Cable Duct Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 4.55 % |

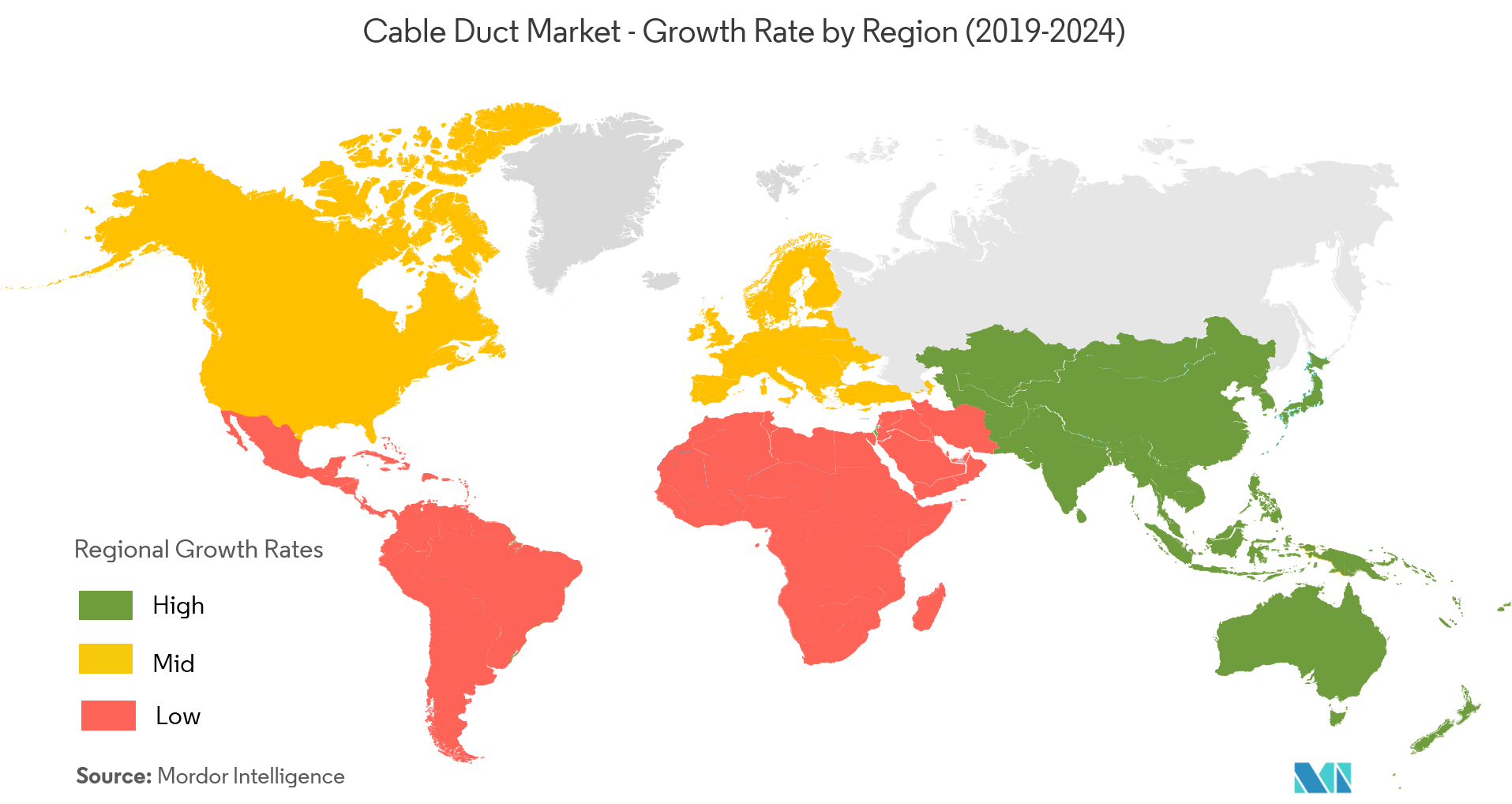

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

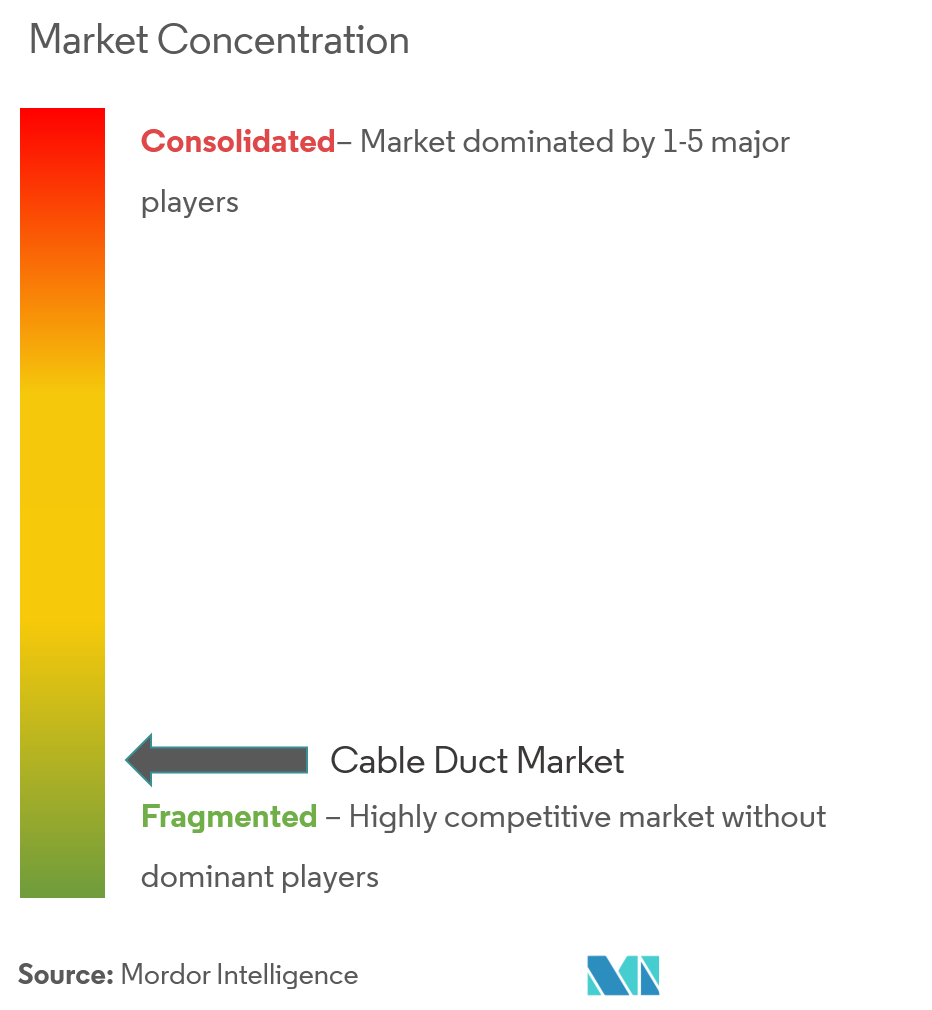

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Cable Duct Market Analysis

The Cable Duct Market was valued at USD 5.554 million in 2020 and is expected to reach USD 7.253 million by 2026, at a CAGR of 4.55% over the forecast period 2021 - 2026. Today's industrial and commercial sectors require efficient wiring arrangements with frequently alterable properties. More reliable safety and security is a thing of concern during the installation of wiring systems. The success and benefit of cable management business depend upon innovating products according to installation and price convenience. A cable duct is beneficial since it results in more simple wiring and is safer, allowing easier and frequent changes in the wiring system, giving protection even in wet and dangerous locations. Further, the wire and cable business analysis identify the increase in renewable power generation. This is supposed to be one of the principal factors for the growth of the electric cable and wire market. This factor is anticipated to support the growth of the cable duct market.

- Cable ducts are mainly used as raceways for cables and wires within electrical enclosures. Cable ducts, along with conduit, wiring ducts, wire ways, and cable carriers, are frequently used as essential components of a cable management system. Growing investments in infrastructure expansion activities, huge demand from IT facilities and data centers, and rising urbanization are propelling the market for wire and cable management, as well as cable duct market growth.

- The development of frequently changed wiring systems in constructions acts as a driving force of the global cable duct market. Owing to the smooth replacement of conductors with a very low disruption, regular wiring changes are made safer and simpler. Thus, the cable ducts guard the wiring replacements against chemical vapors, flammable gases, moisture, electromagnetic interruption, and other external discrepancies. The rise in the development of the construction industry is driving the growth of the cable duct market.

Cable Duct Market Trends

This section covers the major market trends shaping the Cable Duct Market according to our research experts:

Growing Construction Industry is to Play a Dominant Role

- The construction industry grew at a steady rate of 3.7%, in 2018, and is expected to gain momentum, over the next five years. As per consensus forecast, in 2018, the US construction industry is expected to grow at 4%, with the residential sector poised to record the highest growth of 6%, whereas, the non-residential and non-building sectors are expected to record growth rates of 2% and 4%, respectively.

- Rising investments in real estate and infrastructure development activities is a major factor responsible for the steadfast growth of the global cable duct market. Besides this, surging demand from data centers and IT facilities and rapid urbanization are also propelling expansion in the global cable duct market. Foreign Direct Investment (FDI) received in Construction Development sector (townships, housing, built-up infrastructure, and construction development projects) from April 2000 to March 2019 stood at USD 25.05 billion in India, according to the Department of Industrial Policy and Promotion (DIPP).

- Besides, during the first five months of this year, construction spending amounted to USD 498.8 billion, 0.3 percent (±1.3 percent) below the USD 500.3 billion for the same period in 2018. The highest growth rate is observed in the US hotel construction industry. With the expansion in the construction industry, a rise in the demand for cable ducts is expected, thus leading to the growth of the market studied.

Asia-Pacific to Witness Fastest Growth

- The growth in Asia-Pacific is attributed to the rapid infrastructure building activities being undertaken in the region, mainly in China and India. In these countries, rural areas are being converted into urban areas and these countries will collectively be responsible for more than a 50% share of the growth in the construction industry by the end of 2020.

- Moreover, the increasing projects in the field of electrification and power supply in these regions also provide ample opportunity for the growth of the electrical conduit pipe market.

- Additionally, in India, the initiatives (such as excise duty exemption for Ferro-silicon-magnesium and pig iron used for manufacturing components for wind-operated electric power generators as well as the target set by the Jawaharlal Nehru National Solar Mission to generate more than 1,00,000 MW of solar power by the end of 2022) are expected to boost the demand for electrical wires and cables.

- With this continuous growth in the building and construction industry, along with the increase in demand for renewable sources of energy, the demand for electrical conduit pipes is expected to increase over the forecast period.

Cable Duct Industry Overview

The overall cable duct market is fragmented in nature, with a large number of players operating in the market globally.In addition to innovative product offerings, cable andwire manufacturersare also following strategies, such as mergers and acquisitions to acquire new technologies and expand their customer reach. Companies are now adopting efficient techniques in an effort to provide consumers with innovated and cost-efficient products.

- January 2019 -Electrical and digital building products company, Legrand,opened its first voice-enabled experience center- Innoval - in Bengaluru, said it plans to open two more in Dehradun and New Delhi. By the end of next year, it wantsto have 10 Innoval centers.

- August 2018 -ABB announced its expansion of the Thomas andBetts facility on Dennis Street in Athens. The addition to the plant is expected to boost production for their 21 product lines.

Cable Duct Market Leaders

-

Legrand

-

Schneider Electric

-

ABB Ltd.

-

Eaton Corporation PLC

-

Barton Engineers Ltd

*Disclaimer: Major Players sorted in no particular order

Cable Duct Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Expansion of the Construction Industry

- 4.3.2 Demand for Frequently Alterable Wiring Systems

-

4.4 Market Restraints

- 4.4.1 Unstable Raw Material Prices

- 4.4.2 Complications in Installation

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Product Type

- 5.1.1 Flexible Cable Duct

- 5.1.2 Rigid Cable Duct

-

5.2 By Material

- 5.2.1 Concrete Cable Duct

- 5.2.2 Plastic Cable Duct

- 5.2.3 Metal Cable Duct

-

5.3 By End-user Industry

- 5.3.1 IT & Telecom

- 5.3.2 Construction

- 5.3.3 Energy & Utility

- 5.3.4 Manufacturing

- 5.3.5 Other End Users

-

5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Atkore International Inc.

- 6.1.2 Legrand SA

- 6.1.3 Schneider Electric SE

- 6.1.4 ABB Ltd.

- 6.1.5 Aliaxis Group

- 6.1.6 Mitsubishi International Corporation

- 6.1.7 Eaton Corporation PLC

- 6.1.8 Robroy Industries

- 6.1.9 Anamet Electrical Inc.

- 6.1.10 Barton Engineers Ltd.

- 6.1.11 Wheatland Tube Co.

- 6.1.12 HellermannTyton Corp

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityCable Duct Industry Segmentation

Cable ducts are manufactured from uniquely compounded high impact rigid polyvinyl chloride. These ducts don't peel, chip or crack. It resists salt solution, oil, and fungus. It is non-flammable confirming to UL 94 V0 standards, non-brittle and warp-proof. It has huge dielectric strength and endures temperature up to 60 degrees Celcius. It magnifies aesthetics and clarity, allows faster connections, addition and error tracing of wires.

| By Product Type | Flexible Cable Duct |

| Rigid Cable Duct | |

| By Material | Concrete Cable Duct |

| Plastic Cable Duct | |

| Metal Cable Duct | |

| By End-user Industry | IT & Telecom |

| Construction | |

| Energy & Utility | |

| Manufacturing | |

| Other End Users | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| Latin America | |

| Middle East & Africa |

Cable Duct Market Research FAQs

What is the current Cable Duct Market size?

The Cable Duct Market is projected to register a CAGR of 4.55% during the forecast period (2024-2029)

Who are the key players in Cable Duct Market?

Legrand, Schneider Electric, ABB Ltd., Eaton Corporation PLC and Barton Engineers Ltd are the major companies operating in the Cable Duct Market.

Which is the fastest growing region in Cable Duct Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Cable Duct Market?

In 2024, the North America accounts for the largest market share in Cable Duct Market.

What years does this Cable Duct Market cover?

The report covers the Cable Duct Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Cable Duct Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Cable Duct Industry Report

Statistics for the 2024 Cable Duct market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Cable Duct analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.