Automotive Telematics Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 28.44 Billion |

| Market Size (2029) | USD 38.22 Billion |

| CAGR (2024 - 2029) | 15.30 % |

| Fastest Growing Market | Asia-Pacific |

| Largest Market | Asia Pacific |

Major Players.webp)

*Disclaimer: Major Players sorted in no particular order |

Automotive Telematics Market Analysis

The Automotive Telematics System Market size is estimated at USD 28.44 billion in 2024, and is expected to reach USD 38.22 billion by 2029, growing at a CAGR of greater than 15.30% during the forecast period (2024-2029).

- The Telematics system comprises electronic, electromechanical, and electromagnetic devices, usually silicon micro-machined components, operating in conjunction with computer-controlled devices and radio transceivers to monitor vehicle operations and precisely provide functional details. Most telematics systems offer stolen-vehicle assistance, such as locating a vehicle using a global positioning system (GPS).

- Moreover, by combining GPS with onboard diagnostics, it is possible to record and map the location of a car and its speed to cross-reference how a car is behaving internally. Insurance companies predominantly use such information. Additionally, telematics devices are used to manage a vehicle fleet efficiently. The services mentioned above offered by the telematics system have been considered in the scope of the market.

- Over the long term, The use of automotive telematics in electric vehicles (EVs) is also expected to propel the growth of the market in the future. The leading vendors are looking forward to leveraging the opportunities presented by introducing EVs into the market.

- Equipping new vehicles with e-Call, as a mandate from the European Commission, has also helped expand the European telematics market. The region is also home to several automotive telematics hardware suppliers in countries like Germany, the United Kingdom, and Italy.

- Safety constitutes a major part of the services offered by automotive telematics. Wireless vehicle safety communications telematics majorly enhances car safety and road safety. The electronic sub-system in a car is used to exchange safety information about road hazards, location, and speed of vehicles.

- In addition to wireless local area networks, emergency warning systems telematics are developed like collision warning for international harmonization and standardization of vehicle-to-vehicle, infrastructure-to-vehicle, and vehicle-to-infrastructure to provide real-time, short-range communication systems. Information from telematics is also used extensively in car-sharing and auto insurance purposes.

- The Asia-Pacific region is the largest market for automobiles in the world. Despite the Chinese market experiencing sluggish growth, which is the largest automobile market in the world, the region is expected to lead in the automotive telematics system market.

Automotive Telematics Market Trends

Safety and Security to Witness Faster Growth

- Tracking stolen vehicles, automatically alerting the help centers in case of accidents, driver monitoring, and remote locking/unlocking of vehicles are the typical applications offered under the safety and security features of telematics devices.

- To reduce road accidents, governments are raising the bar for the safety evaluation of vehicles and reducing the turnaround time for medical help to vehicle operators in case of emergencies.

- Additionally, players in the automotive industry have been consistently working to improve vehicle safety and security features by enhancing vehicle telematics technology to meet the growing regulation standards in the respective regions.

- In March 2022, Navistar announced it would include a factory-installed telematics device as standard on all new builds of the complete Class 6-8 International Truck and IC Bus vehicle product portfolios, including electric models.

- The above trends toward the development of vehicle telematics and growing safety standards in the automotive industry are likely to drive automakers to incorporate more safety and security features in their new vehicle models as a standard. Therefore, it is expected that there will be faster growth in the market for telematics devices used for vehicle safety and security applications during the forecast period.

Asia-Pacific Expected to Capture Major Market Share

- Asia-Pacific is one of the fastest emerging markets, due to its growing demand for fuel-efficient vehicles, along with the navigation feature (such as GPS) as a standard option to tackle issues like growing fuel prices, increasing number of accidents, and vehicle thefts.

- India recently released its first Automotive Research Association of India (ARAI) certified AIS (Automotive Industry Standard) 140 - a compliant vehicle telematics and emergency button solution.

- The AIS 140 regulation is in line with the Indian Ministry of Road Transport and Highways (MoRTH) 2016 dictate. The implementation of the AIS 140 regulation began on April 1, 2018, and it mandated a vehicle tracking device and one or more emergency buttons in all existing and new public service vehicles.

- In April 2022, Borqs Technologies, Inc. announced that it is collaborating with Qualcomm Technologies, Inc. to engage in the R&D and sales of automobile telematics products, especially for the Indian and Southeast Asia markets. The products include an in-vehicle-infotainment system (IVI) and Telematics Control Unit (TCU) for two and three-wheelers. All of these products are based on technologies in Qualcomm chipsets.

- Implementing such regulations toward improving vehicle safety and security across Asia-Pacific countries is expected to propel faster adoption of vehicle telematics during the forecast period.

Automotive Telematics Industry Overview

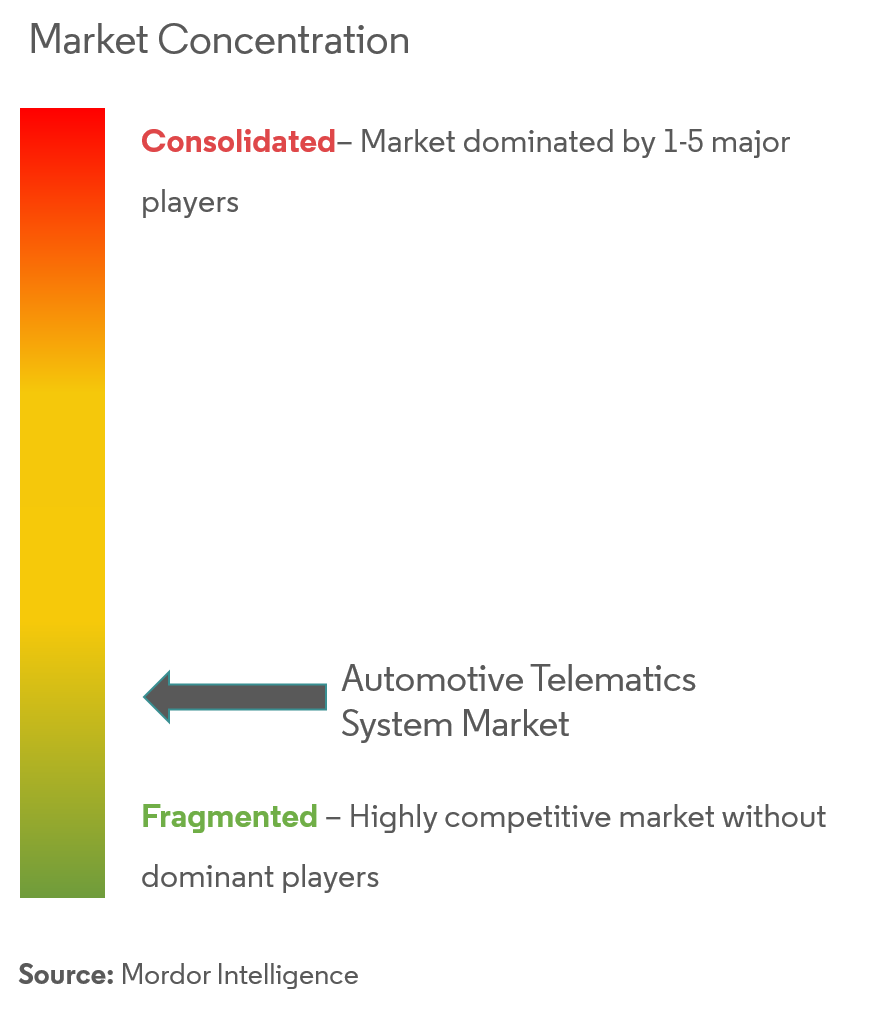

The global automotive telematics market is highly fragmented due to the presence of many regional players. However, some major players, like Continental AG, DENSO Corporation, Ficosa International SA, Magnetic Marelli SpA, and Robert Bosch GmbH, have captured significant shares in the market.

In March 2022, Geotab, a global leader in IoT and connected transportation, announced its partnership with Free2Move, the global fleet, mobility, and connected data company of Stellantis.

Through this partnership, Geotab plans to deliver a Geotab Integrated Solution for Stellantis vehicles, including Ram, Dodge, Jeep, and Chrysler.

In March 2022, Bosch Limited acquired up to 14% of the paid-up capital of Zeliot Connected Services Private Limited. Zeliot is a B2B start-up offering connected mobility solutions for vehicle tracking, fleet management, and telematics.

Automotive Telematics Market Leaders

-

Ficosa International SA

-

ACTIA Group

-

Robert Bosch GmbH

-

Continental AG

-

Magnetic Marelli SpA

*Disclaimer: Major Players sorted in no particular order

Automotive Telematics Market News

- May 2023: Targa Telematics made a significant announcement about acquiring Viasat Group Spa, resulting in the formation of a major global player in the IoT field. This acquisition will pave the way for innovative solutions and digital services for connected mobility, reaching eight key European countries: Italy, Portugal, Spain, France, the UK, Belgium, Poland, and Romania, in addition to a company in Chile.

- May 2023: Bridgestone Mobility Solutions revealed its partnership with RIO, a digital service provider. This collaboration enables Bridgestone's Webfleet to integrate its telematic solutions seamlessly into all MAN trucks equipped with existing original equipment manufacturer (OEM) hardware RIO boxes from MAN.

- May 2023: ZF Friedrichshafen AG introduced its cutting-edge AxTrax 2 electric axle platform, designed to cater to various commercial vehicle types. The system boasts full synchronization with crucial vehicle functions such as braking, advanced driver-assistance system (ADAS), and automated driving systems while also facilitating communication and information sharing through telematics systems via the CAN bus.

Automotive Telematics Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

-

4.1 Market Drivers

- 4.1.1 Safety and Security to Witness Faster Growth

- 4.1.2 Others

-

4.2 Market Restraints

- 4.2.1 Disturbances in Supply Chain Due to Chip Shortage

- 4.2.2 Others

-

4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Service

- 5.1.1 Infotainment and Navigation

- 5.1.2 Fleet Management

- 5.1.3 Safety and Security

- 5.1.4 Diagnostics

-

5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 Brazil

- 5.2.4.2 Saudi Arabia

- 5.2.4.3 Other Countries

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

-

6.2 Company Profiles*

- 6.2.1 Continental AG

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Clarion Co. Ltd (Faurecia Clarion Electronics)

- 6.2.4 ACTIA Group

- 6.2.5 Octo Telematics

- 6.2.6 Magnetic Marelli SpA

- 6.2.7 Valeo Group

- 6.2.8 NavInfo Co. Ltd

- 6.2.9 Ficosa International SA

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityAutomotive Telematics Industry Segmentation

An automotive telematics system is a technology that combines telecommunications and informatics to gather and transmit real-time data from vehicles to a central platform. This system enables remote monitoring and analysis of vehicle performance, location, driver behavior, and diagnostics, enhancing efficiency and safety and providing valuable insights for fleet management and vehicle owners.

The automotive telematics system market has been segmented based on service (infotainment and navigation, fleet management, safety and security, and diagnostics) and geography (North America, Europe, Asia-Pacific, and the Rest of the World).

The report offers market size and forecast in terms of value in USD for all the above segments.

| By Service | Infotainment and Navigation | |

| Fleet Management | ||

| Safety and Security | ||

| Diagnostics | ||

| Geography | North America | United States |

| Canada | ||

| Rest of North America | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | Brazil |

| Saudi Arabia | ||

| Other Countries |

Automotive Telematics Market Research FAQs

How big is the Automotive Telematics System Market?

The Automotive Telematics System Market size is expected to reach USD 28.44 billion in 2024 and grow at a CAGR of greater than 15.30% to reach USD 38.22 billion by 2029.

What is the current Automotive Telematics System Market size?

In 2024, the Automotive Telematics System Market size is expected to reach USD 28.44 billion.

Who are the key players in Automotive Telematics System Market?

Ficosa International SA, ACTIA Group, Robert Bosch GmbH, Continental AG and Magnetic Marelli SpA are the major companies operating in the Automotive Telematics System Market.

Which is the fastest growing region in Automotive Telematics System Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Automotive Telematics System Market?

In 2024, the Asia Pacific accounts for the largest market share in Automotive Telematics System Market.

What years does this Automotive Telematics System Market cover, and what was the market size in 2023?

In 2023, the Automotive Telematics System Market size was estimated at USD 24.09 billion. The report covers the Automotive Telematics System Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Automotive Telematics System Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Automotive Telematics Systems Industry Report

Statistics for the 2024 Automotive Telematics Systems market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Automotive Telematics Systems analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.