Beer Packaging Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 3.60 % |

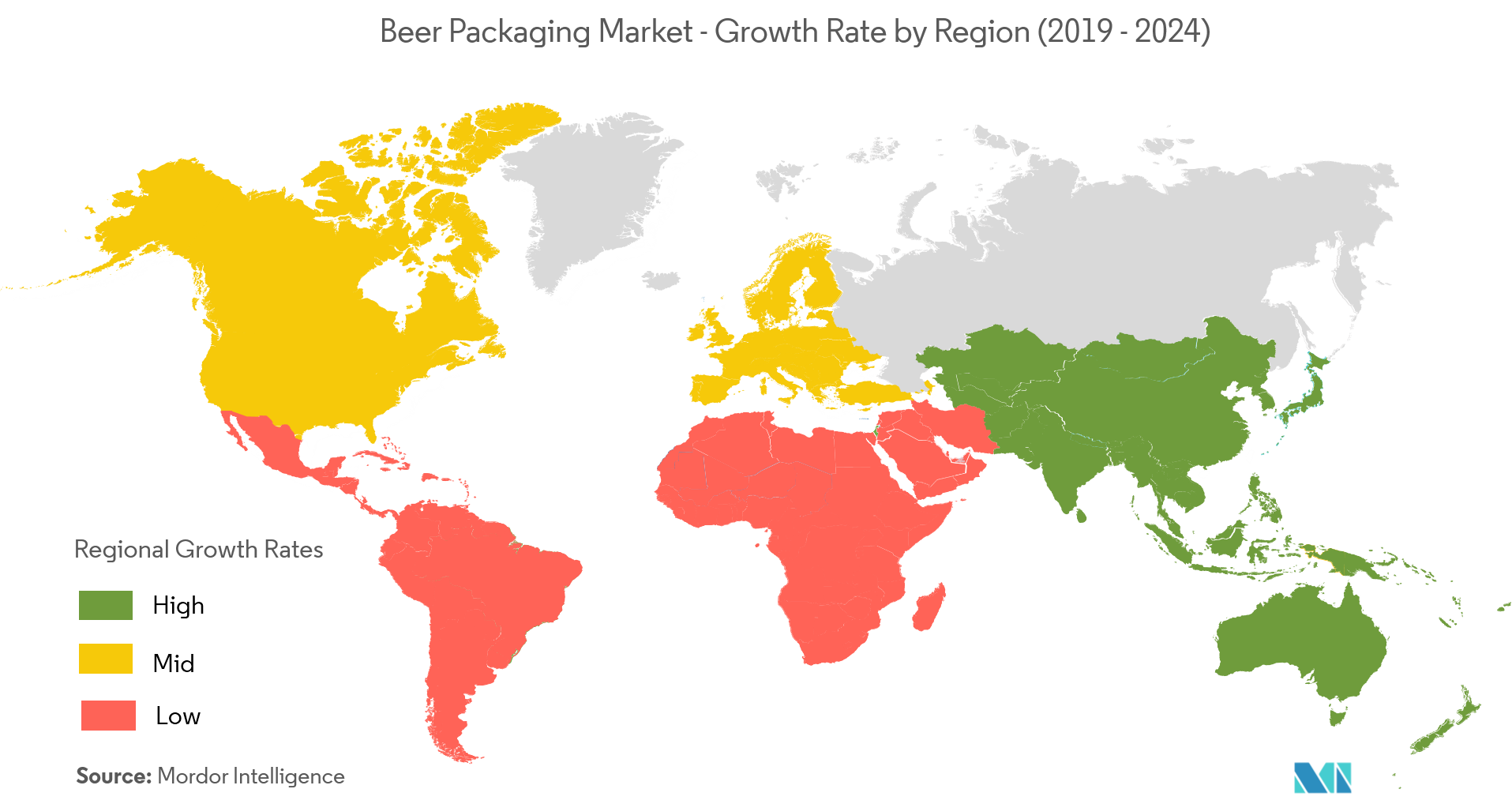

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Beer Packaging Market Analysis

The beer packaging market is expected to register a CAGR of 3.6% during the forecast period, 2021-2026. Over the last few years, the beer packaging industry has been riding a wave of popularity for innovative packaging solutions, a trend that is expected to impact the market significantly.

- The beer packaging industry has a direct relation with the beer manufacturing industry. During the past decade, due to the changing lifestyle trends and increasing affordability of beer across the globe, beer packaging has gained significant traction.

- The demand for various sizes of beer and its benefits, like one-time consumption, have made beer a preferred option for a wide range of consumers, thereby, driving the growth of the beer industry that drives the packaging market as well.

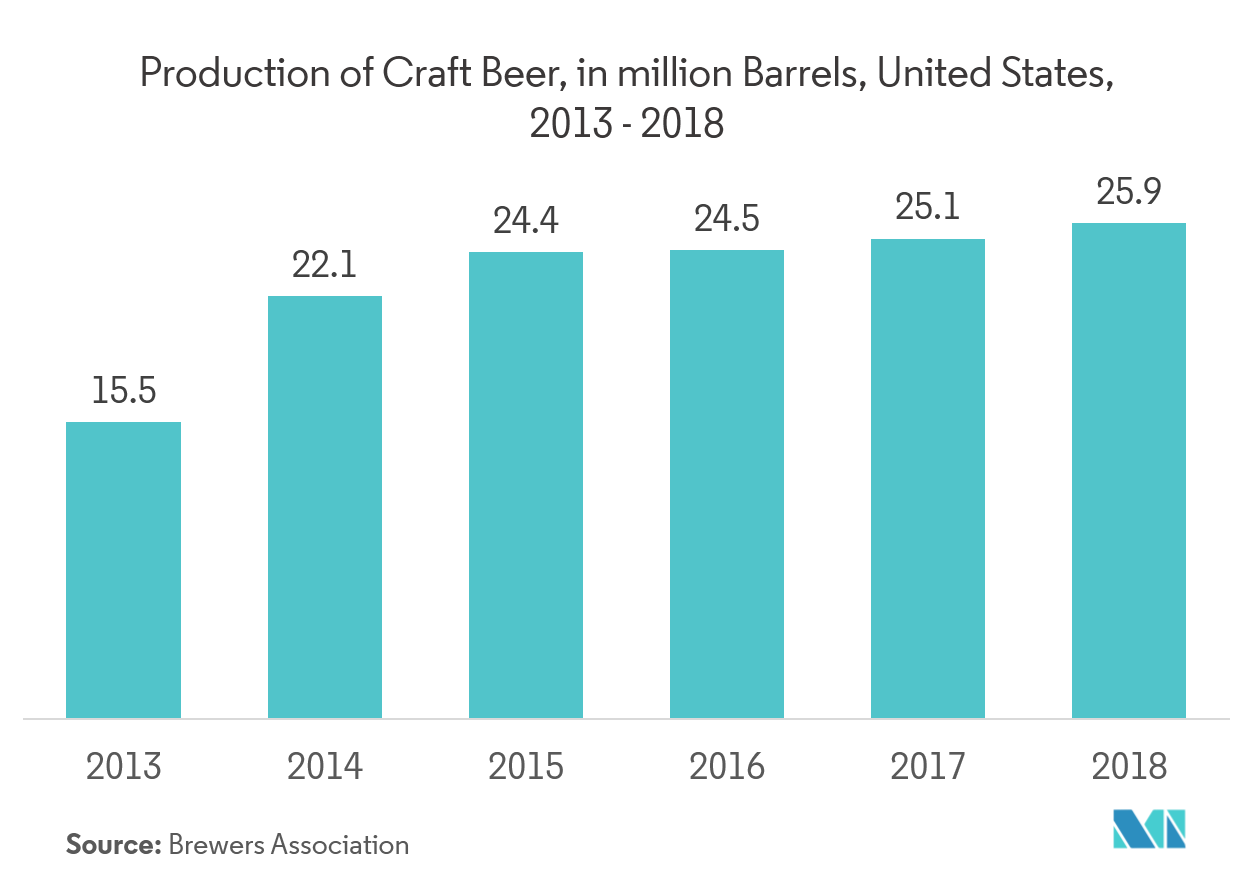

- With the growing consumption of craft beer across various regions, the beer packaging market is also witnessing a positive growth. Consumers are increasingly preferring craft beer brewed by both small and big breweries.

- On the contrary, consumer preference for wine might act as a challenge to the market. Owing to the increasing affordability of wine and liquor products, this shift is expected to continue, making more consumers shift toward these beverages.

Beer Packaging Market Trends

This section covers the major market trends shaping the Beer Packaging Market according to our research experts:

Glass Packaging is Expected to Hold the Largest Market Share

- Advantages, like reusability and the ability to keep beer fresh for a longer period of time as compared to other alternative packaging materials, the glass packaging method is estimated to hold the highest share in the beer packaging market.

- The returnable glass used for packing beer prevents light from entering the bottle and the beer from being skunked, making it a viable packaging option for companies. Moreover, glass adds an authentic look to the packaging and satisfies various consumer preferences.

- Glass has a zero rate of chemical interactions with products, which reduces the risk of spoilage. Taking the benefits into consideration, glass is estimated to hold the highest share over the forecast period.

- Furthermore, an amber glass beer bottle provides 99.9% protection from ultraviolet (UV) rays. Additionally, glass is a good insulator and it keeps beer colder much longer than any other type of single-use packaging.

- With the increasing beer production in various regions, the packaging market may also witness an increasing demand. Hence, it is driving the beer packaging market forward.

Asia-Pacific to Witness the Highest Growth Rate

- The Asia-Pacific beer packaging market is primarily driven by changing cultural trends, the expanding population, growing urbanization, and the rising popularity of beer among the younger population.

- Owing to the various investments and higher penetration of beer in different regions, this trend for beer in this region is expected to continue and grow, which in turn, may boost the packaging market.

- Heineken, an Amsterdam-based company, increased its stake in United Breweries, India’s largest beer manufacturer, thereby, offering high growth potential for the beer packaging industry in the country.

- Furthermore, with a significant rise in the number of working-class individuals and the increase in disposable incomes of the people in this region, the adoption of premium and high-quality beers in this region is increasing. Thus, this is driving the beer packaging market.

Beer Packaging Industry Overview

The beer packaging market iscompetitive, owing to the presence of various international and domestic manufacturers. The market appears to be fragmented with the vendors competingin terms of price, capacity, volume, product quality, and technological innovation in the market. Some of the major players in the market areAmcor Limited,Ardagh Group SA,and Ball Corporation, among others.

- Apr 2018 - Crown HoldingsInc.completed its previously announced acquisition ofSignode Industrial Group Holdings (Bermuda) Ltd, a leading global provider of transit packaging systems and solutions, from TheCarlyle Group.

- Sep 2018 -Carlsberg announced the launch of its new Snap Pack, which is set to reduce plastic waste globally by more than 1,200 metric tona year,that isequivalent to 60 million plastic bags. The Snap Pack replaces the plastic wrapping used around Carlsberg’s six packs with a pioneering technology that glues its cans together.

Beer Packaging Market Leaders

-

Amcor Limited

-

Ardagh Group SA

-

Crown Holdings Incorporated

-

Ball Corporation

-

WestRock Company

*Disclaimer: Major Players sorted in no particular order

Beer Packaging Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Changing Consumer Preferences

- 4.3.2 Innovative Packaging and Attractive Marketing

-

4.4 Market Restraints

- 4.4.1 Consumer Preference of Wine and Liquor Over Beer in a Few Regions

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Packaging Material

- 5.1.1 Glass

- 5.1.2 Metal

- 5.1.3 PET

-

5.2 By Packaging Type

- 5.2.1 Bottle

- 5.2.2 Keg

- 5.2.3 Can

-

5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Amcor Limited

- 6.1.2 Ardagh Group SA

- 6.1.3 Crown Holdings Incorporated

- 6.1.4 Ball Corporation

- 6.1.5 Westrock Company

- 6.1.6 Tetra Laval International SA

- 6.1.7 Carlsberg Group

- 6.1.8 Allied Glass Containers Limited

- 6.1.9 Plastipak Holdings Inc.

- 6.1.10 Nampack Ltd

- 6.1.11 Smurfit Kappa Group PLC

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityBeer Packaging Industry Segmentation

Beer packaging is an extremely important process in the production, transport, and sale of this beverage. The bottling of beverages can be performed into glass bottles, PET bottles, and in cans.

| By Packaging Material | Glass | |

| Metal | ||

| PET | ||

| By Packaging Type | Bottle | |

| Keg | ||

| Can | ||

| By Geography | North America | United States |

| Canada | ||

| By Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Rest of Europe | ||

| By Geography | Asia-Pacific | China |

| India | ||

| Japan | ||

| Rest of Asia-Pacific | ||

| By Geography | Latin America | Brazil |

| Mexico | ||

| Rest of Latin America | ||

| By Geography | Middle East & Africa | Saudi Arabia |

| United Arab Emirates | ||

| South Africa | ||

| Rest of Middle East & Africa |

Beer Packaging Market Research FAQs

What is the current Beer Packaging Market size?

The Beer Packaging Market is projected to register a CAGR of 3.60% during the forecast period (2024-2029)

Who are the key players in Beer Packaging Market?

Amcor Limited, Ardagh Group SA, Crown Holdings Incorporated, Ball Corporation and WestRock Company are the major companies operating in the Beer Packaging Market.

Which is the fastest growing region in Beer Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Beer Packaging Market?

In 2024, the North America accounts for the largest market share in Beer Packaging Market.

What years does this Beer Packaging Market cover?

The report covers the Beer Packaging Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Beer Packaging Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Beer Packaging Industry Report

Statistics for the 2024 Beer Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Beer Packaging analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.