Beverage Caps and Closures Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 4.54 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Beverage Caps and Closures Market Analysis

The Global Beverage Caps and Closures market was valued at USD 62.08 billion in 2020 and is expected to reach a value of USD 80.87 billion by 2026 and work at a CAGR of 4.54% over the forecast period (2021-2026).

- The increasing demand for packaged beverages coupled with the technological advancements in packaging solutions is expected to aid the growth of the market over the forecast period.

- It was anticipated that the most established beverage categories such as milk and fruit juice are expected to offer sluggish growth opportunities, whereas, newer beverage categories including sports drinks, ready-to-drink tea and coffee, and other healthy beverage alternatives will increase the overall demand for beverage closures.

- Stringent Regulations on the Usage of Plastic Bottles will act as a factor which will restrain the growth of beverage caps and closures. The regulations by the government have a direct and adverse effect on the sales of caps and closures.

Beverage Caps and Closures Market Trends

This section covers the major market trends shaping the Beverage Caps & Closures Market according to our research experts:

Plastic is Expected to Experience a Significant Market Share

- Technology advancements in plastic packaging have resulted in innovations in product development in the beverage industry. With many companies investing significantly in R&D activities to come up with a unique and cost-effective product, the innovations in this space are increasing at a significant pace.

- For instance in April 2018, FIJI Water, United States one of the major premium imported bottled water brand, recently unveiled its new FIJI Water Sports Cap bottle featuring a slim and sleek design, especially targeting the sports enthusiasts.

- Moreover, Dow industries introduced a new range of PET resins portfolio for manufacturing of caps and closures. The Italian company, Imola has also come up with a new HD printing machine to print high-quality images at a fast rate on caps.

- Many other major companies such as Amcor, Ball Corp. are also following similar suite and are offering new and innovative final products. With innovations in the industry, the demand for products is also growing, thus driving the growth of caps and closures in the beverages industry around the globe.

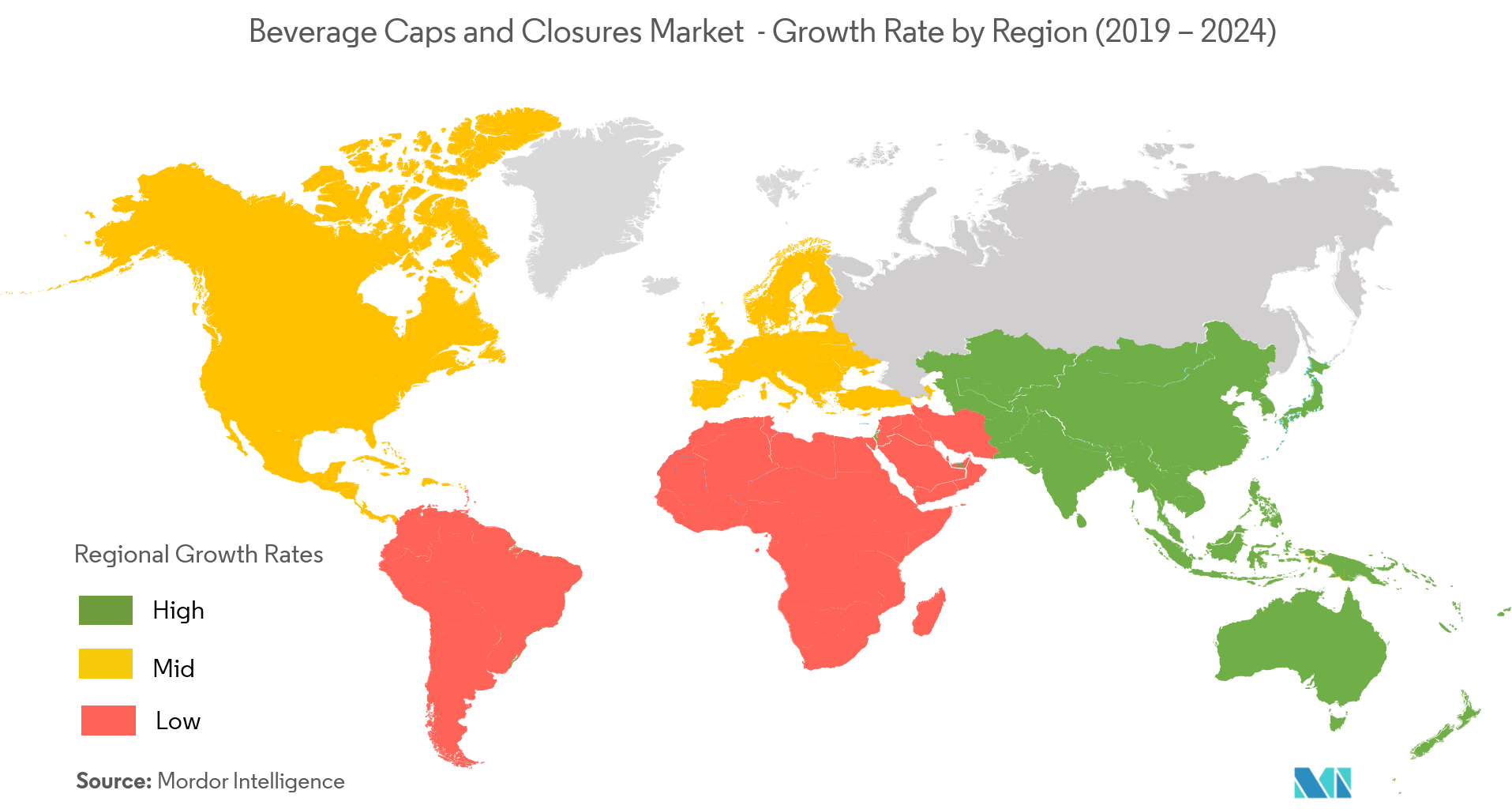

Asia Pacific is Expected to Hold a Major Market Share

- The beverages industry in the Asia Pacific region has shown robust growth in the past decade, owing to rising disposable incomes and this trend is expected to follow over the forecast period, owing to changing consumer preferences, indicating an increasing prominence towards energy and nutritional drinks.

- Rapidly growing middle class and evolving workplace culture, are increasing the amount of alcohol consumed in the region. Statistics from the World Health Organization (WHO) reported that total pure alcohol consumption per capita amounted to 7.6 liters in 2015.

- This trend is further expected to increase over the forecast period, resulting in a higher production of alcohol, proportionately driving the demand for caps and closures in the APAC region especially in countries such as India, Taiwan.

- However, the vendor landscape of the market has been rendered primarily fragmented owing to the presence of a massive set of regional as well as international players.

Beverage Caps and Closures Industry Overview

- July 2018 - AptarGroup Inc. has a deal in place to acquire CSP Technologies Inc. a specialty plastic packaging maker, for USD 555 million.

Beverage Caps and Closures Market Leaders

-

Crown Holdings Inc.

-

Berry Global, Inc.

-

Aptar Group Inc.

-

Evergreen Packaging Inc.

-

Global Closure Systems

*Disclaimer: Major Players sorted in no particular order

Beverage Caps and Closures Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

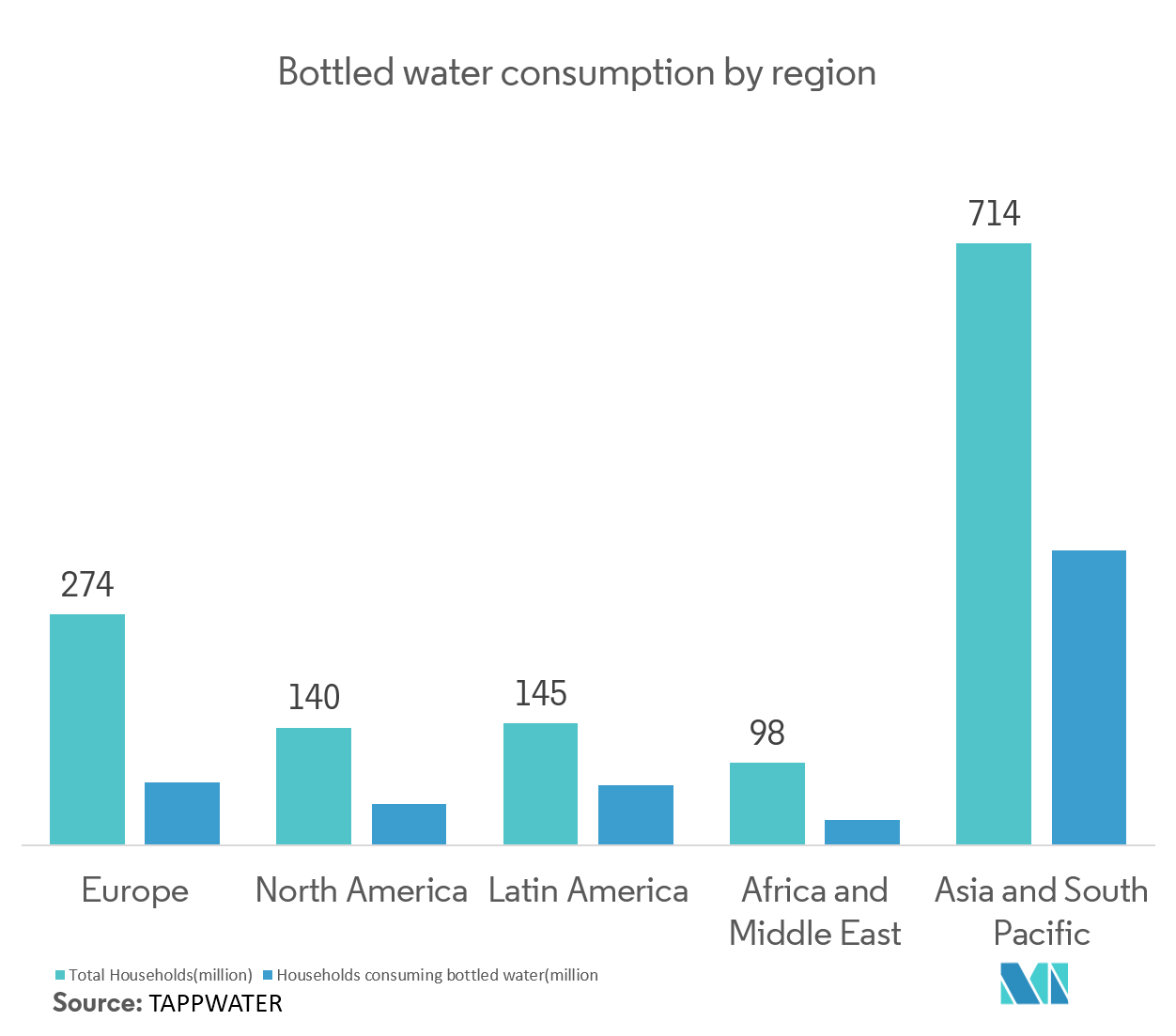

- 4.3.1 Increasing Beverage Consumption in Developing Economies

- 4.3.2 Technological Advancements and Innovative Packaging Solutions

-

4.4 Market Restraints

- 4.4.1 Stringent Regulations on the Usage of Plastic Bottles

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Material

- 5.1.1 Metal

- 5.1.2 Plastic

- 5.1.3 Other Materials (Rubber, Cork)

-

5.2 Geography

- 5.2.1 North America

- 5.2.1.1 US

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 UK

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 UAE

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Crown Holdings Inc.

- 6.1.2 Berry Global, Inc.

- 6.1.3 Aptar Group Inc.

- 6.1.4 Evergreen Packaging Inc.

- 6.1.5 Global Closure Systems

- 6.1.6 Silgan Holdings Inc.

- 6.1.7 Bericap GmbH & Co. KG

- 6.1.8 Guala Closures Group

- 6.1.9 Ball Corporation

- 6.1.10 Amcor Ltd.

- 6.1.11 Pact Group

- 6.1.12 Albea Group

- 6.1.13 Tetra Laval International

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityBeverage Caps and Closures Industry Segmentation

| By Material | Metal | |

| Plastic | ||

| Other Materials (Rubber, Cork) | ||

| Geography | North America | US |

| Canada | ||

| Geography | Europe | Germany |

| UK | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Brazil |

| Mexico | ||

| Rest of Latin America | ||

| Geography | Middle East and Africa | UAE |

| Saudi Arabia | ||

| South Africa | ||

| Rest of Middle East & Africa |

Beverage Caps and Closures Market Research FAQs

What is the current Beverage Caps and Closures Market size?

The Beverage Caps and Closures Market is projected to register a CAGR of 4.54% during the forecast period (2024-2029)

Who are the key players in Beverage Caps and Closures Market?

Crown Holdings Inc., Berry Global, Inc., Aptar Group Inc., Evergreen Packaging Inc. and Global Closure Systems are the major companies operating in the Beverage Caps and Closures Market.

Which is the fastest growing region in Beverage Caps and Closures Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Beverage Caps and Closures Market?

In 2024, the North America accounts for the largest market share in Beverage Caps and Closures Market.

What years does this Beverage Caps and Closures Market cover?

The report covers the Beverage Caps and Closures Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Beverage Caps and Closures Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Beverage Caps & Closures Industry Report

Statistics for the 2024 Beverage Caps & Closures market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Beverage Caps & Closures analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.