Cattle Feed Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 87.46 Billion |

| Market Size (2029) | USD 103.87 Billion |

| CAGR (2024 - 2029) | 3.50 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Cattle Feed Market Analysis

The Cattle Feed Market size is estimated at USD 87.46 billion in 2024, and is expected to reach USD 103.87 billion by 2029, growing at a CAGR of 3.5% during the forecast period (2024-2029).

- Globally, the beef cattle segment has witnessed growth during the forecast period due to factors such as a rise in the demand for high-quality beef meat and high consumption of beef meat in western countries such as the United States, the United Kingdom, and Asia. China is the biggest consumer and producer of beef meat and growth in the beef cattle population.

- In 2021, The United Nations Food & Agriculture Organization (FAO) projected a 1.7% year-on-year increase in the demand for cattle products by 2050, with the demand for dairy products projected to increase by 55% and beef by 70%. The increasing demand for milk and dairy products in developing countries will boost the global market during the forecast period.

- Europe and North America currently have a significant consumption share of dairy products and meat, while rapid growth has been projected in the Asian-Pacific and Latin American regions. Increased demand for dairy products and beef has led to increased industrialization of cattle rearing. This translates to an increase in herd sizes, increased use of compound feed, and better scientific management of cattle. This phenomenon has helped in the growth of the cattle feed market.

Cattle Feed Market Trends

This section covers the major market trends shaping the Cattle Feed Market according to our research experts:

Increasing Industrialization of Livestock Production in Developing Countries

The increasing population and the need to satisfy the nutritional and taste preferences of the population in developing countries have led to increased industrialization of livestock production. In developing countries, cattle rearing has traditionally been a backyard occupation. However, with increased demand and more awareness regarding the economies of scale of maintaining larger herds, cattle rearing in these countries has started to transform. For instance, according to FAO, the cattle population in India has increased to 193.2 million in 2021 from 191.9 million in 2018. Also, in 2021, India produced 108.3 million metric ton of milk, an increase of 20.6% from 2018.

According to FAO, in land-locked developing countries, cow milk production accounted for 41.9 million metric tons in 2021. Moreover, the cattle population increased to 264.4 million heads in 2021 from 246.3 million heads in 2018. Increased industrialization of cattle husbandry would lead to the adoption of advanced management practices, including the usage of compound feed in appropriate dosages. This is expected to boost the growth of the cattle feed market over the forecast period.

North America Dominates the Global Market

In North America, the cattle population was 140.8 million heads in 2021. The increasing population creates an increasing demand for cattle feed. In North America, the United States is the largest producer of animal feed including cattle feed, and globally, the second largest producer of cattle feed after China due to the significant population and demand of its livestock industry, the United States is one of the largest cattle feed exporters. According to ITC, in 2021, the United States contributed 8.9% of the total feed export. The region is witnessing growth due to a free-trade agreement between the United States, Canada and Mexico as these are the countries which accounted for more than 90% of the feed production in the North America.

The region has many of the global leading animal feed producers. The prominent feed manufacturers in the country include Cargill, Land O'Lakes, Alltech, ADM Alliance Nutrition, Perdue Farms, J.D. Heiskell & Co. Kent Nutrition Group, Hi-Pro Feeds, and Southern States Coop.

Therefore, owing to factors such as free-trade agreement, high cattle population and presence of leading feed manufacturers for exporting and domestic consumption has helped the North America region to be a largest region during the forecasted period.

Cattle Feed Industry Overview

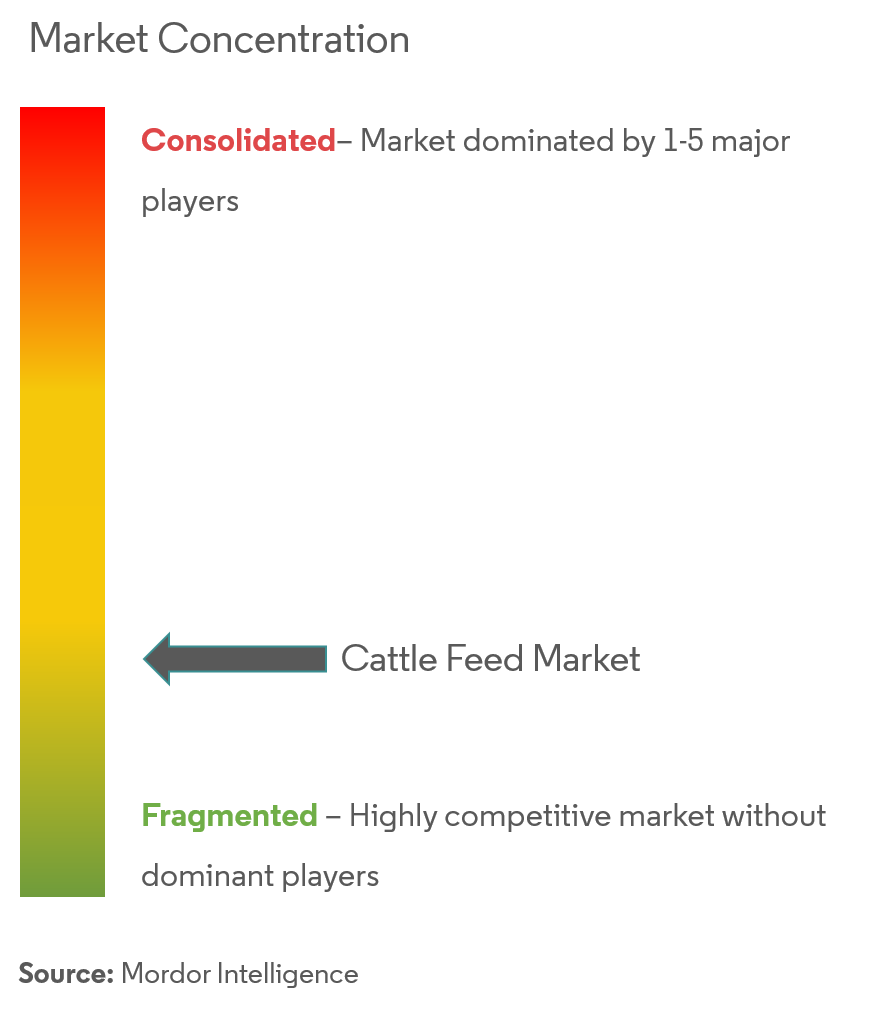

The cattle feed market is highly fragmented, with numerous local and regional players vying for increasing market shares in a market that has a strong presence of multinational players. Archer Daniels Midland, Cargill Inc., Land O' Lakes Inc., De Heus, and ForFarmers are some of the major players in the market. The fragmented supply of raw materials and the geographically dispersed consumer group in developing markets provide significant opportunities for local feed manufacturers to maintain a niche group of customers.

Cattle Feed Market Leaders

-

Cargill Inc.

-

Archer Daniels Midland Company

-

ForFarmers Inc.

-

De Heus

-

Land O'Lakes, Inc.

*Disclaimer: Major Players sorted in no particular order

Cattle Feed Market News

- January 2023: De Heus Animal Nutrition established a new greenfield animal feed factory in Ivory Coast with an initial capacity of producing 120,000 metric ton of feed for animals including cattle.

- May 2022: Archer Daniel Midland Co. acquired a feed mill in Southern Mindanao, the Philippines expanded its Animal Nutrition footprint in the country.

- November 2021: De Heus Vietnam signed a strategic agreement with Masan, after which De Heus obtained control of 100% of the feed-related business of MNS Feed. The feed business of MNS Feed covers thirteen animal feed mills, with a total production capacity of nearly 4 million metric ton, strengthening De Heus' position in Southeast Asia's largest animal feed market.

Cattle Feed Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

-

4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Animal Type

- 5.1.1 Dairy Cattle

- 5.1.2 Beef Cattle

- 5.1.3 Other Cattle Types

-

5.2 Ingredient

- 5.2.1 Cereals

- 5.2.2 Cakes and Mixes

- 5.2.3 Food Wastages

- 5.2.4 Feed Additives

- 5.2.5 Other Ingredients

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Russia

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Archer Daniels Midland Company

- 6.3.2 Land O'Lakes Inc.

- 6.3.3 De Heus

- 6.3.4 For Farmers Inc.

- 6.3.5 DBN Group

- 6.3.6 Biomin

- 6.3.7 New Hope Lihue

- 6.3.8 Wen's Food Group

- 6.3.9 Godrej Agrovet Limited

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityCattle Feed Industry Segmentation

Cattle feed contains protein, energy, minerals, and vitamins required for the growth, maintenance, and milk production of animals. For the purpose of this report, only commercial cattle feed has been considered. The Cattle Feed Market is Segmented by Animal Type (Dairy Cattle, Beef Cattle, and Other Cattle), Ingredient (Cereals, Cakes and Mixes, Food Wastages, Feed Additives, and Other Ingredients), and Geography (North America, Europe, Asia-Pacific, South America, and Africa). The report offers market size and forecasts for cattle feed in terms of value (USD million) for all the above segments.

| Animal Type | Dairy Cattle | |

| Beef Cattle | ||

| Other Cattle Types | ||

| Ingredient | Cereals | |

| Cakes and Mixes | ||

| Food Wastages | ||

| Feed Additives | ||

| Other Ingredients | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Spain | ||

| Russia | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| India | ||

| Japan | ||

| Australia | ||

| Rest of the Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Africa | South Africa |

| Rest of Africa |

Cattle Feed Market Research FAQs

How big is the Cattle Feed Market?

The Cattle Feed Market size is expected to reach USD 87.46 billion in 2024 and grow at a CAGR of 3.5% to reach USD 103.87 billion by 2029.

What is the current Cattle Feed Market size?

In 2024, the Cattle Feed Market size is expected to reach USD 87.46 billion.

Who are the key players in Cattle Feed Market?

Cargill Inc., Archer Daniels Midland Company, ForFarmers Inc., De Heus and Land O'Lakes, Inc. are the major companies operating in the Cattle Feed Market.

Which is the fastest growing region in Cattle Feed Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Cattle Feed Market?

In 2024, the North America accounts for the largest market share in Cattle Feed Market.

What years does this Cattle Feed Market cover, and what was the market size in 2023?

In 2023, the Cattle Feed Market size was estimated at USD 84.5 billion. The report covers the Cattle Feed Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Cattle Feed Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Cattle Feed Industry Report

Statistics for the 2024 Cattle Feed market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Cattle Feed analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.