Barrier Film Packaging Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 6.40 % |

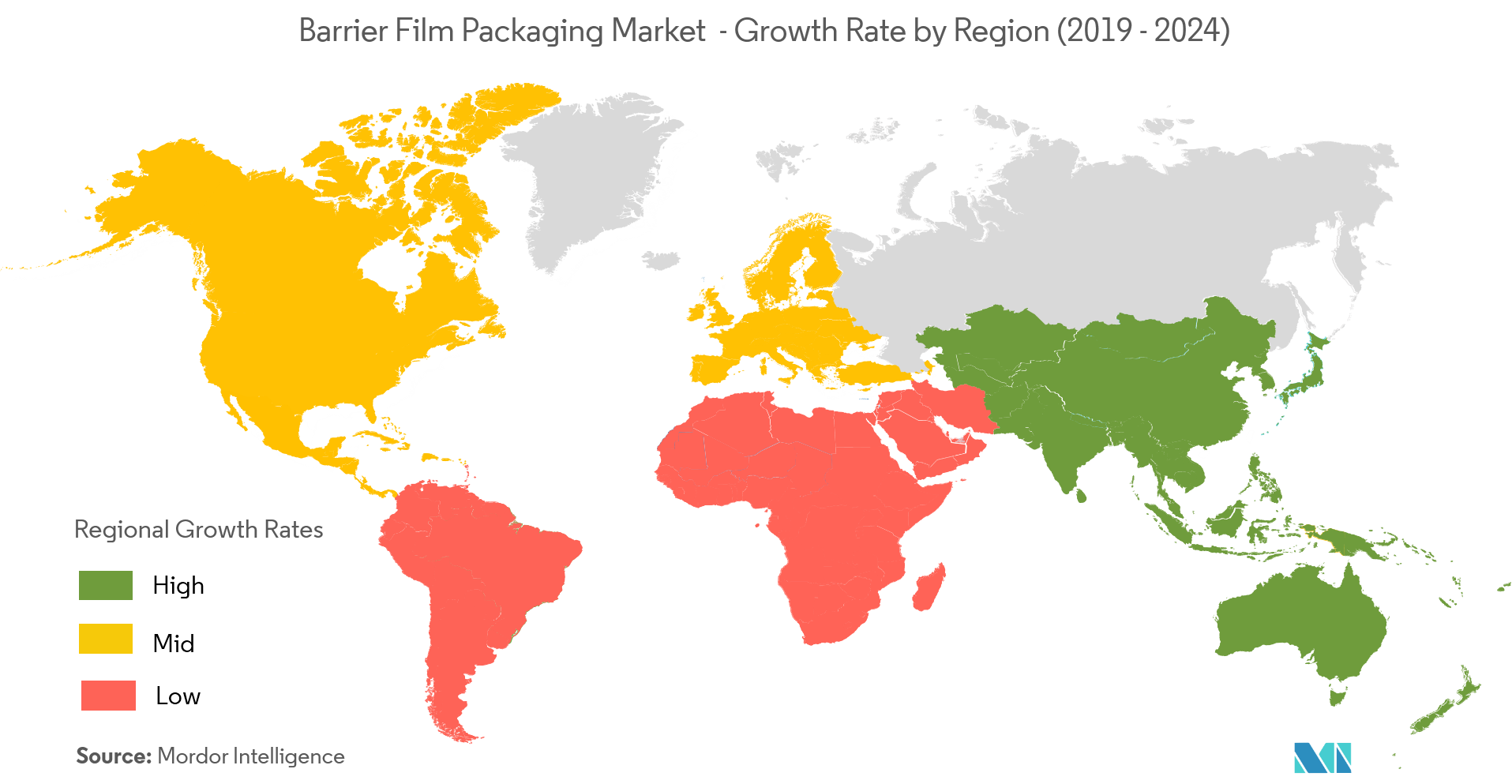

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Barrier Film Packaging Market Analysis

The barrier film packaging market was valued at USD 30312.51 million in 2019and is expected to reach USD 43859.36million by 2025, registering a CAGR of 6.4% during the period of 2020-2025. The growth of the barrier film market is augmented by the huge demand for high-performance films, owing to the rising barrier requirements in multiple end-user industries. Improvements, particularly in processing technologies, are expected to support the increasing use of barrier films for suitable applications and low-cost production.

- Packaging applications for food are expected to account for a major share of the barrier film market. This can be attributed to the rising trend of down-gauging, which has supported the shift from rigid to flexible packaging. Strong incentives from retailers, producers, and consumers to increase product shelf life and reduce wastage of packaging material, along with the rising preference for fresh foods, such as meat, fruits, vegetables, and seafood, have increased the demand for barrier films.

- Furthermore, Pharmaceutical and medical products make up one of the largest markets for high barrier films. This market is expected to grow at a strong pace, based on increased healthcare spending and new drug formulations that require higher barrier packaging.

- Among the materials, PET is expected to witness an increase in use, due to its ability to be metalized by vapor deposition of metals, which further improves the barrier against oxygen, water vapor, and aroma loss. LCP (liquid crystal PET) is an emerging PET film for high gas barrier applications.

- Moreover, developments in barrier films offer adequate measurements at the low levels of permeability required for organic photovoltaics and OLEDs.Barrier films are designed to safeguard electronic components, such as transistors, electronic circuits, and other electronic products, from degradation caused by moisture/oxygen. Flexible barrier films enclose flexible, organic, and printed electronics to save them from corrosion, without affecting their performance and functionality.

- However, recycling challenges with flexible packaging products and higher operational costs are hindering the growth of the market.

Barrier Film Packaging Market Trends

This section covers the major market trends shaping the Barrier Film Packaging Market according to our research experts:

Food Industry to Augment the Market Growth

- Protection, preservation, maintaining, and extending the shelf-life of food products are the primary challenges faced in the food industry.

- Food products are affected due to both intrinsic parameters, such as pH, preservatives, and water activity, as well as extrinsic parameters, like temperature, humidity, and gaseous environment. Barrier film packaging solution allows mitigating these challenges.

- Barrier film is extensively used for products, like bakery goods, biscuits, frozen foods, pet food, chips and snacks, meat and dairy products, and dry fruits in the food industry.

- Moreover, companies are manufacturing barrier film packaging solutions that provide high emphasis on developing 100% recyclable products to promote a circular economy in the packaging industry. For instance, Innovia Films recently launched its new series of transparent barrier film packaging solutions for cereal bars, biscuits, snacks, dried fruits, nuts, tea, and coffee. These products are designed with standalone mono film or to be used in laminated construction so that they can be recycled readily.

- Consumer, today, are focusing on convenience and purchase grab-and-go products rather than bulk buying; this is resulting in high demand for packaged food. The trend of grab-and-go food and snacks is driving the demand for barrier film packaging solutions in the food industry.

Asia-Pacific to be Fastest Growing Market

- Asia-Pacific is the third-largest pharmaceutical market after North America and Europe. The region has densely populated countries, such as India and China, that have significantly contributed to the production of pharmaceuticals in the region.

- India is the source of 60,000 generic brands across 60 therapeutic categories and manufactures more than 500 different Active Pharmaceutical Ingredients (APIs). The Department of Pharmaceuticals aims to make the country a hub for end-to-end drug discovery under its ‘Pharma Vision 2020’.

- The country is home to 3,000 pharma companies, with a strong network of over 10,500 manufacturing facilities. According to the National Investment Promotion & Facilitation Agency, the domestic pharmaceuticals market turnover reached USD 18.12 billion in 2018, up 9.4% from 2017, growing as penetration of health insurance and pharmacies rise. The increasing pharmaceuticals production in the region is significantly driving the growth of the barrier film market in the region.

- According to the US Agriculture Department, China consumed around 74 million metric tons of pork, beef, and poultry in 2017, approximately twice as much as the United States. With a growing preference for Western-style packaged meats, such as various steak cuts, coupled with increasing meat imports to the country, the market for retort packaging for these meat products is expected to drive the market in the region.

- Moreover, the region is also witnessing an increase in demand for ready-to-eat food. Ready-to-eat meals (REM) or take-home food items represent an important area of growth, and sales from this sector are essential to increase the retail food and beverage industry revenue. According to the Japan Ready-Made Meal Association, total sales in 2017 were JPY 10.155 trillion (USD 89.78 billion), and in 2018, total sales were JPY 10.351 trillion (USD 92.12 billion), which was 1.9% higher than the previous year. Such factors are anticipated to boost the growth of barrier films in the food and beverage industry.

Barrier Film Packaging Industry Overview

- Jan 2019 -Mondi invested in its Styria, Austria, plant to further boost its ability to develop safe, clean, eco-friendly liners for Flexible Intermediate Bulk Containers byinstalling new equipment at Styria to make high-barrier, side-gusseted tubes for FIBCs.This also enables the company to make these films in a variety of structures, likefrom PE to PE/PA, and PE/EVOH to seven-layered PE/PA/EVOH structures, Investment in Europe indicates the company’s confidence in the business opportunity in the region.

- April 2019 -Huhtamaki started flexible packaging manufacturing in Egypt. The investment marks the company's entry into manufacturing flexible packaging in Africa. Moreover, the product manufactured would be exported to other African countries and Europe.

Barrier Film Packaging Market Leaders

-

Amcor PLC

-

Berry Global Inc.

-

Sealed Air Corporation

-

Mondi Group

-

Huhtamaki Group

*Disclaimer: Major Players sorted in no particular order

Barrier Film Packaging Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Replacement of Rigid Packaging Formats

- 4.3.2 Increasing Biodegradable Barrier Films

-

4.4 Market Restraints

- 4.4.1 Environmental Legislations For Recycling

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Technology Snapshot

5. MARKET SEGMENTATION

-

5.1 By Packaging Product

- 5.1.1 Bags

- 5.1.2 Pouches

- 5.1.3 Tray Lidding Films

- 5.1.4 Blister Base Films

- 5.1.5 Wrapping Films and Forming Webs

-

5.2 By Material

- 5.2.1 Polyethylene (HDPE, LDPE, LLDPE)

- 5.2.2 Biaxially Oriented Polyethylene Terephthalate (BOPET)

- 5.2.3 Polypropylene (CPP and BOPP)

- 5.2.4 Polyvinyl Chloride (PVC)

- 5.2.5 Other Materials (EVOH, Polystyrene (PS), and Nylon,)

-

5.3 By End-user Industry

- 5.3.1 Food

- 5.3.2 Beverages

- 5.3.3 Pharmaceutical and Medical

- 5.3.4 Personal Care and Home Care

- 5.3.5 Other End-user Industries

-

5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Rest of the World

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Berry Global Inc.

- 6.1.3 Sealed Air Corporation

- 6.1.4 UFlex Limited

- 6.1.5 Huhtamaki Group

- 6.1.6 Mondi Group

- 6.1.7 Winpak Limited

- 6.1.8 Constantia Flexibles Group GmbH

- 6.1.9 Proampac LLC

- 6.1.10 Polyplex Corporation Limited

- 6.1.11 KM Packaging Services Limited

- 6.1.12 Glenroy Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityBarrier Film Packaging Industry Segmentation

| By Packaging Product | Bags |

| Pouches | |

| Tray Lidding Films | |

| Blister Base Films | |

| Wrapping Films and Forming Webs | |

| By Material | Polyethylene (HDPE, LDPE, LLDPE) |

| Biaxially Oriented Polyethylene Terephthalate (BOPET) | |

| Polypropylene (CPP and BOPP) | |

| Polyvinyl Chloride (PVC) | |

| Other Materials (EVOH, Polystyrene (PS), and Nylon,) | |

| By End-user Industry | Food |

| Beverages | |

| Pharmaceutical and Medical | |

| Personal Care and Home Care | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Barrier Film Packaging Market Research FAQs

What is the current Barrier Film Packaging Market size?

The Barrier Film Packaging Market is projected to register a CAGR of 6.40% during the forecast period (2024-2029)

Who are the key players in Barrier Film Packaging Market?

Amcor PLC, Berry Global Inc., Sealed Air Corporation, Mondi Group and Huhtamaki Group are the major companies operating in the Barrier Film Packaging Market.

Which is the fastest growing region in Barrier Film Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Barrier Film Packaging Market?

In 2024, the Asia Pacific accounts for the largest market share in Barrier Film Packaging Market.

What years does this Barrier Film Packaging Market cover?

The report covers the Barrier Film Packaging Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Barrier Film Packaging Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Barrier Films Industry Report

Statistics for the 2023 Barrier Films market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Barrier Films analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.