Market Trends of Brazil RTP Industry

This section covers the major market trends shaping the Brazil Returnable Transport Packaging Market according to our research experts:

Barrels and Drums is Expected to Register a Significant Growth

Drums and barrels are cylindrical containers that are used for shipping bulk cargo. They are primarily used in the transportation of liquid chemicals and handlings, such as hazardous chemicals, oils, petroleum, gasoline, liquefied natural gas (LNG), and liquid nitrogen. Industries, such as food and beverage, chemicals, oil and gas, etc., are mainly focusing on strengthening their supply chain capabilities, in order to deal with the increasing demand.

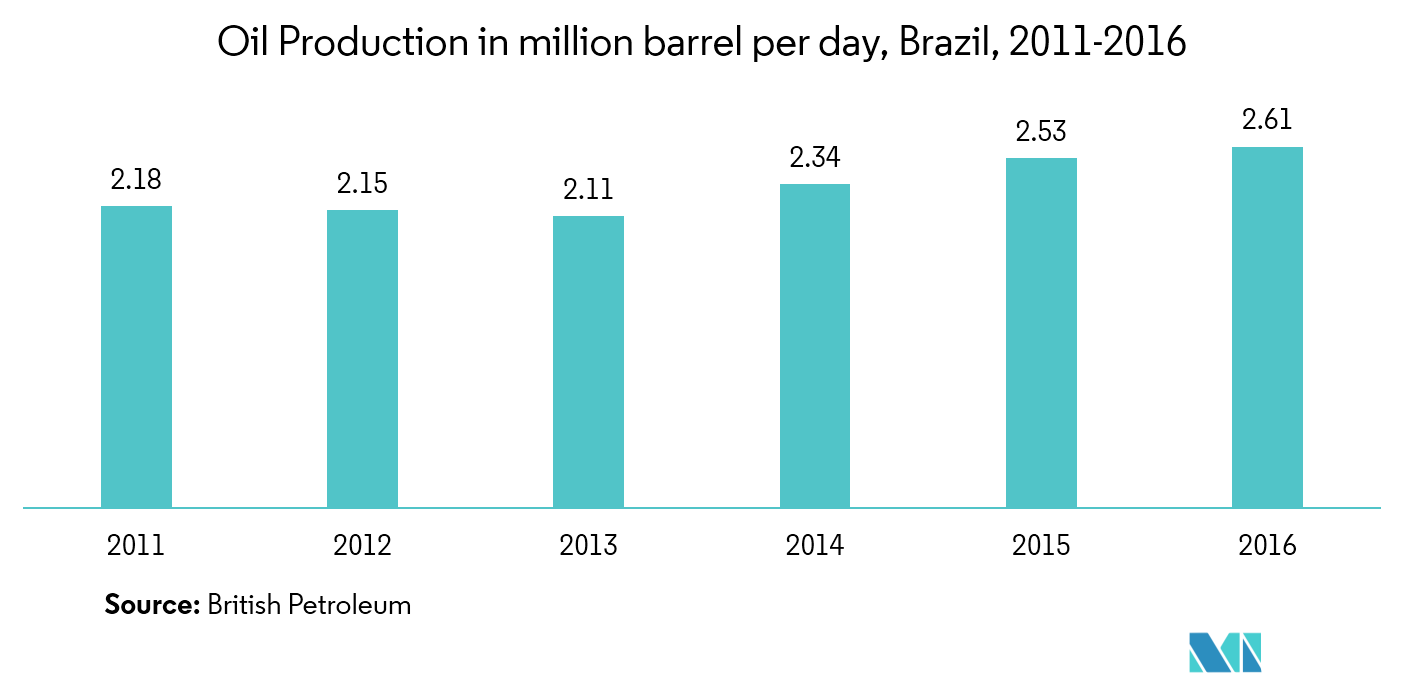

The country’s oil production, particularly, is contributing to the growth of the market studied, as oil transport mostly uses barrels. The volume of liquid bulk cargo handled by ports in Brazil decreased from 598.95 million metric ton in 2014 to 99 million metric ton in 2016, and 89.91 million metric ton during first half of 2017, as reported by the Brazilian Ministry of Transport.

Thus, as the oil and gas industry has been facing challenges, in terms of revenue, due to recovery from an economic downturn, companies are adopting sustainable solutions to reduce maintenance and transportation costs. Metals and plastics are the predominant materials used for forming drums and barrels. For food, grains and grocery, food-grade drums are manufactured using the best grade material and modern machinery that adhere to international standards, at the vendors' end.

These drums are extensively used by numerous industries, for exporting their products to other countries. While food-grade drums and barrels are for the use of long-term food packaging, food safety grade barrels are for recycled drums, such that they do not contain toxic or harmful chemicals. Plastic drums and barrels are used for food products, as they do not react with food content, unlike metal barrels.

Further, pharmaceutical, chemicals, and wine manufacturers are demanding cost-effective, lightweight, yet durable packaging solutions for all their bulk liquid packaging needs, thereby, contributing to the demand for barrels and drums.

Increase in the Number of Retail Establishments

The Brazilian consumer good industry is one of the fastest-growing applications for returnable transport packaging. A considerable increase in the number of retail establishments and average number of goods provided by the retailers is increasing the demand for RTP solutions, in both intra-logistics and transport applications. The Brazilian supermarket sector alone recorded a turnover of BRL 353.2 billion in 2017, thus, indicating a nominal growth of 4.3%, when compared to 2016. (Brazilian Association of Supermarkets (ABRAS)). This growth and increasing e-commerce activities create a significant potential for the growth of the market studied.

The e-commerce sector is one of the largest users of RTP solutions, in the country. With over 68% internet penetration and over 52 million online shoppers in the country, e-commerce is increasing, thus, becoming a popular channel for the sales of consumer goods. In addition, there is a considerable increase in the number of cross-border e-commerce activities, in the country. In 2017 alone, about 22.4 million customers (41% of total e-shoppers in Brazil) purchased cross-border goods online, indicating an increase of 6%, when compared to 2016.

When compared to regular purchases, cross-border purchases involve more logistics operations, thus, leading to an immense demand for returnable transport packaging solutions, in the Brazilian e-commerce and retail industry. Over the forecast period, the increasing number of online shoppers (87 million by 2020) and considerable economic growth in the country are expected to bolster the retail activity, and subsequently, the demand for RTP solutions.

The downside scenario of the market would include Brazil not showing significant recovery from its economic crisis suffered in 2013, due to which the GDP and spending power of consumers may further drop. Because of limited consumer spending, sales of smartphones and other high-end products could face a frugal demand. This will lead to limited e-commerce sales as well. In such a case, the CAGR for this sector may range between 2-2.7%.