Automotive Turbocharger Industry Overview

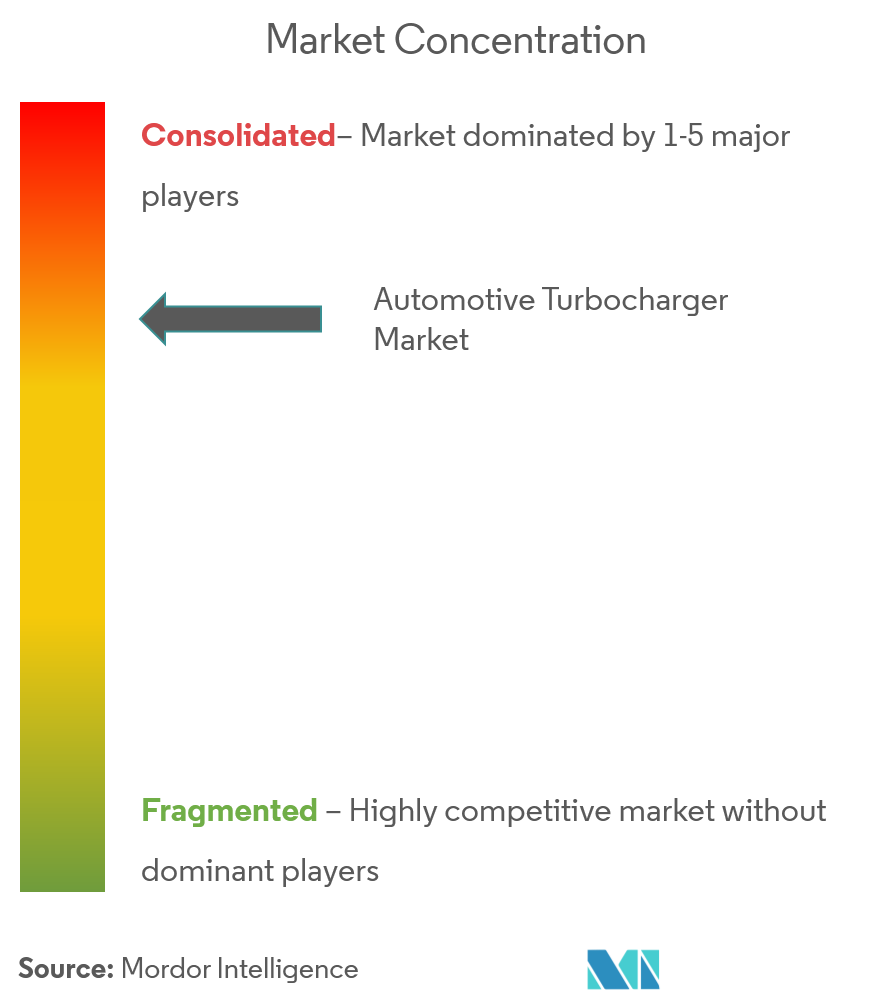

The automotive turbocharger market is highly consolidated among seven players, Honeywell, BorgWarner, IHI, MHI, Cummins, Bosch-Mahle, and Continental AG. Honeywell constitutes a significant share of the market, followed by BorgWarner, IHI, MHI, Cummins, etc. Bosch and Mahle produce turbochargers under the Bosch-Mahle joint venture.

Players are either following a constructive alliance approach else aggressively launching turbochargers in the market. For instance:

- In November 2021, several media sources reported that Cummins has been investing BRL 170 million to produce new Euro 6 engines to meet the demands of the P8 phase of the Proconve program for heavy vehicles, which will become effective in Brazil in 2022. The engines will be equipped with Holset turbochargers. The resources were also used to increase the nationalization of components for Euro 6 engines, a process that required the development of new local suppliers.

- In October 2021, Fiat presented its all-new Pulse SUV in Brazil as dealers are now accepting orders throughout the country. Produced at the Betim plant, the Pulse debuts with the 130 hp1.0-liter Turbo 200 Flex engine, featuring BorgWarner's low inertia turbocharger, which generates 130 hp of maximum power with ethanol (125hp with gasoline) and 200 Nm (20.4 kgf.m) of torque, regardless of fuel.

- In October 2021, Angka-Tan Motor (ATM) officially launched the JMC Vigus Pro pick-up truck in Malaysia with starting price of MYR 98,888. According to ATM, the Vigus Pro, which is CKD locally assembled at Tan Chong's Serendah plant, is a new value proposition among pick-up trucks sold in Malaysia. Power comes from a 'Puma' 2.0-liter turbodiesel engine with a variable geometry turbocharger.

Automotive Turbocharger Market Leaders

-

BorgWarner Inc.

-

Continental AG

-

Mitsubishi Heavy Industries Ltd

-

IHI Corporation

-

Garrett Motion Inc.

- *Disclaimer: Major Players sorted in no particular order