Cosmetic & Toiletry Containers Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.40 % |

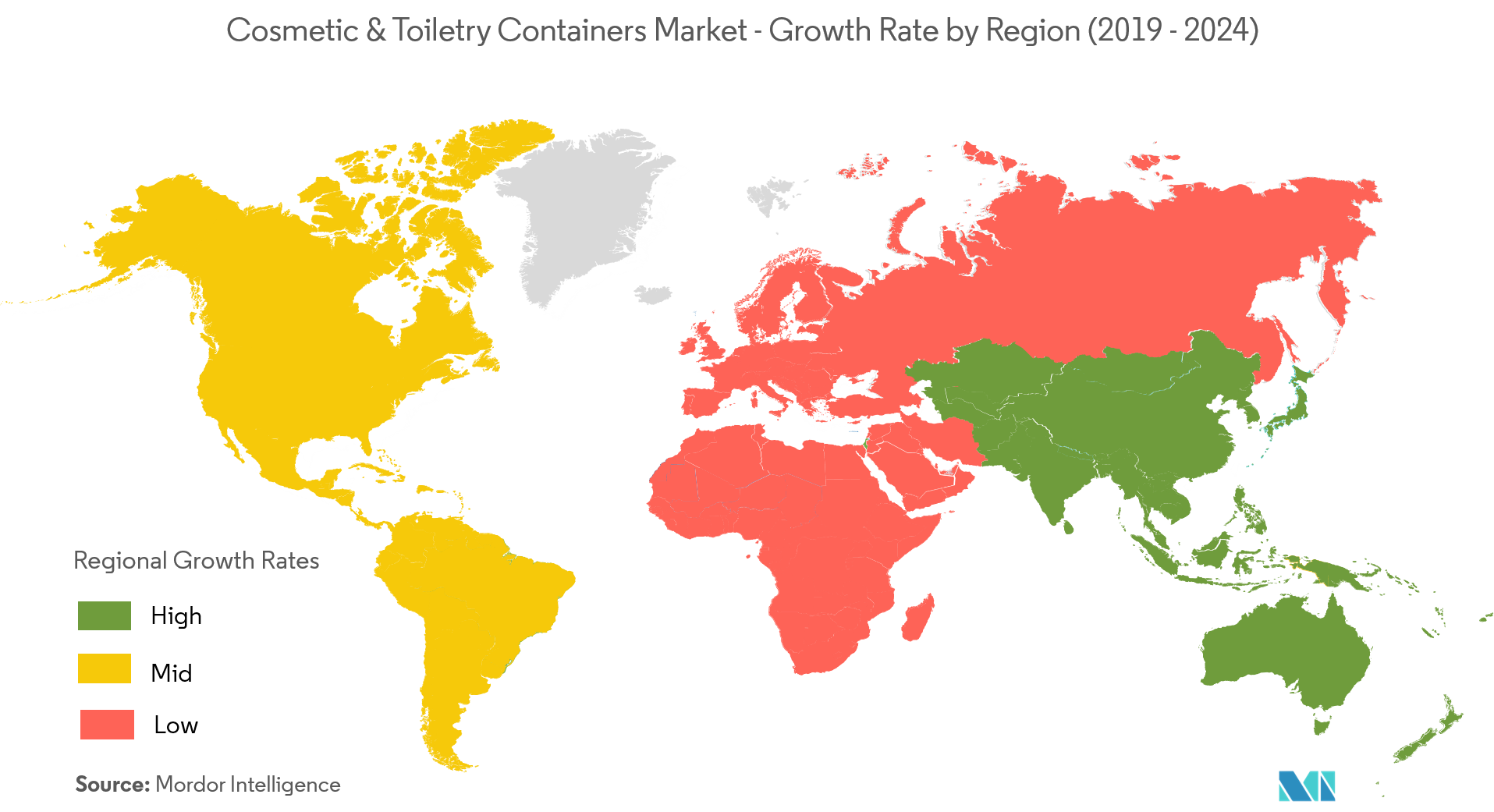

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Cosmetic & Toiletry Containers Market Analysis

The cosmetic & toiletry containers market is forecasted to reach a CAGR of 5.4% during the forecast period (2021 - 2026). In developing countries, demographic factors alike rising disposable income or urbanization as well as change in legislation are impacting product consumption and consumers are slowly moving away from single-use flexible plastic and increasingly adopting HDPE bottles and squeezable plastic tubes. Also with consumers increasingly aware of the impact of packaging globally, brand owners are more and more active in offering greener packaging. From using recycled plastics to lighter packaging, compressed deodorants, refill pouches, many initiatives show that the packaging manufacturers and brand owners are going toward more sustainability.

- Growing popularity in the beauty market, along with changing scenario of beauty retail distribution, is expected to contribute to significant demand for the market. According to FranchiseHelp, in the beauty industry, the number of employees in the service segment is expected to increase by 10% for barbers, hairdressers, cosmetologists, and by almost 22% for massage therapists by 2024. North America drives the cosmetic packaging industry due to high number of prominent vendors. According to Vogue Business, due to the raised awareness about the importance of skincare and the rising number of men purchasing skincare products, this market segment continues to grow and also skincare sales grew by 5% in the first quarter of 2019 and facts from the beauty industry in United States refers that revenue reached USD 1.4 billion in 2019.

- Increasing online penetration to enhance greater visibility of international brands across the world drives the market. Prominent manufacturers of these cosmetic and toiletry containers are mostly China-based and they majorly distribute cosmetic and toiletry containers through Alibaba Group Holding Limited, a Chinese conglomerate specialized in e-commerce and retail. Some of the other online retailers apart from Amazon are SavvyHomemade, LightInTheBox, The Container Store Inc., and AliExpress.

- Fluctuation in the rate of raw material will restrain the market to grow. The price of plastics is volatile because it depends heavily on the price of oil, and presently, high rate of cosmetic and toiletry products are being stored in plastic containers.

Cosmetic & Toiletry Containers Market Trends

This section covers the major market trends shaping the Cosmetic & Toiletry Containers Market according to our research experts:

Plastic Container Holds the Significant Share in The Market

- Toiletries which are consumer products are used for personal hygiene and also for beautification. The largest segments in the toiletries market contain Lotions (including sunscreens), Hair preparations, Face creams and Perfumes where the demand for plastic usage for the container is higher due to superior resistance to breakage, in both production and transportation.

- Some types of plastic bottles are incompatible with specific kind of toiletries. GoToobs are a desired choice for travel toiletry bottles for their soft silicone material, flip caps and suction cups that one can stick onto the wall of the shower. It’s BPA free and easy to clean. Also, Pitotubes are best for things that won’t clot and won’t be difficult at high pressures. These bottles are in a number of sizes but are typically in 0.5 ounces or 1-ounce bottles.

- Moreover, Nalgene bottles are finest for slightly runny liquids like shampoo and lotion. Anything firmer, like gels and creams, perform best in the Nalgene tubs. These are highly preferred in the United kingdom.

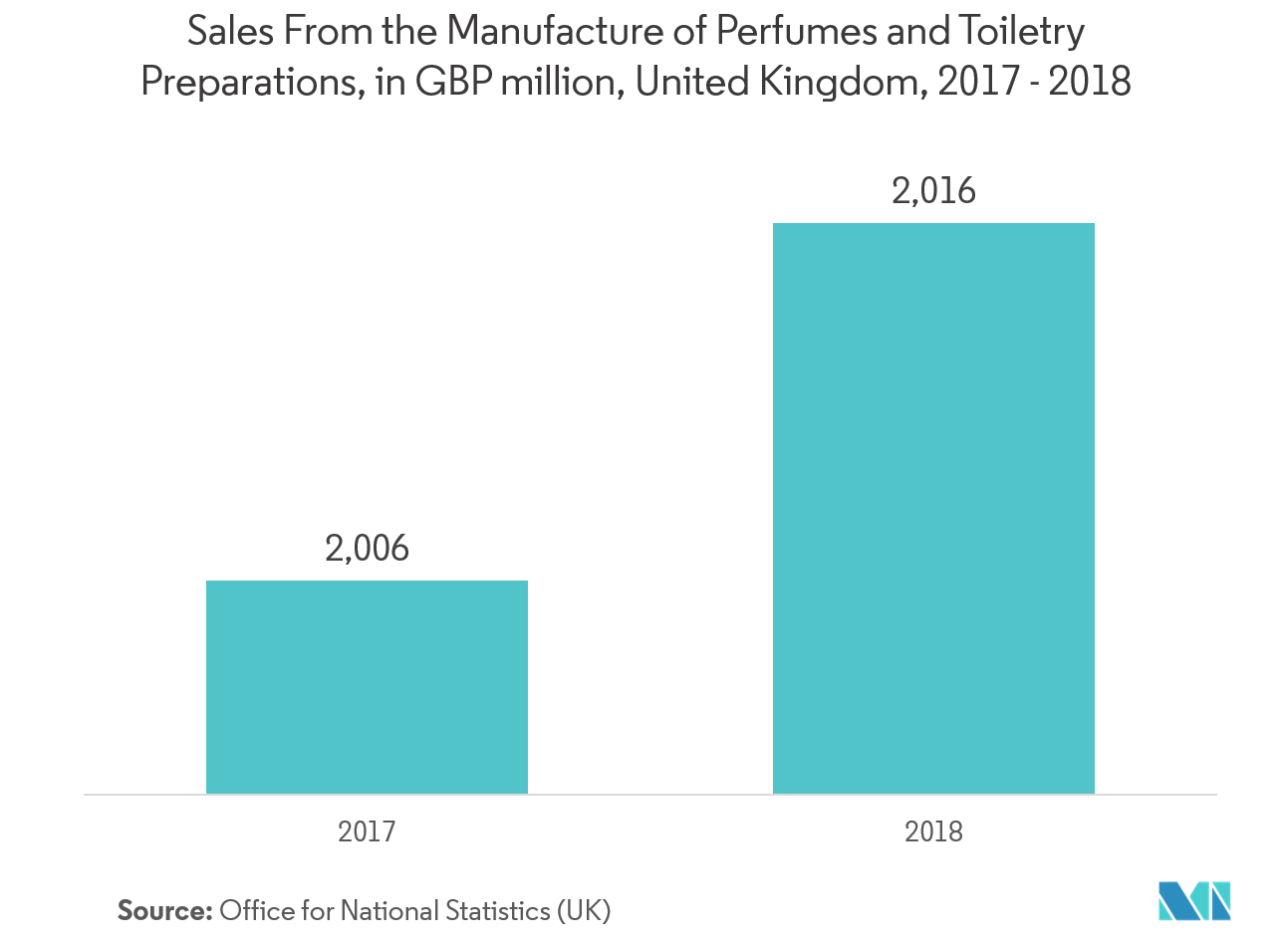

- According to UK's Office for National Statistics, the median disposable household income in the U.K. was about USD 33,787 in the fiscal year 2017. This suggested an increase of 2.3% from the previous year and the sales of perfume and toiletries increases on a yearly basis.

- Also, according to UK's Office for National Statistics, average weekly household expenditure on toiletries and soap in the United Kingdom under age 50 - 64 is GBP 2.8 and under the age of 30 - 49 is GBP 2.7 in 2018. This rate is increasing with the increasing demand for toiletry products by which the raise of plastic container in this region is increasing.

Asia-Pacific Account for Significant Market Growth

- Asia-Pacific is accounted for significant growth in the coming years. The growing trend of various home-based skincare products developed mainly by young beauty supporter is one of the significant factors for driving the market of cosmetic and toiletry containers in the region.

- According to the National Bureau of Statistics of China, China’s skincare-products market is becoming more high-end. Though the retail sales value of high - end skincare products was however below that of mass-market alternatives in the year 2018, the market share of the skincare products has risen gradually to 32% in 2018 from 25.3% in 2013. Consumers are favoring major international brand skincare products and this factor is rising the demand for cosmetic containers at the production site to export the finished goods in this region.

- Moreover, according to statistics from NMPA (National Medical Products Administration), which is now under SAMR (State Administration for Market Regulation), there were 4,933 enterprises licensed to manufacture cosmetics in China at the end of June 2019. Domestic brands are mostly concentrated in the mid- to low-end market segments, while joint ventures and enterprises with foreign investment dominate the high-end segment.

- Moreover, according to the Indian Brand Equity Foundation in 2017, India’s rural per capita disposable income was estimated to increase and reach USD 631 by 2020 with a CAGR of 4.4%. This rate of increment shows a high growth of demand of cosmetics and toiletries product in future which will increase the growth of the market.

Cosmetic & Toiletry Containers Industry Overview

The cosmetic & toiletry containers market is fragmented as a large number of players are present across the key regions. The presence of several medium and small scale manufacturers on a global, as well as regional level, are keeping the market at high rivalry position. With the introduction of green packaging for cosmetics and toiletries, there will be a high competition in the future which will encourage the growth of market. Key players are SKS Bottle & Packaging Inc., Albea S.A., Gerresheimer Holdings GmbH, etc. Recent developments in the market are -

- April 2019 - LUXE PACK SHANGHAI is planning to welcome 200 exhibitors of which 41 will be joining for the first time specializing in all types of cosmetic packaging, bringing cutting-edge in packaging technology, materials and crafts. Due to key contributor on high-end cosmetic packaging, this packaging show is now renowned for its selectivity and creativity on all booths and experiences on works.

- November 2018 - Vetroplas announced a new partnership with a Spanish aluminum bottle manufacturer, Envases, on extending its packaging options to the UK cosmetic and personal care market. The aluminium bottles suitable for a variety of products includes perfumes and skincare products, which will be paired with Vetroplas’ own closures including crimp-on pumps and screw neck caps.

- November 2018 - Cosmopak has introduced a new line of stock PCR (Post-Consumer Recycled) plastic cosmetic containers, where the supplier introduce that the lines of the PCR series convey a simple design ethic that represents the simplicity of nature. There is a lipstick, vial and compact available and customization is available for a completely new design.

Cosmetic & Toiletry Containers Market Leaders

-

SKS Bottle & Packaging Inc.

-

Albea S.A.

-

Gerresheimer Holdings GmbH

-

Silgan Holdings

-

APC Packaging

*Disclaimer: Major Players sorted in no particular order

Cosmetic & Toiletry Containers Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Growing Popularity in The Beauty Market Along With Changing Scenario of Beauty Retail Distribution

- 4.2.2 Increasing Online Penetration to Enhance Greater Visibility of International Brands Across the World

-

4.3 Market Restraints

- 4.3.1 Fluctuation in the Prices of Raw Material

- 4.4 Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Plastic

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Other Types

-

5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 SKS Bottle & Packaging Inc.

- 6.1.2 Albea S.A.

- 6.1.3 Gerresheimer Holdings GmbH

- 6.1.4 Silgan Holdings

- 6.1.5 APC Packaging

- 6.1.6 RPC Group Plc

- 6.1.7 Amcor Plc

- 6.1.8 FusionPKG

- 6.1.9 Libo Cosmetics Co., Ltd.

- 6.1.10 Jixiang Forever Packaging Co., Ltd

- 6.1.11 B & I Polycontainers Pty Ltd

- 6.1.12 Amcor Plc

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityCosmetic & Toiletry Containers Industry Segmentation

The cosmetic & toiletry containersis a fully enclosed object used to contain, store, and transportcosmetics.Considering the consumer's buyinglifestyle, manufacturers respond to their needs by offering compact container sizes made of suitable materials such as plastic, glass, metal, etc.

| By Type | Plastic | |

| Glass | ||

| Metal | ||

| Other Types | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | |

| Middle East & Africa |

Cosmetic & Toiletry Containers Market Research FAQs

What is the current Cosmetic & Toiletry Containers Market size?

The Cosmetic & Toiletry Containers Market is projected to register a CAGR of 5.40% during the forecast period (2024-2029)

Who are the key players in Cosmetic & Toiletry Containers Market?

SKS Bottle & Packaging Inc., Albea S.A., Gerresheimer Holdings GmbH, Silgan Holdings and APC Packaging are the major companies operating in the Cosmetic & Toiletry Containers Market.

Which is the fastest growing region in Cosmetic & Toiletry Containers Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Cosmetic & Toiletry Containers Market?

In 2024, the North America accounts for the largest market share in Cosmetic & Toiletry Containers Market.

What years does this Cosmetic & Toiletry Containers Market cover?

The report covers the Cosmetic & Toiletry Containers Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Cosmetic & Toiletry Containers Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Cosmetic & Toiletry Containers Industry Report

Statistics for the 2024 Cosmetic & Toiletry Containers market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Cosmetic & Toiletry Containers analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.