Cambodia Frozen Food Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 3.74 % |

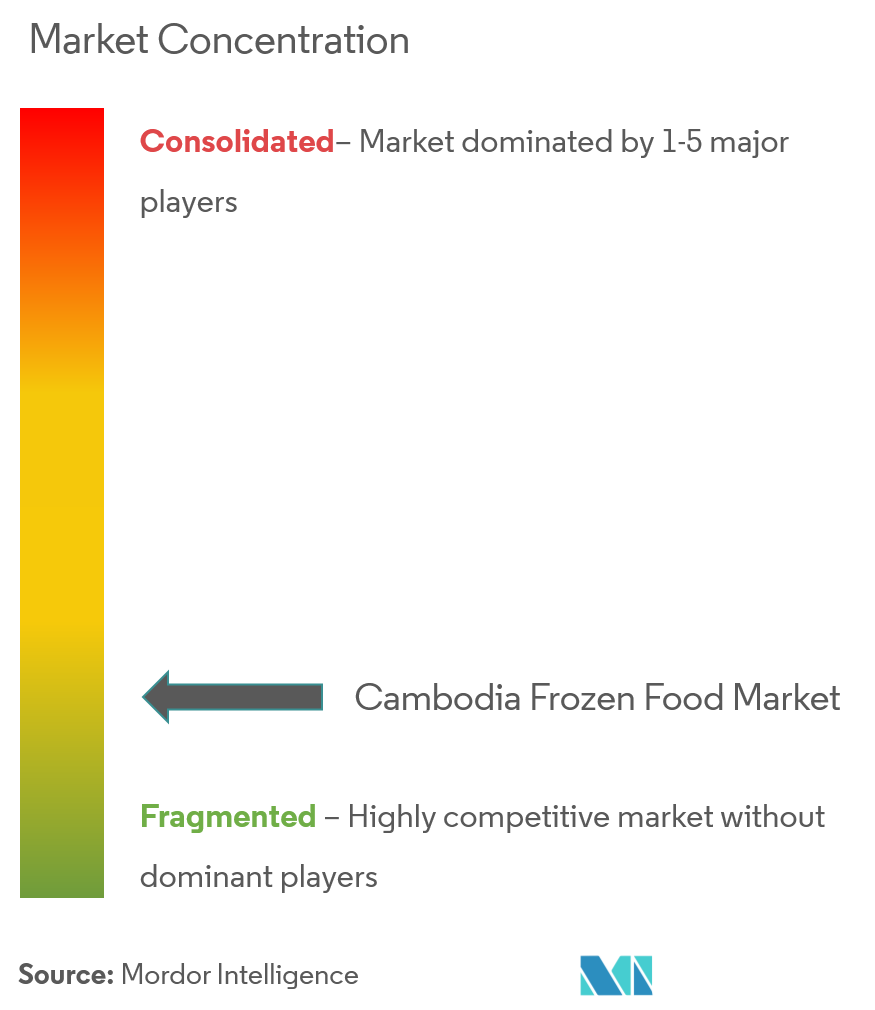

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Cambodia Frozen Food Market Analysis

The Cambodia Frozen Food Market is projected to register a CAGR of 3.74% during the study period (2020-2025).

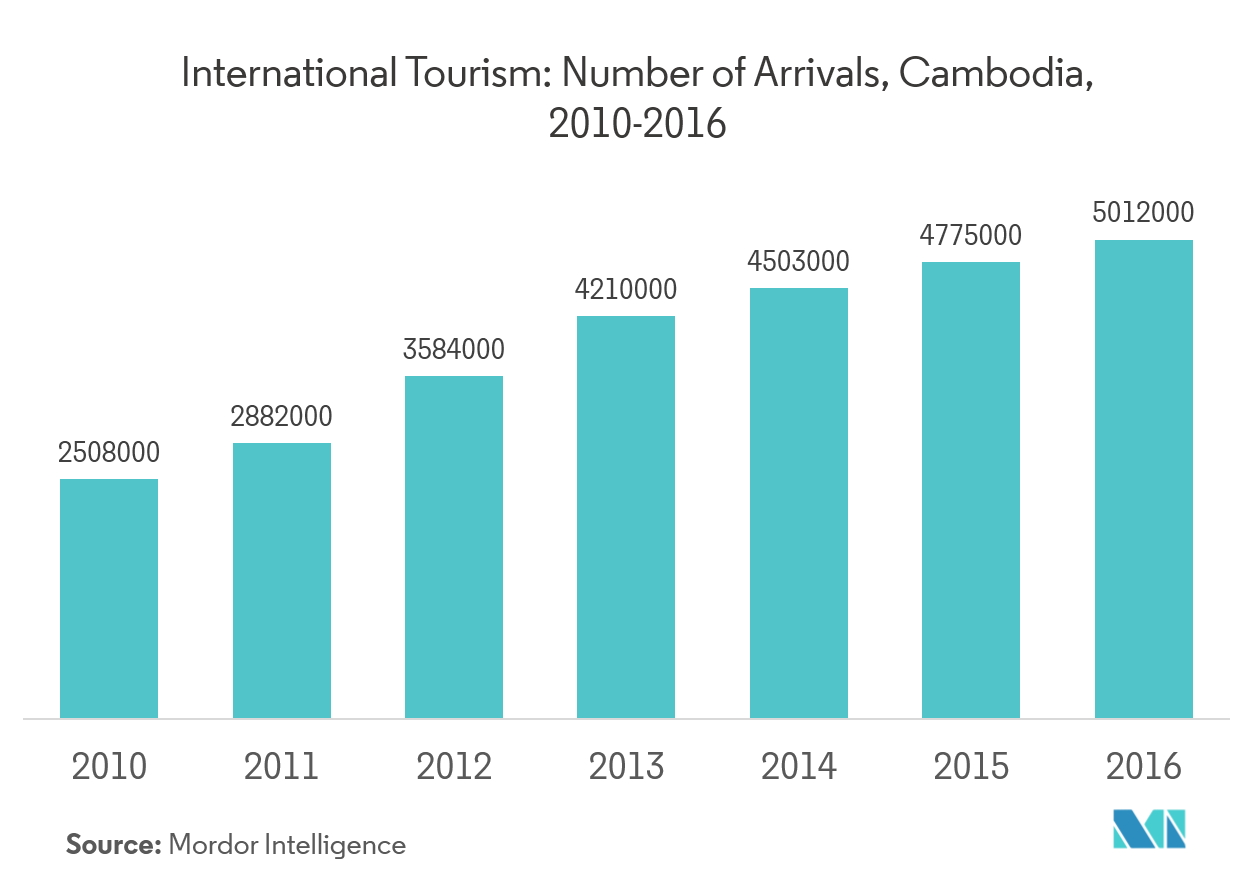

- Fast adoption of Western diet trends owing to increasing tourism and expat population are the prime factors that has led to a hike in the retail sales of packaged food, especially frozen and chilled food. Recently, the Cambodian population has adopted the trend of mini-meals, which has, for long, been a part of Western culture.

- Consumers in Cambodia displayed higher demand for frozen desserts, frozen potatoes, and frozen ready meals. Some importers in Cambodia specialize in servicing the hotel restaurant and institution (HRI) trade, and have the appropriate frozen and chilled storage and distribution infrastructure. Most of the modern food retailers, such as DFI Lucky and Thai Huot, also service the HRI trade through their retail stores or wholesale operations.

- However, high production costs, in terms of raw material and machinery, create major obstacles for this market. In addition, the high import duty levied in Cambodia, which leads to the high cost of frozen food, is another major concern in the market.

Cambodia Frozen Food Market Trends

This section covers the major market trends shaping the Cambodia Frozen Food Market according to our research experts:

Influence of Westernization on Diet and Healthy Tourism

A shift from the Southeast Asian cultural tradition of eating multiple (four or five times) small meals a day, to the norm of most developed countries of having three meals a day is being widely noticed. The trend also includes increased purchase of ready-to-eat, cooked foods, and the consumption of frozen food products. The fast adoption of western diet trends has led to a hike in the retail sales in packaged food industry, especially frozen and chilled food. Consumers in Cambodia displayed higher demand for frozen desserts, frozen potatoes, and frozen ready meals. Some importers in Cambodia specialize in servicing the hotel restaurant and institution (HRI) trade and have the appropriate frozen and chilled storage and distribution infrastructure. Most of the modern food retailers, such as DFI Lucky and Thai Huot, also service the HRI trade through their retail stores or wholesale operations.

Growing Demand for Frozen Seafood

Frozen seafood occupies a significant share in the frozen food product category in the Cambodian market. Frozen seafood manufacturers find it difficult to compete on the prices with the traders in the native market. The Institute of Standards of Cambodia (ISC) and the United Nations Industrial Development Organization (UNIDO) teamed up in 2016 to increase the export of four seafood products adhering to the international standards. Fish sauce, frozen shrimp, dried shrimp, and crab meat form the major exports of the seafood in the country. The hectic lifestyles, changing taste and preferences of the consumers, and the increased shelf life of frozen products are the reasons for the gaining popularity of frozen foods in the country.

Cambodia Frozen Food Industry Overview

At present, the market is dominated by international players, such as Thai Beverage PLC, Unilever PLC, and DiraFrost. The share of local players in the market is quite low, as frozen food requires high capital requirements for individual quick freezers and cold storage facilities, which are out of reach for companies operating in the frozen food market in Cambodia.The Cambodian frozen food market is growing at a steady pace, with a low production capacity. The demand for frozen food in the market is majorly met through imports. The country has more importers and distributors than producers. The frozen food market is in the stage of infancy, but this scenario is expected to change over the forecast period, with the growth of the middle-class population in the country.

Cambodia Frozen Food Market Leaders

-

Unilever PLC

-

DiraFrost

-

Natural Garden

-

Les Vergers Boiron

*Disclaimer: Major Players sorted in no particular order

Cambodia Frozen Food Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Frozen Meat and Seafood

- 5.1.2 Frozen Dessert

- 5.1.3 Frozen Fruit and Vegetable

- 5.1.4 Frozen Ready Meal

- 5.1.5 Other Types

-

5.2 By Distribution Channel

- 5.2.1 Hypermarket/Supermarket

- 5.2.2 Traditional Grocery Store

- 5.2.3 Online Channel

- 5.2.4 Other Distribution Channels

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Dirafrost

- 6.1.2 Karem Ice Cream

- 6.1.3 Natural Garden

- 6.1.4 Les Vergers Boiron

- 6.1.5 Karem Ice Cream

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityCambodia Frozen Food Industry Segmentation

The Cambodia frozen food market is segmented by product type and distribution channel. By product type, the scope includes frozen meat and seafood, frozen dessert, frozen fruit and vegetable, frozen ready meal, and other product types. By distribution channel, the market studied is segmented into hypermarket/supermarket, traditional grocery store, online channel, and other distribution channels.

| By Type | Frozen Meat and Seafood |

| Frozen Dessert | |

| Frozen Fruit and Vegetable | |

| Frozen Ready Meal | |

| Other Types | |

| By Distribution Channel | Hypermarket/Supermarket |

| Traditional Grocery Store | |

| Online Channel | |

| Other Distribution Channels |

Cambodia Frozen Food Market Research FAQs

What is the current Cambodia Frozen Food Market size?

The Cambodia Frozen Food Market is projected to register a CAGR of 3.74% during the forecast period (2024-2029)

Who are the key players in Cambodia Frozen Food Market?

Unilever PLC, DiraFrost, Natural Garden and Les Vergers Boiron are the major companies operating in the Cambodia Frozen Food Market.

What years does this Cambodia Frozen Food Market cover?

The report covers the Cambodia Frozen Food Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Cambodia Frozen Food Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Cambodia Frozen Food Industry Report

Statistics for the 2024 Cambodia Frozen Food market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Cambodia Frozen Food analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.