Cable Tags Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.77 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Cable Tags Market Analysis

The cable tag market was valued at USD 1492.64 million in 2020 and is expected to reach a value of USD 2077.141 million at a CAGR of 5.77% during the forecast period. Cable tags have the ability to withstand harsh weather conditions and high temperatures, such that printing on the tag does not fade away. Therefore, cables used in the manufacturing and automotive industries are labeled with these tags that avoid any damage, and it is easy to identify different cables in industrial processes. The cable tag companies are printing labels on stainless steel or aluminum tags, by punching the letters on tags. Stainless steel and aluminum tags have a longer life than that of paper or plastic, thereby, offering a competitive advantage. However, plastic ferrules and other plastic-coated, paper wrap-around cable label tags are used commonly in the market, owing to their low cost.

- The market for automation is increasing at a significant rate, owing to its adoption in industrial and urban use. Automation uses a large number of components, such as switchgear, relays, HVAC systems, human-machine interface (HMI,) and IT systems, which are connected through wires or cables.

- These cables may be small in size, ranging from 0.5 sq. mm to 35 sq. mm. Tracking the exact wire connection in an automation system is a challenging task for any skilled professional. Thus, the use of a cable tag has become an important component in the cable management process.

- Moreover, recently, data centers are growing drastically. With the rise in cloud computing, social media, big data, online gaming, and other online applications, there is a constant need for enhanced IT infrastructure that caters to the ever-increasing demand for resources; a factor that further supplements the demand for hyperscale data centers.

Cable Tags Market Trends

This section covers the major market trends shaping the Cable Tag Market according to our research experts:

Manufacturing Occupies Major Share in the Cable Tag End-user Industry

- Manufacturers across various industries must identify parts, cartons, pallets, and shipments. This requires labeling, coding, and marking on a wide range of products and packaging systems, without sacrificing line speed.

- Cable tags are able to withstand high temperature and harsh weather condition so that the printing on the tag does not fade away, which is necessary for the manufacturing sector. Cable tag companies are now finding innovative ways to resolve this problem.

- Furthermore, continuous self-adhesive label stocks are ideal for warehouse and pipe marking. Self-adhesive labels are being used for asset labeling, removable asset tracking, temporary tracking labels, warehouse labeling, pipe marking, wire and cable identification, and secure identification of component parts and circuit boards.

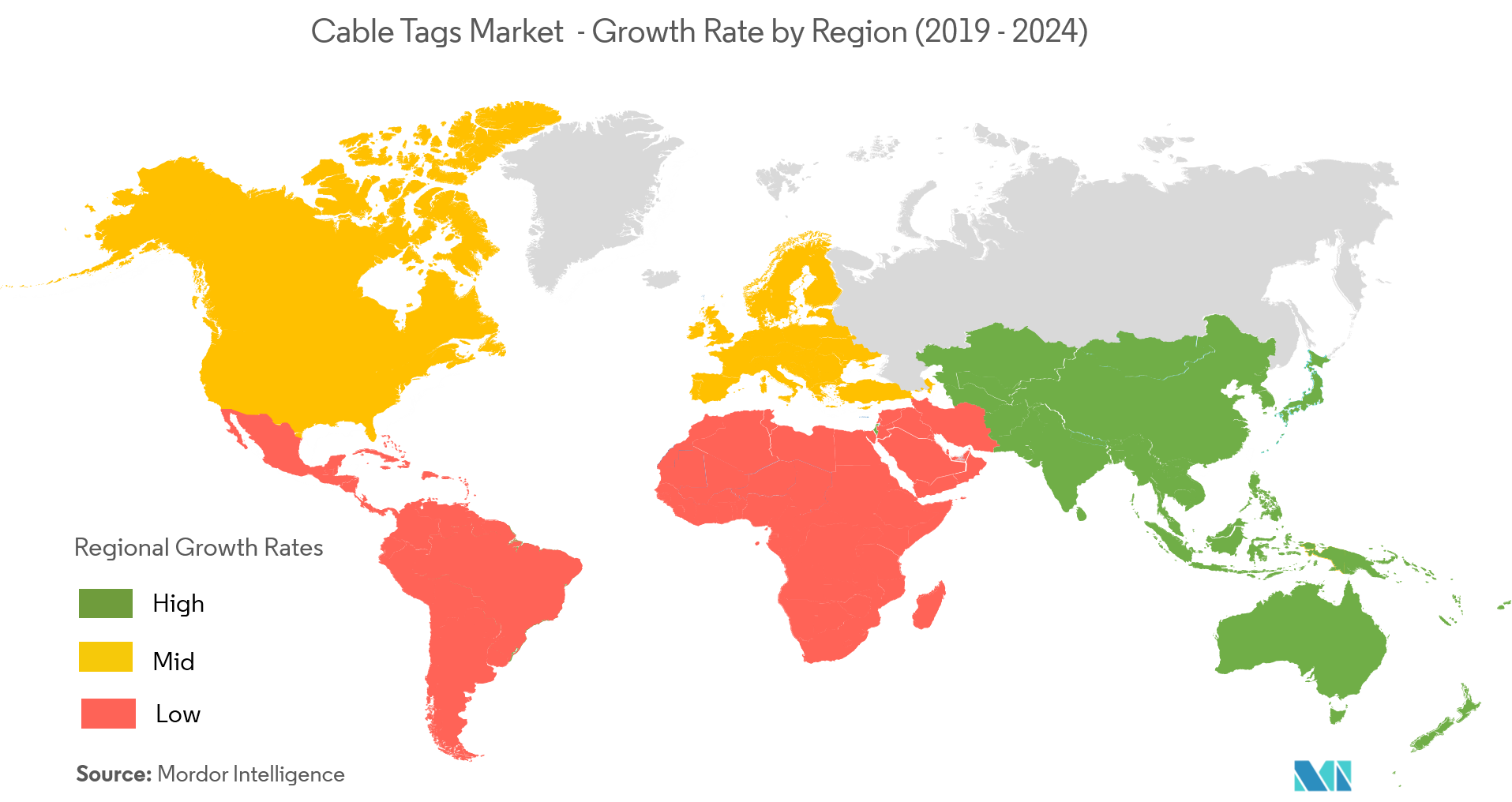

Asia-Pacific is Expected to Witness Highest Growth Rate

- China is one of the major players in the global cable tags market, mainly due to a high rate of investment in industrial automation and also due to growing local manufacturing production. The need to track the exact wire connection in an automation system is boosting the demand for cable tags.

- According to the National Bureau of statistics, China’s industrial output grew by 6.1% in 2018. The growth is expected to sustain as a result of the increase in retail sales of industrial products by about 10.4%. These factors are also acting as a significant driver for automation in the country.

- The Indian manufacturing sector is one of the highest growth sectors, registering a 7.9% year-on-year growth. The Make in India initiative plans to make India equally attractive for domestic and foreign players, and give global recognition to the Indian economy. By the end of 2020, the Indian manufacturing sector is expected to touch USD 1 trillion.

- Japan is becoming an automated industrial economy, and the advancement in Industrial version 4.0 is taking up at a faster pace in the country. The country has emerged as the manufacturing hub for the factory automation products, supplying them to another regional market in the Asia-Pacific region.

- The Olympic games that are to be held in Japan in 2020 has accelerated the pace of public and private sector investment in construction projects. Even the government efforts to revitalize the economy by focusing on infrastructure development are expected to provide momentum to the construction industry's growth. As the adoption of cable tags are vital in infrastructure, this is expected to impact the market for cable tags.

Cable Tags Industry Overview

- August 2017 - TE Connectivity acquired Hirschmann Car Communication, a company that provides antennas, antenna systems, and broadcast tuners for automotive and commercial vehicle applications. The acquisition expands TE Connectivity’s product portfolio as well as the integrated and highly engineered solutions provided for connected and autonomous vehicles, worldwide. Hirschmann Car Communication’s strong R&D and engineering capabilities in electronics and software development allow the company to further strengthen its global leadership position in automotive sensing and connectivity.

Cable Tags Market Leaders

-

TE Connectivity Ltd

-

Brady Corporation

-

ZipTape Label ID Systems

-

Novoflex Marketing Ltd

-

Panduit Corporation

*Disclaimer: Major Players sorted in no particular order

Cable Tags Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Scope of the Study

- 1.3 Study Assumptions

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Introduction to Market Drivers and Restraints

-

4.4 Market Drivers

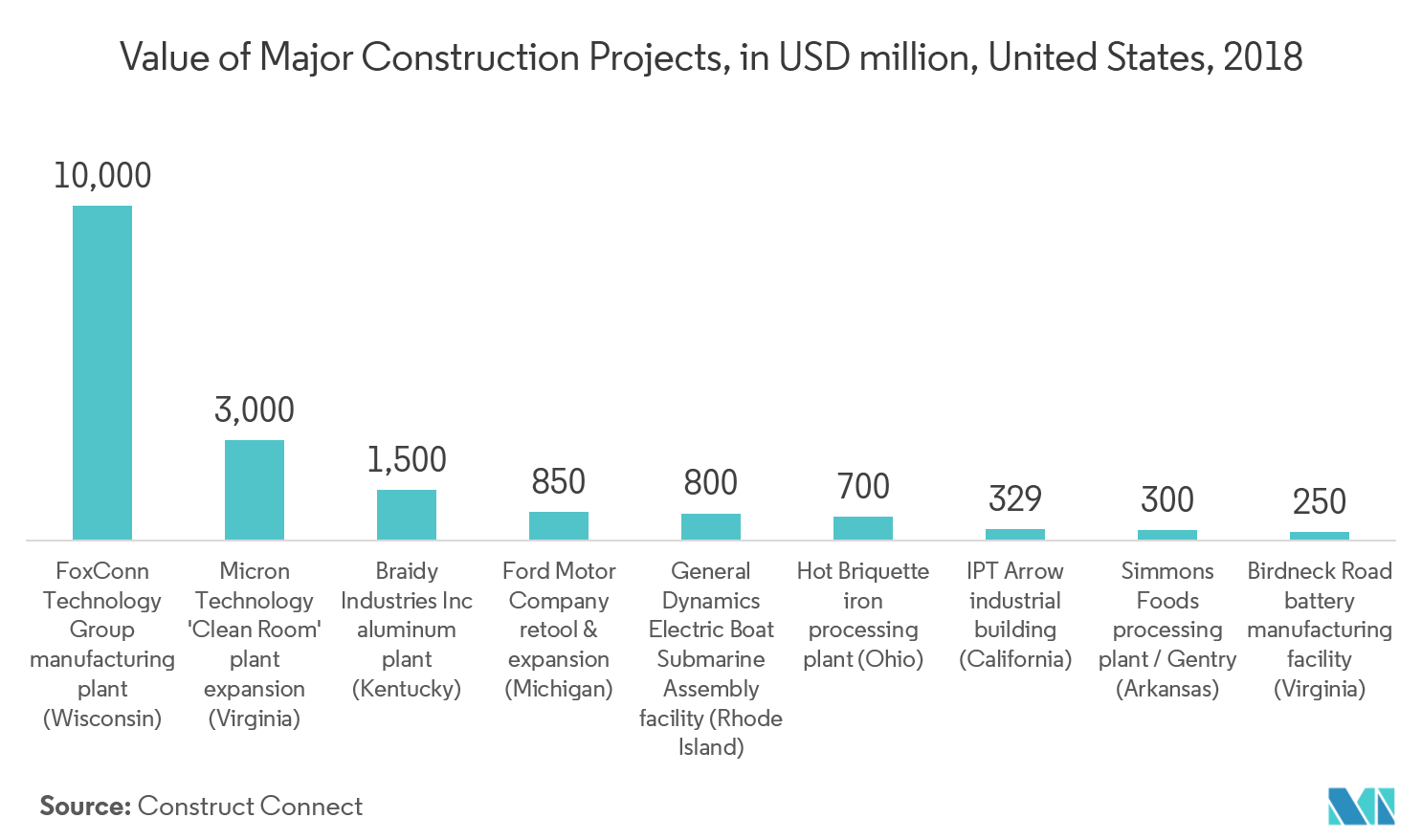

- 4.4.1 Increased Usage in Construction Industry

- 4.4.2 Increasing Adoption of Automation

-

4.5 Market Restraints

- 4.5.1 Difficulty in Manufacturing Durable Printed Tags

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Metallic

- 5.1.2 Non-metallic

-

5.2 By End User

- 5.2.1 IT and Telecom

- 5.2.2 Construction

- 5.2.3 Power and Utilities

- 5.2.4 Manufacturing

- 5.2.5 Other End Users

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 TE Connectivity Ltd

- 6.1.2 Brady Corporation

- 6.1.3 ZipTape Label ID Systems

- 6.1.4 Novoflex Marketing Ltd

- 6.1.5 Panduit Corporation

- 6.1.6 3M Company

- 6.1.7 Vizinex RFID Inc.

- 6.1.8 HellermannTyton Group PLC (AptivPLC)

- 6.1.9 Industrial Labelling Solution

- 6.1.10 Marking Services Inc.

- 6.1.11 Nelco

- *List Not Exhaustive

7. INVESTMENT LANDSCAPE

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityCable Tags Industry Segmentation

A cable tag is a label representing the information or a serial number on a particular wire to which, a component is connected. A cable tag can be pasted or inserted as a ferrule on the cable. Cable tags come in various types, such as ferrule tags, sleeveless-based tag, sleeve-based tag, tie-based tag, wrap-around label tag, and heat shrinkable tag. A ferrule tag is a small and medium plastic bracelet, which is inserted at the end of the cable. Ferrules are available in the form of numbers and alphabets, separately.

| By Type | Metallic |

| Non-metallic | |

| By End User | IT and Telecom |

| Construction | |

| Power and Utilities | |

| Manufacturing | |

| Other End Users | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| Rest of the World |

Cable Tags Market Research FAQs

What is the current Cable Tags Market size?

The Cable Tags Market is projected to register a CAGR of 5.77% during the forecast period (2024-2029)

Who are the key players in Cable Tags Market?

TE Connectivity Ltd, Brady Corporation, ZipTape Label ID Systems, Novoflex Marketing Ltd and Panduit Corporation are the major companies operating in the Cable Tags Market.

Which is the fastest growing region in Cable Tags Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Cable Tags Market?

In 2024, the Asia Pacific accounts for the largest market share in Cable Tags Market.

What years does this Cable Tags Market cover?

The report covers the Cable Tags Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Cable Tags Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Cable Tags Industry Report

Statistics for the 2024 Cable Tags market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Cable Tags analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.