Business Process Outsourcing Market Size

| Study Period | 2020 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR (2024 - 2029) | 8.50 % |

| Fastest Growing Market | South East Asia |

| Largest Market | Asia Pacific |

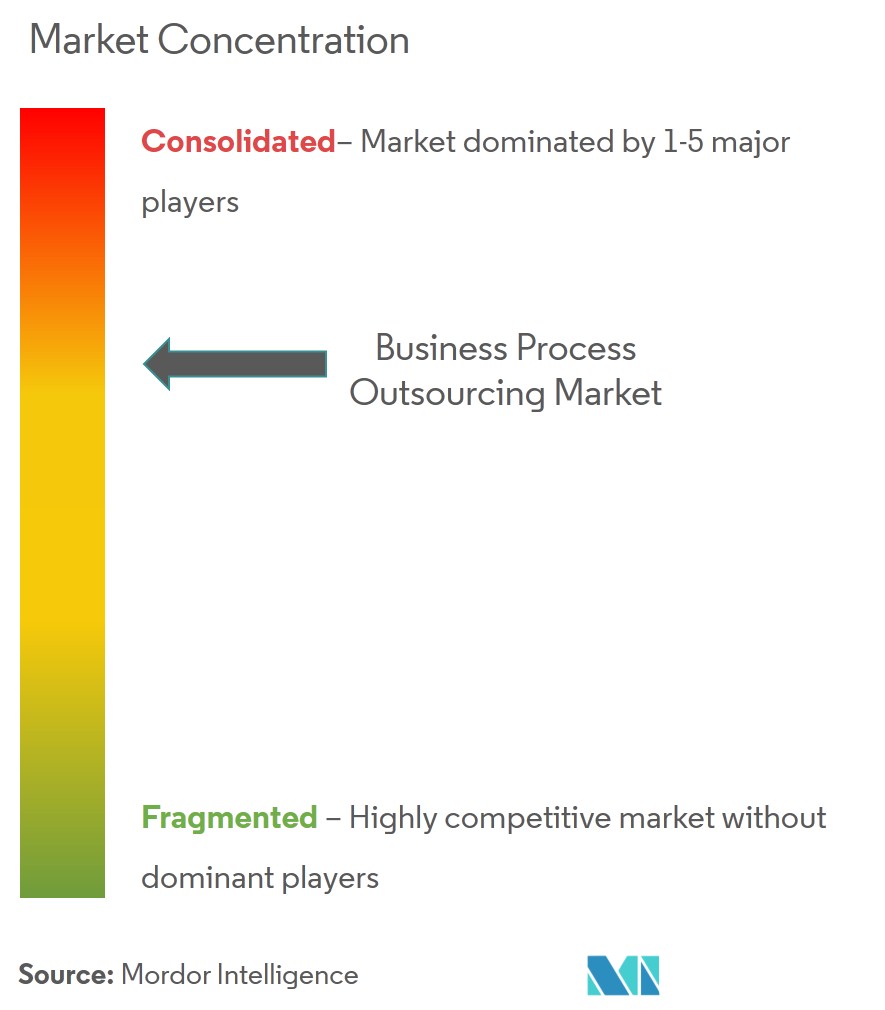

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

BPO Industry Analysis

The Business Processing Outsourcing Market is expected to register a CAGR of 8.5% during the forecast period.

Business process outsourcing has become incredibly popular with companies ranging from Fortune 500s to startups over the last two decades. Businesses in every industry can now outsource non-core processes while applying more resources to core business functions. The BPO industry is a subset of outsourcing that involves contracting third-party service providers for various business-related operations and responsibilities. While manufacturers initially used BPO, pretty much every industry you can think of around the world now uses it as part of their business models. Businesses across all industries have adopted BPO because business process outsourcing solutions provide an array of opportunities for cost reduction and business growth. Services within the BPO Industry (including payroll, accounting, and data analytics outsourcing) make it easier for businesses to dedicate their time and resources to core business and office operations. The BPO sector also enables businesses to react faster to changing market dynamics by adapting their processes as the market changes.

Global business process outsourcing companies are increasingly benefiting from the growing complexities in supply chains, which create a trend wherein organizations are looking to third-party firms for outsourcing their operations. Automation will continue to be a significant threat to low skilled jobs in the BPO sector. Many of the major business process outsourcing companies intend to make major investments into robotic automation in the coming years. APAC continues to be a vibrant market for the business process outsourcing (BPO) space. The BPO Industry is primarily driven by the increasing number of global companies expanding their base in the region and partnering with agile business partners to provide them with the required services.

The North American business process outsourcing market accounted for a significant portion of the global market. Regional BPO industry growth is accredited to flexibility and customization of service offerings in order to better meet individual needs, coupled with an increasing demand for cloud computing technology. However, some of the Asian countries like India and the Philippines have shown strong growth in recent years.

Growing competitiveness from new outsourcing destinations, coupled with the pressure on businesses to run cost-efficiently, will drive accelerated growth in the Business Process Outsourcing industry. Automation will continue to be a significant threat to low-skilled jobs in the BPO sector. Many major outsourcing companies intend to make major investments in robotic automation in the coming years. The advantages of BPO include cost-efficiency, higher flexibility, better quality and performance, competitive advantage, etc. Outsourced service providers can complete business processes at lower costs because of economies of scale, specialized processes, low-cost countries, etc. Outsourcing non-critical functions allows organizations to use their internal resources for core competencies and essential business functions. The BPO sector also enables businesses to react faster to changing market dynamics by adapting their processes as the market changes.

BPO Industry Trends

The America have the largest Business Process Outsourcing Market

The Americas have the largest Business Process Outsourcing Market. North America alone had the largest BPO market than Europe, Middle East, and Africa. New technologies that have been developed over the past few years, including robotic process automation (RPA), have begun to impact the BPO industry. Robotic Process Automation (RPA), a significant development in BPO industry trends, uses bots and artificial intelligence on a user interface to complete work faster, at a cheaper rate. RPA, with its cost savings, speed, and efficiency benefits, is slowly making its way into all industries and all types of business processes. While it is an uphill task for many BPO service providers, the top Business Process Outsourcing Companies are already working to make robotic process automation part of their standard client services portfolio.

Before 2000, the customer service industry was entirely dependent on websites and interactive voice response (IVR) for transferring a call to the correct representative. Now, around 79% of the US population has at least one social media account, leading to a notable shift in consumer behavior. Instead of call center software programs, companies now want to invest in real-time customer engagement that allows them to gain first-hand product insights and turn issues into new products or solutions toaddress future problems through social media.

Currently, the BPO industry’s overview clearly shows increased optimism about market growth and reduced regulations. Businesses are also encouraged by the benefits gained through innovative technologies, such as cloud computing and process automation. Global outsourcing service providers are expected to use new technological innovations to effectively address market challenges, enhance products and services, and manage talent shortages while helping keep operating costs low.

The Use of the Cloud Computing in BPO industry is on rise.

According to the Business Process Outsourcing industry sources, consumer demands for multi-channel communications have exploded over the past five years. For BPO service providers, this change in customer management is a huge opportunity in the BPO Market. Over the last few years, BPOs have been investing in the tools and capabilities to offer a wide range of social media management services. These service offerings range from social media monitoring to business intelligence and actioning customer response. Many BPO service providers are also investing in dedicated social media service teams. Working in tandem, social media teams and customer representatives can deal with customer grievances much faster, leading to higher customer satisfaction and better customer experience.

Small and medium businesses (SMBs) have a limited budget, which can’t grant state-of-the-art office space and infrastructure. More and more SMBs are adopting virtual storage and systems to counter a lack of data centers, hardware and software, and the personnel required to implement new technology. The benefits of cloud computing include improved business collaboration due to a standardized system between the Business Process Outsourcing Companies and the client, and higher data security due to impenetrable cloud systems. The adoption of cloud services and investments by top Business Process Outsourcing Companies in this technology will continue further as cloud computing becomes more mainstream, mature, and cost-effective.

Business Process Outsourcing Industry Overview

The report covers major international vendors operating in the global business process outsourcing market. In terms of market share, a few of the major Business Process Outsourcing Companies currently dominate the market. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping into new markets. Despite the advent of these relatively small Business Process Outsourcing Companies in the market, the BPO market is still consolidated with top 10 vendors, accounting for over 55% of the market.

Business Process Outsourcing Market Leaders

-

Accenture

-

ADP

-

Capgemini

-

TCS

-

Infosys

*Disclaimer: Major Players sorted in no particular order

Business Process Outsourcing Market News

- In June 2021, IBM announced IBM z/OS V2.5 the next-generation operating system (OS) for IBM Z designed to accelerate client adoption of hybrid cloud and Artificial Intelligence and drive application modernization projects.

- In July 2021, Wipro Limited launched FieldX, a cloud-based end-to-end digital service lifecycle automation solution built on ServiceNow's Now Platform®. Using FieldX, manufacturing organizations can enhance and scale-up their after-sales customer service operations while reducing costs.

Business Process Outsourcing Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

-

4.1 Market Overview

- 4.1.1 Vertical BPO vs Horizontal BPO

- 4.1.2 Traditional BPO vs Platform BPO

- 4.1.3 The benefits of BPO

- 4.1.4 Risks of BPO

- 4.1.5 Security and regulatory concerns

- 4.2 Market Drivers

- 4.3 Market Restraints

-

4.4 Porters 5 Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Impact Of Covid 19 on the Industry

5. MARKET SEGMENTATION

-

5.1 End User

- 5.1.1 BFSI

- 5.1.2 Manufacturing

- 5.1.3 Heathcare

- 5.1.4 Retail

- 5.1.5 Telecom

- 5.1.6 Other End Users

-

5.2 Application

- 5.2.1 Human Resource

- 5.2.2 Procurement

- 5.2.3 Facilities and Administration

- 5.2.4 Customer Care

- 5.2.5 Logistics

- 5.2.6 Sales and Marketing

- 5.2.7 Training

- 5.2.8 Product Engineering

- 5.2.9 Other Applications

-

5.3 Location

- 5.3.1 Onsite

- 5.3.2 Offsite

- 5.3.3 Offshore

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of NA

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of NA

- 5.4.3 Asia Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of AP

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.5 Middle East

- 5.4.5.1 UAE

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

-

6.3 Company Profiles

- 6.3.1 Accenture

- 6.3.2 Triniter

- 6.3.3 IBM

- 6.3.4 Cognizant

- 6.3.5 Concentrix

- 6.3.6 Wipro

- 6.3.7 Genpact

- 6.3.8 Amdocs

- 6.3.9 Infosys Limited (Infosys BPM)

- 6.3.10 HCL Technologies Limited.

- 6.3.11 CBRE Group, Inc.

- 6.3.12 NCR Corporation.

- 6.3.13 Capgemini.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityBusiness Process Outsourcing Industry Segmentation

Business process outsourcing (BPO) is the delegation of one or more IT-intensive business processes to an external provider that, in turn, owns, administers, and manages the selected processes based on defined and measurable performance metrics. A complete background analysis of the business process outsourcing market, which includes assessment of the economy, the contribution of the sectors in the economy, market overview, BPO market size, and the BPO industry growth estimation for the key segments, emerging trends in the market segments, market dynamics, and logistics spending by the end-user industries, is covered in the global BPO industry report.

| End User | BFSI | |

| Manufacturing | ||

| Heathcare | ||

| Retail | ||

| Telecom | ||

| Other End Users | ||

| Application | Human Resource | |

| Procurement | ||

| Facilities and Administration | ||

| Customer Care | ||

| Logistics | ||

| Sales and Marketing | ||

| Training | ||

| Product Engineering | ||

| Other Applications | ||

| Location | Onsite | |

| Offsite | ||

| Offshore | ||

| Geography | North America | US |

| Canada | ||

| Mexico | ||

| Rest of NA | ||

| Geography | Europe | Germany |

| UK | ||

| France | ||

| Russia | ||

| Spain | ||

| Rest of NA | ||

| Geography | Asia Pacific | India |

| China | ||

| Japan | ||

| Rest of AP | ||

| Geography | South America | Brazil |

| Argentina | ||

| Geography | Middle East | UAE |

| Saudi Arabia | ||

| Rest |

Business Process Outsourcing Market Research FAQs

What is the current Business Processing Outsourcing Market size?

The Business Processing Outsourcing Market is projected to register a CAGR of 8.5% during the forecast period (2024-2029)

Who are the key players in Business Processing Outsourcing Market?

Accenture, ADP, Capgemini, TCS and Infosys are the major companies operating in the Business Processing Outsourcing Market.

Which is the fastest growing region in Business Processing Outsourcing Market?

South East Asia is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Business Processing Outsourcing Market?

In 2024, the Asia Pacific accounts for the largest market share in Business Processing Outsourcing Market.

What years does this Business Processing Outsourcing Market cover?

The report covers the Business Processing Outsourcing Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Business Processing Outsourcing Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Which end-use segment dominated the Business Process Outsourcing (BPO) Market?

Based on end-use segmentation, the IT & telecommunication segment dominated the Business Process Outsourcing (BPO) Market.

Business Process Outsourcing Industry Report

The global business process outsourcing (BPO) market is experiencing significant growth, driven by the increasing demand for outsourcing services in various sectors such as IT & telecommunications, BFSI, healthcare, and retail. This trend is largely due to BPO's ability to provide cost reductions, enhance service quality, and allow businesses to focus on their core operations, which positively impacts the market size. Additionally, the adoption of cloud computing is becoming more prevalent, offering BPO operators benefits like lower costs, faster time to market, and improved quality control.

The landscape of the BPO industry is characterized by a high volume of mergers and acquisitions, which help companies expand their service portfolios. Despite challenges such as security and intellectual property rights concerns, the market is poised for substantial growth. Technological advancements and the growing recognition of outsourcing as a strategic business solution are key drivers of this growth.

For a comprehensive understanding of the market, industry reports provide detailed statistics on market share, size, revenue growth rate, and a forecast outlook. These reports also offer insights into market trends, market growth, and industry analysis. The market forecast and industry outlook suggest a positive trajectory for the BPO industry. Market leaders are leveraging industry research and market data to stay ahead in this competitive landscape.

In summary, the BPO market is undergoing significant transformation, with market segmentation highlighting various applications and end users. The industry analysis reveals that the market is set for continued expansion, driven by market growth and industry trends. For detailed insights, industry reports and market research offer valuable information on market value, market overview, and market predictions.