Israel Commercial Real Estate Market Size

| Study Period | 2020 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2020 - 2022 |

| CAGR | 6.12 % |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Israel Commercial Real Estate Market Analysis

The demand for real estate sector in Israel remains relatively stable and was growing at a decent pace during the historic period of 2015-2018. According to the data by Israel’s Central Bureau of Statistics of Israel, the construction area for commercial properties involving varied business services had maximum approval compared to hotels. Israel REITs – REITs are yet to make an impact on the commercial space demand, unlike that in residential area.

- In the industrial segment, hi-tech and biotech industries areexpanding at a rapid rate every year.

- Israel is second only to the US Silicon Valley in the hi-tech sector, and has the largest number of NASDAQ-listed companies outsideNorth America.

- Israel is considered to be the leader of the world's high tech developments, with the presence of multiple hi-tech companies that excel in computer technologies, semiconductors, and communications.

- Retail real estate segment registered a moderate NOI growth of about 0.5-1% lower than that of previous years, owing to the rise in the ecommerce sales shifting from the traditional brick and mortar set ups.

Israel Commercial Real Estate Market Trends

This section covers the major market trends shaping the Israel Commercial Real Estate Market according to our research experts:

Shortage of Building Land and Labor Availability

- The current major problems of the industry are shortage of building land, the shortage of labor, and the regulatory regime under which the industry operates. However, the problem regarding shortage of land has somewhat abated.

- Most of the land marketed by the Israel Land Authority is for target price projects. The Finance Ministry now allows entrepreneurs who have won the land tenders to use 60% of the land for target price projects (that is for young couples or for families who do not own a home).

- The remaining 40% of the land can be used to build houses for the general public. This has greatly improved the problem of land scarcity in the country. The next big problem is the shortage of construction workers. That is one of the major reasons for the rise in the production costs, which has risen greatly in the past five years.

- This problem will be alleviated by the agreement with China, which will bring in Chinese construction workers. Although the Palestinian construction workers are very well trained, there is a problem with their work timings, despite their excellent work.

- The shortage of land and workers poses a problem for the developers and the government alike. In order to solve the problem of housing shortage and rising prices, they must make land available and make sure that there is sufficient work force for the current needs.

- The current accumulated shortage of housing is 149,000. Since 2000, housing starts have usually been less than the annual creation of households.

- Construction of nearly 58,000 houses was completed in 2016 and during the past five years, the annual average numbered to 54,000 houses. In 2016, housing starts were 53,300. The average annual housing starts during the past five years was 48,840.

Property Investment in Israel is Evolving to Offer Ample and Flexible Opportunities

- Investing in various types of commercial properties and/or private residential projects is a practice, which is emerging as an increasingly viable alternative. The market is evolving to broaden its offering and cater to the foreign investors’ needs.

- Financial experts, global asset managers, and government representatives say the property market is a solid and attractive alternative to others.

- This is mainly due to the fact that despite the mounting anticipation of a drop in Israeli real estate prices, property prices remain impervious and continue to rise year over year.

- This is further compounded by the fact that, in the face of indications that Israel's economy is slowing down, the slower 3.2% growth rate expected this year, is still a faster pace than most economies in the United States or Europe.

- Looking beyond the financial aspects of this type of transaction, there are many emotional aspects that are driving foreign investments in real estate in Israel, namely Zionism and the rising anti-Semitism in the world.

Israel Commercial Real Estate Industry Overview

The report covers major international players operating in the Israeli commercial real estate market. In terms of market share, few of the major players currently dominate the market.

However, with technological advancement and product innovation, medium-sized to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

Israel Commercial Real Estate Market Leaders

-

Azrieli Group Ltd

-

Ashtrom Group Ltd

-

Gazit-Globe Ltd

-

Amot Investments Ltd

-

Melisron Ltd

*Disclaimer: Major Players sorted in no particular order

Israel Commercial Real Estate Market Report - Table of Contents

1. INTRODUCTION

2. EXECUTIVE SUMMARY

3. SCOPE OF THE STUDY

4. RESEARCH METHODOLOGY

5. MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Drivers

- 5.3 Restraints

- 5.4 Opportunities

- 5.5 Technological Innovations

- 5.6 PESTLE Analysis

- 5.7 Industry Policies and Government Regulations

- 5.8 Insights on Existing and Upcoming Projects in Israel

-

5.9 Industry Attractiveness - Porter's Five Forces Analysis

- 5.9.1 Threat of New Entrants

- 5.9.2 Bargaining Power of Buyers/Consumers

- 5.9.3 Bargaining Power of Suppliers

- 5.9.4 Threat of Substitute Products

- 5.9.5 Intensity of Competitive Rivalry

6. MARKET SEGMENTATION

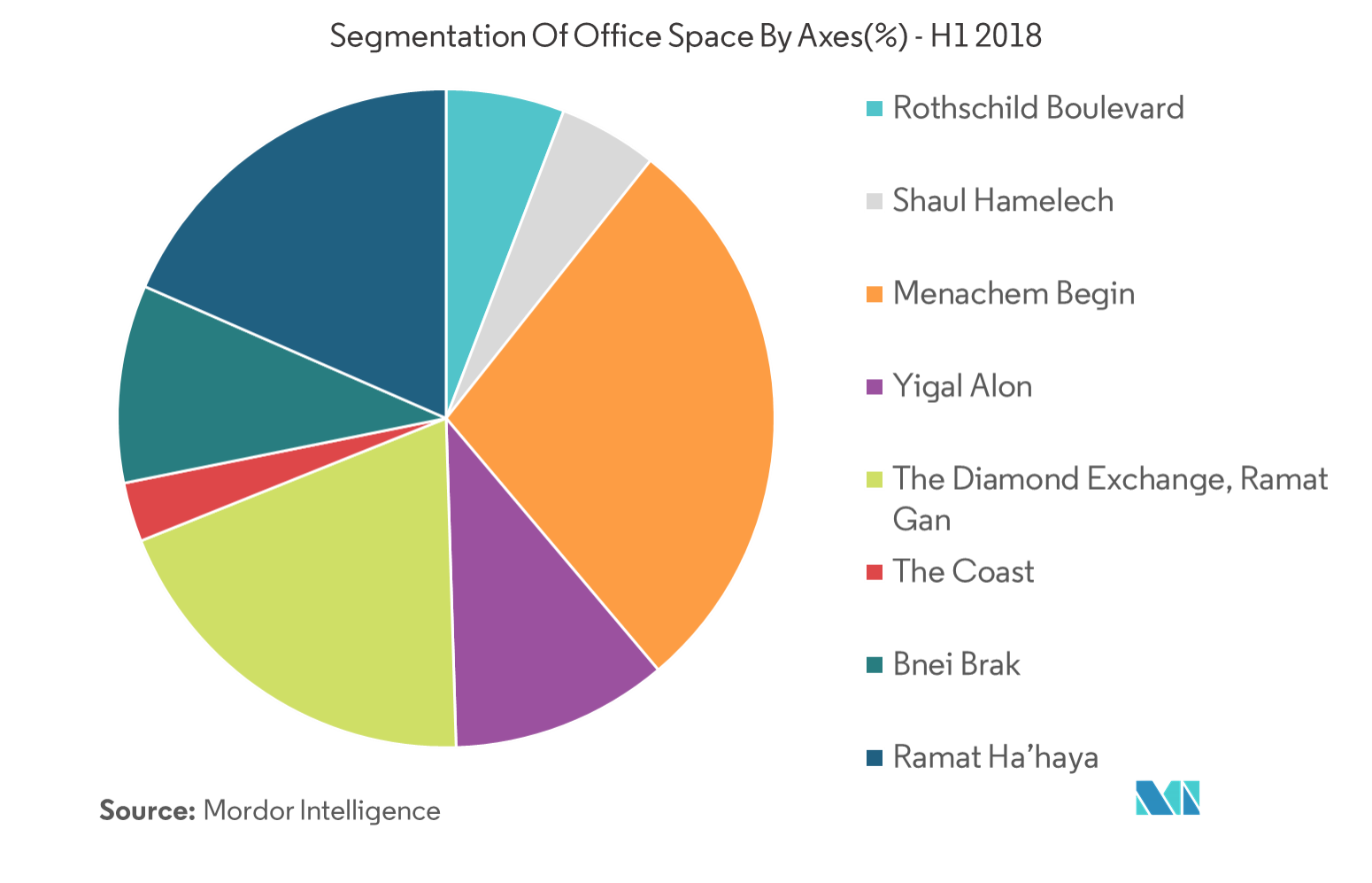

- 6.1 Offices

- 6.2 Industrial

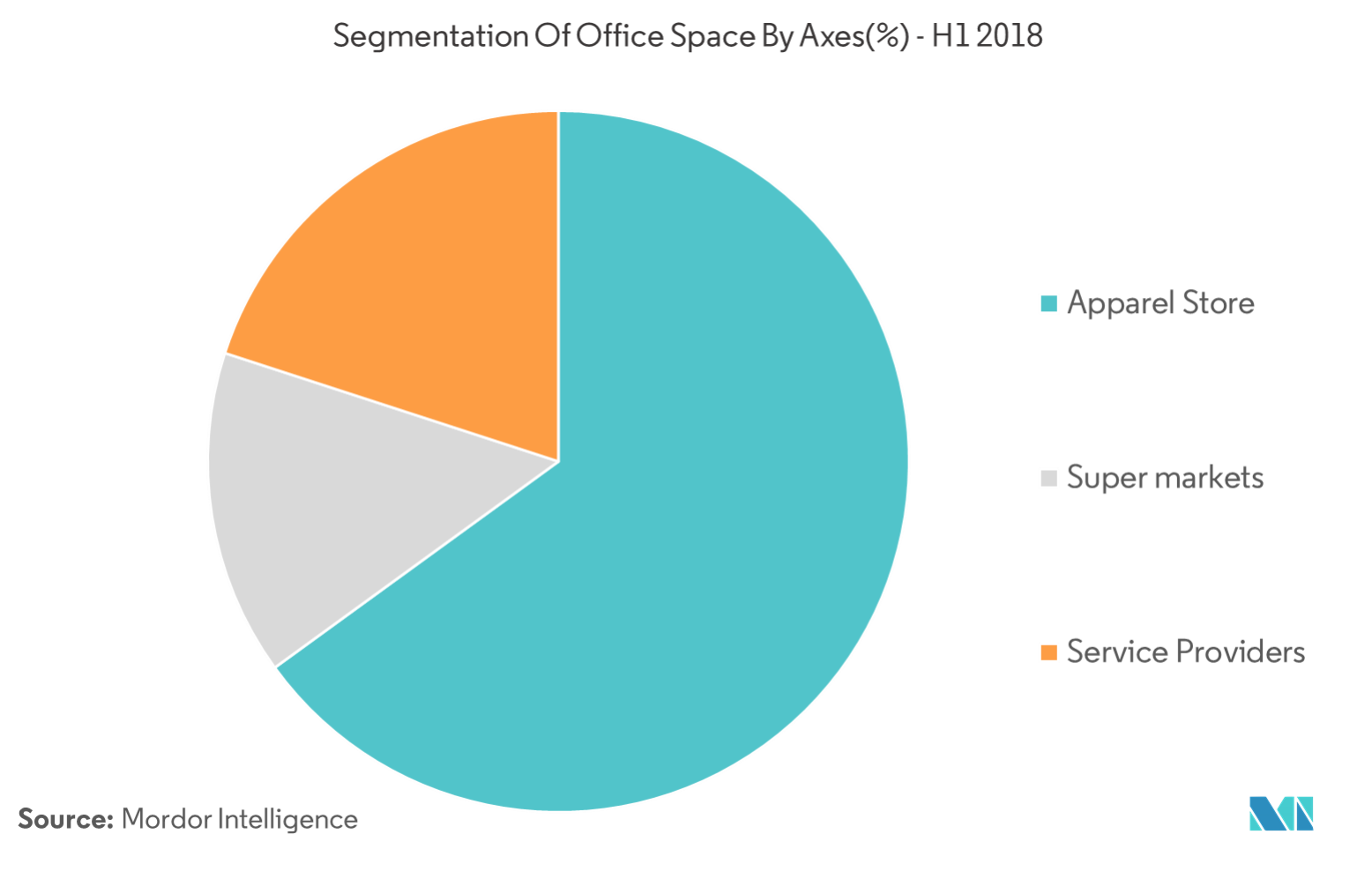

- 6.3 Retail

- 6.4 Hotels

- 6.5 Other Property Types

7. INVESTMENT ANALYSIS

- 7.1 Private Equity in Real Estate

- 7.2 FDI in Real Estate

8. COMPANY PROFILES

- 8.1 Arko Holdings Ltd

- 8.2 Ashtrom Group Ltd

- 8.3 Gazit-Globe Ltd

- 8.4 Azrieli Group Ltd

- 8.5 Melisron Ltd

- 8.6 Elbit Imaging Ltd

9. MARKET OPPORTUNITIES AND FUTURE TRENDS

10. APPENDIX

** Subject To AvailablityIsrael Commercial Real Estate Industry Segmentation

A complete background analysis of Israeli commercial real estate market, which includes an assessment of the parental market, emerging trends by segments and regional markets, significant changes in market dynamics, and market overview is covered in the report

Office

Industrial

By Property Type Retail

Hotels

Other Property Types

Israel Commercial Real Estate Market Research FAQs

What is the current Israel Commercial Real Estate Market size?

The Israel Commercial Real Estate Market is projected to register a CAGR of 6.12% during the forecast period (2024-2029)

Who are the key players in Israel Commercial Real Estate Market?

Azrieli Group Ltd, Ashtrom Group Ltd, Gazit-Globe Ltd, Amot Investments Ltd and Melisron Ltd are the major companies operating in the Israel Commercial Real Estate Market.

What years does this Israel Commercial Real Estate Market cover?

The report covers the Israel Commercial Real Estate Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Israel Commercial Real Estate Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Commercial Real Estate in Israel Industry Report

Statistics for the 2024 Commercial Real Estate in Israel market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Commercial Real Estate in Israel analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.