Contract Cleaning Services Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 366.35 Billion |

| Market Size (2029) | USD 516.22 Billion |

| CAGR (2024 - 2029) | 7.10 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Contract Cleaning Services Market Analysis

The Contract Cleaning Services Market size is estimated at USD 366.35 billion in 2024, and is expected to reach USD 516.22 billion by 2029, growing at a CAGR of 7.10% during the forecast period (2024-2029).

Organizations are increasingly focusing on creating a healthier work environment for employees to enhance their productivity. The adoption of contract cleaning services helps organizations adopt a holistic approach in keeping their offices cleaner, healthier, and greener.

- Increasing awareness about workplace wellness and sustainability is one of the primary factors driving the demand for contract cleaning services. Many companies are increasingly outsourcing their cleaning services due to their various advantages, such as ease of management and cost-effectiveness.

- From adopting fundamental cleaning tools to sophisticated tools and technologies, the market has evolved with technology, thus impacting the market's growth and bringing a notable improvement in cleaning efficiency. Implementing tools like low-noise vacuum cleaners, steam cleaners, and high-quality cleaning agents and supplies resulted in efficient and better-quality services.

- Commercial and industrial establishments are the ones who typically use cleaning services, which include floor, upholstery, carpet, and window cleaning, to keep the space hygienic. For the purpose of obtaining cleaning services, business organizations, particularly large businesses, enter into contracts with the service providers. Service providers determine the cost based on the type of service users and the frequency of services required, which may be daily, once a week, once a month, semiannually, or annually.

- The increasing awareness of green cleaning products is identified as one of the primary contract cleaning services market trends contributing to its growth. Chemicals such as carcinogens and allergens present in cleaning products are harmful to individuals and the environment. Repeated exposure to these chemicals is also linked to symptoms ranging from headaches, allergies, and rashes to decreased fertility or cancer. As per the American Association of Poison Control Centers, cleaning products are one of the major substance classes involved in reported toxic exposures. Thus, green cleaning processes are gaining popularity as they protect the environment and promote sustainability.

- The COVID-19 outbreak heightened the worries about workplace sanitation and hygiene. The need for hygiene procedures to ensure the safety of both staff and customers rose with the easing of lockdown restrictions and the gradual reopening of the economy. In order to contain and stop future epidemics, business organizations are increasing the frequency of premise sanitization. In addition, numerous national governments have established SOPs and guidelines to be followed by businesses to reduce the risk of subsequent waves of the COVID-19 pandemic. Commercial and industrial businesses are required to follow the rules outlined to protect the safety of their personnel and avoid legal repercussions.

Contract Cleaning Services Market Trends

This section covers the major market trends shaping the Contract Cleaning Services Market according to our research experts:

Commercial Cleaning is Expected to Hold a Significant Share

- The commercial sector mainly consists of office buildings, which make major investments in maintaining their facilities' cleanliness and sanitization. The segment holds a high share due to the rising number of commercial buildings after the recovery of the construction and real estate sector from a brief period of stagnation in the early half of this decade. In order to help their staff and management to concentrate on the main business operations, other commercial enterprises like healthcare/medical facilities, educational institutions, hotels and restaurants, and retail outlets typically prefer outsourcing the necessary cleaning operations. There was a growing need for sanitization and cleanliness during the COVID-19 pandemic, which may continue post the pandemic. Therefore, the business sector is expected to present many growth prospects for service providers even after the pandemic.

- Commercial sectors, such as office buildings, require consistent cleaning to maintain quality and upkeep. The demand for cleaning services in this sector is increasing due to the growing need for a clean and safe environment for employees. For instance, office desks contain more than 400 times the amount of germs as a bathroom toilet. These germs contribute to US workers taking an average of seven sick days per year. This problem can be solved by implementing an office cleaning service program that can avoid germs from spreading.

- As the number of offices, stores, and other commercial enterprises is increasing, the cost of in-house cleaning services is alss rising, thus burdening the operating overheads. For instance, according to the US Census Bureau, the total value of US commercial construction in November 2022 was USD 120.66 billion, with 116.51 in private construction and USD 4.16 billion in public construction. Thus, the demand for outsourcing essential cleaning is expected to rise due to the growing office and commercial spaces.

- The commercial segment is likewise anticipated to increase strongly and consistently during the projected period. At such industrial production plants, contract service providers are hired to handle construction cleaning chores like oil spill cleanup and containment and waste and dust cleanup. Additionally, manufacturing facilities must regularly clean up after their restoration work. The market demand among residential end-users will also be driven by the rising level of disposable income and the growing propensity of the young population to outsource routine cleanup duties.

- In the United States, the Northeast area had the most office space under construction nationwide in the second quarter of the last year. At the time, approximately 30 million square feet of offices were being built in the Northeast. According to Colliers International, a diversified professional services and investment management organization with headquarters in Canada, the Midwest had the least amount of new office space under construction.

North America is Expected to Hold a Major Share

- North America is expected to hold a prominent share in the contract cleaning services market due to factors such as a rise in construction activities, changing consumer lifestyles, a growing number of working women, and the proliferation of advanced cleaning services offered by vendors. The rgion has a significant number of service providers, particularly in the United States. The majority of business enterprises have contracts with service providers to ensure a hygienic and sanitary atmosphere for their workers.

- For instance, Wegmans, a grocery store chain in the United States, contracted cleaning services from Cleaning Services Group Inc. for all its store locations in the country. The cleaning services help the company in keeping its construction sites clean as it constructs 4-5 new stores per year. It also helps the company maintain an environment free from dust and oil spills from construction equipment, thus improving the worksite's safety.

- In the United States, the market for commercial cleaning services remained sizable in the last year, and a sizable portion of the workforce continued to work in this sector. According to the Bureau of Labor Statistics, there were close to three million people employed in the US cleaning services sector in 2021.

- The US Bureau of Labor predicted that there will be more than 236,500 new janitorial jobs throughout the country by the end of the current year. Given a large number of Americans working in the US cleaning services industry, the market is anticipated to expand quickly.

- To keep consumers safe and reduce the likelihood of an infection or outbreak, strict COVID-19 laws in the United States and Canada were implemented, which require cleaning companies to be COVID-certified and continue offering sanitization and disinfection services. More and more cleaning businesses are providing specific COVID-19 cleaning and sanitization services to their clients. This factor may also contribute to the growth of the contract cleaning services market in North America.

Contract Cleaning Services Industry Overview

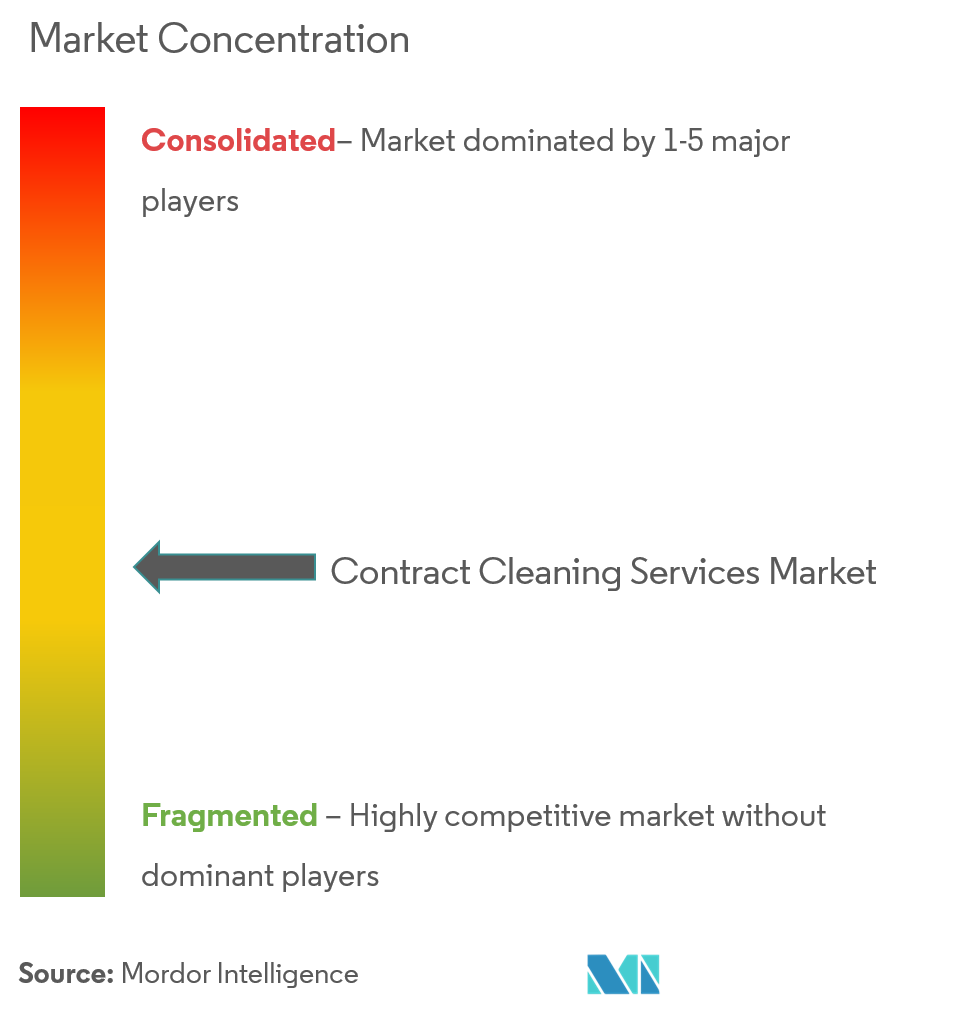

The contract cleaning services market is competitive and consists of several players, with many companies often vying for potential business or clients. Thus, companies in the market are continuously introducing new offerings, expanding their operations, or adopting strategic mergers and acquisitions as part of their competitive strategies. Some major market players are ABM Industries Incorporated, Jani-King International Inc., Anago Cleaning Systems Inc., and Sodexo Group.

- March 2022 - Trivest Partners and Three20 Capital Group are joint venture partners in Office Pride Commercial Cleaning Services. Office Pride, one of the commercial cleaning franchise systems in the United States with the quickest growth, announced its development goal to reach 300 units and USD 300 million in system sales. With more than 145 franchise locations, the Office Pride franchise network covers 25 states. Over the next five years, the network's growth is anticipated to be driven by acquisitions and the addition of new units.

Contract Cleaning Services Market Leaders

-

ABM Industries Incorporated

-

Jani-King International Inc.

-

ISS A/S

-

Anago Cleaning Systems Inc.

-

Sodexo Group

*Disclaimer: Major Players sorted in no particular order

Contract Cleaning Services Market News

- October 2022 - With a five-year deal, SBFM plans to provide a full range of commercial cleaning services to PureGym, the largest gym operator in the United Kingdom, at all its UK locations. The contract began on September 1, 2022, and SBFM and PureGym have their main offices in Leeds. With 1.7 million members spread across 525 clubs, primarily in the United Kingdom and Europe, PureGym's venues are usually open. The group recently revealed ambitions to increase the number of clubs in its portfolio by a factor of two, intending to have more than 1,000 clubs worldwide by 2030..

- July 2022 - A multi-year global partnership deal was reached between Gausium and Diversey-TASKI. This alliance aims to provide complete process and machine integration for customer sites worldwide, unlocking the full potential of cleaning robotics with cutting-edge cleaning knowledge, tools, and intelligence. The expectations for commercial hygiene and cleanliness are always rising. By deploying cutting-edge technology that symbolizes cleaning innovation, commercial facilities can meet and surpass those expectations due to such partnerships.

Contract Cleaning Services Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Increasing Hygienic Consciousness

-

4.3 Market Challenges

- 4.3.1 Intense Competition Among Small and Established Companies

-

4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technology Snapshot (Includes Different Types of Cleaning Services such as Floor and Fabric Cleaning Services, Exterior Cleaning Services, etc.)

5. MARKET SEGMENTATION

-

5.1 By End User

- 5.1.1 Residential

- 5.1.2 Commercial

- 5.1.3 Industrial

-

5.2 By Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 ABM Industries Incorporated

- 6.1.2 Anago Cleaning Systems Inc.

- 6.1.3 Duraclean International Inc.

- 6.1.4 Jani-King International Inc.

- 6.1.5 Pritchard Industries Inc.

- 6.1.6 ISS AS

- 6.1.7 Sodexo Group

- 6.1.8 Vanguard Cleaning Systems Inc.

- 6.1.9 Stanley Steemer International Inc.

- 6.1.10 The ServiceMaster Company LLC

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityContract Cleaning Services Industry Segmentation

A contract cleaning service is a co-effective cleaning solution for all types of clients. In this service, the customer receives cleaning services at their place of choice on a regular basis according to the contract agreed. Contract cleaning services are available for offices, factories, homes, schools, businesses, hospitals, etc.

Thecontract cleaning services market is segmented by end user (residential, commercial, and industrial) and geography (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa).

The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

| By End User | Residential |

| Commercial | |

| Industrial | |

| By Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East and Africa |

Contract Cleaning Services Market Research FAQs

How big is the Contract Cleaning Services Market?

The Contract Cleaning Services Market size is expected to reach USD 366.35 billion in 2024 and grow at a CAGR of 7.10% to reach USD 516.22 billion by 2029.

What is the current Contract Cleaning Services Market size?

In 2024, the Contract Cleaning Services Market size is expected to reach USD 366.35 billion.

Who are the key players in Contract Cleaning Services Market?

ABM Industries Incorporated, Jani-King International Inc., ISS A/S, Anago Cleaning Systems Inc. and Sodexo Group are the major companies operating in the Contract Cleaning Services Market.

Which is the fastest growing region in Contract Cleaning Services Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Contract Cleaning Services Market?

In 2024, the North America accounts for the largest market share in Contract Cleaning Services Market.

What years does this Contract Cleaning Services Market cover, and what was the market size in 2023?

In 2023, the Contract Cleaning Services Market size was estimated at USD 342.06 billion. The report covers the Contract Cleaning Services Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Contract Cleaning Services Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Contract Cleaning Service Industry Report

Statistics for the 2024 Contract Cleaning Service market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Contract Cleaning Service analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.