Temperature Sensors in Automotive Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 6.17 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Temperature Sensors in Automotive Market Analysis

The Automotive Temperature Sensor market was valued at USD 12.13 billion in 2020 and is expected to reach USD 8.47 billion by 2026, at a CAGR of 6.17% over the forecast period 2021 - 2026. The automotive industry has grown significantly in the past few years, aided by the growth in unit volumes and the emergence of new technologies, whether it be for safety, entertainment, or for pure innovation.

- Government organizations in many countries are implementing safety and emission control standards that mandate the installation of sensors. Automotive companies are thereby required to comply with these safety and emission control regulations set by these authorities. This trend is expected to increase the demand for automotive temperature sensors over the forecast period.

- In line with this trend, companies such as MS Motorservice International GmbH, in 2018, launched aftermarket exhaust gas temperature sensors that feature temperature resistance in the range from - 40° to + 1,000°C and exceptional accuracy. These sensors monitor the hot exhaust gas flow and protect temperature-sensitive components, like turbochargers from overheating. In the case of critical overheating, the control unit responds with suitable actions to reduce the temperature, for example, reducing the performance.

- Moreover, the growing automotive HVAC market, which is facilitating the broader adoption of temperature sensors, is one of the major trends contributing to the growth of the automotive temperature sensor market. Temperature sensors are the most commonly used sensors for HVAC as they can monitor ambient conditions inside a car.

- Along with the aforementioned factors, increasing adoption of electric vehicles is also favoring the market growth over the forecast period as these vehicles also require temperature monitoring. Companies such as Sensor Scientific Inc. is developing thermistor temperature sensors for electric cars.

Temperature Sensors in Automotive Market Trends

This section covers the major market trends shaping the Automotive Temperature Sensor Market according to our research experts:

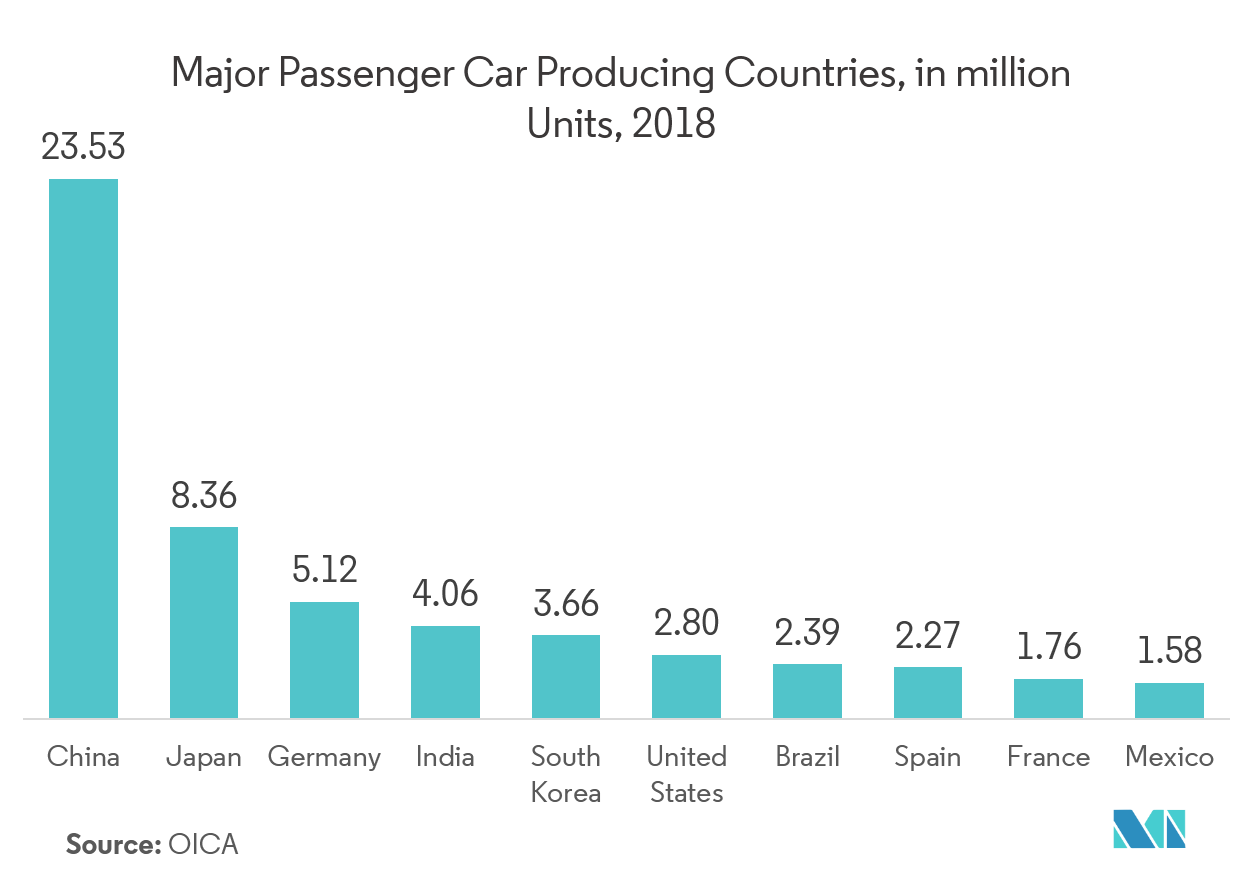

Passenger Cars Expected to Hold a Significant Share

- Due to the rising purchasing power of the millennial population, the demand for passenger cars is growing, which results in increasing automotive sales. According to the OICA, in 2018, around 70.5 million passenger cars were produced across the world. Utility Vehicles, such as sports utility vehicle (SUV) and multi-purpose vehicle (MPV) segments is gaining popularity in passenger car due to higher ride position, flexible interior space for passengers or cargo and improved fuel efficiency. Thus, with the growing demand for passenger cars, the demand for temperature sensors are expected to rise over the forecast period.

- Considering stringent emission regulations, safety and comfort factors, temperature sensors are playing a vital role in the passenger car. These sensors are used for a wide range of applications. The most significant and standard applications are power train and HVAC systems, followed by body electronics and alternative fuel.

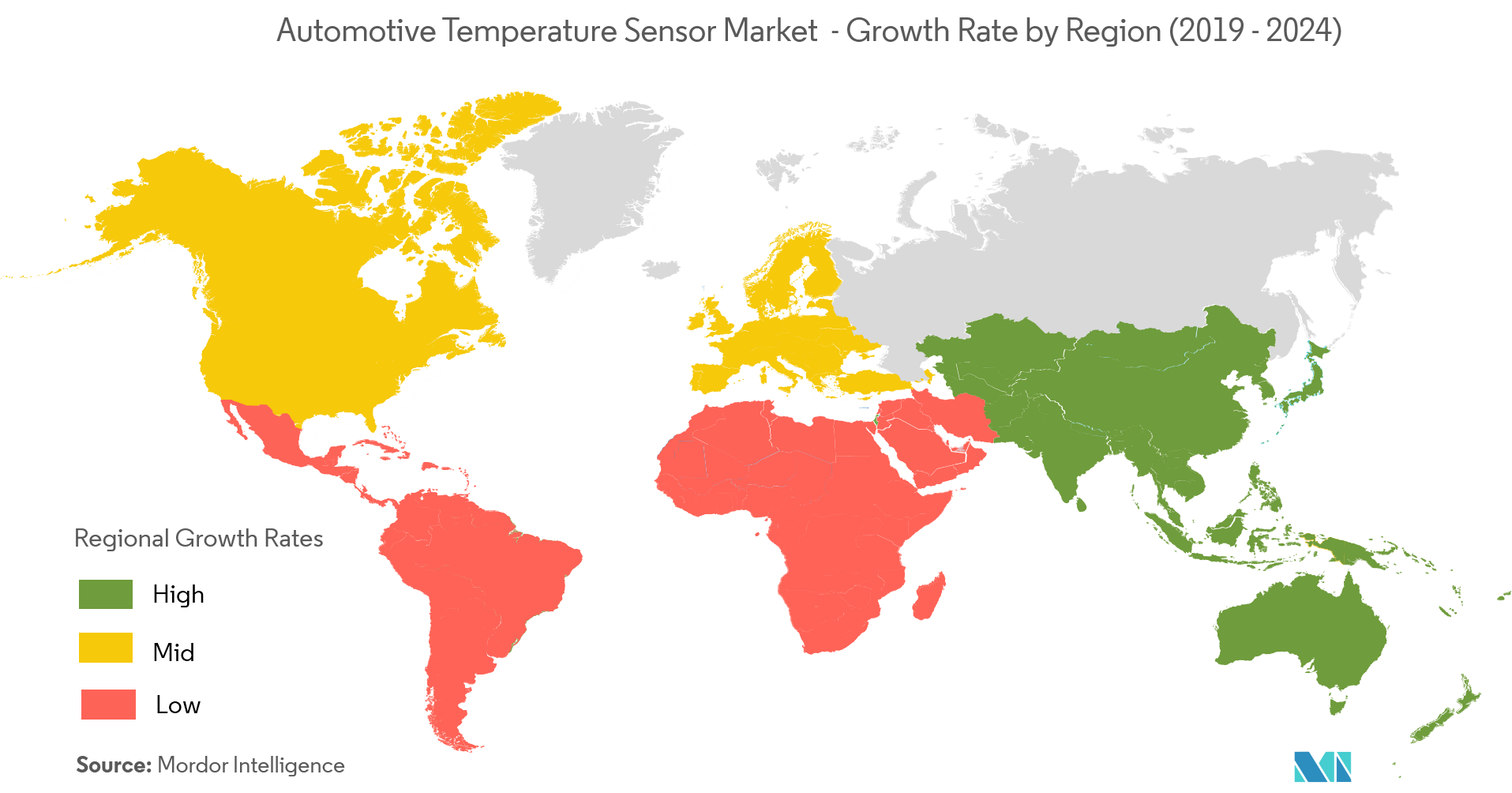

Asia-Pacific Expected to Have the Largest Share

- The growth of Asia-Pacific market can be attributed to the developing automotive industry in countries, such as China and India. According to the IBEF, the Indian automotive sector became the 4th largest in the world, with sales increasing 9.5% year-on-year to 4.02 million units in 2017. It was the seventh-most significant manufacturer of commercial vehicles in 2018.

- To keep up with the growing demand, various automotive makers are heavily investing in various segments of the industry, which in turn, is expected to drive the adoption of temperature sensors in the region. For instance, Mercedes Benz increased the manufacturing capacity of its Chakan Plant to 20,000 units per year, highest for any luxury car manufacturing in India.

- The market for electric vehicles in the region is booming in various countries such as China, supported by subsidies and other incentives. In 2018, China remains the world’s largest electric car market, followed by Europe and the United States. The Japanese company, Honda Motors Company, in 2018, set up its third factory in India for launching hybrid and electric vehicles. Such trends will further impact the growth of automotive temperature sensor market in the region.

Temperature Sensors in Automotive Industry Overview

The automotive temperature sensor market is competitive and consists of several players. The companies in the market continuously trying to increase their market presence by introducing new products, expanding their operations, or by entering into strategic mergers and acquisitions.

October 2018 - TDK Corporation launched EPCOS NTC temperature sensor designed to measure extended temperature range between -10 °C up – +300 °C. The sensor can be used for many applications in automotive and industrial electronics. As the thermistors sleeves are made of ceramic, the sensor is suitable for use in applications under extreme operating conditions and is also resistant to aggressive media such as acid.

Temperature Sensors in Automotive Market Leaders

-

Sensata Technologies Inc.

-

NXP Semiconductors N.V.

-

Amphenol Corporation

-

Robert Bosch GmbH

-

Continental AG

*Disclaimer: Major Players sorted in no particular order

Temperature Sensors in Automotive Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Stringent Emission Regulations for Automobiles

- 4.3.2 Increasing Penetration of Electric and Autonomous Vehicles

-

4.4 Market Restraints

- 4.4.1 Cost Pressure on Automotive OEM's

- 4.5 Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

-

5.2 By Application

- 5.2.1 Powertrain

- 5.2.2 Body Electronics

- 5.2.3 Alternative Fuel Vehicles

- 5.2.4 Other Applications

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 France

- 5.3.2.2 Germany

- 5.3.2.3 Italy

- 5.3.2.4 Spain

- 5.3.2.5 United Kingdom

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 NXP Semiconductors N.V.

- 6.1.2 Sensata Technologies Inc.

- 6.1.3 Amphenol Advanced Sensors (Amphenol Corporation)

- 6.1.4 Robert Bosch GmbH

- 6.1.5 Continental AG

- 6.1.6 Texas Instruments Inc.

- 6.1.7 TE Connectivity Ltd.

- 6.1.8 Panasonic Corporation

- 6.1.9 Murata Manufacturing Co. Ltd.

- 6.1.10 TDK Corporation

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityTemperature Sensors in Automotive Industry Segmentation

Temperature sensor in the automotive industry effectively and accurately measure the temperature of a vehicle's oil, coolant, and air to ensure optimum performance. Automotive temperature sensors usually consist of either a thermistor, thermocouple, resistance temperature detector or an infrared device. Thermocouples are mainly used for measuring high temperatures (like exhaust gas temperatures), and infrared sensors are utilized where direct contact with the object being sensed is undesirable.

| By Vehicle Type | Passenger Cars | |

| Commercial Vehicles | ||

| By Application | Powertrain | |

| Body Electronics | ||

| Alternative Fuel Vehicles | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | France |

| Germany | ||

| Italy | ||

| Spain | ||

| United Kingdom | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| India | ||

| Japan | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | Latin America |

| Middle-East & Africa |

Temperature Sensors in Automotive Market Research FAQs

What is the current Automotive Temperature Sensor Market size?

The Automotive Temperature Sensor Market is projected to register a CAGR of 6.17% during the forecast period (2024-2029)

Who are the key players in Automotive Temperature Sensor Market?

Sensata Technologies Inc., NXP Semiconductors N.V., Amphenol Corporation, Robert Bosch GmbH and Continental AG are the major companies operating in the Automotive Temperature Sensor Market.

Which is the fastest growing region in Automotive Temperature Sensor Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Automotive Temperature Sensor Market?

In 2024, the Asia Pacific accounts for the largest market share in Automotive Temperature Sensor Market.

What years does this Automotive Temperature Sensor Market cover?

The report covers the Automotive Temperature Sensor Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Automotive Temperature Sensor Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Automotive Temperature Sensor Industry Report

Statistics for the 2024 Automotive Temperature Sensor market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Automotive Temperature Sensor analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.