Cable Conduit Systems Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 11.62 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

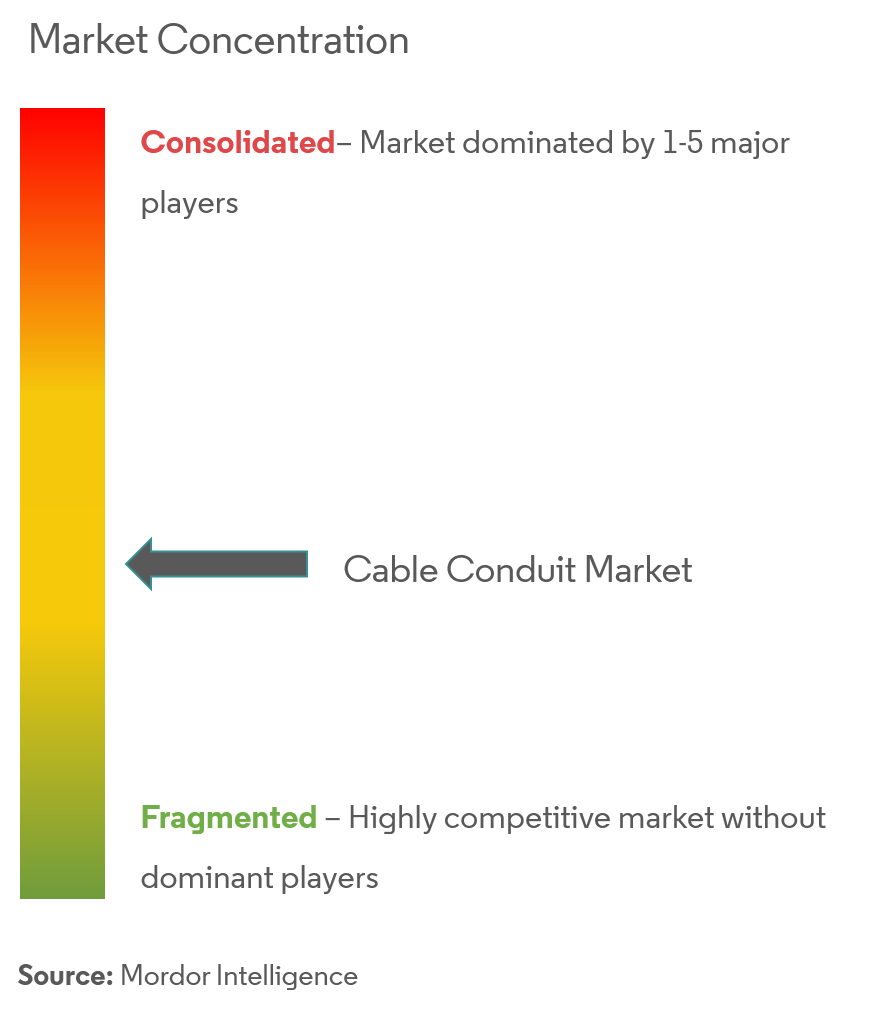

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Cable Conduit Systems Market Analysis

The cable conduit market is expected to register a CAGR of 11.62% over the forecast period of (2021 - 2026).

- The rapid urbanization in the developing economies leads to an increase in construction projects. This factor further increases the demand for alterable wiring systems. This factor is boosting the sales of cable conductive.

- Further, the wire and cable industry analysis identify the growth in renewable power generation. This is expected to be one of the primary factors for the growth of the electric cable and wire market. This factor is expected to boost the growth of the cable conduit market.

- However, the fluctuating prices of raw materials, such as steel, plastic, and aluminum, are the key factors hindering the growth of the global cable conduit system market.

Cable Conduit Systems Market Trends

This section covers the major market trends shaping the Cable Conduit Market according to our research experts:

Commercial Buildings Offer Potential Growth

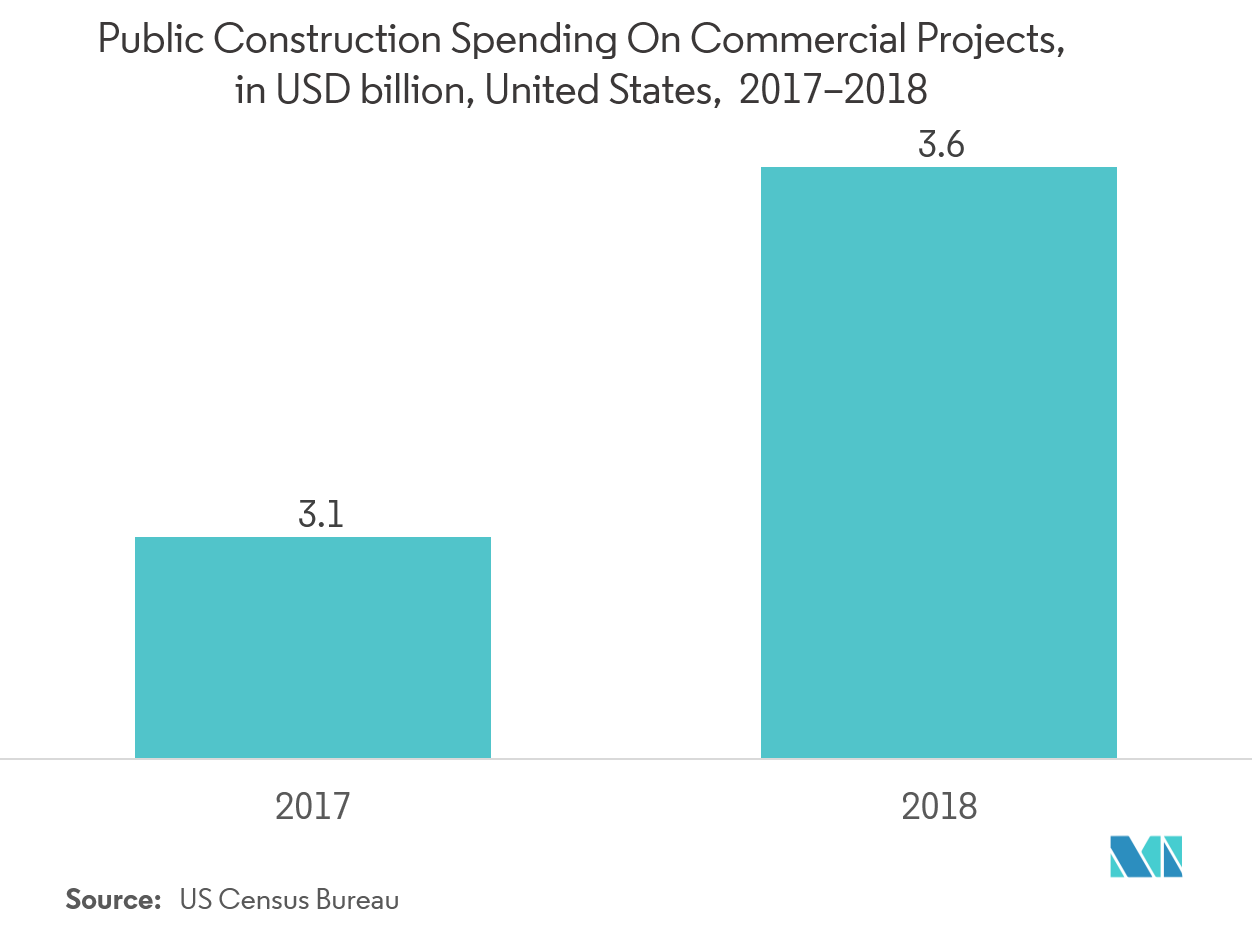

- The American Institute of Architects (AIA) semi-annual report indicates that the commercial construction sectors will generate much of the expected gains and the high demand for better infrastructure provides opportunities for cable conduit systems.

- Further, there is a growing demand for safer and more secure wiring systems in commercial and industrial applications. The factors, such as compressive strength and resistance of conduits, are of great significance, especially in industry and crafts business. Circuit integrity in case of fire and the prevention of hazardous smoke or gas are the key priorities in public areas, such as airports, railway stations or hotel facilities.

- Moreover, with the advancements in technology, IoT-ready commercial building design is emerging. IoT networks often require a “backhaul” fiber network. Depending on the size of the operation and the data generated, it will require wired connections. This is expected to create a huge market opportunity for the cable conduit market.

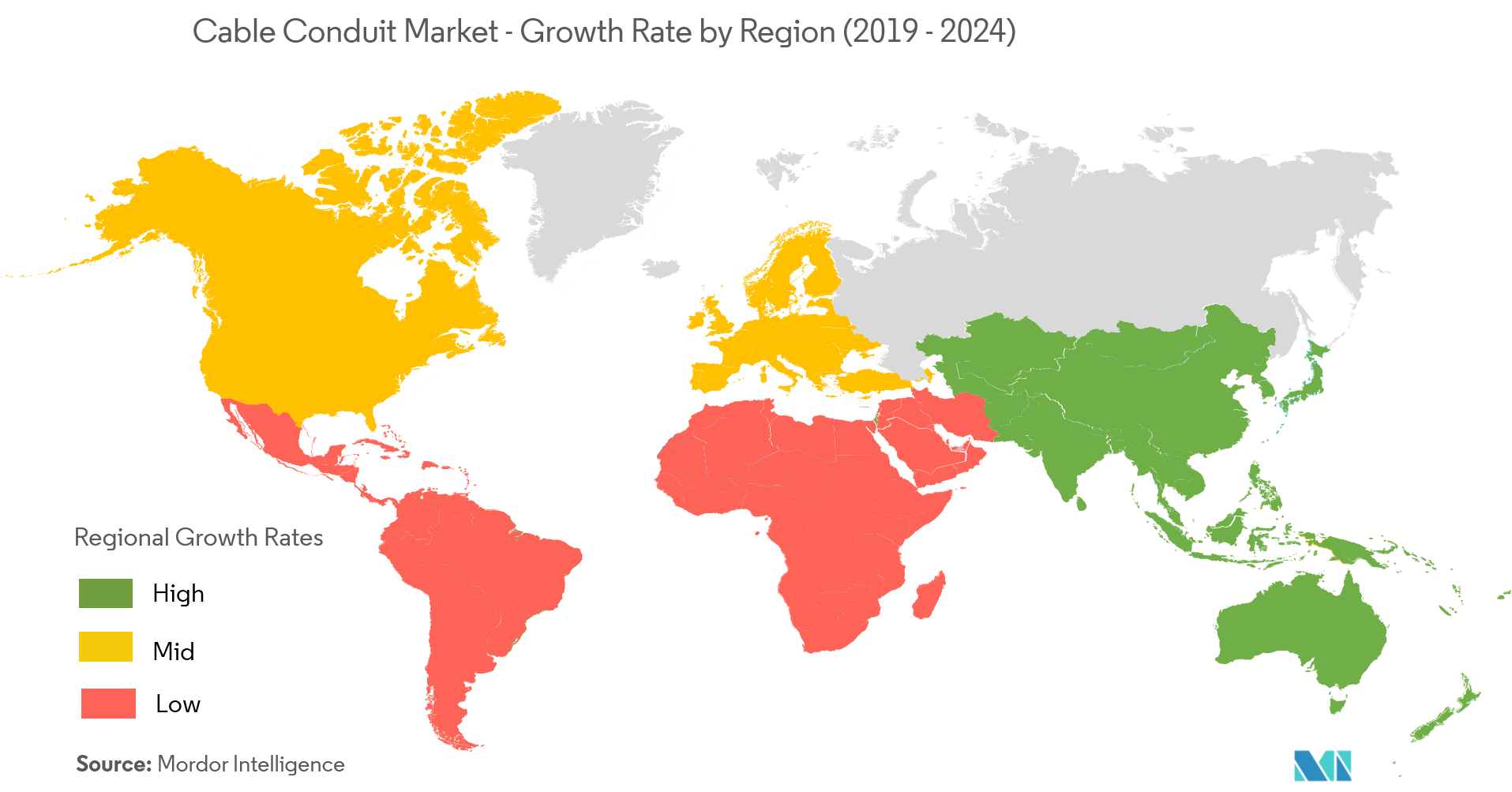

Asia-Pacific to Witness Fastest Growth

- The growth in Asia-Pacific is attributed to the rapid infrastructure building activities being undertaken in the region, mainly in China and India. In these countries, rural areas are being converted into urban areas and these countries will collectively be responsible for more than a 50% share of the growth in the construction industry by the end of 2020.

- Moreover, the increasing projects in the field of electrification and power supply in these regions also provide ample opportunity for the growth of the electrical conduit pipe market.

- Additionally, in India, the initiatives (such as excise duty exemption for Ferro-silicon-magnesium and pig iron used for manufacturing components for wind-operated electric power generators as well as the target set by the Jawaharlal Nehru National Solar Mission to generate more than 1,00,000 MW of solar power by the end of 2022) are expected to boost the demand for electrical wires and cables.

- With this continuous growth in the building and construction industry, along with the increase in demand for renewable sources of energy, the demand for electrical conduit pipes is expected to increase over the forecast period.

Cable Conduit Systems Industry Overview

The overall electrical conduit systems market is fragmented in nature, with a large number of players operating in the market globally.In addition to innovative product offerings, cable andwire manufacturersare also following strategies, such as mergers and acquisitions to acquire new technologies and expand their customer reach. Companies are now adopting efficient techniques in an effort to provide consumers with innovated and cost-efficient products. Some of the key players areSchneider Electric,Hubbell Incorporated, ABB Group, etc., among others.

- August 2018 -ABB announced its expansion of the Thomas andBetts facility on Dennis Street in Athens. The addition to the plant is expected to boost production for their 21 product lines.

Cable Conduit Systems Market Leaders

-

Hubbell Incorporated

-

Schneider Electric SE

-

ABB Group

-

Legrand

-

Aliaxis Group

*Disclaimer: Major Players sorted in no particular order

Cable Conduit Systems Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Demand for Highly Secure and Safe Wiring System

- 4.3.2 Growing Commercial Constructions

-

4.4 Market Restraints

- 4.4.1 Increasing Prices of Raw Material

- 4.5 Value Chain / Supply Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Product Type

- 5.1.1 Flexible Cable Conduit

- 5.1.1.1 Metallic

- 5.1.1.2 Non-metallic

- 5.1.2 Rigid Cable Conduit

- 5.1.2.1 Metallic

- 5.1.2.2 Non-metallic

-

5.2 By End-user Industry

- 5.2.1 IT and Telecommunication

- 5.2.2 Construction

- 5.2.3 Energy and Utility

- 5.2.4 Manufacturing

- 5.2.5 Other End-user Industries

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Hubbell Incorporated

- 6.1.2 Schneider Electric SE

- 6.1.3 ABB Group

- 6.1.4 Legrand

- 6.1.5 Aliaxis Group

- 6.1.6 Atkore International

- 6.1.7 Electri-Flex Company

- 6.1.8 Eaton Corporation PLC

- 6.1.9 Robroy Industries

- 6.1.10 Champion Fiberglass Inc.

- 6.1.11 Dura-Line Holdings Inc.

- 6.1.12 Prime Conduit

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityCable Conduit Systems Industry Segmentation

An electrical conduit is useful for routing wires by safely grouping them. The primary use of cable conduit is for safety. Conduit isolates wires to avoid exposure, and thereby, reduces the risk of short-circuits and electrocution or fires. The end-user segment consists of manufacturing, commercial construction, IT and telecommunication, healthcare and energy. However, Asia-Pacific is expected to be the fastest growing region for the cable conduit systems during the forecast period.

| By Product Type | Flexible Cable Conduit | Metallic |

| Non-metallic | ||

| By Product Type | Rigid Cable Conduit | Metallic |

| Non-metallic | ||

| By End-user Industry | IT and Telecommunication | |

| Construction | ||

| Energy and Utility | ||

| Manufacturing | ||

| Other End-user Industries | ||

| Geography | North America | |

| Europe | ||

| Asia-Pacific | ||

| Latin America | ||

| Middle East & Africa |

Cable Conduit Systems Market Research FAQs

What is the current Cable Conduit Market size?

The Cable Conduit Market is projected to register a CAGR of 11.62% during the forecast period (2024-2029)

Who are the key players in Cable Conduit Market?

Hubbell Incorporated, Schneider Electric SE, ABB Group, Legrand and Aliaxis Group are the major companies operating in the Cable Conduit Market.

Which is the fastest growing region in Cable Conduit Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Cable Conduit Market?

In 2024, the North America accounts for the largest market share in Cable Conduit Market.

What years does this Cable Conduit Market cover?

The report covers the Cable Conduit Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Cable Conduit Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Cable Conduit Industry Report

Statistics for the 2024 Cable Conduit market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Cable Conduit analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.