Blockchain as a Service Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 1.50 Billion |

| Market Size (2029) | USD 3.37 Billion |

| CAGR (2024 - 2029) | 17.50 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Blockchain as a Service Market Analysis

The Blockchain-as-a-Service Market size is estimated at USD 1.5 billion in 2024, and is expected to reach USD 3.37 billion by 2029, growing at a CAGR of 17.5% during the forecast period (2024-2029).

- With the expansion of the cryptocurrency market, in December 2017, many new users have gained knowledge about blockchain and cryptocurrency, and started exploring the same. Thus, there has been a rapid rise of blockchain and cryptocurrency users. The bitcoin blockchain market has witnessed a steep rise over the past few years.

- Blockchain is often called the technology of trust, as they do not have a single point of failure and cannot be changed from a single computer. Furthermore, blockchain allows for the use of tools, like 'smart contracts,' which may potentially automate manual processes, from compliance and claims processing, to distributing the contents of a will. These are some of the desirable features, which are encouraging the BFSI industry to leverage blockchain.

- Blockchain requires huge investment when it comes to setting up infrastructure and maintaining it. It is much more resource intensive, as compared to traditional databases. It also consumes a huge amount of energy and requires huge bandwidth, which the developing countries are struggling for.

Blockchain as a Service Market Trends

This section covers the major market trends shaping the Blockchain-as-a-Service Market according to our research experts:

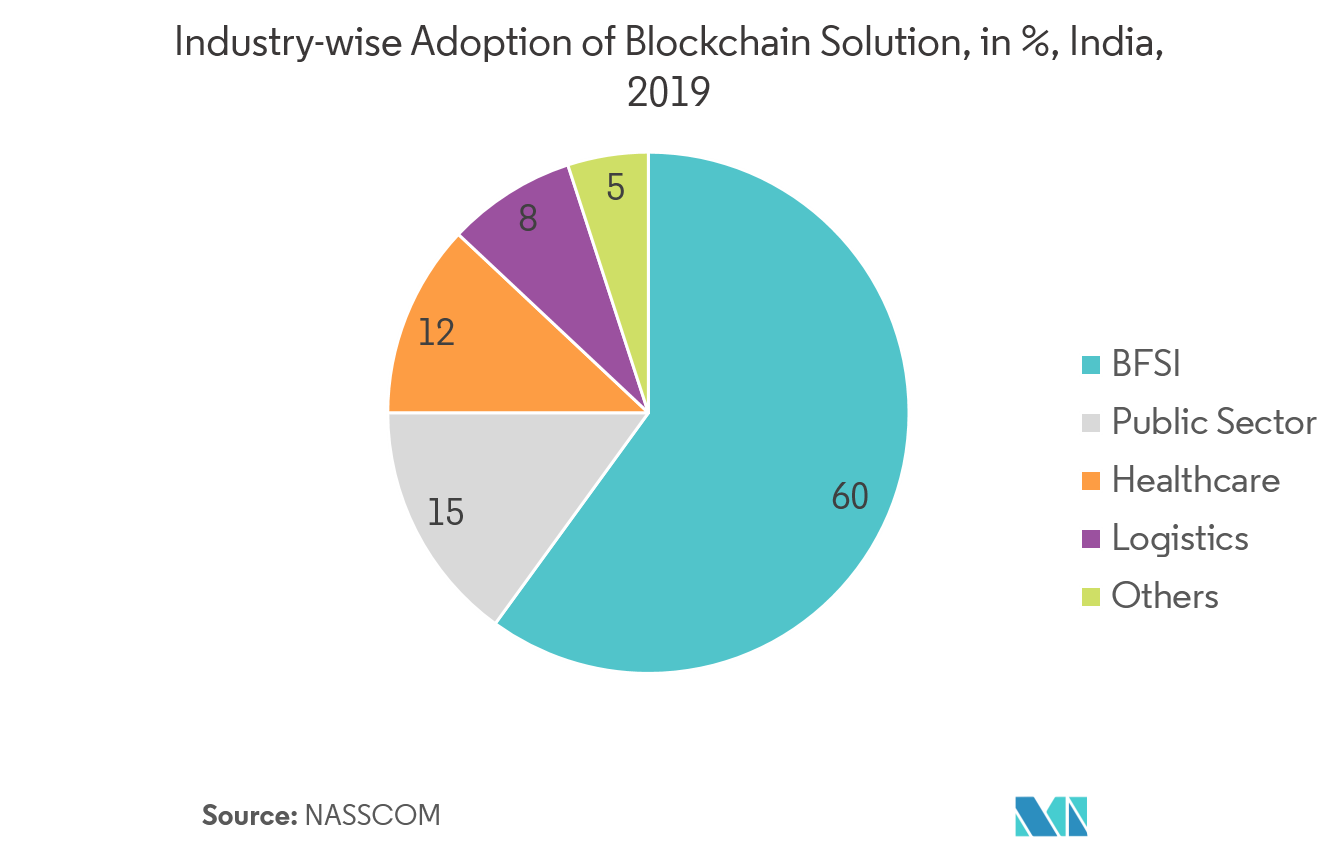

BFSI is Expected to Occupy the Largest Market Share

- Blockchain-as-a-service offerings are revolutionizing the BFSI industry, as banks and financial service companies are among the most heavily invested enterprises exploring blockchain technology.

- This is due to the many, highly valuable decentralized applications of this technology, thereby giving rise to new business models in various areas, such as cross-border payments, remittance, exchanges, internet banking, trade finance, Know Your Customers (KYC), and risk and compliance.

- However, it is still in the nascent stage in the market, owing to which the banks and financial institutions are exploring the viable possibilities of this technology, and investing into the same, which is likely to boost the market growth.

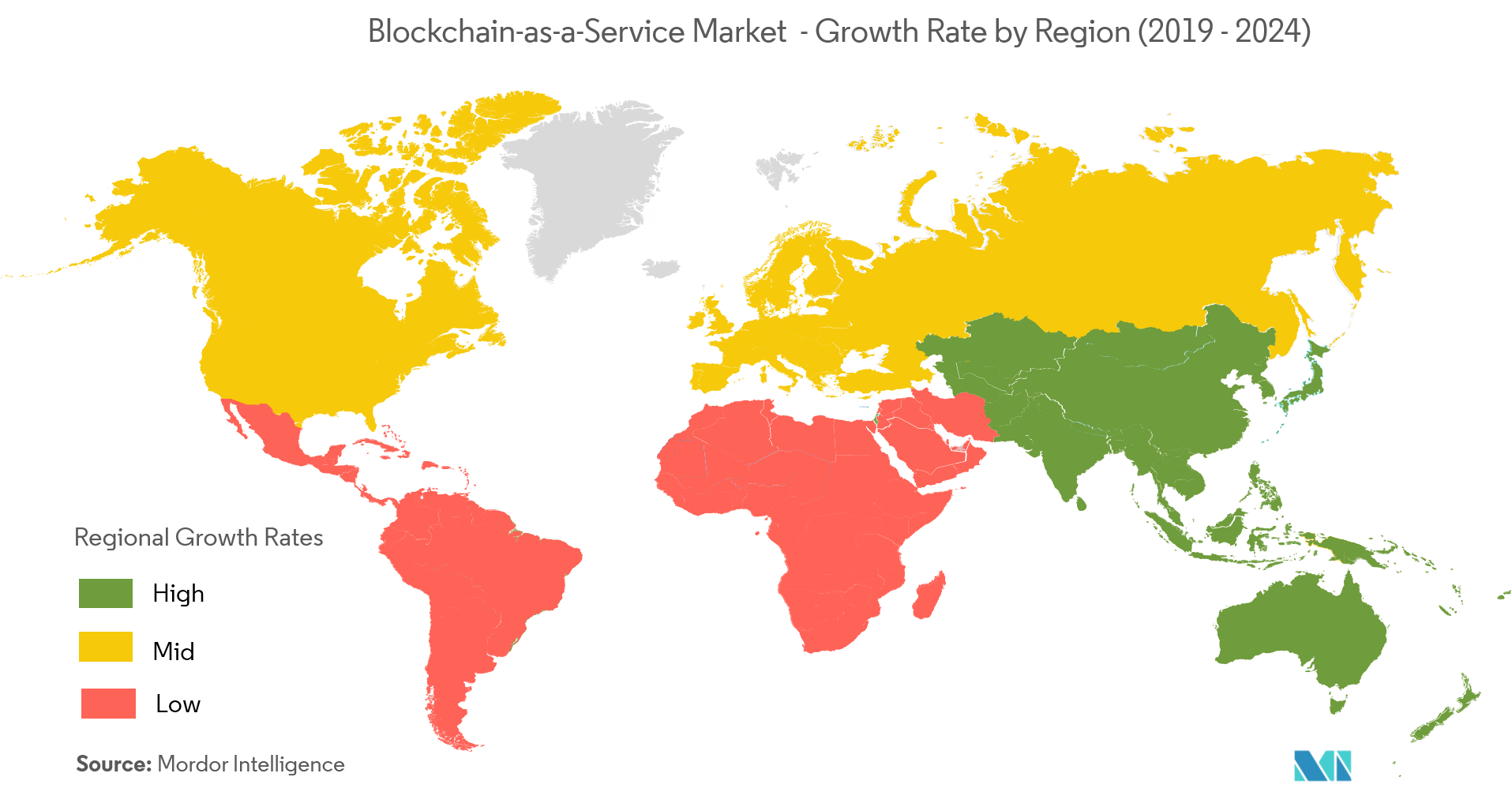

Asia-Pacific is Expected to Witness the Highest Growth Rate

- After May 2018, the Chinese government has been promoting the adoption of blockchain technology, due to its multiple advantages. Majority of mining operations take place in China.

- A leading global ICT (information and communications technology) solutions provider, Huawei, announced the launch of its hyperledger-based blockchain service in April 2018, in China, to enable companies to develop smart contracts on top of a distributed ledger network for several use-case scenarios.

- Moreover, in Thailand, the government positively accepted cryptocurrency projects. Thai regulators established cryptocurrency licenses in 2018, to enable exchanges and ICOs. Clear and specific guidelines have been drawn for foreign blockchain businesses.

- Furthermore, the South Korean government also spent USD 880 million on blockchain development for 2019. Owing to all these factors, Asia-Pacific is expected to witness the fastest growth rate over the forecast period.

Blockchain as a Service Industry Overview

The potential of blockchain-as-a-service has been recognized by few of the world’s largest software companies. The three big cloud providers, Amazon, Microsoft, and IBM, have developed blockchain-as-a-service platforms that are already available for their cloud customers. Blockchain startups are also hiring freelancers for a better talent pool.

- March 2019 -Tata Consultancy Services (TCS) collaborated with Microsoft and R3 technology (R3), to adopt a scalable cross-industry blockchain platform. Some of the anchor solutions that are being built on these platforms include skills marketplace, anti-counterfeiting of luxury goods, affordable mobility, and shared telecom infrastructure for 5G, and loyalty and rewards programs.

- February 2019 -IBM made the IBM Food Trust solution "generally available", and the latest company to experiment with this solution isAlbertsons Companies, the world’s second-largest supermarket company, by sales.

Blockchain as a Service Market Leaders

-

Microsoft Corporation

-

Hewlett-Packard Enterprise

-

IBM Corporation

-

SAP SE

-

Stratis

*Disclaimer: Major Players sorted in no particular order

Blockchain as a Service Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET OVERVIEW

5. MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

-

5.2 Market Drivers

- 5.2.1 Increasing Awareness of Blockchain Technology is Helping to Expand the Market

- 5.2.2 Need for Security in Transactions is Driving the Blockchain's Growth

-

5.3 Market Restraints

- 5.3.1 Volatility of Network Speed and Cost Involved Can be a Restraining Factor

- 5.4 Value Chain Analysis

-

5.5 Industry Attractiveness - Porter's Five Forces Analysis

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Buyers/Consumers

- 5.5.3 Bargaining Power of Suppliers

- 5.5.4 Threat of Substitute Products

- 5.5.5 Intensity of Competitive Rivalry

6. MARKET SEGMENTATION

-

6.1 End-user Vertical

- 6.1.1 BFSI

- 6.1.2 Healthcare

- 6.1.3 IT and Telecom

- 6.1.4 Energy and Utilities

- 6.1.5 Retail

- 6.1.6 Manufacturing

- 6.1.7 Other End-user Verticals

-

6.2 Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Russia

- 6.2.2.5 Spain

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 South Korea

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.4.3 Rest of Latin America

- 6.2.5 Middle East & Africa

- 6.2.5.1 United Arab Emirates

- 6.2.5.2 Saudi Arabia

- 6.2.5.3 South Africa

- 6.2.5.4 Egypt

- 6.2.5.5 Rest of Middle East & Africa

7. COMPETITIVE LANDSCAPE

-

7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 Hewlett-Packard Enterprise

- 7.1.3 IBM Corporation

- 7.1.4 SAP SE

- 7.1.5 Stratis

- 7.1.6 Amazon Web Services

- 7.1.7 Oracle Corporation

- 7.1.8 Huawei Technologies Co. Ltd

- 7.1.9 Blockstream Inc.

- 7.1.10 PayStand Inc.

- *List Not Exhaustive

8. INVESTMENT ANALYSIS

9. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityBlockchain as a Service Industry Segmentation

| End-user Vertical | BFSI | |

| Healthcare | ||

| IT and Telecom | ||

| Energy and Utilities | ||

| Retail | ||

| Manufacturing | ||

| Other End-user Verticals | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Russia | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Brazil |

| Argentina | ||

| Rest of Latin America | ||

| Geography | Middle East & Africa | United Arab Emirates |

| Saudi Arabia | ||

| South Africa | ||

| Egypt | ||

| Rest of Middle East & Africa |

Blockchain as a Service Market Research FAQs

How big is the Blockchain-as-a-Service Market?

The Blockchain-as-a-Service Market size is expected to reach USD 1.50 billion in 2024 and grow at a CAGR of 17.5% to reach USD 3.37 billion by 2029.

What is the current Blockchain-as-a-Service Market size?

In 2024, the Blockchain-as-a-Service Market size is expected to reach USD 1.50 billion.

Who are the key players in Blockchain-as-a-Service Market?

Microsoft Corporation, Hewlett-Packard Enterprise, IBM Corporation, SAP SE and Stratis are the major companies operating in the Blockchain-as-a-Service Market.

Which is the fastest growing region in Blockchain-as-a-Service Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Blockchain-as-a-Service Market?

In 2024, the North America accounts for the largest market share in Blockchain-as-a-Service Market.

What years does this Blockchain-as-a-Service Market cover, and what was the market size in 2023?

In 2023, the Blockchain-as-a-Service Market size was estimated at USD 1.28 billion. The report covers the Blockchain-as-a-Service Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Blockchain-as-a-Service Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Blockchain as a Service Industry Report

Statistics for the 2024 Blockchain as a Service market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Blockchain as a Service analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.