Aviation Connectors Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.00 % |

| Fastest Growing Market | North America |

| Largest Market | North America |

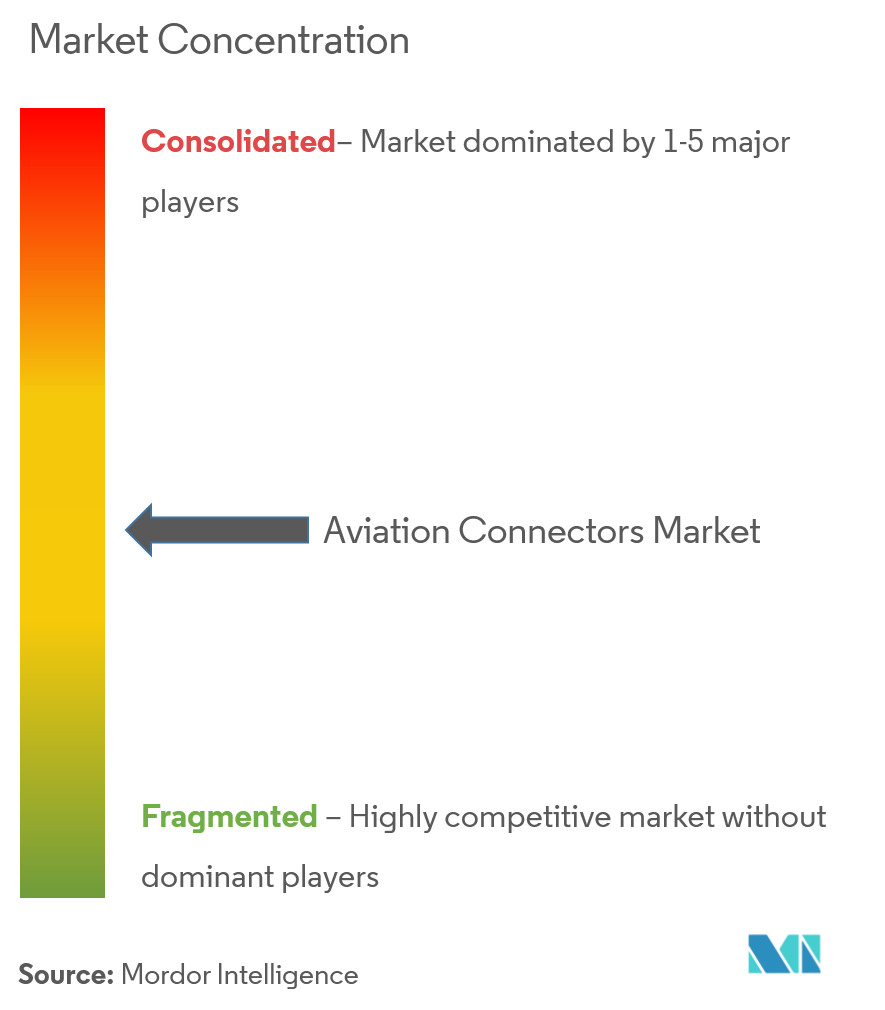

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Aviation Connectors Market Analysis

The Aviation Connectors Market is expected to witness a CAGR of over 5% during the forecast period (2021 - 2026). Military and commercial aircraft requires a massive amount of electrical and electronic systems for monitoring and flying the plane, managing the engines, providing communications, etc. Less critical applications like in-flight entertainment also need a lot of electrical and electronic systems. Thus, these system installations imply connector devices are required within every airframe.

- The market is driven by increasing demand for the aircraft along with a shift towards electric architecture and technology, which was primarily conceived by Airbus SE while the production of Airbus A-380, and has been gaining traction since then. This has also attracted the attention of aircraft manufacturing companies, like Rolls Royce, who are partnering to develop technologies that align with electric architecture.

- According to Boeing forecasts in 2018, the demand for commercial airplanes is expected to increase due to rising passenger traffic and upcoming airplane retirements. The company forecasted the need for 42,730 new jets valued at USD 6.3 trillion over the next 20 years. Growing demand for aircraft is expected to drive the demand for connectors as they are widely used in avionics bays, cockpit displays, and engine management.

- Most of the aerospace projects emphasize the need for high-speed, lightweight, and resilient connectors and cables. Fiber optic connector is making significant advances for use in the harsh environment in aviation applications. Fiber-optic interconnects are one of the prime choice for military applications as it features enhanced ruggedness suitable for military-grade systems. Companies such as Amphenol offers fiber optic connectors for use in the harsh environments found in military and aerospace applications.

Aviation Connectors Market Trends

This section covers the major market trends shaping the Aviation Connectors Market according to our research experts:

Fiber Optic Connectors are Expected to Register a Significant Growth Rate

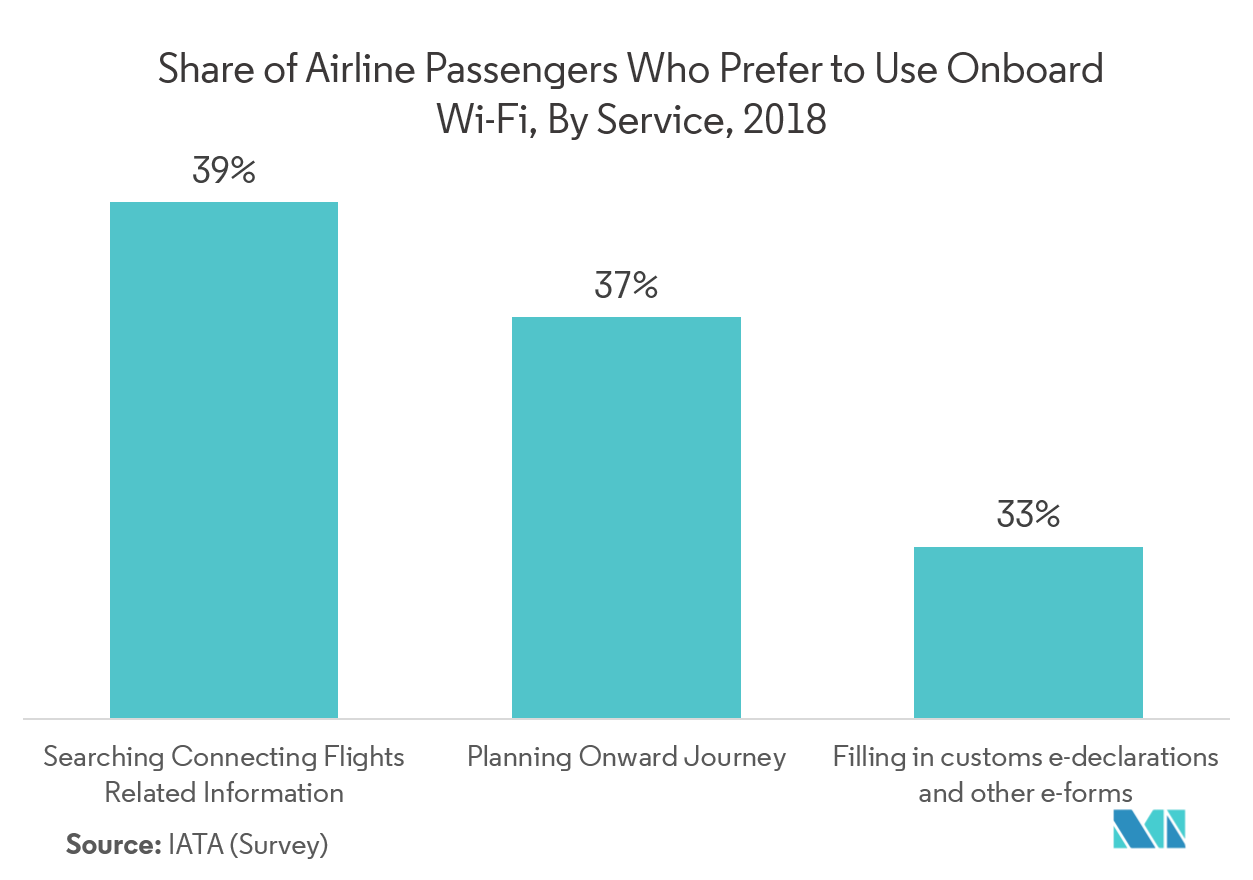

- Fiber optic connectors are making significant advances for use in aviation applications. Commercial aircraft runs on information. As aircraft designers embrace more electric aircraft to replace mechanical control systems, embedded computers are evolving to increasing signal processing and control loads. Passenger amenities such as in-flight entertainment and internet access also need high transmission rate to provide the capabilities for high-definition video and high-speed on-line connectivity. Thus, fiber optic technology is an ideal option for providing high-speed data and also offers lower wastage, weight, etc.

- According to the Inmarsat Aviation 2018 Inflight Connectivity Survey, around 66% of the passengers believe in-flight Wi-fi is necessary. For instance, ITT Cannon's ARINC 801 fiber-optic connector series is designed for applications in harsh environments that require accurate data transfer and high-speed, such as aviation systems. The connector operates at transmission speeds of 10Gbit/s and higher, making them suitable for in-flight entertainment and connectivity, commercial and military avionics and ground-based communications.

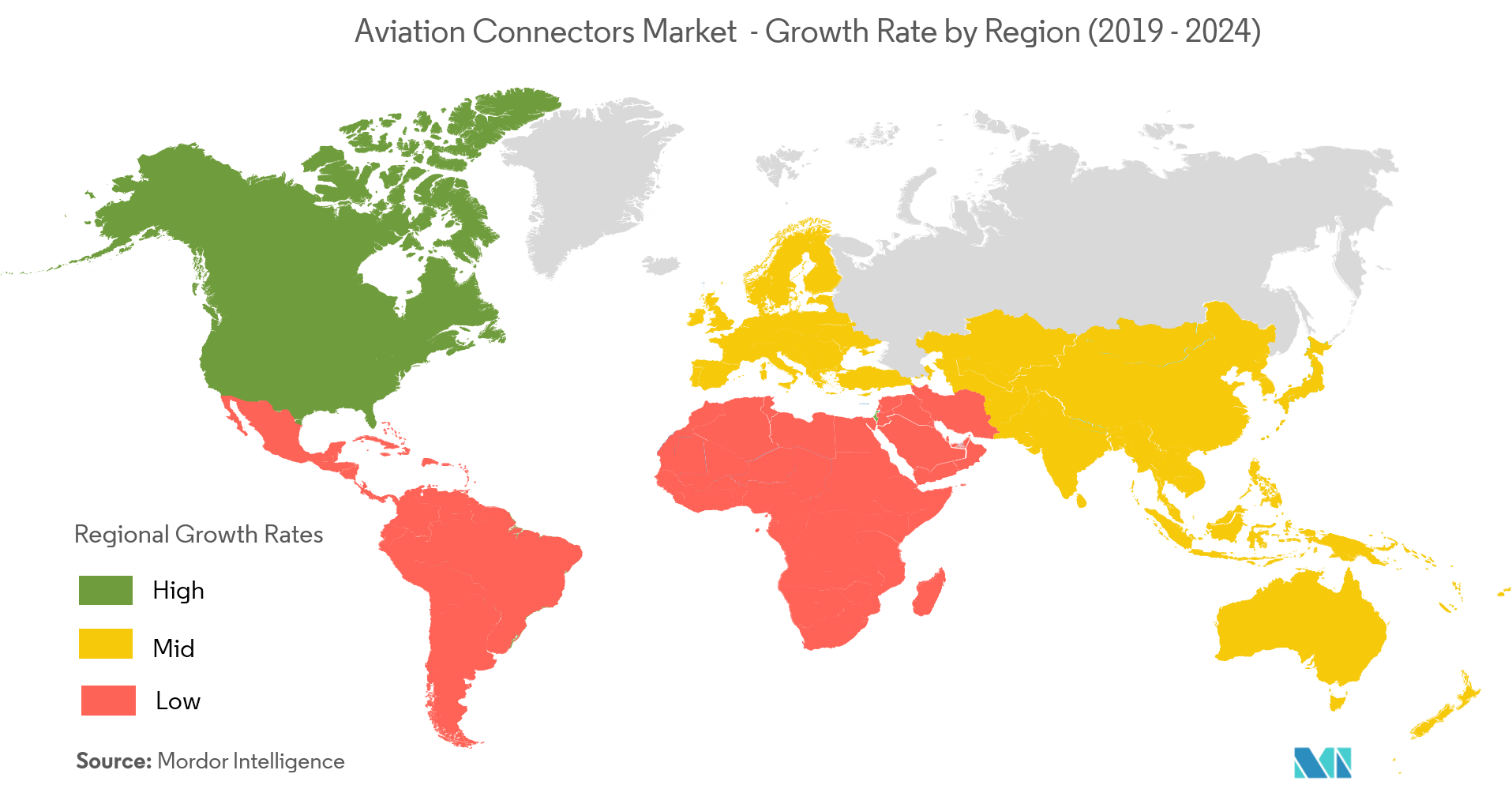

North America is Expected to Hold the Largest Share

- The increasing frequency of air travel and rising demand for aircraft in the region is expected to drive the demand for connectors. According to Boeing, an American aircraft manufacturing company, the number of aircraft ordered has increased by 61.28% from 2010 to 2018. In 2018, Boeing received a USD 9.2 billion contract to produce the United States air force’s next-generation training jet.

- The growing trend of in-flight communication can be expected to be a significant part of the North American aviation connectors market. The trend for in-light broadband is already rising in the region. For instance, Air Canada will offer its customers in-flight Wi-Fi connectivity on international flights so that the customers can email, surf the internet and stream entertainment at broadband speeds while flying anywhere in the world.

- Aircraft lighting forms an important aspect of commercial aviation as it appeals to the customer’s aesthetic senses and also serves secondary purposes like emergency lighting and exit path guidance. Boeing adopts TE Connectivity's DEUTSCH 369 series connectors for cabin lighting on their aircraft. These connectors provide a range of high-reliability, compact, lightweight, and cost-efficient connectors suited for harsh aerospace environments.

Aviation Connectors Industry Overview

The aviation connectors market is competitive and consists of several players. These manufacturers of connectors are needed to build their offerings as per the standards required by the aerospace industry. Many companies are increasing their market presence by introducing new products, expanding their operations, or by entering into strategic mergers and acquisitions.

May 2018 - Bulgin (Elektron Technology) launched a new series of LC fibre optic connectors specialised for harsh environments. These connectors are suitable for civil engineering, aviation, marine, and rail applications.

Aviation Connectors Market Leaders

-

Amphenol Corporation

-

TE Connectivity Ltd.

-

Eaton Corporation

-

Smiths Group PLC

-

Carlisle Companies Inc.

*Disclaimer: Major Players sorted in no particular order

Aviation Connectors Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increase in the Demand for Aircraft

- 4.3.2 Shift towards Electric Architecture and Technology

-

4.4 Market Restraints

- 4.4.1 Existing Backlog of Aircraft Deliveries

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 PCB (Printed Circuit Board)

- 5.1.2 RF Connectors

- 5.1.3 Fiber Optic

- 5.1.4 Other Types

-

5.2 By Shape

- 5.2.1 Circular

- 5.2.2 Rectangular

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 Japan

- 5.3.3.2 China

- 5.3.3.3 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Amphenol Corporation

- 6.1.2 TE Connectivity Ltd.

- 6.1.3 SOURIAU SAS

- 6.1.4 Radiall SA

- 6.1.5 ITT Inc.

- 6.1.6 Cooper Industries (Eaton Corporation)

- 6.1.7 Smiths Interconnect Inc. (Smiths Group PLC)

- 6.1.8 Rosenberger Group

- 6.1.9 Carlisle Interconnect Technologies (Carlisle Companies Inc.)

- 6.1.10 Conesys Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityAviation Connectors Industry Segmentation

A connector is a device that connects electrical terminations to create an electrical circuit. Connectors provide the means of linking cables to transmitting or receiving equipment. Aviation connectors integrate functions on an aircraft such as airframe, avionics, and power systems.

| By Type | PCB (Printed Circuit Board) | |

| RF Connectors | ||

| Fiber Optic | ||

| Other Types | ||

| By Shape | Circular | |

| Rectangular | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| France | ||

| Germany | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | Japan |

| China | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | Latin America |

| Middle-East & Africa |

Aviation Connectors Market Research FAQs

What is the current Aviation Connectors Market size?

The Aviation Connectors Market is projected to register a CAGR of 5% during the forecast period (2024-2029)

Who are the key players in Aviation Connectors Market?

Amphenol Corporation, TE Connectivity Ltd., Eaton Corporation, Smiths Group PLC and Carlisle Companies Inc. are the major companies operating in the Aviation Connectors Market.

Which is the fastest growing region in Aviation Connectors Market?

North America is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Aviation Connectors Market?

In 2024, the North America accounts for the largest market share in Aviation Connectors Market.

What years does this Aviation Connectors Market cover?

The report covers the Aviation Connectors Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Aviation Connectors Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Aviation Connectors Industry Report

Statistics for the 2024 Aviation Connectors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Aviation Connectors analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.