Canada Food Sweetener Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 1.21 % |

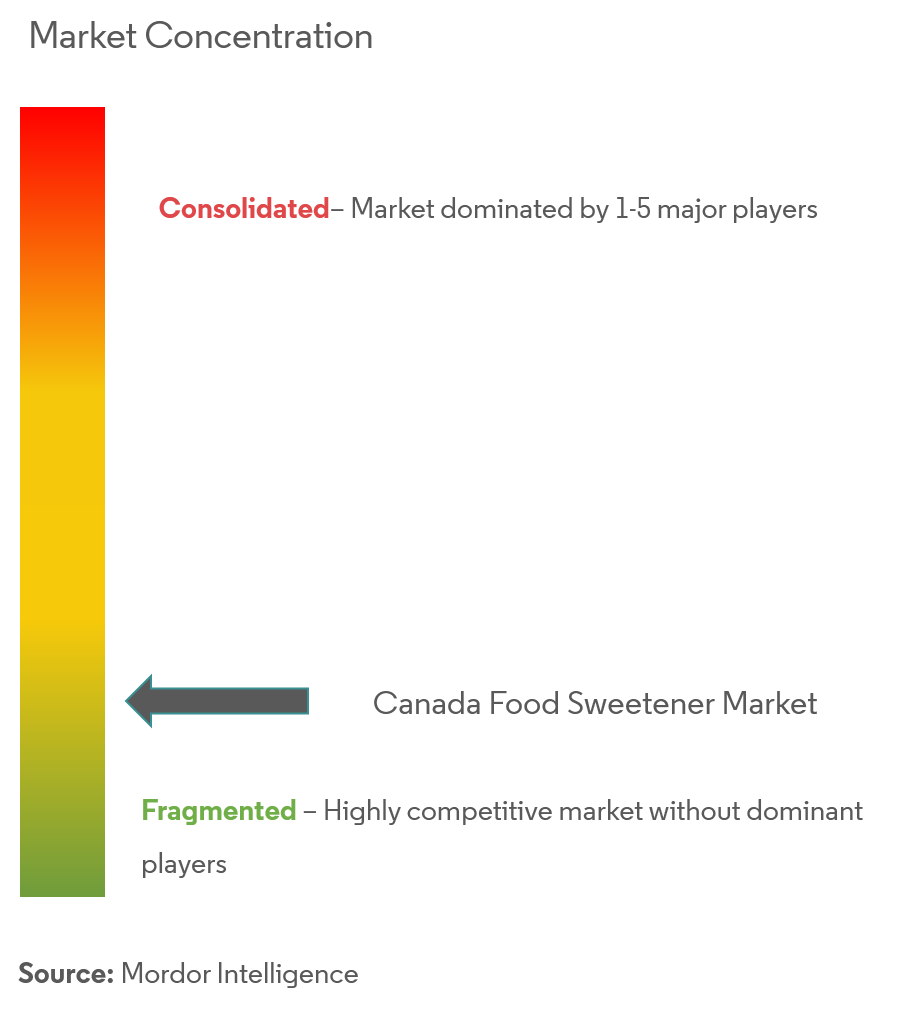

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Canada Food Sweetener Market Analysis

Canada Food Sweetener Market is growing at a CAGR of 1.21% during the forecast period (2020-2025).

- In Canada, sugar production capability is significantly low. The country has been relying on imports, since the past few decades, despite being a major region in the continent.South American countries are the primary exporters to Canada, and are subjected to related trade disputes.

- The country’s regulatory structure, especially for sugar substitutes, is highly extensive. Furthermore, it covers, both, natural and artificial sweeteners under the Food and Drugs Act and Regulations.

- In Canada, purified stevia extractis regulated as a food additive. It has undergone a full safety review, and was approved for use in various foods sold in Canada. Stevia is not considered safe is various countries, but the Canadian Health added stevia to its list of permitted sweeteners.

Canada Food Sweetener Market Trends

This section covers the major market trends shaping the Canada Food Sweetener Market according to our research experts:

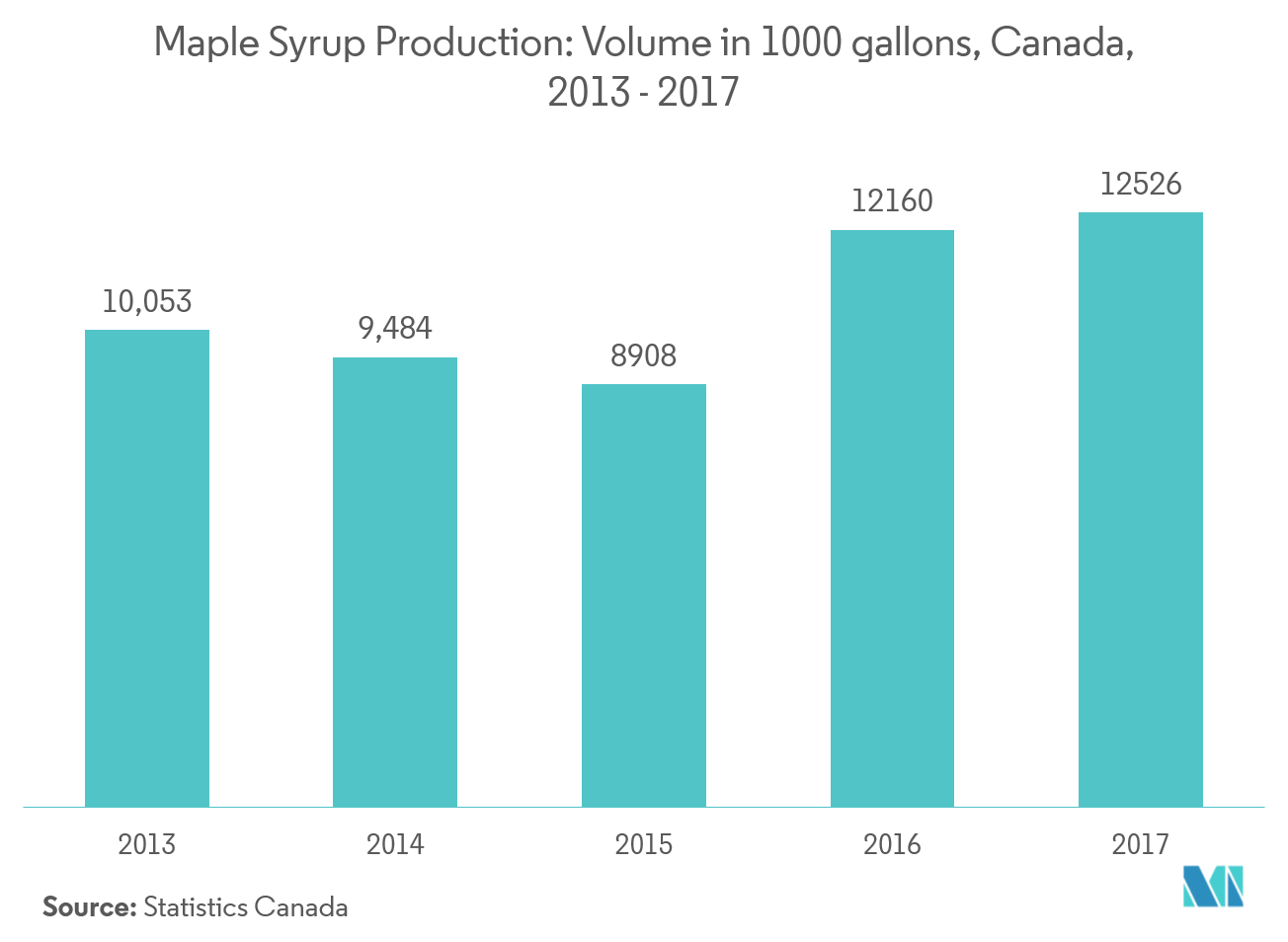

High Production of Maple Syrup

Maple syrup produced in Canada is increasingly being utilized as an ideal alternative to sugar, in a variety of foods, such as desserts and baked goods. The Canadian maple syrup industry accounts for a major share of the global maple syrup production and the country remains the leading global producer of maple syrup-based products. However, Canada’s market share has witnessed a decline in the market in 2017, due to rising competition from the United States. The Federation of Quebec Maple Syrup Producers and Vermont Maple Sugar Makers' Association are the two major cartels producing a major chunk of maple syrup. However, the stringent quota system and black marketing of maple syrup are hindering the overall market growth.

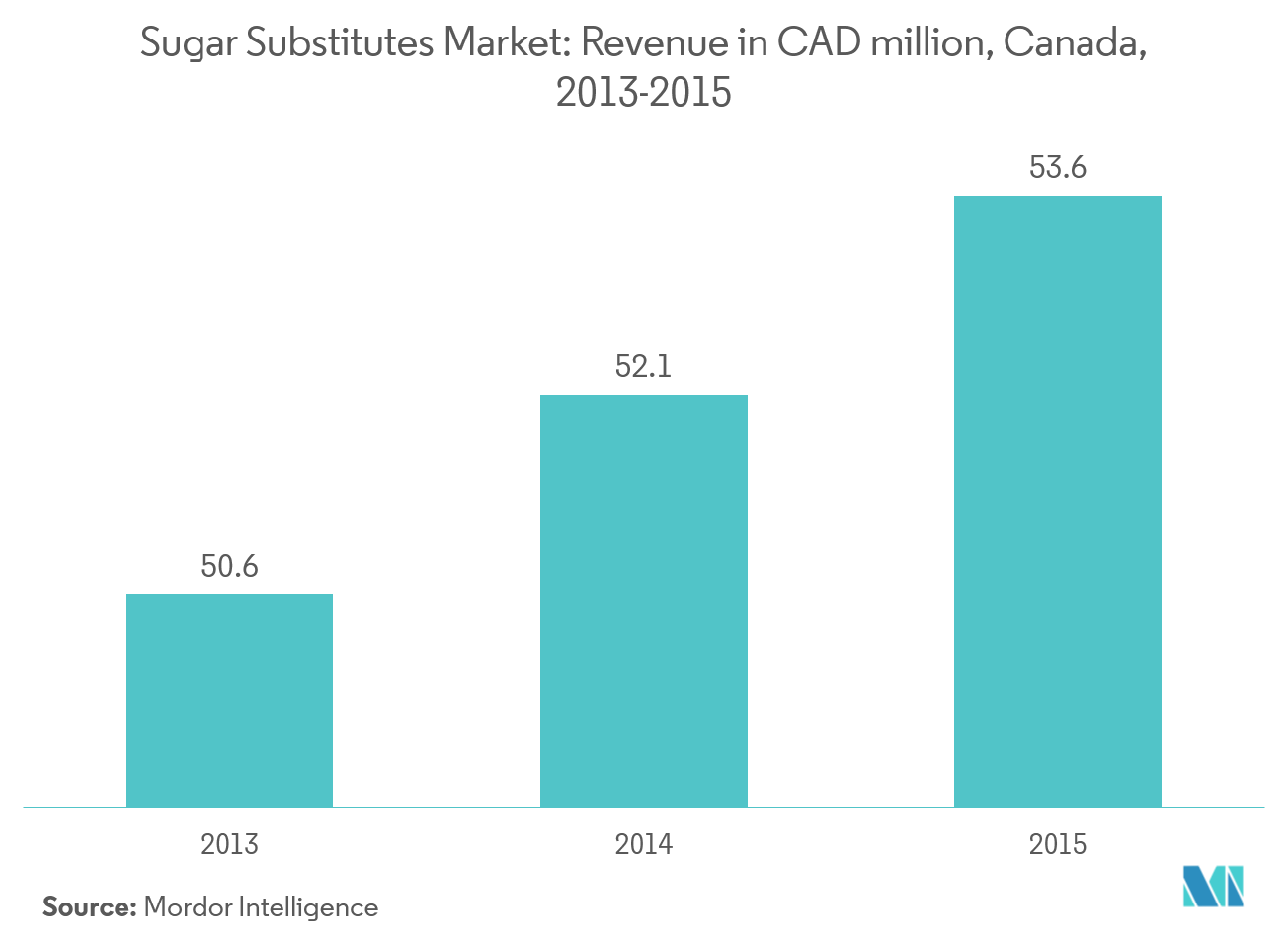

Growing Demand for Sugar Substitutes

Sugar substitutes are food additives that are used to duplicate the effect of sugar in taste, usually with less food energy. The majority of sugar substitutes approved for food use are artificially-synthesized compounds. However, some bulk natural sugar substitutes are known, including sorbitol and xylitol, which are found in berries, fruit, vegetables, and mushrooms. Sugar substitutes like stevia, aspartame, sucralose, neotame, acesulfame potassium, and saccharin. are approved by USDA and are categorized under GRAS in the North American region. Aspartame, a low-calorie artificial sweetener, has been permitted for use as a food additive in Canada since 1981. It is used in a number of foods, including soft drinks, desserts, breakfast cereals, and chewing gum. It is also available as a table-top sweetener.

Canada Food Sweetener Industry Overview

Canada Food Sweetener Market is a fragmented market with the presence of various large and small players. Players compete to grab the market with various product innovations such as introducing natural and clean label products, low calorie products etc. Players are also into expanding their product portfolio to make their stand in the market stronger.

Canada Food Sweetener Market Leaders

-

Cargill

-

Ingredion

-

Tate & Lyle

-

DuPont

*Disclaimer: Major Players sorted in no particular order

Canada Food Sweetener Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Market

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Drivers

- 4.2 Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products and Services

- 4.3.5 Degree of Competition

5. MARKET SEGMENTATION

-

5.1 By Product Type

- 5.1.1 Sucrose (Common Sugar)

- 5.1.2 Starch Sweeteners and Sugar Alcohols

- 5.1.2.1 Dextrose

- 5.1.2.2 High Fructose Corn Syrup (HFCS)

- 5.1.2.3 Maltodextrin

- 5.1.2.4 Sorbitol

- 5.1.2.5 Xylitol

- 5.1.2.6 Others (Glucose Syrup,Glucose-Fructose syrup, Fructose-glucose syrup, Isoglucose, Fructose, Mannito, Maltitol, Erythritol, Lactitol, Isomalt)

- 5.1.3 High Intensity Sweeteners (HIS)

- 5.1.3.1 Sucralose

- 5.1.3.2 Aspartame

- 5.1.3.3 Saccharin

- 5.1.3.4 Cyclamate

- 5.1.3.5 Ace-K

- 5.1.3.6 Neotame

- 5.1.3.7 Stevia

- 5.1.3.8 Others (Glycyrrhizin, Mogroside V , Luo han guo, Thaumatin, Monatin and others)

-

5.2 By Application

- 5.2.1 Dairy

- 5.2.2 Bakery

- 5.2.3 Soups, Sauces and Dressings

- 5.2.4 Confectionery

- 5.2.5 Beverages

- 5.2.6 Others

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Most Active Companies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Tate & Lyle PLC

- 6.4.2 Cargill Incorporated

- 6.4.3 DuPont

- 6.4.4 Ingredion Incorporated

- 6.4.5 Ajinomoto Co., Inc.

- 6.4.6 PureCircle Limited

- 6.4.7 NutraSweet Company

- 6.4.8 GLG Life Tech Corporation

- *List Not Exhaustive

7. MARKET TRENDS AND OPPORTUBITIES

** Subject To AvailablityCanada Food Sweetener Industry Segmentation

Canada Food Sweetener Market is segmented by Type into Sucrose, Starch Sweeteners and Sugar Alcohols. By Application the market is segmented into Dairy, Bakery, Beverages, Confectionery, Soups, Sauces and Dressings and Others.

| By Product Type | Sucrose (Common Sugar) | |

| Starch Sweeteners and Sugar Alcohols | Dextrose | |

| High Fructose Corn Syrup (HFCS) | ||

| Maltodextrin | ||

| Sorbitol | ||

| Xylitol | ||

| Others (Glucose Syrup,Glucose-Fructose syrup, Fructose-glucose syrup, Isoglucose, Fructose, Mannito, Maltitol, Erythritol, Lactitol, Isomalt) | ||

| High Intensity Sweeteners (HIS) | Sucralose | |

| Aspartame | ||

| Saccharin | ||

| Cyclamate | ||

| Ace-K | ||

| Neotame | ||

| Stevia | ||

| Others (Glycyrrhizin, Mogroside V , Luo han guo, Thaumatin, Monatin and others) | ||

| By Application | Dairy | |

| Bakery | ||

| Soups, Sauces and Dressings | ||

| Confectionery | ||

| Beverages | ||

| Others |

Canada Food Sweetener Market Research FAQs

What is the current Canada Food Sweetener Market size?

The Canada Food Sweetener Market is projected to register a CAGR of 1.21% during the forecast period (2024-2029)

Who are the key players in Canada Food Sweetener Market?

Cargill, Ingredion, Tate & Lyle and DuPont are the major companies operating in the Canada Food Sweetener Market.

What years does this Canada Food Sweetener Market cover?

The report covers the Canada Food Sweetener Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Canada Food Sweetener Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Canada Food Sweetener Industry Report

Statistics for the 2024 Canada Food Sweetener market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Canada Food Sweetener analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.