Market Trends of China Vehicle Rental Industry

This section covers the major market trends shaping the China Vehicle Rental Market according to our research experts:

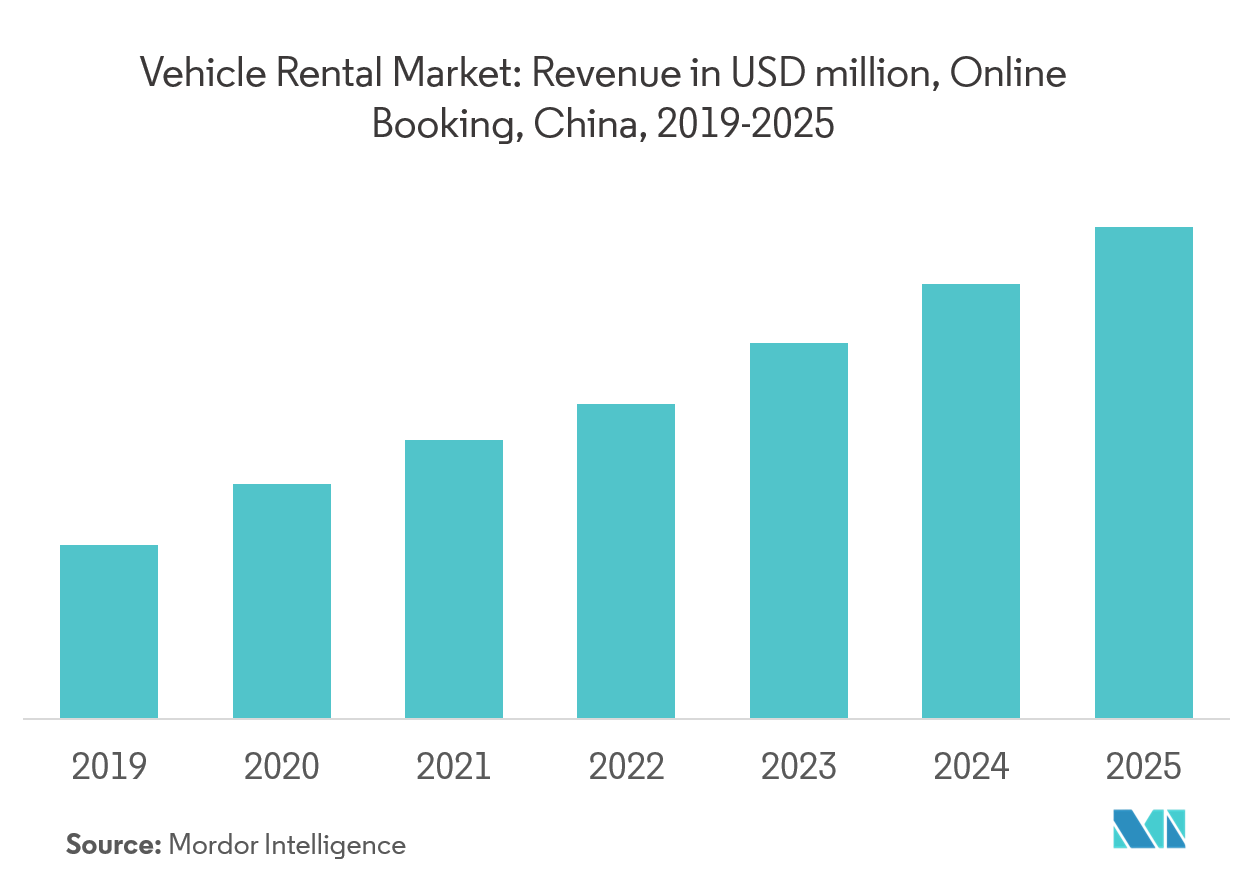

Additional Features Added in Online Booking by Rental Operators

With the growing trend in technology, the ease of renting a vehicle through online booking has been the most preferred choice of customers over the past few years. As it provides the additional facilities to monitor a rental vehicle’s operation, performance, and maintenance in real-time. These features made tremendous assets for drivers and fleet managers, enabling them to better and more efficiently identify risks and implement timely improvements of their rental services.

The above new system features are expected to serve 1,500 leasing partners by the end of 2019. DiDi launched its financial services hub in its main China app in January 2019, covering a diversified portfolio of insurance, wealth management, and payment services to riders, drivers and car-owners across its ride-hailing and auto-solutions businesses. As of 2019, Didi Chuxing offers a full range of app-based transportation options for nearly 550 million users in the country.

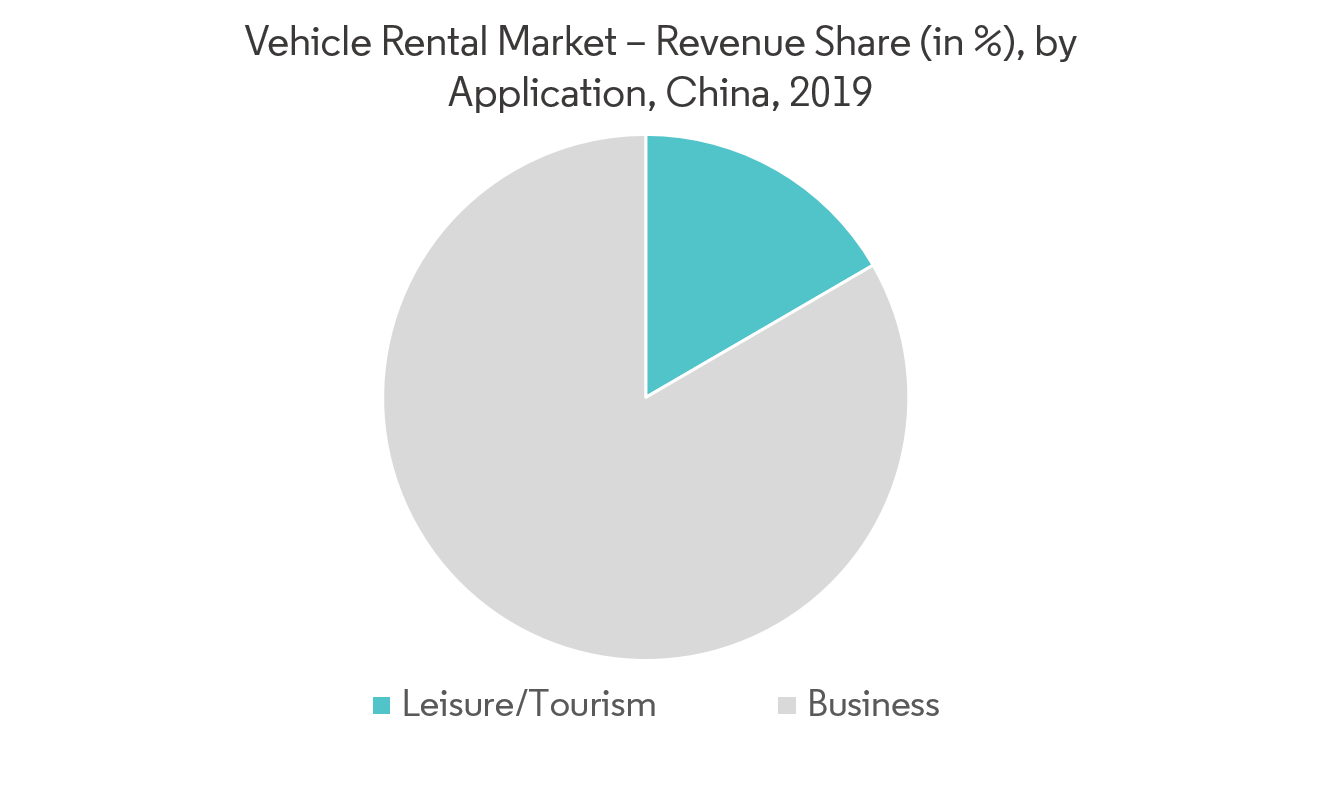

Leisure/Tourism Continue to Capture Significant Market Share

In 2018, China outbound tourist arrivals totaled 149.72 million, placing the country among the top tourist destinations in the world. Shenzhen, Guangzhou, Shanghai, Hangzhou, Beijing, Xiamen, Chongqing, Tianjin, Chengdu, and Wuhan are the biggest tourist destinations in the country in 2018.

A major challenge for the tourism vehicle rental market in China is the process of obtaining a Chinese driving license. China is not among the 194 countries in the world that recognize the International Driver's Permit (IDP). Chinese driver's license is a basic requirement to rent a car in China and while foreigners can apply for this license, the process is a difficult one.

- In the Chinese tourism vehicle rental industry, the foreigners trouble surviving the high traffic in many cities in China is making them prefer chauffeur services or employing a driver for the rented cars. Because of Chinese wages, the cost of the drivers is also quite low.

- Despite these factors, the tourist vehicle rentals by domestic tourists is high, making the country a big market for the tourist vehicle rentals.

- Online tourist vehicle bookings are increasing in the country, due to increasing usage of smartphones and the growth in the number of users aging between 25 - 34 years, who prefer to book vehicle rentals through online channels.

- High inflow of international tourists and the growth of domestic tourists preferring car rentals is helping the growth of the tourism vehicle rental market in the country.