Thailand Crop Protection Chemicals Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Market Size (2024) | USD 675.10 Million |

| Market Size (2029) | USD 942.20 Million |

| CAGR (2024 - 2029) | 6.80 % |

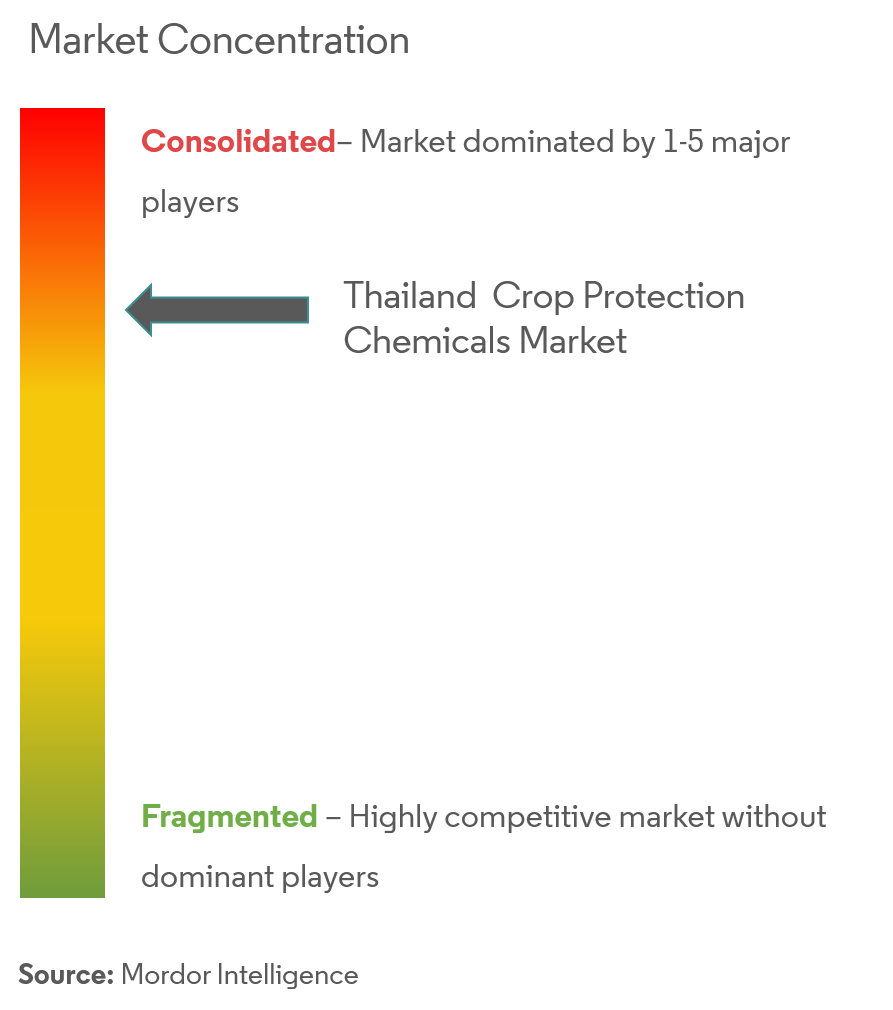

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Thailand Crop Protection Chemicals Market Analysis

The Thailand Crop Protection Chemicals Market size is estimated at USD 675.10 million in 2024, and is expected to reach USD 942.20 million by 2029, growing at a CAGR of 6.80% during the forecast period (2024-2029).

The rapid increase in pesticide use in Thailand is expected to account for an increase in cash crops. Most pesticide-intensive crops, vegetables, and fruits are the highest cash value-added crops in Thailand. As farmers have gradually switched from low-value-added to high-value-added crop production, the overall consumption rate of pesticides has naturally increased.

- According to the Office of Agricultural Economics (OAE) and the Office of Agriculture Regulations (OAR), the usage of pesticides has increased significantly in recent years. The import value of pesticides increased from USD 649.8 million in 2020 to USD 885.1 million in 2021. The major reason for the increase in pesticide imports and use over the last decade is Thailand's significant role as a leading exporter of food and agricultural products.

- Insecticide classes commonly imported included organophosphate (OP, e.g., chlorpyrifos), carbamate (e.g., fenobucarb and methomyl), and pyrethroid. Paraquat, glyphosate, 2,4-D, ametryn, and atrazine were the most often imported herbicides. Dithiocarbamate, mancozeb, carbendazim, and captan were the most often imported fungicides in the previous years.

- The favorable tax policy of the Thai government toward the growing market of agrochemical imports, the promotion of sustainable and integrated pest management techniques, and the increased intensity of land use are the major drivers for the market.

Thailand Crop Protection Chemicals Market Trends

An Increase in Cash Crops with a Higher Application Rate

Cash crops, such as rubber, coffee, and sugarcane, are primarily grown on large holdings in Thailand owned by agribusinesses that have emerged in recent years. Thailand is the world's largest producer and exporter of natural rubber, accounting for roughly one-third of the world's production. As farmers have gradually switched from low-value-added to high-value-added crop production, the overall consumption of crop protection chemicals has naturally increased. To raise yield, farmers have intensified insecticides and pesticide use in the production of all crops.

Rubber production in Thailand has received more attention from growers than other cash crops. According to the Department of Agriculture Thailand, production has been increasing gradually in the past few years, and the total production totaled 1.25 million metric tons in 2021, with a rise of 11% compared to 2020. Outputs have tended to climb due to increased crop area, improved climatic conditions, and the motivating effect of high prices on growers. The Rubber Authority of Thailand estimated higher exports in 2022 due to rising international demand for rubber from Thailand, with China being the key market.

More cash crops, a reduction in the prices of agrochemicals, awareness about increasing crop yield by mitigating risks posed by pests and diseases, and the government's promotion of agrochemical use are some of the factors that relate to this rapid rise in the use of herbicides, pesticides and insecticides application in Thailand. Further, the volume of agrochemicals imported into Thailand has increased remarkably, owing to higher demand and application.

Increasing Production and Exports of Fruits and Vegetables

The Thai horticultural sector plays a very crucial role in the herbicide, insecticide, and fungicide markets.

Fresh and processed tropical fruits are important contributors to the booming Thai agriculture sector, complementing the crop protection industry. Thai farmers currently cultivate 57 different types of tropical fruits on around 1.2 million hectares of land. Thailand also produced approximately 11 million metric tons of tropical fruits. Thailand's tropical fruit business is well-known due to variables such as geography and tropical environment. Thailand's topography conditions vary by location, allowing for the development of a wide range of tropical fruits. The tropical fruit business in Thailand has expanded, as seen by the rising output index in recent months due to the increasing use of agrochemicals for steady production. Durian, young coconut, longan, and pomelo are Thailand's most valuable exported fruits, complemented by the consumption of crop protection chemicals. According to ITC Trademap Statistics, the value of durian exports from Thailand rose by more than 500% in 2021 compared to 2017.

A research study undertaken by the Biodiversity Sustainable Agriculture Food Sovereignty Action Thailand (Biothai) found that the highest levels of pesticide residues were present in fruits and vegetables. Also, around 62.0% of such fruits and vegetables included more than one pesticide as residue. However, the intensity of pesticide use in Thailand is still lower than that of Vietnam but also higher than in Laos and Cambodia. The application of pesticides in fruits and vegetables has been the highest over the past several years, and this trend is likely to continue.

Thailand Crop Protection Chemicals Industry Overview

The Thai crop protection chemicals market is consolidated with a few major players. Thailand's top major global pesticide players are Corteva Agriscience, Syngenta, ADAMA Agriculture Solutions, BASF SE, and Bayer Crop Science AG. The market is also dominated by local traders. Companies in the market are mainly focusing on developing new and qualitative products and new technologies to improve product quality. New product launches, partnerships, and mergers and acquisitions are the main strategies followed by the major players in the market.

Thailand Crop Protection Chemicals Market Leaders

-

Bayer Crop Science AG

-

BASF SE

-

Corteva Agriscience

-

Syngenta International AG

-

ADAMA Agriculture Solutions

*Disclaimer: Major Players sorted in no particular order

Thailand Crop Protection Chemicals Market News

- June 2022: Best Agrolife, one of the leading agrochemical companies in Thailand, launched its agro-products basket of insecticide, fungicide, and pesticide products, Ronfen, AxeMan, Warden, and Tombo.

- June 2022: BASF Agriculture Solutions launched Basta - x with new applications on cassava and rubber in Thailand. With Basta - x, BASF provides a non-selective, non-residual herbicide with limited translocation potential, effectively controlling over 80 weed species of rice, mango, cassava, palm oil, and rubber farms.

- May 2022: Bayer Thai invested THB 26.7 million (USD 0.76 million) for the 'Better Farms, Better Lives 2.0' to support smallholder farmers in improving their crop yield, reducing production costs, and enhancing their technical know-how. The 'Better Farms, Better Lives 2.0' program aims to benefit 26,000 smallholder farmers in 11 provinces in the central and northeastern regions.

Thailand Crop Protection Chemicals Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

-

4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Product

- 5.1.1 Herbicides

- 5.1.2 Insecticides

- 5.1.3 Fungicides

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

-

5.2 Crop

- 5.2.1 Commercial Crops

- 5.2.2 Fruits and Vegetables

- 5.2.3 Grains and Cereals

- 5.2.4 Pulses and Oil seeds

- 5.2.5 Turf and Ornamental Crops

-

5.3 Application

- 5.3.1 Chemigation

- 5.3.2 Foliar

- 5.3.3 Fumigation

- 5.3.4 Seed Treatment

- 5.3.5 Soil Treatment

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Bayer Crop Science AG

- 6.3.2 BASF SE

- 6.3.3 Corteva Agrisicence

- 6.3.4 ADAMA Agriculture Solutions

- 6.3.5 Syngenta International AG

- 6.3.6 Arysta Lifescience Co. Ltd

- 6.3.7 Sumitomo Corporation

- 6.3.8 Sahaikaset Agrochemicals Co. Ltd

- 6.3.9 AG-AGRO Co. Ltd

- 6.3.10 Sotus International Co. Ltd

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityThailand Crop Protection Chemicals Industry Segmentation

Crop protection chemicals are a class of agrochemicals used to prevent the destruction of crops by insect pests, diseases, weeds, and other pests.

The Thai crop protection chemicals market is segmented by product (herbicides, insecticides, fungicides, molluscicide, and nematicide), crop (commercial crops, fruits and vegetables, grains and cereals, pulses and oil seeds, and turf and ornamental crops), and application (chemigation, foliar, fumigation, seed treatment, and soil treatment). The report offers market size and forecasts in terms of value (USD) for all the above segments.

| Product | Herbicides |

| Insecticides | |

| Fungicides | |

| Molluscicide | |

| Nematicide | |

| Crop | Commercial Crops |

| Fruits and Vegetables | |

| Grains and Cereals | |

| Pulses and Oil seeds | |

| Turf and Ornamental Crops | |

| Application | Chemigation |

| Foliar | |

| Fumigation | |

| Seed Treatment | |

| Soil Treatment |

Thailand Crop Protection Chemicals Market Research FAQs

How big is the Thailand Crop Protection Chemicals Market?

The Thailand Crop Protection Chemicals Market size is expected to reach USD 675.10 million in 2024 and grow at a CAGR of 6.80% to reach USD 942.20 million by 2029.

What is the current Thailand Crop Protection Chemicals Market size?

In 2024, the Thailand Crop Protection Chemicals Market size is expected to reach USD 675.10 million.

Who are the key players in Thailand Crop Protection Chemicals Market?

Bayer Crop Science AG, BASF SE, Corteva Agriscience, Syngenta International AG and ADAMA Agriculture Solutions are the major companies operating in the Thailand Crop Protection Chemicals Market.

What years does this Thailand Crop Protection Chemicals Market cover, and what was the market size in 2023?

In 2023, the Thailand Crop Protection Chemicals Market size was estimated at USD 629.19 million. The report covers the Thailand Crop Protection Chemicals Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Thailand Crop Protection Chemicals Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Thailand Crop Protection Chemicals Industry Report

Statistics for the 2024 Thailand Crop Protection Chemicals market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Thailand Crop Protection Chemicals analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.