Brisket Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR (2024 - 2029) | 4.20 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

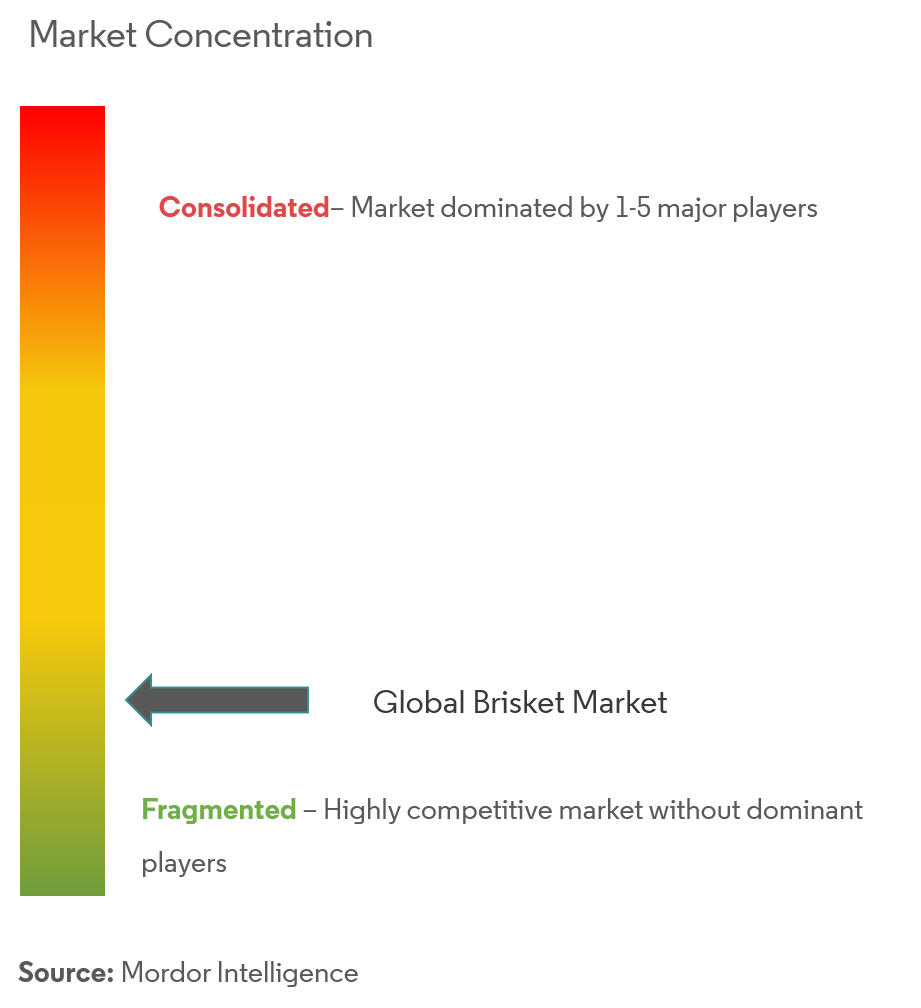

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Brisket Market Analysis

The Brisket Market size is estimated at 3.56 Million metric tons in 2024, and is expected to reach 4.38 Million metric tons by 2029, growing at a CAGR of 4.20% during the forecast period (2024-2029).

- The growing preference for clean labeled products is driving the market growth of brisket market.

- The increasing demand for protein-rich food products is also influencing themarket growth. Moreover, the increasing popularity of grass-fed brisket, is one of the trends that is triggering the growth of the global brisket market. Furthermore,demand for grass-fed brisket is increasing among consumers owingto the increasing awareness about health benefits associated with it.

Brisket Market Trends

This section covers the major market trends shaping the Brisket Market according to our research experts:

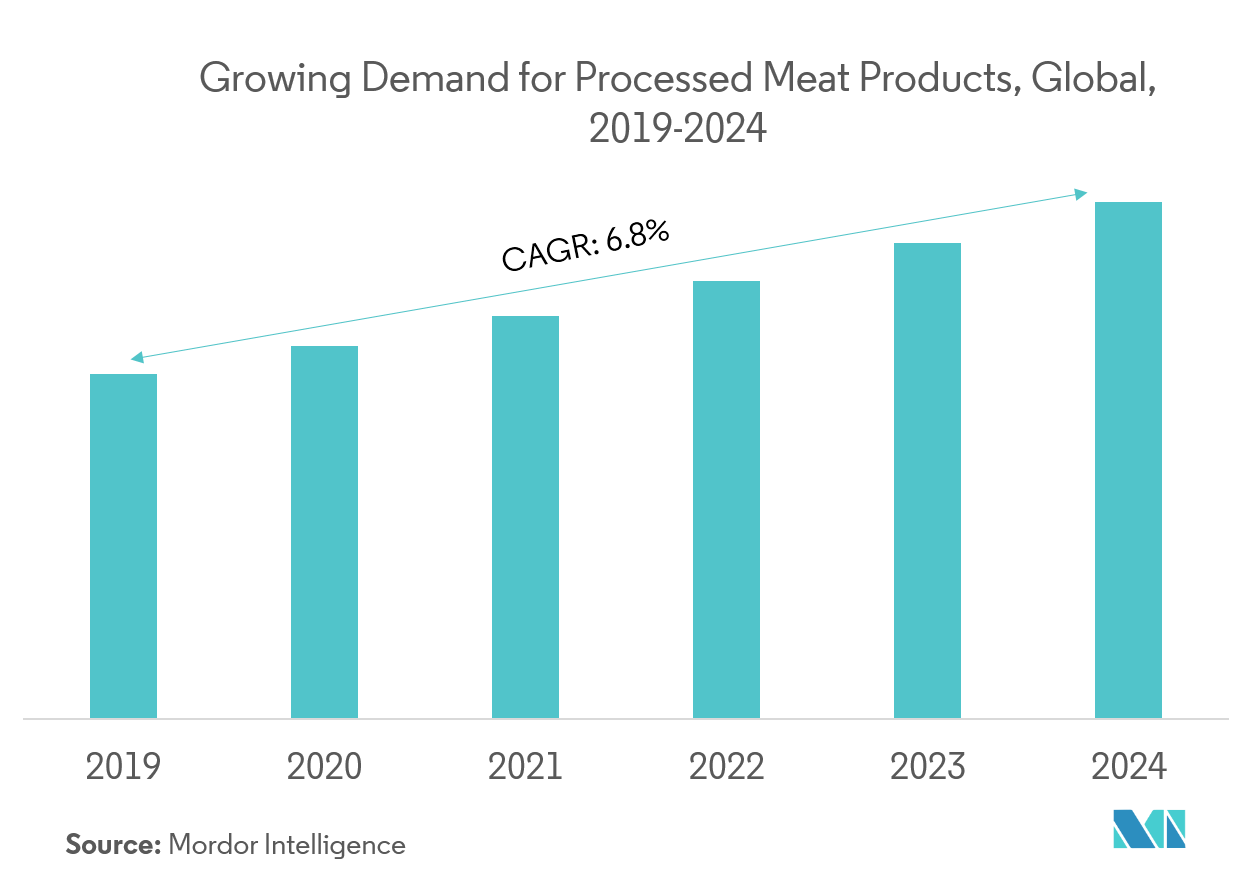

Increasing Demand for Processed Meat Products

Factors such as hectic lifestyle, rapid urbanization, adoption of new lifestyle trends and food habits will drive the demand for convenience food such as processed meat. Growth in food service and retail industry has led to increased supply of processed meat products such as brisket, the growing demand for meat products has also been influenced by variety, prices, and services that the food retail firms have been offering to their customers. Innovation in meat processing technologies has led to the introduction of diverse products in the market thus ensuring bigger consumer base. The growing demand for processed meat products across the globe is driving the brisket market.

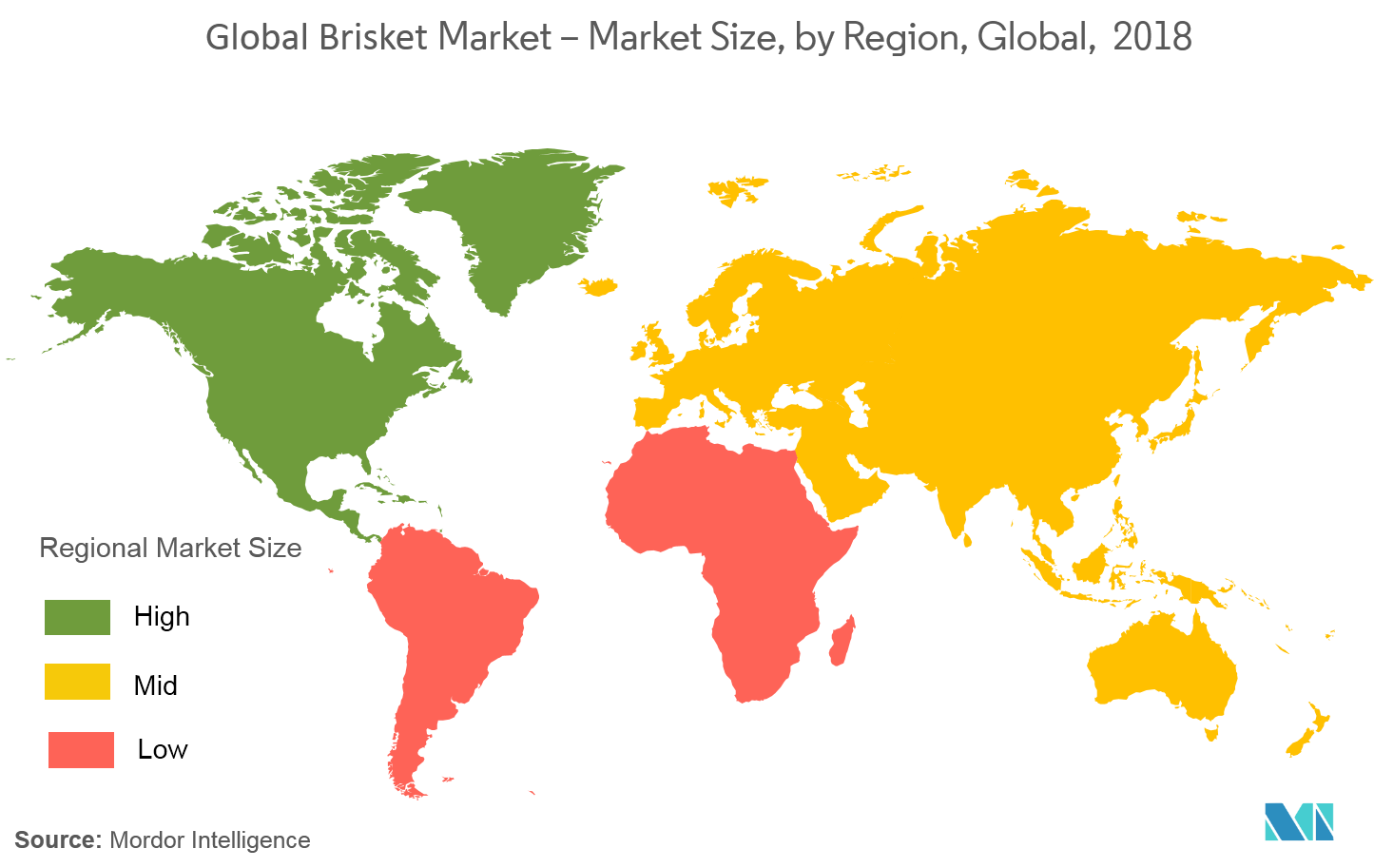

North America Holds a Significant Market Share

In terms of geography, North America holds a significant market share in the brisket market and will continue to dominate the market for the forecasted period. Asia-pacific region has high potential mainly due to increasing demand for high-value protein food and growth in organized retail. China and India are the fastest growing countries in the region. Increased awareness among the masses about the health hazards of processed meat and growing veganisim trend in the region has slowed down the consumption rate of brisket in Europe.

Brisket Industry Overview

The global brisket market is highly fragemented with local and regional players competing fiercely with multinational companies. Some of the major key players in the brisket market, globally includes Boston Brisket Compnay, National Beef Packing Company LLC, Tyson Foods, Hormel Foods Corporation, Conagra Brands, among others.

Brisket Market Leaders

-

Boston Brisket Compnay

-

Conagra Brands

-

Tyson Foods

-

National Beef Packing Company LLC

-

Hormel Foods Corporation

*Disclaimer: Major Players sorted in no particular order

Brisket Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Point Cut

- 5.1.2 Flat Cut

-

5.2 By Product Type

- 5.2.1 Conventional brisket

- 5.2.2 Organic brisket

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Italy

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Boston Brisket Compnay

- 6.3.2 Conagra Brands

- 6.3.3 Hormel Foods Corporation

- 6.3.4 Tyson Foods

- 6.3.5 J. Freirich Foods

- 6.3.6 Goode Company

- 6.3.7 National Beef Packing Company LLC

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityBrisket Industry Segmentation

Global Brisket Market is segmented by type and product type. On the basis of type, the market is segmented into point cut and flat cut. On the basis of product type, the market is segmented into conventional brisket and organic brisket.Also, the study provides an analysis of the brisket market in the emerging and established markets across the globe, including North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

| By Type | Point Cut | |

| Flat Cut | ||

| By Product Type | Conventional brisket | |

| Organic brisket | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Russia | ||

| Italy | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| India | ||

| Japan | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East & Africa | South Africa |

| Saudi Arabia | ||

| Rest of Middle East & Africa |

Brisket Market Research FAQs

How big is the Brisket Market?

The Brisket Market size is expected to reach 3.56 million metric tons in 2024 and grow at a CAGR of 4.20% to reach 4.38 million metric tons by 2029.

What is the current Brisket Market size?

In 2024, the Brisket Market size is expected to reach 3.56 million metric tons.

Who are the key players in Brisket Market?

Boston Brisket Compnay, Conagra Brands, Tyson Foods, National Beef Packing Company LLC and Hormel Foods Corporation are the major companies operating in the Brisket Market.

Which is the fastest growing region in Brisket Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Brisket Market?

In 2024, the North America accounts for the largest market share in Brisket Market.

What years does this Brisket Market cover, and what was the market size in 2023?

In 2023, the Brisket Market size was estimated at 3.42 million metric tons. The report covers the Brisket Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Brisket Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Brisket Industry Report

Statistics for the 2024 Brisket market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Brisket analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.