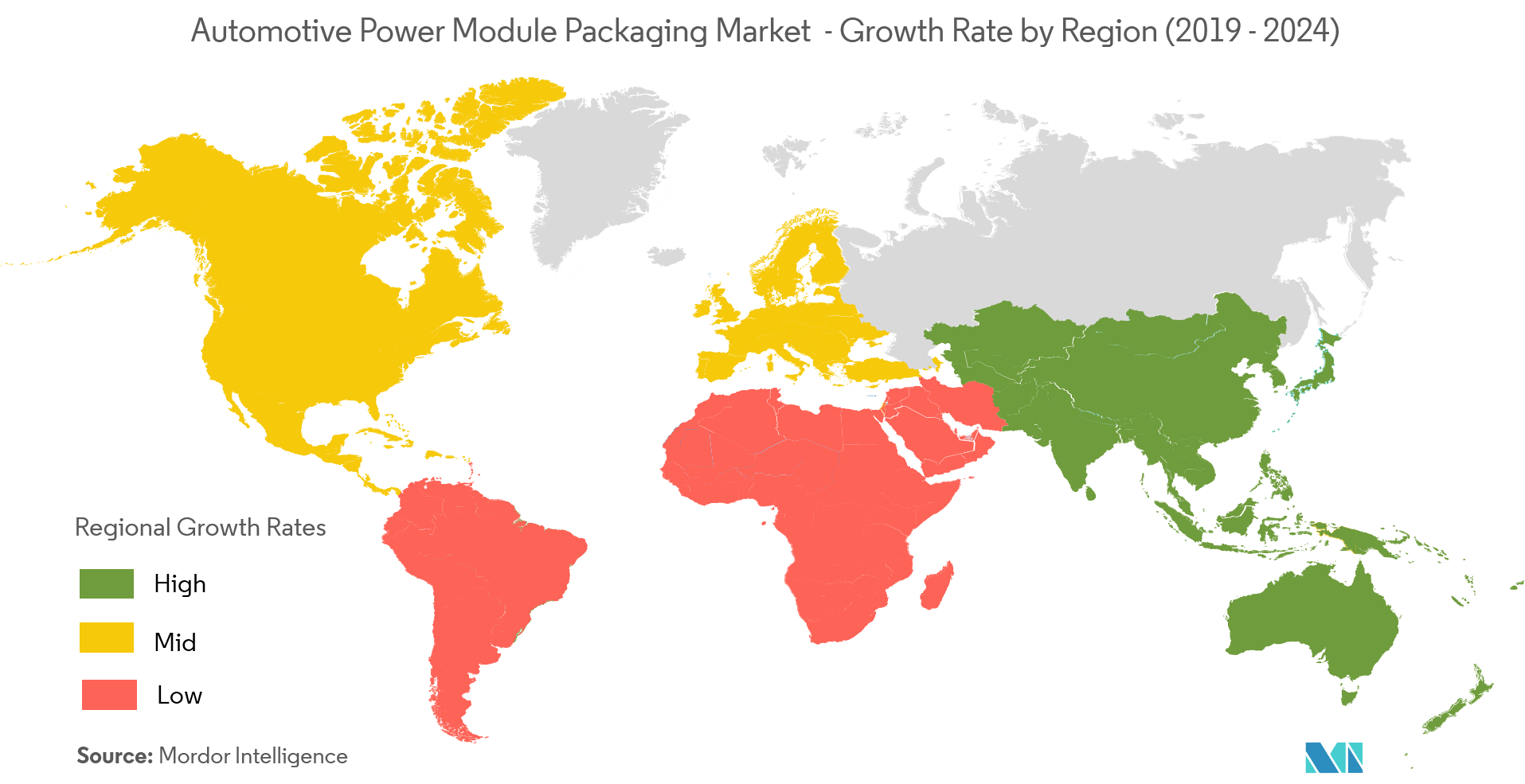

Asia-Pacific is Expected to Register Highest Growith Rate

- The Asia-Pacific region is estimated to hold the largest market share during the forecast period owing to growing automotive infrastructure and increases in sales of electric vehicles across the region.

- Increasing uses of electrification in vehicles is expected to boost the demand for automotive power module packaging market in this region.

- Furthermore, increasing investment by public and private players to develop automotive power modules such as power inverter, integrated dual charger, among others and the rise in demand for safety features in vehicles across the region are contributing in the growth of this market in this region.

- Moreover, the governments of countries, like China and India, where the pollution is rampant, are taking actions to reduce the pollution issue, thereby resulting in the rise in sales of the alternative fuel engines and green vehicles, such as the electric vehicle, hybrid electric vehicle, among others.

Automotive Power Module Packaging Industry Overview

The automotive power module packaging market isvery competitive in nature. The market is highly consolidateddue to the presence of largeplayers. The major players in the market are Amkor Technology, Kulicke & Soffa, PTI Technology Inc., Infineon Technologies, STMicroelectronics, Fuji Electric Co. Ltd., Toshiba Electronic Device & Storage Corporation, among others.

- September 2019 -STMicroelectronics planned to supply advanced silicon-carbide power electronics to Renault-Nissan-Mitsubishi for high-speed battery charging in Next-Generation Electric Vehicles.

- May 2019 -New Infineon HybridPACKpower modules enable fast and flexible electrification of vehicles to support the automotive industry in building up a broad and cost-competitive portfolio of hybrid and electric vehicles. Furthermore, Infineon introduces the HybridPACK Double-Sided Cooling (DSC) S2, a technology upgrade to the existing HybridPACK DSC. This module targets main inverters up to 80 kW in hybrid and plug-in hybrid electric vehicles with high power density requirements.

Automotive Power Module Packaging Market Leaders

-

Amkor Technologies

-

Infineon Technologies

-

STMicroelectronics

-

Fuji Electric Co. Ltd.

-

Toshiba Electronics Device & Storage Corporation

*Disclaimer: Major Players sorted in no particular order

Automotive Power Module Packaging Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Electric Vehicle and Hybrid Electric Vehicle to Drive the Automotive Power Module Packaging

- 4.3.2 Growing Demand Energy Efficient Battery Powered Devices.

- 4.3.3 Increasing Stringency of Emission Standards

-

4.4 Market Restraints

- 4.4.1 Lack of Standard Protocols for the Development of Power Modules

- 4.4.2 Slow Adoption of New Technologies Derailing Innovation

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Technology Snapshot

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Intelligent Power Module (IPM)

- 5.1.2 SiC Module

- 5.1.3 GaN Module

- 5.1.4 Others (IGBT,FET)

-

5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Amkor Technology

- 6.1.2 Kulicke and Soffa Industries Inc.

- 6.1.3 PTI Technology Inc.

- 6.1.4 Infineon Technologies

- 6.1.5 STMicroelectronics

- 6.1.6 Fuji Electric Co. Ltd.

- 6.1.7 Toshiba Electronic Device & Storage Corporation

- 6.1.8 Semikron

- 6.1.9 STATS ChipPAC Ltd. (JCET)

- 6.1.10 Starpower Semiconductor Ltd.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityAutomotive Power Module Packaging Industry Segmentation

Packaging of automotive power modules needs to meet high-reliability standards like harsh operating environment (which includes high ambient temperature range, high operating temperature, temperature excursion, and thermal shock), mechanical vibration and shock, and frequent power surging. To ensure reliable operation of the power module, packaging of the power modules has been intensively modified in terms of packaging materials and processing as well as in terms of reliability design. The Electric Vehicle and Hybrid Electric Vehicle (EV/HEV) industry’s demand for high power density and mechatronics integration is the main driver for automotive power module packaging market.

| By Type | Intelligent Power Module (IPM) |

| SiC Module | |

| GaN Module | |

| Others (IGBT,FET) | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Automotive Power Module Packaging Market Research FAQs

What is the current Automotive Power Module Packaging Market size?

The Automotive Power Module Packaging Market is projected to register a CAGR of 7.5% during the forecast period (2024-2029)

Who are the key players in Automotive Power Module Packaging Market?

Amkor Technologies, Infineon Technologies, STMicroelectronics, Fuji Electric Co. Ltd. and Toshiba Electronics Device & Storage Corporation are the major companies operating in the Automotive Power Module Packaging Market.

Which is the fastest growing region in Automotive Power Module Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Automotive Power Module Packaging Market?

In 2024, the Asia Pacific accounts for the largest market share in Automotive Power Module Packaging Market.

What years does this Automotive Power Module Packaging Market cover?

The report covers the Automotive Power Module Packaging Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Automotive Power Module Packaging Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Automotive Power Module Packaging Industry Report

Statistics for the 2024 Automotive Power Module Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Automotive Power Module Packaging analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.