Communication Test Equipment Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 6.70 % |

| Fastest Growing Market | North America |

| Largest Market | Asia Pacific |

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Communication Test Equipment Market Analysis

Communication test equipment (CTE) market is expected to register a CAGR of 6.7 over the forecast period(2021 - 2026).

- The growing volumes of data is one of the significant factors contributing to the growth of the CTE market. This is evident the mobile data traffic per smartphone per month expected to grow at a CAGR of 14% from 6.8 GB (gigabyte) in 2018 to 15 GB in 2024 according to Ericcson.

- Through extensive research and development, the players in the industry have been able to further the technology. These developments are expected to contribute to the growth of the market over the forecast period.

- For instance, GW Instek introduced its C-1200 Multi-Channel LoRa Tester for Transmitter and Receiver Tests. In terms of LoRa Transmitter, C-1200 provides tests including spectrum analysis, time domain, FEI (Frequency Error Indicator), and TOA (Time-On-Air) while LoRa Receiver, tests provide PER (Packet Error Rate), sensitivity, and. BER (Bit Error Rate).

- The increasing investments in the aerospace and defense systems by the governments and the related regulated authorities to provide support and upgrades for the pre-existing equipment and machinery is expected to provide a boost to the CTE market over the forecast period.

- In September 2019, According to the Pentagon Huntington Ingalls Industries was awarded a USD 30.8 million contract to provide modernization and procurement of material, equipment, spares, repair parts, and test equipment for operational nuclear-powered aircraft carriers; command, control, communications, computers, intelligence, surveillance and reconnaissance upgrades amongst others.

Communication Test Equipment Market Trends

This section covers the major market trends shaping the Communication Test Equipment Market according to our research experts:

Telecommunications is Expected to witness a Significant Growth

- The increasing initiatives by the government and the related regulatory bodies in order to beef up preparedness for the upcoming technologies and security that allow them to provide a better experience is expected to fuel the CTE market growth over the forecast period.

- For instance, The Department of Telecommunications (DoT) has demanded mandatory testing and certification from the local authorized agencies for telecom equipment imported or sold in India.

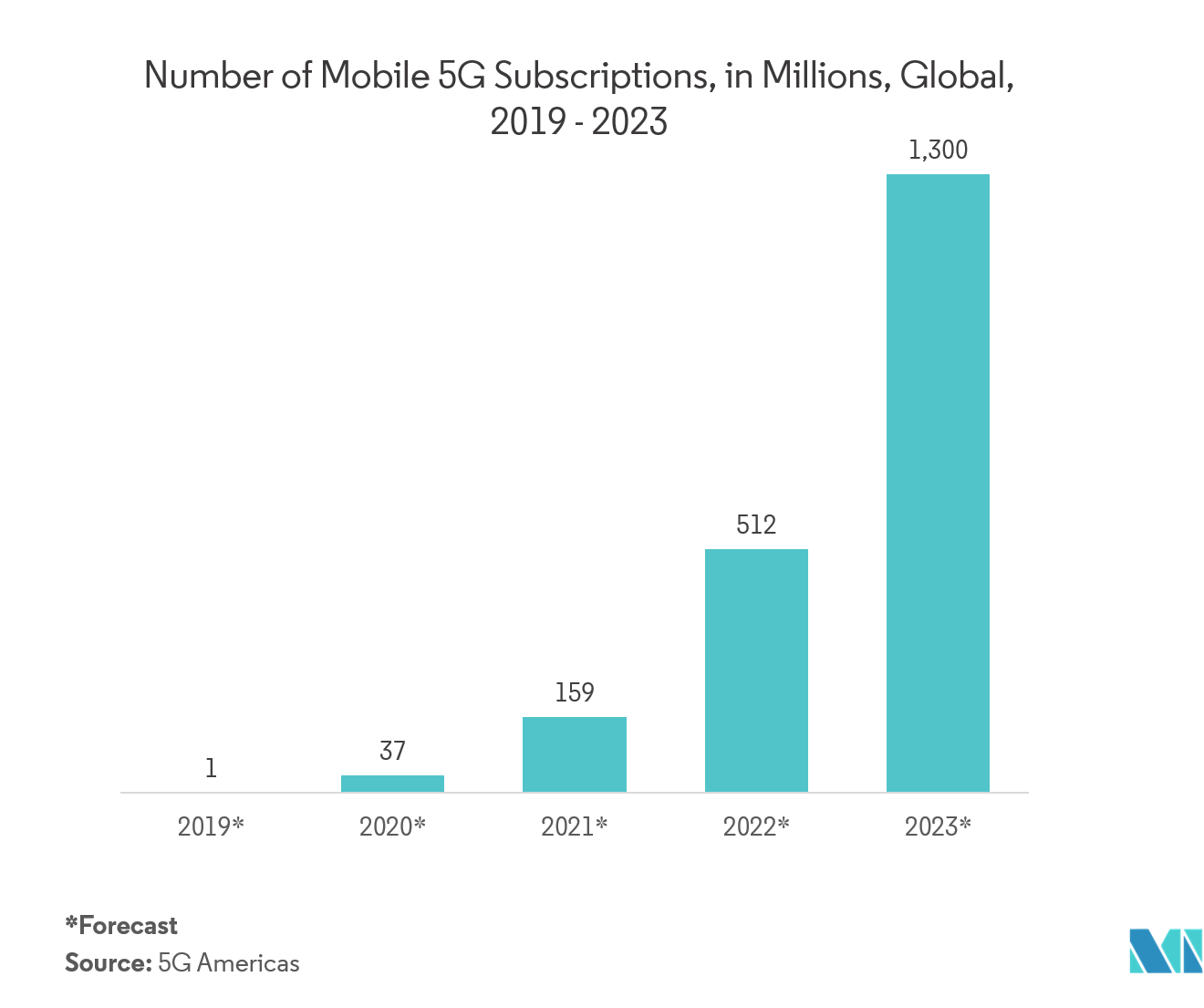

- 5G is expected to unleash a massive IoT ecosystem that would allow networks to serve for billions of connected devices making it essential for the providers to have CTEs that would enable them to provide smooth and uninterrupted connectivity. According to Ericsson's Mobility Report of June 2019, More than 10 million 5G subscriptions are projected worldwide by the end of 2019. This in itself is indicative of the fact that there lies a lucrative opportunity for the communications test equipment providers which could boost the market over the forecast period.

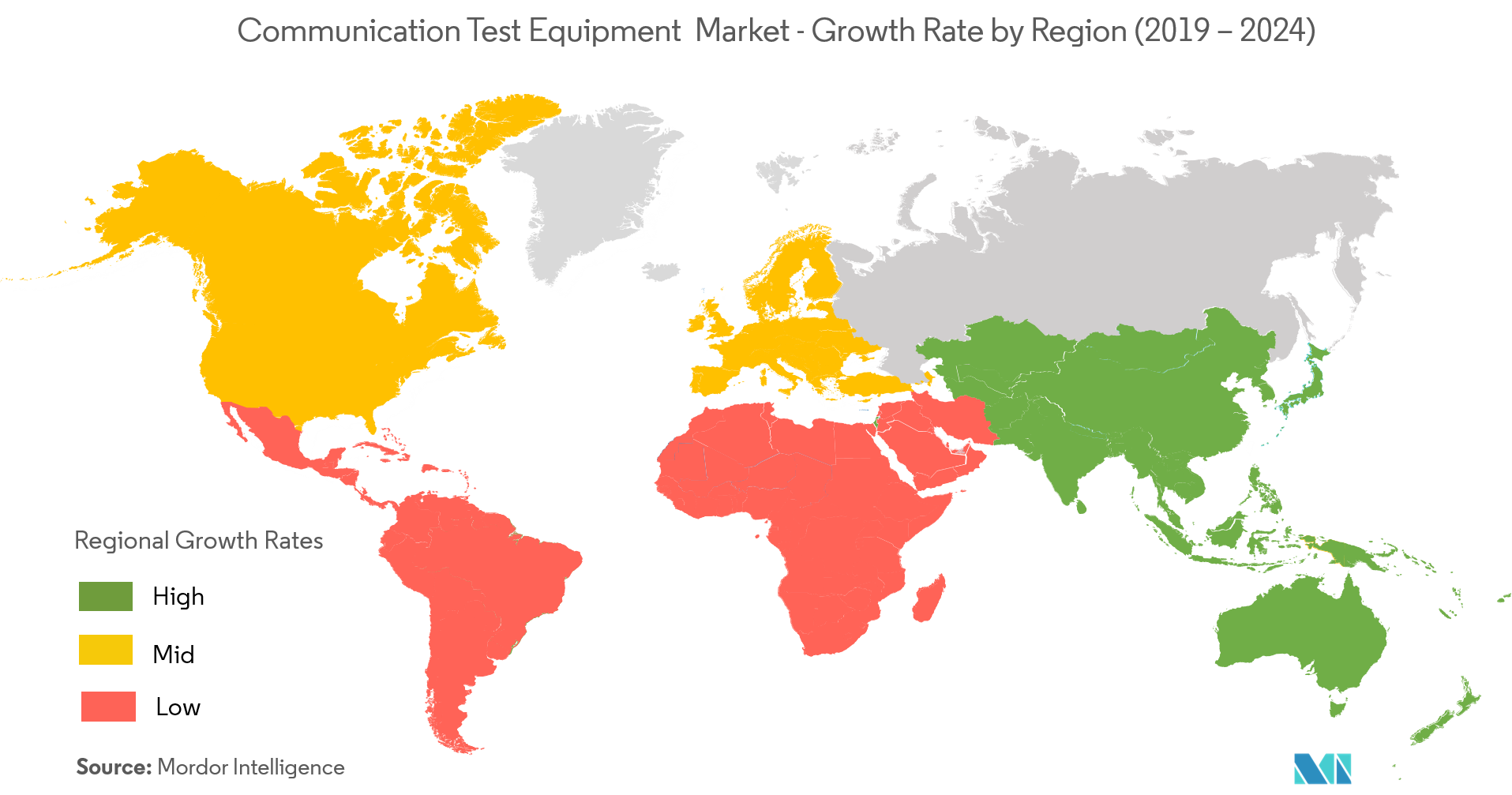

North America is Expected to Hold Significant Share

- North America is expected to dominate the market over the forecast period, owing to the presence of some major players in the region such as Texas Instruments Incorporated, Exfo Inc. amongst others.others coupled with the extensive research and development activities that have resulted in the wide-scale adoption of the communication test equipment market in the region.

- The government is increasingly investing in the aerospace and defense sector to upgrade the pre-existing infrastructure that allows them to gain an edge over the potential threats and allows them to be ready for the future.

- For instance, in September 2019, KBR announced that it was awarded two contract modifications totaling almost USD 40 million to upgrade remote tracking stations in the Air Force Satellite Control Network (AFSCN). This is expected to boost the adoption of the CTE market over the forecast period.

- Also, the region is one of the pioneers in the roll out of 5G is expected to witness a surge in the 5G subscriptions over the forecast period thereby propelling the vendors in the 5G market to possess communication test equipment that allows them to better serve their consumers.

- According to the Ericcson's Mobility Report of June 2019, the region is expected to hold close to 270 million 5G subscriptions accounting for more than 60 percent of mobile subscriptions.

Communication Test Equipment Industry Overview

The competitive rivalry amongst the players in the communications test equipment market is high owing to the presence of some key players such as Exfo. Spirent, Texas instruments, amongst others. The research & development activities conducted by the players to innovate their offerings has allowed them to gaina competitive advantage over others. These players have been able to gain a stronger foothold in the market by entering into strategic partnerships, mergers & acquisitions.

- September 2019 -Anritsu announced the launch ofits popular Radio Communication Test Station MT8000A with upgraded 5G Protocol Test functions.Previously, an external 5G RF fading simulator was required which is now used asn internal fader in the MT8000A, supporting either 2CC 4x4 MIMO tests with one MT8000A unitor 8CC 2x2 MIMO tests with two units.

Communication Test Equipment Market Leaders

-

EXFO Inc.

-

Spirent Communications Inc.

-

Texas Instruments Incorporated

-

Anritsu A/S

-

Rohde & Schwarz GmbH & Co KG

*Disclaimer: Major Players sorted in no particular order

Communication Test Equipment Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

-

4.3 Market Drivers

- 4.3.1 Increasing Investments in the Telecommunication Sector

- 4.3.2 The Advent of Technologies Such as AI, Big Data, IOT

-

4.4 Market Restraints

- 4.4.1 Interoperability Issues to Hinder the Market Growth

- 4.5 Industry Value Chain Analysis

5. MARKET SEGMENTATION

-

5.1 End-user Industry

- 5.1.1 Telecommunication

- 5.1.2 Avionics & Defense

- 5.1.3 Automotive

- 5.1.4 Other End-user Industries

-

5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Rest of the World

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Analog Devices, Inc.

- 6.1.2 JM Test Systems Inc

- 6.1.3 Megger Group Ltd

- 6.1.4 Rohde & Schwarz GmbH & Co KG

- 6.1.5 Texas Instruments Incorporated

- 6.1.6 Aplab Limited

- 6.1.7 EXFO Inc.

- 6.1.8 Spirent Communications Inc.

- 6.1.9 Anritsu A/S

- 6.1.10 TESSCO Inc

- 6.1.11 Good Will Instrument Co.,

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityCommunication Test Equipment Industry Segmentation

Communication Test Equipment (CTE) enables the userto test thedevices to ensure compliance with multiple standards and ensure smooth and efficient connectivity and efficiency. This report segments the byEnd-User Vertical (Avionics & Defense, Telecommunication, Automotive), and Geography.

| End-user Industry | Telecommunication |

| Avionics & Defense | |

| Automotive | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| Rest of the World |

Communication Test Equipment Market Research FAQs

What is the current Communication Test Equipment (CTE) Market size?

The Communication Test Equipment (CTE) Market is projected to register a CAGR of 6.70% during the forecast period (2024-2029)

Who are the key players in Communication Test Equipment (CTE) Market?

EXFO Inc., Spirent Communications Inc., Texas Instruments Incorporated, Anritsu A/S and Rohde & Schwarz GmbH & Co KG are the major companies operating in the Communication Test Equipment (CTE) Market.

Which is the fastest growing region in Communication Test Equipment (CTE) Market?

North America is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Communication Test Equipment (CTE) Market?

In 2024, the Asia Pacific accounts for the largest market share in Communication Test Equipment (CTE) Market.

What years does this Communication Test Equipment (CTE) Market cover?

The report covers the Communication Test Equipment (CTE) Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Communication Test Equipment (CTE) Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Communication Test Equipment (CTE) Industry Report

Statistics for the 2024 Communication Test Equipment (CTE) market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Communication Test Equipment (CTE) analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.