Collision Sensors Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 22.70 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Collision Sensors Market Analysis

The collision sensors market was valued at USD 6.23 billion in 2020, at a CAGR of 22.7% over the forecast period 2021 - 2026. The automobile industry is growing fast, and end-user expectation is far beyond what has been realized. The current development in the trade has been to rework the control systems of the essential functions of a vehicle (acceleration, de-acceleration, braking, and steering) performed by mechanical or hydraulic systems to more suitable, flexible and dependable electrical/electronic systems. The combination of collision sensors in the anti-collision systems in mass-market vehicles and updated safety ratings of agencies are anticipated to boost market growth over the next few years. Though, the vast cost of LiDAR-based systems and long-range radars might cause an obstacle to market growth as manufacturers of low-priced cars may abstain from placing sensors to avoid growing the overall cost of vehicles.

- New technological developments in sensors are focused on building extremely sophisticated devices and increasing their performance using several components of the vehicle. Anti-collision systems allow automotive OEMs to combine additional knowledge to achieve the goal of producing an autonomous vehicle. Developed economies are now inclined toward automated systems and driverless cars, which makes it mandatory for the inclusion of anti-collision sensors, thus fueling the growth.

- The integration of sensors in collision avoidance systems in vehicles is expected to help reduce the number of vehicle accidents due to human errors, as every year the lives of approximately 1.35 million people are cut short as a result of a road traffic crash and between 20 and 50 million more people suffer non-fatal injuries, with many incurring a disability as a result of their injury (World Health Organization, 2018).

- The limited detection limit of this device is supposed to be a principal restraining factor. Moreover, the absence of awareness concerning the technology is anticipated to restrain the market growth. The debut of these systems in vehicles has raised the complexity of vehicle consoles, the probability of system component failures, errors in system design, and unconscious driver errors. This is expected to negatively influence parking sensors' market growth.

Collision Sensors Market Trends

This section covers the major market trends shaping the Collision Sensors Market according to our research experts:

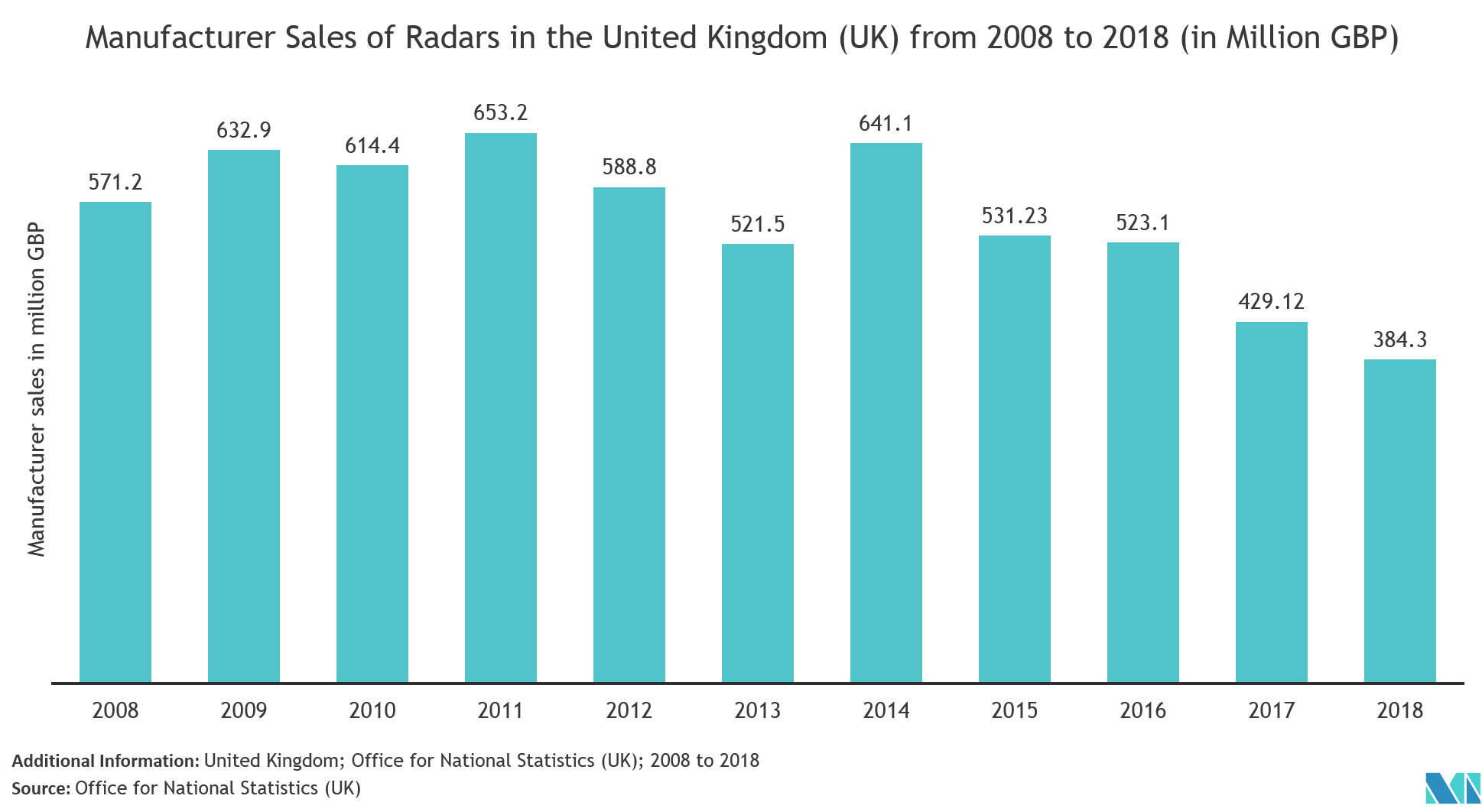

Growing Use of Radar Technology to Continue Dominating the Market

- The radar technology contains the highest market share in the collision sensors market, and it is supposed to command the market during the forecast period. The radar sensors technology is the most usable sensor technology in the collision avoidance system. The broad range, great precision and the exactness of radar sensors are encouraging its growth in numerous collision avoidance systems.

- The trending autonomous cars and the Unmanned Aerial Vehicles (UAVs) technologies led to the extraordinary adoption of radar and the sensors in their systems that connected to the growing requirement of these collision sensors globally.

- Moreover, innovations and the progressions in the automotive industries are anticipated to contribute substantial growth possibilities in the adoption of radar sensors technology which in turn is supposed to encourage the collision sensors market growth.

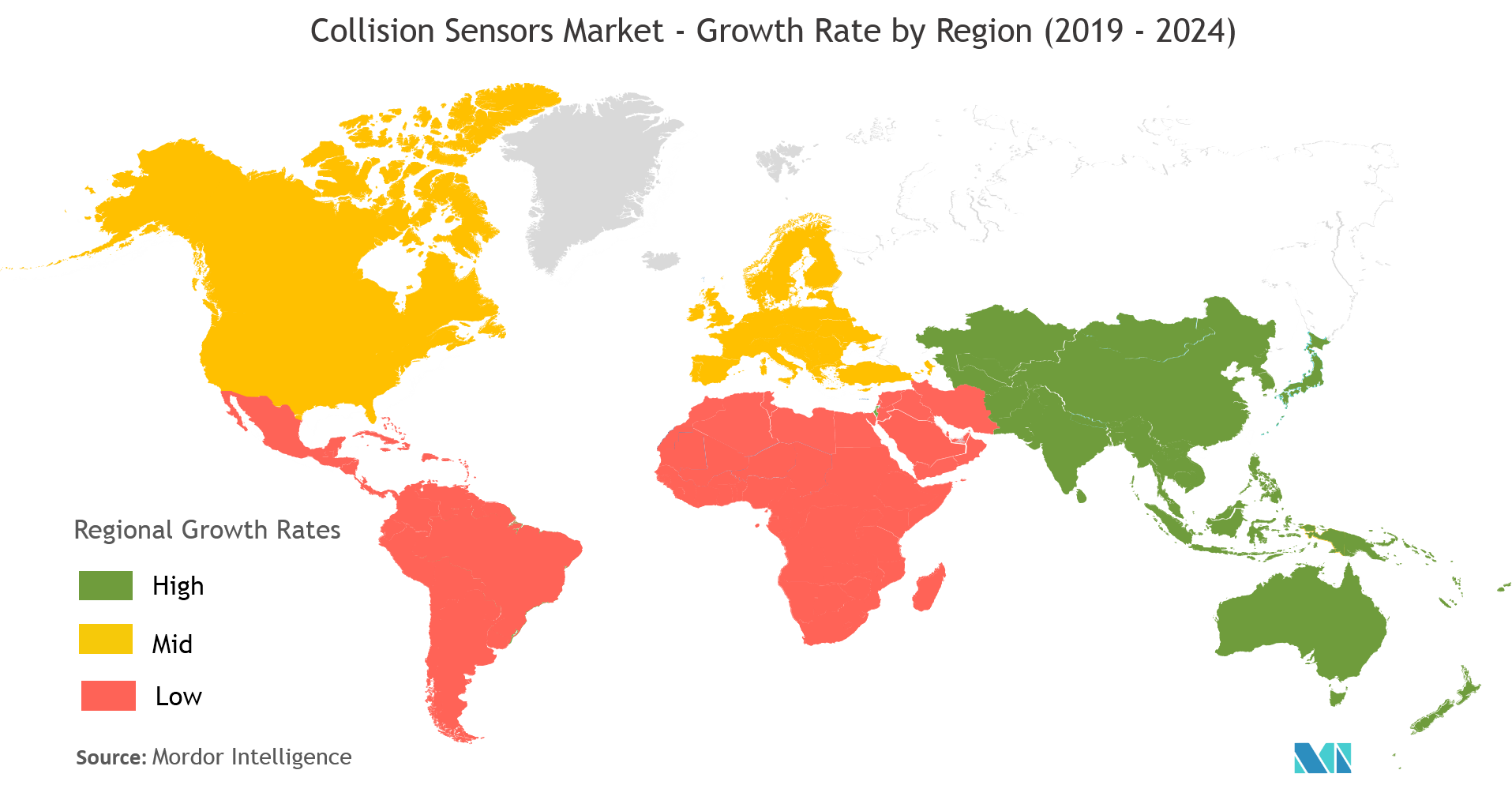

Asia Pacific to Hold a Substantial Market Share

- The Asia Pacific collision sensor market is expected to grow substantially, owing to the rapid use of cars in developing economies of India and China. Rapid urbanization and government policies support the country’s growing car usage. Japan’s extensive network of automated rails throughout the country can be credited to its concept of a decentralized transportation system is also fueling market growth. The presence of major manufacturers in this region including are Aisin Seiki Co. Ltd., Denso and others are contributing to the growth of the anti-collision sensors market in the Asia Pacific.

- Furthermore, increasing the spending capacity of the people in this region, increasing focus on road safety and rules, and development in the automotive technologies are also driving the growth of the collision sensors market in this region. Moreover, the expansion of global technology leaders in this region along with increasing awareness of vehicle safety features and technological advancements in the automotive industry in this region is the primary factor attributed to this huge market share of this region.

Collision Sensors Industry Overview

The global collision sensors market is moderately fragmented because of the presence of numerous majorvendors. However, the market still attracts a number of new playerswhich is an indication of the great potential this market exhibits. The important vendorsoperating in the collision sensors market include Continental AG, Robert Bosch GmbH, NXP Semiconductor, TRW Automotive, Texas Instruments, Denso Corporation,Aisin Seiki Co, Autoliv AB, and Delphi Automotive.

- November2019 -Continental and Pyrolyx entered into a joint development commitment aimed to lay the foundation for using recovered carbon black (rCB) in various tire segments during tire production.

Collision Sensors Market Leaders

-

Continental AG

-

NXP Semiconductors N.V.

-

Delphi Automotive LLP

-

Infineon Technologies AG

-

Murata Manufacturing Co., Ltd.

*Disclaimer: Major Players sorted in no particular order

Collision Sensors Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Rising Awareness about Vehicle Security

- 4.3.2 Technological AdvancementS and Development in Sensors

- 4.3.3 Rising Adoption of Collision Sensors in Military and Defense Sectors

-

4.4 Market Restraints

- 4.4.1 Increased Price of the Technology

- 4.4.2 Less Use of These Sensors in Low Priced Car

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Application

- 5.1.1 Adaptive Cruise Control

- 5.1.2 Forward Collision Warning System

- 5.1.3 Blind Spot Monitor

- 5.1.4 Lane Departure Warning System

- 5.1.5 Parking Sensor

- 5.1.6 Other Applications

-

5.2 By Technology

- 5.2.1 Ultrasonic

- 5.2.2 Radar

- 5.2.3 Camera

- 5.2.4 LiDar

-

5.3 By End-User

- 5.3.1 Automobile

- 5.3.2 Aerospace & Defense

- 5.3.3 Maritime

- 5.3.4 Rail

- 5.3.5 Other End-users

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Rest of the World

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Continental AG

- 6.1.2 NXP Semiconductors N.V.

- 6.1.3 Delphi Automotive LLP

- 6.1.4 Infineon Technologies AG

- 6.1.5 Murata Manufacturing Co., Ltd.

- 6.1.6 Denso Corporation

- 6.1.7 Robert Bosch GmbH

- 6.1.8 ZF Friedrichshafen AG

- 6.1.9 Texas Instruments Incorporated

- 6.1.10 Aisin Seiki Co., Ltd.

- 6.1.11 Autoliv Inc.

- 6.1.12 Analog Devices, Inc.

- 6.1.13 General Electric Company

- 6.1.14 Rockwell Collins Inc.

- 6.1.15 Honeywell International Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityCollision Sensors Industry Segmentation

Collision sensors are placed within a car which provides a warning to the driver if there are any dangers that lie ahead on the road. These sensors include how close the car is to other cars, how much its speed needs to be reduced when obstacles closer to the car, how close the car going off the road, and the system consists of audio warning to prompt the driver, initiates braking if the driver fails to respond to the warning.

| By Application | Adaptive Cruise Control | |

| Forward Collision Warning System | ||

| Blind Spot Monitor | ||

| Lane Departure Warning System | ||

| Parking Sensor | ||

| Other Applications | ||

| By Technology | Ultrasonic | |

| Radar | ||

| Camera | ||

| LiDar | ||

| By End-User | Automobile | |

| Aerospace & Defense | ||

| Maritime | ||

| Rail | ||

| Other End-users | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World |

Collision Sensors Market Research FAQs

What is the current Collision Sensors Market size?

The Collision Sensors Market is projected to register a CAGR of 22.70% during the forecast period (2024-2029)

Who are the key players in Collision Sensors Market?

Continental AG, NXP Semiconductors N.V., Delphi Automotive LLP, Infineon Technologies AG and Murata Manufacturing Co., Ltd. are the major companies operating in the Collision Sensors Market.

Which is the fastest growing region in Collision Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Collision Sensors Market?

In 2024, the Asia Pacific accounts for the largest market share in Collision Sensors Market.

What years does this Collision Sensors Market cover?

The report covers the Collision Sensors Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Collision Sensors Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Collision Sensors Industry Report

Statistics for the 2024 Collision Sensors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Collision Sensors analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.