Biodegradable Plastic Packaging Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 20.70 % |

| Fastest Growing Market | Europe |

| Largest Market | North America |

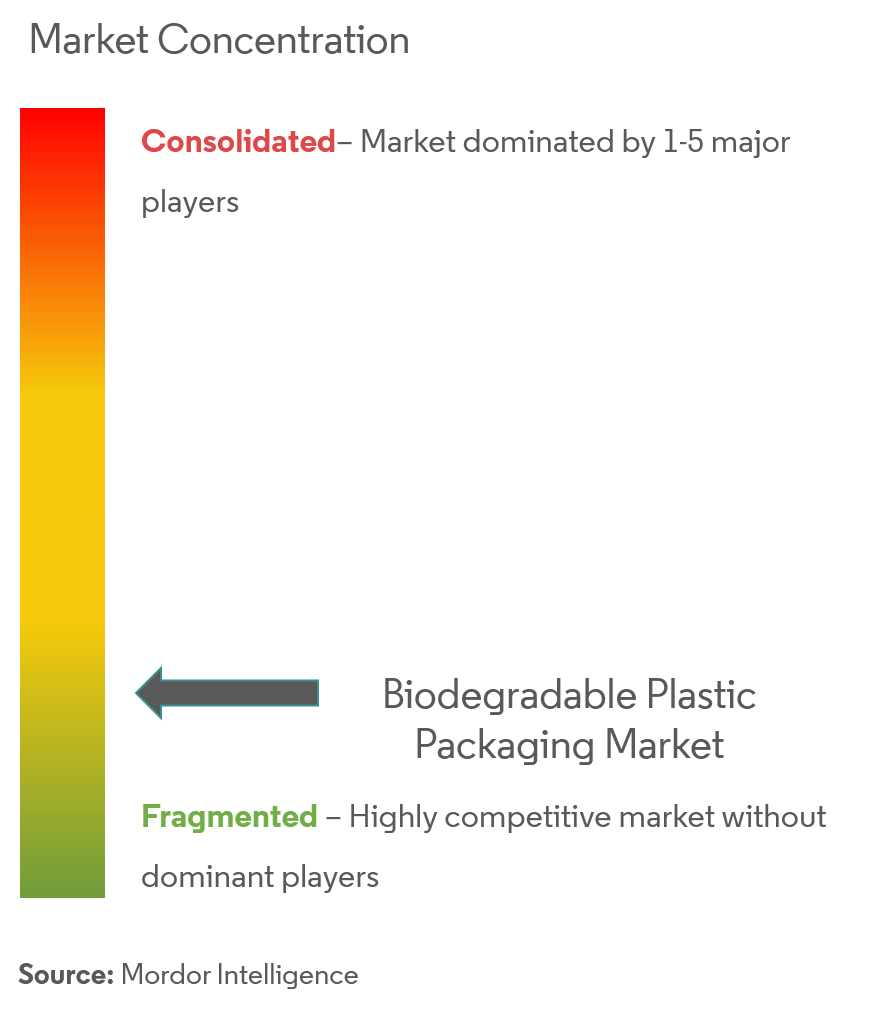

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Biodegradable Plastic Packaging Market Analysis

The biodegradable plastic packaging market was valued at USD 2.77 billion in 2020 and expected to reach USD 8.53 billion by 2026 and grow at a CAGR of 20.7% over the forecast period (2021 - 2026).

- The increasing environmental concerns regarding plastic usage (as plastics contain toxic pollutants that harm plants, animals, and people) are driving the use of biodegradable plastic alternatives. Floating plastic waste that survives thousands of years in water can serve as a transportation device for invasive species that disrupt habitats. This aforementioned factor is contributing to the growth of the market.

- The stringent regulations by various governments and federal agencies with an objective to reduce plastic waste and promote biodegradable plastics usage in packaging are boosting the demand of this market. The regulations related to green packaging is increasing. As a result, various FMCG companies are required to adopt biodegradable packaging to comply with the standards, which in turn, is propelling the growth of this market.

- However, high costs (compared to normal plastic) are restraining the growth of the market, as biodegradable plastic is made from plants' starch and its decomposition needs specific conditions, like temperature, bacteria, humidity, etc. (which may not be available in most of the dump yards and landfills).

Biodegradable Plastic Packaging Market Trends

This section covers the major market trends shaping the Biodegradable Plastic Packaging Market according to our research experts:

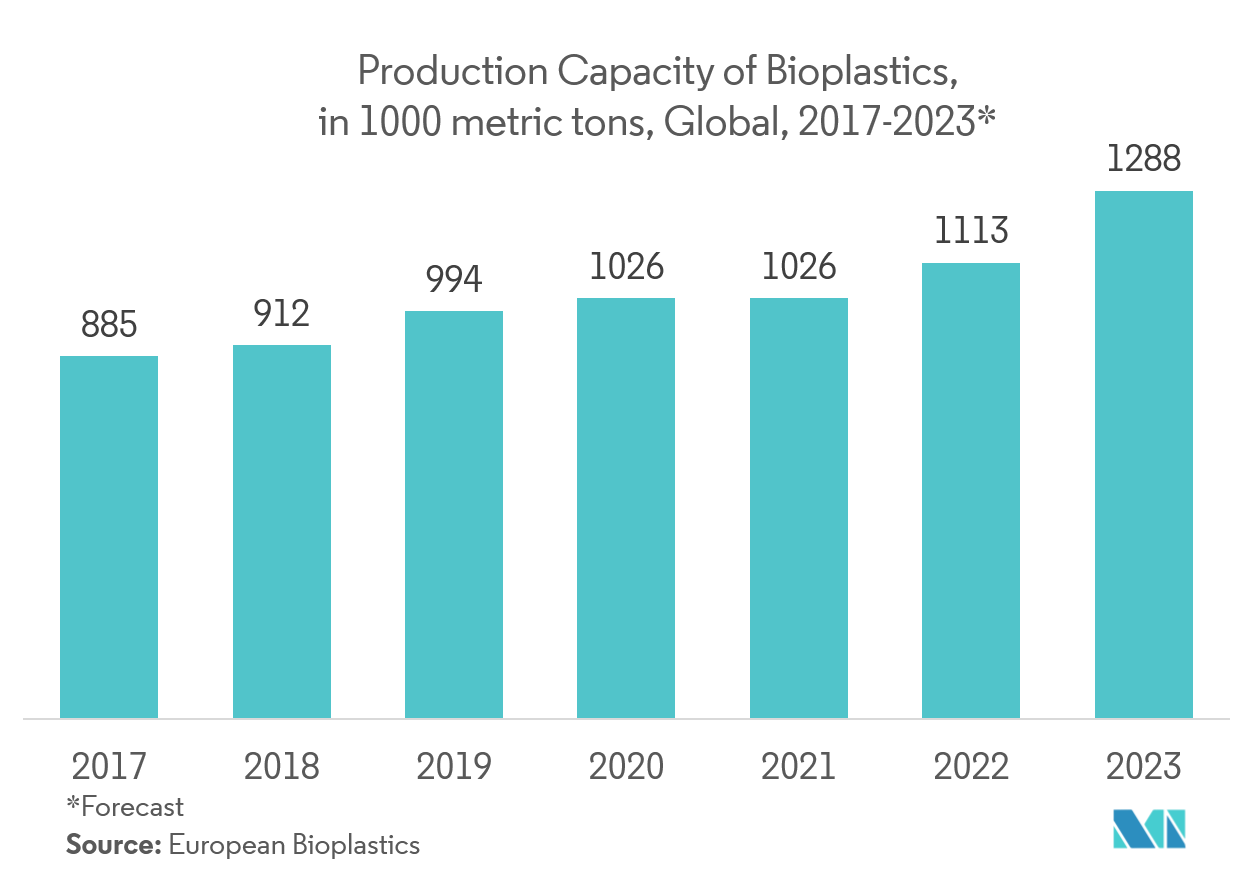

Use of Bioplastics is Stimulating the Market Growth

- The overarching problem of climate change and the expected future shortage of fossil resources have accelerated the search for better concepts for plastics packaging. Bioplastics packaging offers the same qualities as conventional packaging. It also offers greater sustainability.

- There is a high demand for bioplastic packaging for wrapping organic food, as well as premium and branded products with specific requirements. A combination of recycling components from conventional plastics, such as rPET with bioplastics (bio-based PET), provides high-performance processing of bioplastics packaging. Biodegradable food packaging, certified as industrially compostable, was the first successfully commercialized bioplastic product.

- Bioplastic's applications are increasing for cosmetics packaging of compact powders, creams, and lipsticks, as well as beverage bottles. The materials, such as PLA, bio-based PE, or bio-based PET, are used in this section. The high percentage of bio-based material in these products, as well as the ability to combine them with recyclates from conventional PE and PET, resulted in a decisive increase in resource efficiency and the reduction of CO2 emissions. These factors are expected to boost the market's growth in the future.

- The retailers in Europe, such as Rossmann, Aldi, Coop, and Carrefour, use single or multi-use carrier bags made from bioplastics, with the add-on bonus of biodegradability. The certified biodegradable/compostable cups are also used at big events, or in major football stadiums throughout Europe.

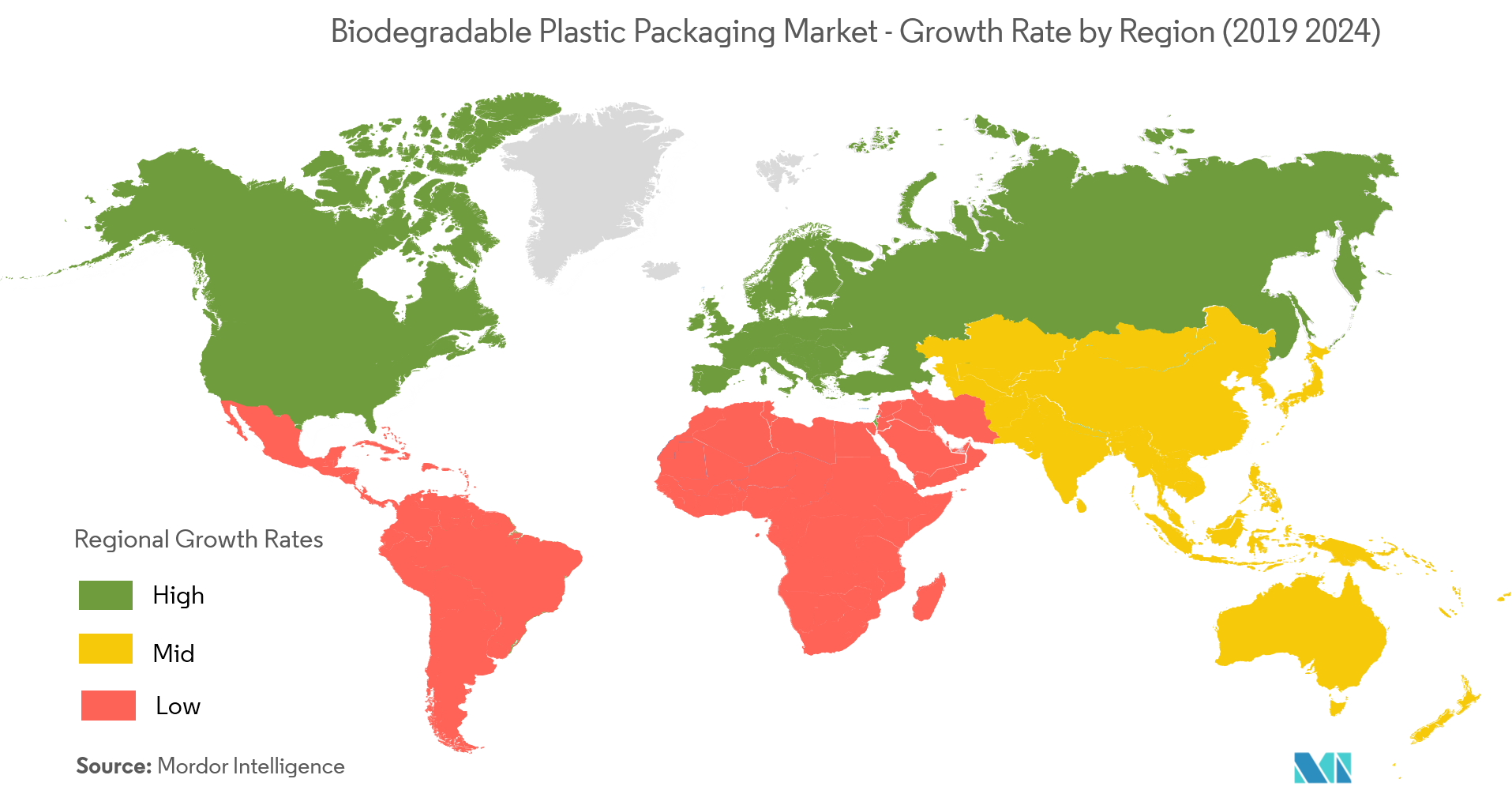

Europe is Expected to Witness a Significant Growth Rate Over the Forecast Period

- The transition to a low-carbon and circular economy, stronger policy support for the bioeconomy, and increased consumer awareness for sustainable products and packaging are driving the expansion of the market in Europe.

- The European Union’s decision to reduce the overall consumption of thin plastic bags in the region by about 80% by 2019, compared to the consumption levels in 2010, is expected to create huge growth opportunities for the manufacturers of biodegradable plastics in the next five years.

- The demand for biodegradable plastics is witnessing a significant rise from conventional end-user industries, such as packaging, agriculture, and textile. The use of biodegradable plastics, especially in the European countries, is also increasing in other niche segments, such as medical implants and drug delivery systems, etc. these factors are driving the overall market's growth.

Biodegradable Plastic Packaging Industry Overview

The biodegradable plastic packaging marketis highly fragmented, as the global players are moving toward developing new technologies to manufacture plastic packaging material from various easily available natural resources. The major investments in research and development by the players, in order to developinnovative products, aregenerating high competitions in the market. The key players are Tetra Pak International SA, Plastic Suppliers Inc., Kruger Inc.,etc. The recent developments in the market are as follows -

- January 2019 - KFC of Plano, Texas,announced a new global sustainability commitment that all plastic-based consumer-facing packaging will be recoverable or reusable by 2025. KFC says the goal supports its long-term plan to implement a more sustainable packaging strategy in its restaurants by both developing and using sustainable packaging options, as well as buildingon the progress already made in some markets to eliminate plastic packaging items.

Biodegradable Plastic Packaging Market Leaders

-

Tetra Pak International SA

-

Plastic Suppliers Inc.

-

Kruger Inc.

-

Amcor Limited

-

Mondi PLC

*Disclaimer: Major Players sorted in no particular order

Biodegradable Plastic Packaging Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Growing Environmental Concerns Regarding Plastic Pollution

- 4.3.2 Stringent Regulations by Various Government and Federal Agencies

-

4.4 Market Restraints

- 4.4.1 High Costs Compared to Normal Plastic

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Starch Based plastic

- 5.1.2 Cellulose Based Plastics

- 5.1.3 Polylactic Acid (PLA)

- 5.1.4 Polyhydroxyalkanoates (PHA)

- 5.1.5 Other Plastic Types

-

5.2 By Application

- 5.2.1 Food

- 5.2.2 Beverage

- 5.2.3 Pharmaceutical

- 5.2.4 Personal/Homecare

- 5.2.5 Other Applications

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Tetra Pak International SA

- 6.1.2 Plastic Suppliers Inc.

- 6.1.3 Kruger Inc.

- 6.1.4 Amcor PLC

- 6.1.5 Mondi PLC

- 6.1.6 International Paper Company

- 6.1.7 Smurfit Kappa Group PLC

- 6.1.8 DS Smith PLC

- 6.1.9 Klabin SA

- 6.1.10 Rengo Co. Ltd

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityBiodegradable Plastic Packaging Industry Segmentation

The biodegradable plastics are very much used in the packaging industry, as they are eco-friendly. With the increasing crude oil prices and the issues related to petroleum-based plastics (such as disposal and efficient waste management), the use of biodegradable plastic as an alternative (in various applications, like FMCG, hospital, and manufacturing) is increasing. This aforementioned factor is driving the market's growth.

| By Type | Starch Based plastic |

| Cellulose Based Plastics | |

| Polylactic Acid (PLA) | |

| Polyhydroxyalkanoates (PHA) | |

| Other Plastic Types | |

| By Application | Food |

| Beverage | |

| Pharmaceutical | |

| Personal/Homecare | |

| Other Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Biodegradable Plastic Packaging Market Research FAQs

What is the current Biodegradable Plastic Packaging Market size?

The Biodegradable Plastic Packaging Market is projected to register a CAGR of 20.70% during the forecast period (2024-2029)

Who are the key players in Biodegradable Plastic Packaging Market?

Tetra Pak International SA, Plastic Suppliers Inc., Kruger Inc., Amcor Limited and Mondi PLC are the major companies operating in the Biodegradable Plastic Packaging Market.

Which is the fastest growing region in Biodegradable Plastic Packaging Market?

Europe is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Biodegradable Plastic Packaging Market?

In 2024, the North America accounts for the largest market share in Biodegradable Plastic Packaging Market.

What years does this Biodegradable Plastic Packaging Market cover?

The report covers the Biodegradable Plastic Packaging Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Biodegradable Plastic Packaging Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Biodegradable Plastic Packaging Industry Report

Statistics for the 2024 Biodegradable Plastic Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Biodegradable Plastic Packaging analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.