Construction Machinery Tires Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 5.00 % |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Construction Machinery Tires Market Analysis

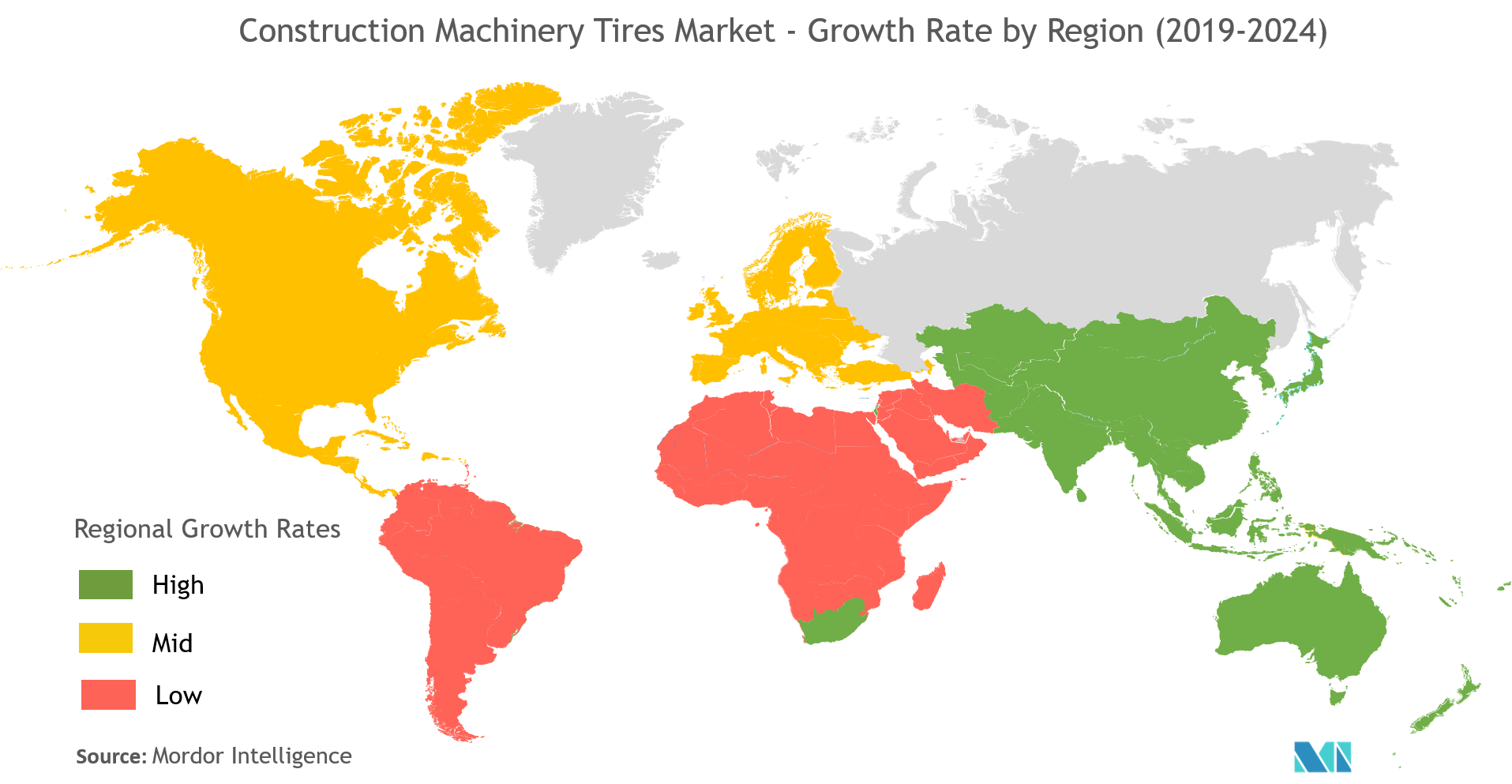

The construction machinery tires market is expected to register a CAGR of more than 5%, during the forecast period, 2019-2024.

- Increased focus on infrastructureand automation in the construction and manufacturing processes showed a great impact on the construction machinery demand over the past two years (2017-2018), globally.

- The improving economy and increasing construction activities across developing countries, like India andSouth Africa, etc., are likely to drive a potential demand for construction machinery, and in turn, anticipateto propel a considerable demand for off-the-road tires, majorly from the aftermarket segment (that includes rental companies and individual machine owners), during the forecast period.

- The demand for tire retreads has been increasing for these vehicles, as fleet managers/operators continue to leverage retread programs to reduce the operating costs. Retreading saved the heavy commercial vehicle segment to a significant extent, as it is significantly cheaper than a tire replacement. The major players in the market are Michelin, Bridgestone, etc.

Construction Machinery Tires Market Trends

This section covers the major market trends shaping the Construction Machinery Tires Market according to our research experts:

Excavators – Witnessing High Demand in Earth Moving Machinery Type

Excavators are typical of two types, namely wheeled excavators and crawler excavators. Among them, crawler excavators covered a major share of more than 50% of the global excavator market in 2018.

- As most of the rental companies purchased a low-cost crawler excavator over high-cost wheeled excavators because former equipment offered high stability during digging operations on rough or uneven terrains, when compared to that of wheeled excavators.

However, the operating cost of wheeled excavators have been less, when compared to that of crawler excavators, as worn out of crawler’s undercarriages and replacing or refurbishing it is an expensive and time-consuming task. Thus, some regions have started adopted usage of wheeled excavators in the construction projects majorly since 2010.

- Europe ranks top in the usage of wheeled excavators, when compared to the United States. As most of the work done in Europe takes place in urbanized areas, while in the United States, work projects included majorly clearing land and digging.

- While in Asia-Pacific and Middle East & Africa, the usage of excavators has been covering more than 55% of the total construction machinery demand during 2015-2017. In the above regions, the majority of the excavators used were crawler-type and very few operations in construction job site preferred wheeled excavators, especially compact wheeled excavators.

With growing infrastructure developments, across the world, the need for excavators identified in almost every construction project. Thus, many rental companies across the world continuously invest in purchasing new excavators to keep the average age of its excavator fleet at a potential of two to three years, to capture the customers' demand, who are looking for advanced and efficient excavators.

- For instance, Theisen Baumaschinen Mietpark GmbH & Co. KG, one of the leading construction equipment rental companies in Germany, had recently purchased 32 new wheeled (12 units) and crawler excavators (20 units) from Doosan in 2018, to strengthen its rental equipment fleet for regional Theisen centers across Germany and also in Vienna, in Austria.

Developing Economies Expected to Lead the Global Market

The global construction industry is expected to witness significant growth in the coming years, with good opportunities in the infrastructure, residential, and non-residential sectors. Some of the major factors driving the market are increasing construction of multi-family houses (with the growing trend of nuclear families); and increasing investments in the construction of roads, highways, smart cities, metros, bridges, and expressways, due to growing population and urbanization.

The Asia-Pacific region is expected to be a major market propelling the global construction industry, with augmenting construction activities in countries, such as India and ASEAN countries (including Thailand, Singapore, Vietnam, and others). For instance, in India, the construction sector is one of the booming industries. The construction sector in the country is expected to grow twice as fast as China’s until 2030, with the country’s populations. The infrastructure sector is an important pillar for the growth of the Indian economy. The government is taking various initiatives to ensure time-bound creation of excellent infrastructure in the country. For instance –

- The Indian government has announced a target of USD 376.5 billion investment in infrastructure over a period of three years, including USD 120.5 billion for developing 27 industrial clusters and USD 75.3 billion for road, railway, and port connectivity projects. Indian roadways are the second-largest in the world. Owing to the increasing number of vehicles and traffic, the government is planning to further extend the roadways in the coming years.

- Growing investments in the infrastructure sector and other strategic initiatives of the government are expected to boost the construction sector in the country, in turn , propelling the demand for construction machinery tires from the aftermarket sector.

Apart from Asia-Pacific region, in Rest of the World, South Africa is also expected to witness high demand for construction tires, especially from the aftermarket sector.

In South Africa, owing to bad economic conditions and decreasing rand exchange rate have been significantly impacting the construction industry in South Africa over a decade. The demand for compact construction equipment rental has been continuously increasing in the country, owing to its low rental price, as well as the capability to handle construction activities in the country. Thus, most of the rental equipment companies are planning to expand their rental fleet in compact equipment. Thus, renting an equipment has been a greater preference by most of the construction contractors in the country. Such growing initiatives in the construction industry in South Africa is likely to propel construction machinery rental companies to expand their fleet size and maintain a timely servicing of their existing machinery, which, in turn, may drive a potential demand for the tires from aftermarket consumers, during the forecast period.

Construction Machinery Tires Industry Overview

Some of the major players dominating the market are Bridgestone Corp., Trelleborg AB, Continental Tires, Sumitomo Rubber Industries Ltd, Goodyear Tire & Rubber Company, and Michelin.

Construction Machinery Tires Market Leaders

-

Bridgestone Corp.

-

Trelleborg AB

-

Continental Tires

-

Michelin

*Disclaimer: Major Players sorted in no particular order

Construction Machinery Tires Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

-

4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Tire Type

- 5.1.1 Radial Tire

- 5.1.2 Bias Tire

-

5.2 By Construction Machinery Type

- 5.2.1 Earth Moving Machinery

- 5.2.1.1 Backhoe

- 5.2.1.2 Loaders

- 5.2.1.3 Excavators

- 5.2.1.4 Other Earth Moving Machinery

- 5.2.2 Material Handling

- 5.2.2.1 Cranes

- 5.2.2.2 Dump Trucks

-

5.3 By Sales Channel Type

- 5.3.1 OEMs

- 5.3.2 Aftermarket

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 South Africa

- 5.4.4.3 Other Countries

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

-

6.2 Company Profiles

- 6.2.1 Bridgestone Corporation

- 6.2.2 Continental Tires

- 6.2.3 Hankook Tire

- 6.2.4 Michelin

- 6.2.5 Sumitomo Rubber Industries Ltd

- 6.2.6 Goodyear Tire & Rubber Company

- 6.2.7 Alliance Tire Company Ltd

- 6.2.8 Trelleborg AB

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityConstruction Machinery Tires Industry Segmentation

The construction machinery tires market has been segmented by tire type, construction machinery type, sales channel type, and geography.

| By Tire Type | Radial Tire | |

| Bias Tire | ||

| By Construction Machinery Type | Earth Moving Machinery | Backhoe |

| Loaders | ||

| Excavators | ||

| Other Earth Moving Machinery | ||

| By Construction Machinery Type | Material Handling | Cranes |

| Dump Trucks | ||

| By Sales Channel Type | OEMs | |

| Aftermarket | ||

| Geography | North America | United States |

| Canada | ||

| Rest of North America | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | Brazil |

| South Africa | ||

| Other Countries |

Construction Machinery Tires Market Research FAQs

What is the current Construction Machinery Tires Market size?

The Construction Machinery Tires Market is projected to register a CAGR of greater than 5% during the forecast period (2024-2029)

Who are the key players in Construction Machinery Tires Market?

Bridgestone Corp., Trelleborg AB, Continental Tires and Michelin are the major companies operating in the Construction Machinery Tires Market.

What years does this Construction Machinery Tires Market cover?

The report covers the Construction Machinery Tires Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Construction Machinery Tires Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Construction Machinery Tires Industry Report

Statistics for the 2024 Construction Machinery Tires market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Construction Machinery Tires analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.