Baby Care Packaging Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.50 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Baby Care Packaging Market Analysis

The baby care packaging market was valued at USD 208.75 billion in 2020 and is expected to reach USD 313.75 billion by 2026, at a CAGR of 5.5% over the forecast period 2021 - 2026. According to numbers generated by a Harris Poll chartered by the Flexible Packaging Association, 83 % of all brand owners are currently using flexible packaging of some type. This supports the growth of the baby care packaging market which includes pouches, plastics bags, packaging.

- According to ALPPM, transparency of the packaging of baby food products is becoming a popular trend. The baby products when packaged in transparent packaging allows the parents to see through and verify what the product looks like before making the purchase and this enhances the trustworthiness of the product

- Further, thin materials with microwaveable characteristics are expected to drive the packaging demand as it caters to parents' requirement for simplifying the baby meals preparation. Growing demand for these materials is expected to steer the sachets and thin plastic containers for baby food over the forecast period.

- However, environmental concerns about plastic packaging are limiting the market during the forecasted period.

Baby Care Packaging Market Trends

This section covers the major market trends shaping the Baby Care Packaging Market according to our research experts:

Baby Food Industry Offers Potential Growth

- The Flexible Packaging Association (FPA) survey of 2,120 consumers, consumers placed a high value on the packaging that is “easy to store,” “easy to reseal,” and “easy to open.” Consumers in the survey also said they are willing to pay more for benefits like “ability to reseal,” “ability to extend product life,” “easy to store” and “easy to open.”

- Among the flexible packaging, stand-up pouches with sprouts are becoming very popular for the packaging of baby food. These are lightweight and have very high barrier properties that keep the baby products safe and fresh for longer. Additionally, they offer the ease of squeeze the baby food which avoids wastage of food.

- Further, according to the World Bank, the percentage of women in the workforce grew more than 4% in the last decade. As many working mothers return to their jobs shortly after giving birth, prepared baby foods and formulas provide an appealing alternative for working mothers, bridging their desires for healthy, nutritious food with their need for convenience. This creates huge market opportunities for the baby food packaging industry.

- Nowadays, even mothers are feeding their babies food from squeezable pouches that eliminate the need for spoons, bowls and even bibs.

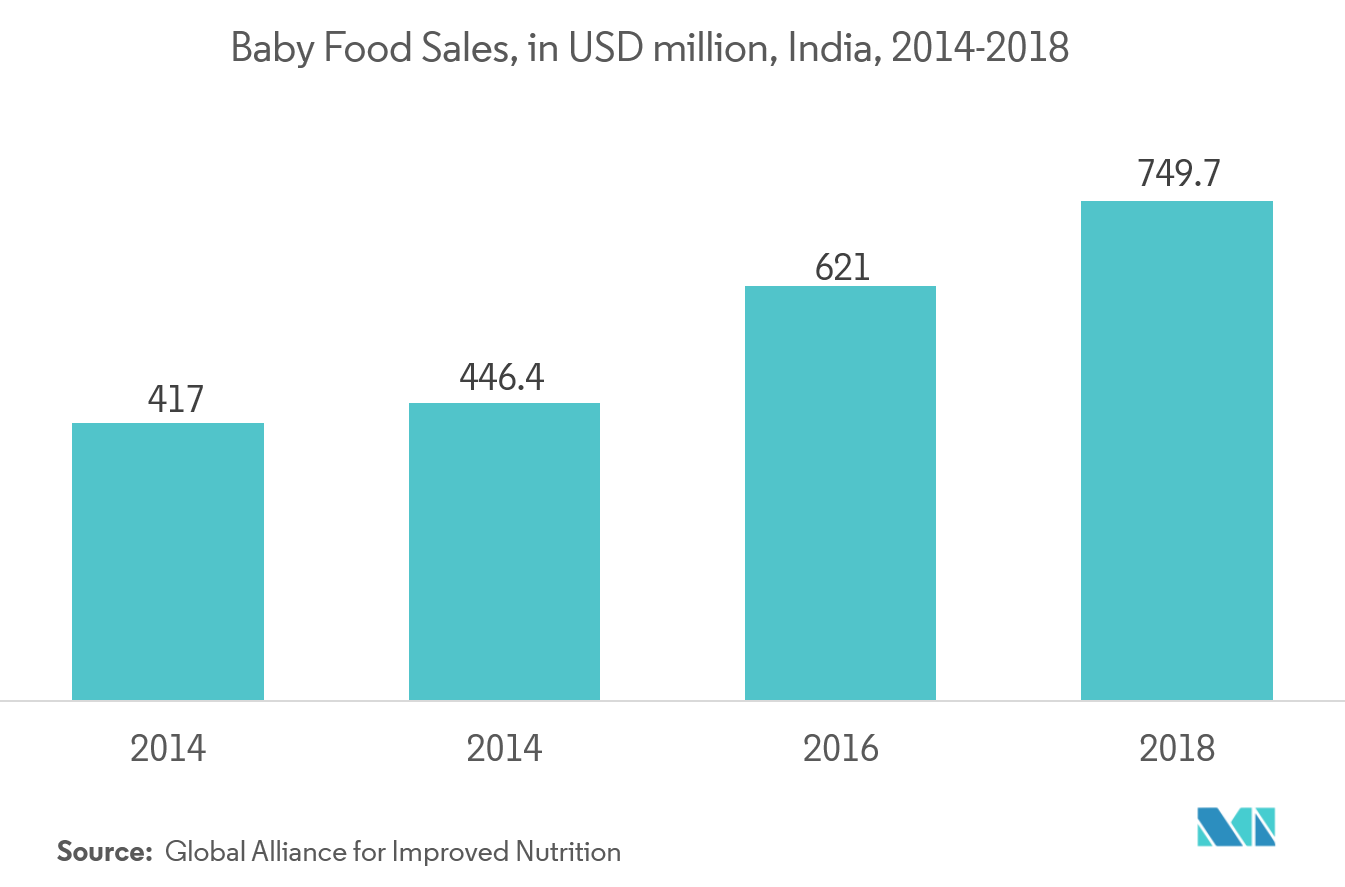

- With the growth of baby food sales in developing nations like India, it can be inferred that the globally the baby food industry will flourish. The increasing population and rising birth rate are aiding the growth of the baby food market which in return will help in flourishing the baby food packaging industry.

- Therefore, the above factors are expected to help in the flourishing of the baby food packaging market.

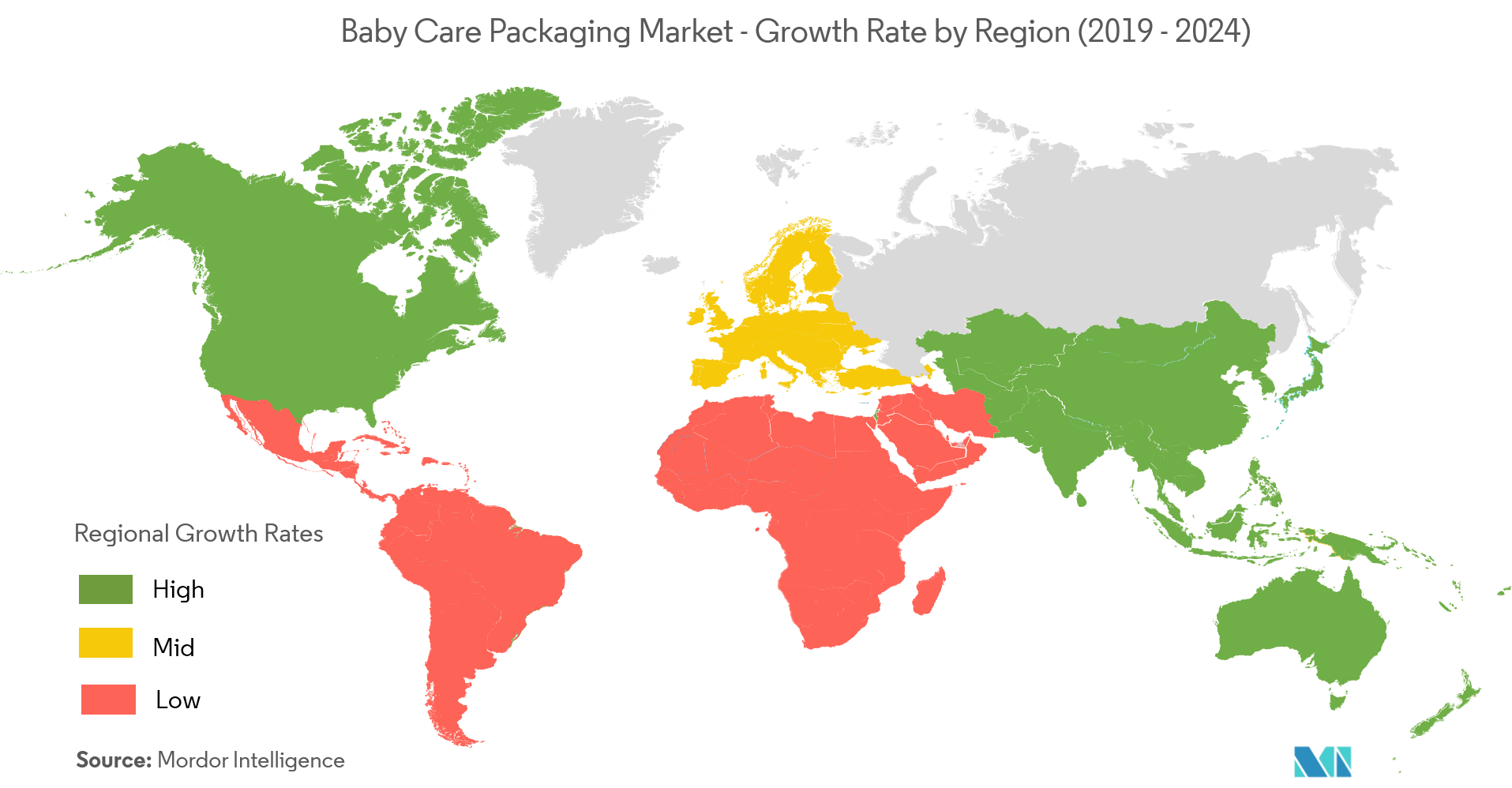

Asia- Pacific to Witness the Fastest Growth

- Asia Pacific region is expected to witness high growth during the forecast period owing to the increased use of packaged baby food products by the urban population. Also with the rising disposable income of people in the emerging economies and their busy lifestyles are also boosting the growth of the baby food packaging market in the Asia Pacific region.

- Further, the Government 's initiatives help in increasing awareness among new parents regarding child hygiene also help in the increase of the baby personal care industry. For instance, in January 2019, in one of the Indian states i.e. Maharashtra State Government started distributing baby-care kits to curb infant deaths. Such initiatives create awareness about infant's health among the new parents and thus have a positive impact on the baby care products market. In return, it will create a market for baby care packaging industry as well.

- Moreover, in China, the two-child policy which was effective from 2016, created a huge opportunity for child care products. With increasing purchasing power and rise in the number of working women in China, it is expected that child care product market will flourish which in return will create a market for baby care packaging market

- Therefore, the above factors are expected to help in the growth of baby care packaging market in the Asia-Pacific region

Baby Care Packaging Industry Overview

The baby care packaging market is fragmented and competitive. The companies are entering into thedeveloping regions because of the rise in the purchasing power of the consumers and the increasing lifestyles of the citizens. Some of the key players areJohnson & Johnson Services, Inc., Mondi,Sonoco Products Company, Tetra Laval Pvt. Ltd, Amcor Limited.

- May 2019 - Sonocosigned a definitive agreement to acquireCorenso Holdings America,a leading U.S. manufacturer of uncoated recycled paperboard (URB) and high-performance cores used in the paper, packaging films, tape, and specialty industriesfor approximatelyUSD 110 million.

- July 2018 - AVON announced the launch of the baby care products like Lavender Baby Wash and Shampooand Moisturizing Lotion in India. They don’t have any harmful chemicals like alcohol, dye, etc. which is not good for the baby.

- May 2018 - Johnson & Johnson decided to relaunch its baby- care products. The new products had more natural products and avoided chemicals like sulfates, parabens, phthalates, artificial fragrances which is harmful to the children.

Baby Care Packaging Market Leaders

-

Johnson & Johnson Services

-

Sonoco Products Company

-

Tetra Laval Pvt Ltd

-

Mondi Group PLC

-

Amcor PLC

*Disclaimer: Major Players sorted in no particular order

Baby Care Packaging Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Attractive and Highly Appealing Display

- 4.3.2 Innovations in Food & Beverages Packaging

-

4.4 Market Restraints

- 4.4.1 Environmental Concerns About Plastic Packaging

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paper

- 5.1.3 Metal

- 5.1.4 Glass

- 5.1.5 Other Materials

-

5.2 By Product

- 5.2.1 Bottles

- 5.2.2 Can

- 5.2.3 Tube

- 5.2.4 Pouch

- 5.2.5 Other Products

-

5.3 By Application

- 5.3.1 Food

- 5.3.2 Apparel

- 5.3.3 Health and Personal care

- 5.3.4 Other Applications

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle East & Africa

- 5.4.5.1 UAE

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Johnson & Johnson's

- 6.1.3 Mondi PLC

- 6.1.4 Nestle SA

- 6.1.5 Sonoco Product Co.

- 6.1.6 Tetra Laval Pvt Ltd

- 6.1.7 Benison (Thailand) Co., Ltd

- 6.1.8 Ameri-Pac Inc (Wilbur-Ellis Holdings Inc)

- 6.1.9 Ball Corp. (Rexam PLC)

- 6.1.10 Winpak Ltd

- 6.1.11 RPC Group Plc ( Berry Global Group)

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityBaby Care Packaging Industry Segmentation

The baby care packaging is the packaging types that are used for baby products. In material, plastic is one of the most used packaging materials due to its lightweight nature which helps in carrying the products very easily. The baby food industry covers a major part of the baby care packaging industry. Moreover, stand up pouches with sprouts is also popular because it offers the ease to squeeze the baby food and also avoiding wastage.

| By Material | Plastic | |

| Paper | ||

| Metal | ||

| Glass | ||

| Other Materials | ||

| By Product | Bottles | |

| Can | ||

| Tube | ||

| Pouch | ||

| Other Products | ||

| By Application | Food | |

| Apparel | ||

| Health and Personal care | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Brazil |

| Argentina | ||

| Rest of Latin America | ||

| Geography | Middle East & Africa | UAE |

| Saudi Arabia | ||

| South Africa | ||

| Rest of Middle East & Africa |

Baby Care Packaging Market Research FAQs

What is the current Baby Care Packaging Market size?

The Baby Care Packaging Market is projected to register a CAGR of 5.5% during the forecast period (2024-2029)

Who are the key players in Baby Care Packaging Market?

Johnson & Johnson Services, Sonoco Products Company, Tetra Laval Pvt Ltd, Mondi Group PLC and Amcor PLC are the major companies operating in the Baby Care Packaging Market.

Which is the fastest growing region in Baby Care Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Baby Care Packaging Market?

In 2024, the North America accounts for the largest market share in Baby Care Packaging Market.

What years does this Baby Care Packaging Market cover?

The report covers the Baby Care Packaging Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Baby Care Packaging Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Baby Care Packaging Industry Report

Statistics for the 2024 Baby Care Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Baby Care Packaging analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.