Brazil Food Flavor & Enhancer Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 3.05 % |

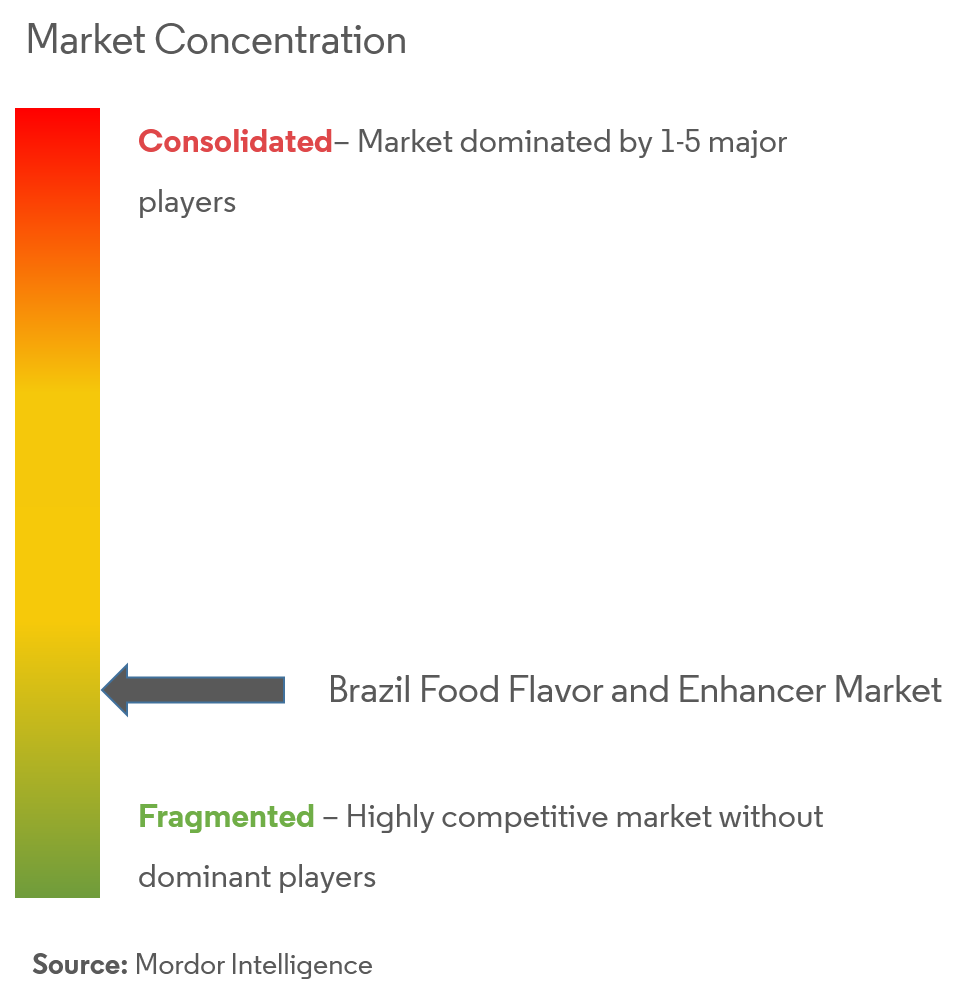

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Brazil Food Flavor & Enhancer Market Analysis

Brazil Food Flavor And Enhancer market is projected to grow at a CAGR 3.05%, during the forecast period (2020 - 2025).

- The synthetic flavor holds a major share in the market closely followed by natural flavors. In general, the key factor influencing the decision to consume functional food in the country are flavors, quality, price, convenience, and expected health effects. Functional foods in the country are fulfilling the consumer's desire for convenience and flavor, which is expected to drive the food flavor and enhancer market in the country over the forecast period.

- There is a rising demand for fat replacers and sweeteners in the Brazilian weight control sector. This is providing an opportunity for the major manufacturers in the country to incorporate new flavors in their products, in order to affect the consumers' decision to buy, based on their taste preferences

Brazil Food Flavor & Enhancer Market Trends

This section covers the major market trends shaping the Brazil Food Flavor & Enhancer Market according to our research experts:

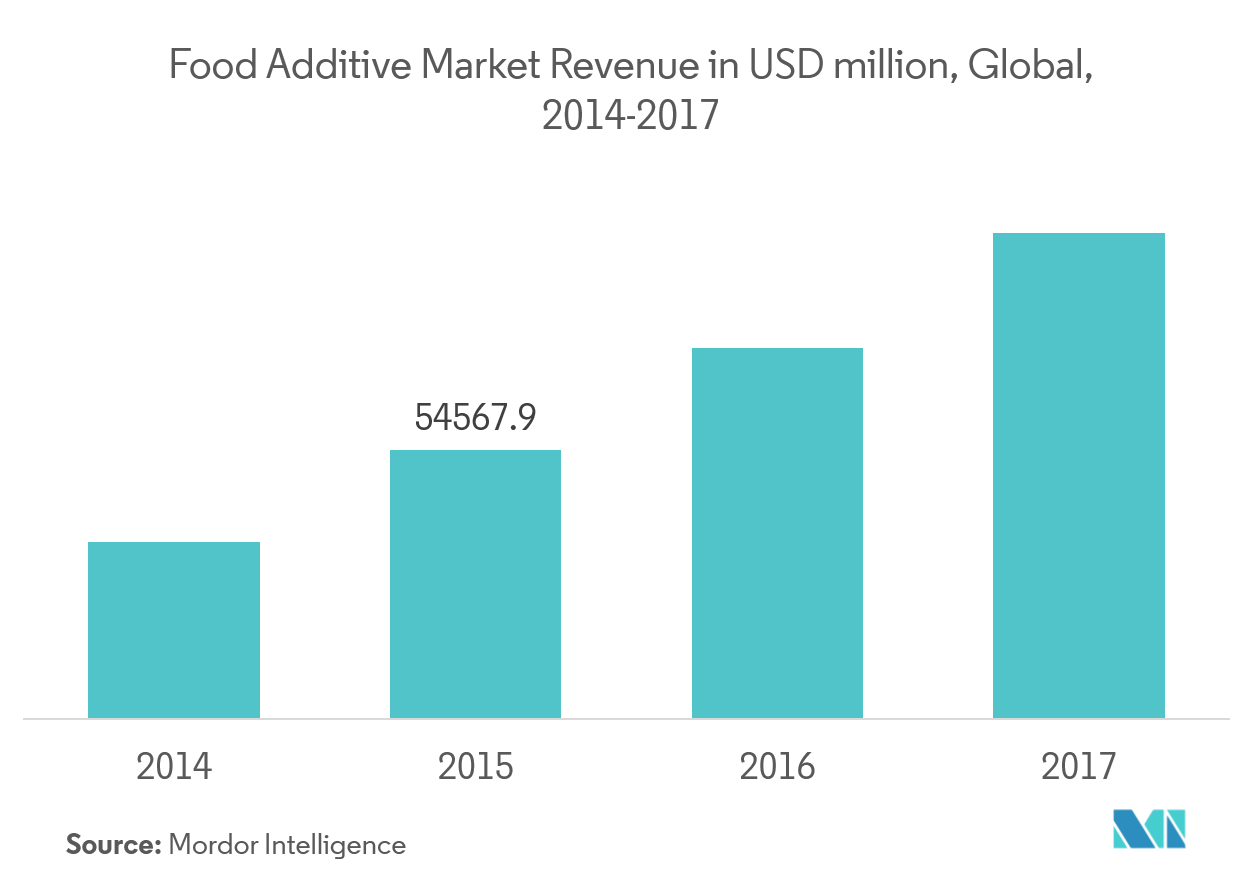

Growing Market For Natural Food Additives in The Country

The increasing consumer interest in nutritionally enriched products and all natural foods is promoting the demand for high-value premium and natural additives. The flavored products and alternative sweeteners remain the largest product types in the segment. The changing lifestyles of people in Brazil also impact their food habits. Natural herbs and spices were earlier used in domestic cooking to add flavors to the food, which is turning out to be an industrial need at present to cater to the big food processors in the local market. Legislatory organizations in the country are constantly making efforts to ensure the circulation of value-based and clean-label products in the country, which is acting as a driver for the food flavor and enhancer market in the country, compelling it to maintain the transparency between the consumers and final tailored products.

Synthetic Flavor Holds a Major Share in the Market

The market is dominated by synthetic food flavor followed by natural flavor and nature identical flavors. Volume of the market for synthetic flavors is quiet higher compared to natural flavors. Although, natural flavors are priced in the higher end, therefore there is little difference between the values of both segments. Consumers with predominant convenience and processed food diet are at greater risk of consuming synthetic flavorings. Synthetic flavors have ill health impacts, if taken for long term. Therefore, regulatory bodies play a key role in making the use of synthetic flavors safe for consuming. A plethora of artificial flavors are available in the market, such as almond flavor, amaretto flavor, apple cinnamon flavor, apple flavor, apple pie type flavor, apricot flavor, artificial amaretto, etc.

Brazil Food Flavor & Enhancer Industry Overview

Kerry group and Givaudan are the most active companies in terms of mergers and acquisitions. The mergers and acquisitions are widely being used as a strategy by these players in order to collaborate their expertise with other market players for a more transparent understanding of consumers desire and deliver the best to the consumers.

Key players: Givaudan, Firmenich, Corbion, Archer Daniels Midland Company, Kerry Group, BASF, International Fragrance and Flavors, Inc., Sensient Technologies.

Brazil Food Flavor & Enhancer Market Leaders

-

Givaudan

-

Corbion NV

-

Firmenich SA

-

BASF SE

-

Kerry Group PLC

*Disclaimer: Major Players sorted in no particular order

Brazil Food Flavor & Enhancer Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porters Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Degree Of Competition

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Food Flavors

- 5.1.1.1 Natural Flavor

- 5.1.1.2 Synthetic Flavor

- 5.1.1.3 Natural Identical Flavors

- 5.1.2 Enhancers

-

5.2 By End User

- 5.2.1 Bakery and Confectionery

- 5.2.2 Dairy

- 5.2.3 Meat and Meat Products

- 5.2.4 Soups, Pastas, and Noodles

- 5.2.5 Beverages

- 5.2.5.1 Alcoholic Beverages

- 5.2.5.2 Non-alcoholic Beverages

- 5.2.6 Sauces, Dressings, and Condiments

- 5.2.7 Other Applications

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Givaudan

- 6.3.2 Corbion NV

- 6.3.3 Firmenich SA

- 6.3.4 BASF SE

- 6.3.5 Kerry Group PLC

- 6.3.6 Archer Daniels Midland Company

- 6.3.7 International Fragrance & Flavors Inc.

- 6.3.8 Sensient Technologies

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityBrazil Food Flavor & Enhancer Industry Segmentation

The market studied is segmented by type and application. Based on type, the market has been segmented into food flavors and enhancers. Food flavors are further segmented into natural flavors, synthetic flavors, and natural identical flavors. By application, the market is segmented into bakery, confectionery, meat and meat products, beverages, dairy, Soups, Pastas, and Noodles and other applications. The beverages segment is further segmented into alcoholic beverages and non-alcoholic beverages.

| By Type | Food Flavors | Natural Flavor |

| Synthetic Flavor | ||

| Natural Identical Flavors | ||

| By Type | Enhancers | |

| By End User | Bakery and Confectionery | |

| Dairy | ||

| Meat and Meat Products | ||

| Soups, Pastas, and Noodles | ||

| Beverages | Alcoholic Beverages | |

| Non-alcoholic Beverages | ||

| Sauces, Dressings, and Condiments | ||

| Other Applications |

Brazil Food Flavor & Enhancer Market Research FAQs

What is the current Brazil Food Flavor and Enhancer Market size?

The Brazil Food Flavor and Enhancer Market is projected to register a CAGR of 3.05% during the forecast period (2024-2029)

Who are the key players in Brazil Food Flavor and Enhancer Market?

Givaudan, Corbion NV , Firmenich SA, BASF SE and Kerry Group PLC are the major companies operating in the Brazil Food Flavor and Enhancer Market.

What years does this Brazil Food Flavor and Enhancer Market cover?

The report covers the Brazil Food Flavor and Enhancer Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Brazil Food Flavor and Enhancer Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Brazil Food Flavor and Enhancer Industry Report

Statistics for the 2024 Brazil Food Flavor And Enhancer market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Brazil Food Flavor And Enhancer analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.