China Waste Management Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Market Size (2024) | USD 78.38 Billion |

| Market Size (2029) | USD 101.23 Billion |

| CAGR (2024 - 2029) | 5.25 % |

Major Players

*Disclaimer: Major Players sorted in no particular order |

China Waste Management Market Analysis

The China Waste Management Market size is estimated at USD 78.38 billion in 2024, and is expected to reach USD 101.23 billion by 2029, growing at a CAGR of 5.25% during the forecast period (2024-2029).

The people’s Republic of China was the largest market for plastics waste in 2016 which accounts for about 60% of the global imports. The G7 countries held a share of about 50% of all the exports of plastic waste to China in 2016. China is the second largest producer of waste in the world. It was a net importer of a huge amount of waste from other countries until January 2018, when the Chinese government banned the import of 24 grades of solid waste, including mixed paper and plastics. The waste industry has consumed a volume of about 211.5 tons in 2017 with the rise in the volume of 4.7% in 2017 compared to 2013. China relies heavily on the imports of recycled materials as industrial raw materials. Hence, there is huge potential for market players in this industry.

China Waste Management Market Trends

This section covers the major market trends shaping the China Waste Management Market according to our research experts:

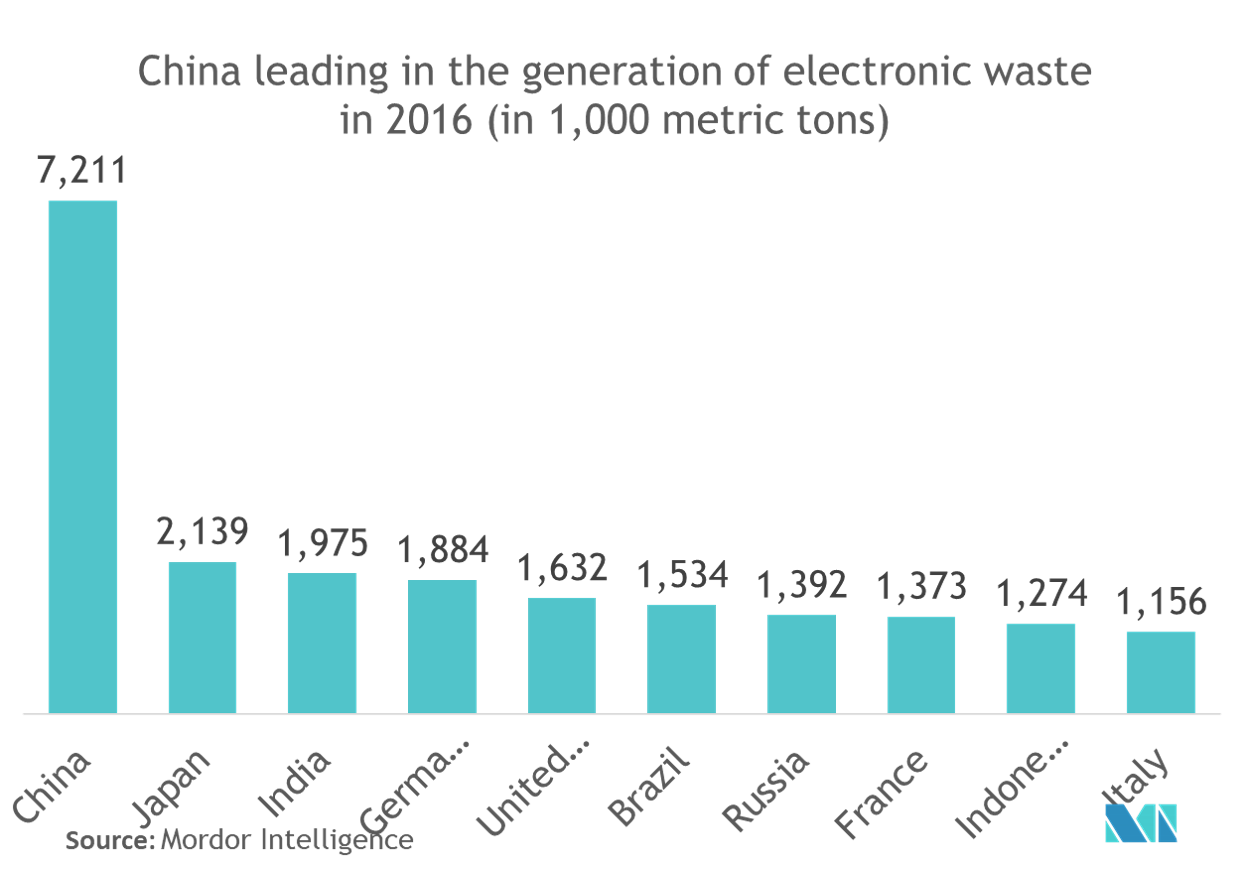

Spotlight on the China e-waste generation and its effective management

China is the leading manufacturer and consumer of electronic products in the world that leads to huge amounts of e-waste generation. The processes involved in the treatment and recycling of the e-wastes had in the past resulted in severe adverse environmental and human health impacts in China. Thus, e-waste management in China needs wide attention to address these issues. In the recent years, central and local governments have made sincere efforts to improve the waste management China. North America is a leading exporter of electronic waste to China as well as Japan.

Importance of recycling increasing rapidly all over China compared to the traditional dumping landfills

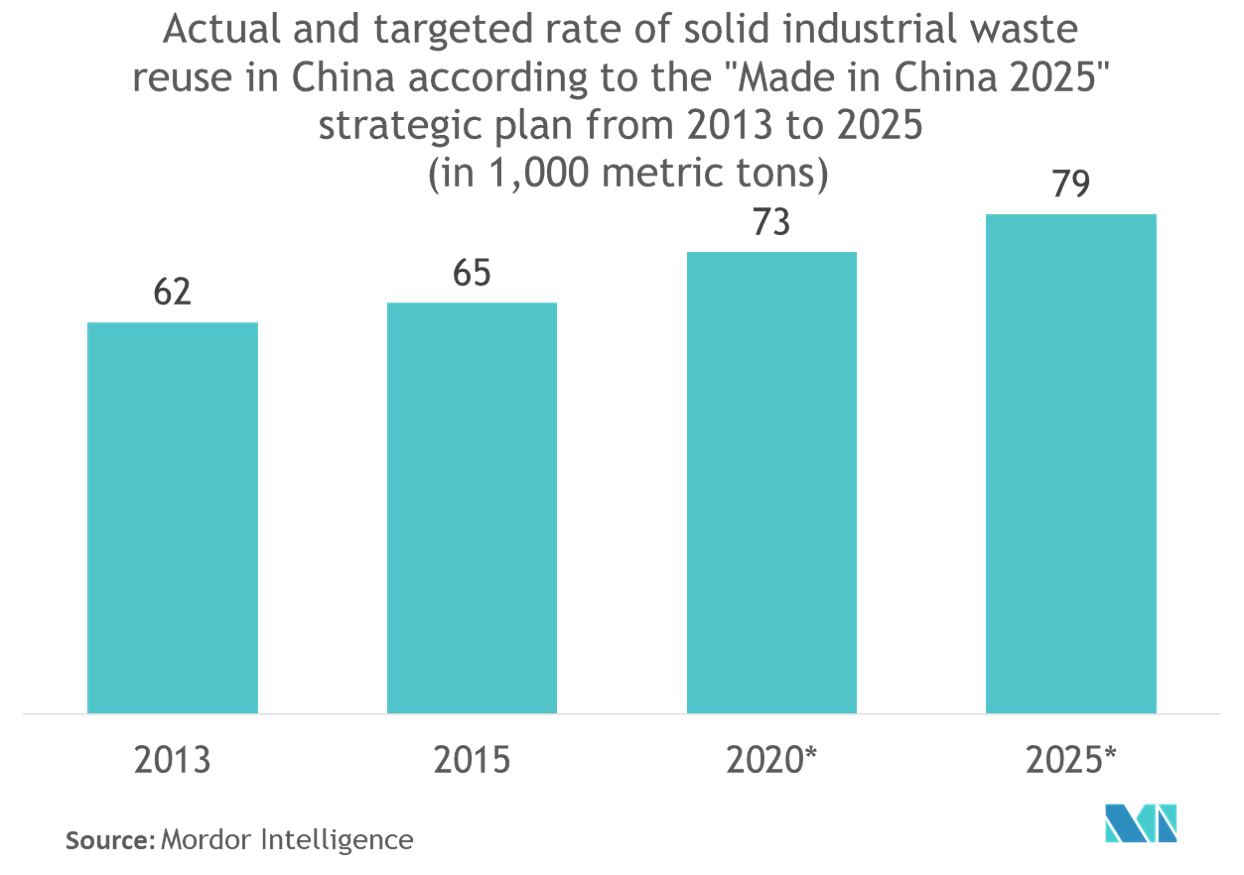

China’s private waste collectors are fast and highly efficient at recycling – sending tons of household waste back to manufacturers. Recycling in China is not subsidized by cities and is driven by the economic value of materials. If the material waste has value, it will somehow find its way to a manufacturer. Plastic, Metal, and electronics are the most recycled materials in China for which most of the enterprises both public and private keep on innovating in terms of the latest technologies to address the needs of the growing waste generated from various industries. The amount of available scrap metal has increased in China and will continue to grow in the future. Soon, China will become a net exporter of scrap metal. For instance, the annual sales of passenger vehicles sold in China had increased from nearly 10 million to 25 million from 2009 to 2018. All these cars are required to be recycled at the end of their lives. The most advanced metal scrap recycling areas are situated in the eastern coastal region from Guangzhou in the south, right up to Beijing and Tianjin in northern China. In 2015, approximately 65% of all the solid industrial waste in China was reused, yet the goal of the "Made in China 2025" plan was to increase the recycling rate by up to 79 percent by 2025.

China Waste Management Industry Overview

China exhibits huge competition in the waste management industry with many established as well upcoming players utilizing latest technologies to treat the various kinds of wastes.

Recently, the Hong Kong listed company Capital Environment Holdings Ltd. (CEHL) is committed to invest sustainably in the circular economy in Asia, the Pacific region and Europe in the interests of environmental and climate protection. As a part of China's new Belt and Road initiative, CEHL is to be active in the integrated waste management both nationally and internationally. The company already ranks among the market leaders in the People's Republic and in New Zealand. Producing energy from waste is among CEHL's core activities.

China Waste Management Market Leaders

-

China Everbright International Limited

-

Sembcorp Industries Ltd

-

Veolia Environnement S.A.

-

Capital Environmental Holdings Ltd. (CEHL)

-

HydroThane

*Disclaimer: Major Players sorted in no particular order

China Waste Management Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Key Deliverables of the Study

- 1.3 Study Assumptions

2. RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3. EXECUTIVE SUMMARY

4. MARKET OVERVIEW

- 4.1 Market Overview

- 4.2 Market Trends

- 4.3 Industry Attractiveness - Porters Five Forces Analysis

- 4.4 Brief on Vietnamese government regulations and initiatives

- 4.5 Value Chain/ Supply Chain Analysis

5. MARKET DYNAMICS and INSIGHTS

- 5.1 Introduction

- 5.2 Drivers

- 5.3 Restraints

- 5.4 Opportunities

- 5.5 Insights on the Logisitcs support and development in the waste management industry in China

- 5.6 Insights on the strategies of the rising startups venturing into the Chinese waste management industry

- 5.7 Technological advancement and innovation in the effective waste management

6. MARKET SEGMENTATION

-

6.1 By Waste type

- 6.1.1 Industrial waste

- 6.1.2 Municipal solid waste

- 6.1.3 Hazardous waste

- 6.1.4 E-waste

- 6.1.5 Plastic waste

- 6.1.6 Bio-medical waste

-

6.2 By Disposal methods

- 6.2.1 Landfill

- 6.2.2 Incineration

- 6.2.3 Dismantling

- 6.2.4 Recycling

-

6.3 By Type of ownership

- 6.3.1 Public

- 6.3.2 Private

- 6.3.3 Public - Private Patnership

7. INVESTMENT ANALYSIS

8. COMPETITIVE LANDSCAPE

- 8.1 Overview (Market Concentration and Major Players)

-

8.2 Company Profiles

- 8.2.1 China Everbright International Limited

- 8.2.2 Sembcorp Industries Ltd

- 8.2.3 Veolia Environnement S.A.

- 8.2.4 Capital Environmental Holdings Ltd. (CEHL)

- 8.2.5 HydroThane*

- *List Not Exhaustive

9. FUTURE GROWTH PROSPECTS OF THE CHINA WASTE MANAGEMENT INDUSTRY

10. APPENDIX

- 10.1 Statistics on the state-wise solid waste generation in urban areas

11. DISCLAIMER AND ABOUT US

** Subject To AvailablityChina Waste Management Industry Segmentation

A complete background analysis of the China waste managementmarket, which includes an assessment of the economy and contribution of sectors in the economy, market overview, market size estimation for key segments, and emerging trends in the market segments, market dynamics is covered in the report.

| By Waste type | Industrial waste |

| Municipal solid waste | |

| Hazardous waste | |

| E-waste | |

| Plastic waste | |

| Bio-medical waste | |

| By Disposal methods | Landfill |

| Incineration | |

| Dismantling | |

| Recycling | |

| By Type of ownership | Public |

| Private | |

| Public - Private Patnership |

China Waste Management Market Research FAQs

How big is the China Waste Management Market?

The China Waste Management Market size is expected to reach USD 78.38 billion in 2024 and grow at a CAGR of 5.25% to reach USD 101.23 billion by 2029.

What is the current China Waste Management Market size?

In 2024, the China Waste Management Market size is expected to reach USD 78.38 billion.

Who are the key players in China Waste Management Market?

China Everbright International Limited, Sembcorp Industries Ltd, Veolia Environnement S.A., Capital Environmental Holdings Ltd. (CEHL) and HydroThane are the major companies operating in the China Waste Management Market.

What years does this China Waste Management Market cover, and what was the market size in 2023?

In 2023, the China Waste Management Market size was estimated at USD 74.47 billion. The report covers the China Waste Management Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the China Waste Management Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

China Waste Management Industry Report

Statistics for the 2024 China Waste Management market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. China Waste Management analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.